Daniels Trading Review 2025

|

|

Daniels Trading is #111 in our rankings of UK brokers. |

| Top 3 alternatives to Daniels Trading |

| Daniels Trading Facts & Figures |

|---|

Daniels Trading was established in 1995 by renowned commodities trader, Andy Daniels, and is a division of the StoneX Group. The broker specializes in personalised futures trading, with access to 36 derivatives exchanges and 175 foreign exchange markets, among others. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, indices, commodities, futures, interest rates |

| Demo Account | Yes |

| Min. Deposit | $2000 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | National Futures Association (NFA) |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| Forex | My tests found that you can use either of the intuitive proprietary charting platforms at Daniels Trading to analyse and speculate upon 14 currency futures products, alongside several more e-mini futures. |

| GBPUSD Spread | Floating |

| EURUSD Spread | Floating |

| GBPEUR Spread | Floating |

| Assets | 14 |

| Stocks | I also found an impressive 25 index futures products offered by Daniels Trading, a much greater number than many competitors. These indices track top global exchanges and several specialist products, such as the value-line index. |

Daniels Trading is a Chicago-based futures broker that specialises in commodities trading. The company caters to individual and institutional clients alike, providing a range of opportunities from pure brokerage services to a fully controlled wealth management strategy. This 2025 Daniels Trading review covers all the important considerations for prospective clients, such as available margin, minimum account funding levels, fees, commission rates and supported trading platforms.

About Daniels Trading

A subsidiary of NASDAQ-listed StoneX Financial Group, Daniels Trading began life in 1995 as the brainchild of prominent agriculture commodities trader Andy Daniels. The company has since expanded, becoming fairly prominent. It now boasts a ten-strong team of seasoned traders based in its Chicago headquarters.

The broker operates on a smaller scale than many online financial providers. This means it can offer a more personalised client experience and it prides itself on providing bespoke solutions catered to individuals.

Markets

Daniels Trading is a futures-only brokerage that focuses on commodities and agriculture. However, the broker does offer additional futures markets on popular instruments such as forex and indices.

Currencies Futures

Daniels Trading offers fourteen currency futures markets, including major European and global tenders such as EUR, CAD, and GBP. In addition, several markets are offered in smaller lot size e-mini form.

Energies Futures

As a commodities specialist, energy futures are a crucial offering. The broker provides nine energy markets, with common products like natural gas and crude oil supplied, in addition to more specialised assets like propane and heating oil.

There are several e-mini contracts within the energies provision for smaller-scale trades. Some assets have a fixed daily trading limit to watch out for, though all markets are traded all year round.

Soft Commodities Futures

Soft commodities and agricultural futures are where the broker shines, with over 20 instruments on livestock, food and fibres. Standard instruments such as coffee and wheat are supplemented by more exotic offerings on lumber, canola and others.

Several soft commodity assets are offered in a range of instruments, with options for a client’s preferred exchange or contract size.

Indices Futures

More than 25 index instruments are supported, tracking top global exchanges such as the FTSE 100, S&P 500 and NIKKEI 225. Several specialised indices, such as the Value-Line Index, are available, though the VIX is notably absent.

Note that Daniels Trading can no longer offer quotes on single stock futures since the closure of the OneChicago futures exchange.

Interest Rate Futures

Over 30 interest rate futures markets are available for speculation, ranging from government bonds from regions like Australia and Japan to long Gilt and short Sterling instruments.

Metals Futures

The final asset class offered is metals futures. Nine instruments are provided by the broker, covering three gold and three silver markets, as well as copper, platinum and palladium offerings.

Leverage

As a bespoke broker, Daniels Trading can provide different leverage rates to individual clients based on their needs. However, the firm pledges to offer at least the minimum margin of the native exchanges for each market.

Account Types

The broker provides a range of account types to cater to a diverse range of client needs. Users can choose from five levels of trade autonomy, starting with fully controlled trades through the self-directed account to allowing a commodity trading advisor to manage funds.

Self-Directed Accounts

The self-directed account allows clients to access all futures markets through two leading trading platforms for those who require minimal guidance when trading. This Daniels Trading account features the lowest commissions and is available in three forms: basic, plus and premium.

While all accounts can access the broker support desk, the higher levels provide one-on-one platform tutorials, position entry and trade management assistance and expert consultation services.

Broker-Assisted Trading Account

The firm recommends the broker-assisted account to those who require an experienced broker to execute complex trading strategies. This account allows customers to work with an industry expert to refine an investing plan or utilise advanced techniques such as hedging or arbitrage.

Commission on this account will be higher than for a self-directed account, though exact fees are calculated for traders individually.

Automated Futures Portfolios

Veteran investors will likely be familiar with automated trading through expert advisors or dedicated automation platforms. Daniels Trading utilises the iSystems platform to execute advanced algorithmic investing strategies. Hundreds of historically proven systems are provided to help clients profit without the active input required for most strategies. Alternatively, users can also create bespoke strategies through iSystems.

Fully Managed Account

The fully managed account provides several advantages as a portfolio diversification method for those seeking the ultimate hands-off investment. The broker strives to provide an excellent fit for every investment profile and risk tolerance: clients can pick from over 170 diverse commodity trading advisors (CTAs).

As with all provided accounts, the commissions and fees of the fully managed service are available upon application only.

Demo Account

Many traders prefer to trial a new broker before committing to a full account, especially when dealing with new markets or trading platforms. Daniels Trading allows prospective clients to access both supported trading platforms to try out its futures trading brokerage.

Full account holders that maintain the $2,000 minimum account requirement have unlimited access to the dt Pro demo platform to trial new strategies or learn new markets.

Trading Platforms

There are two trading platforms supported by the broker: dt Pro and MultiCharts.

dt Pro

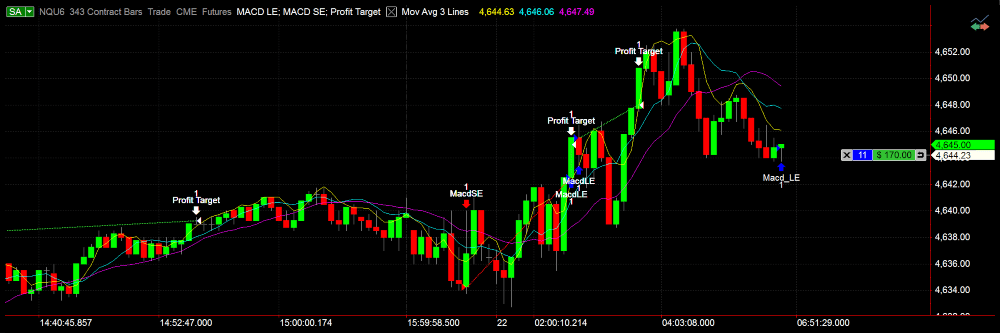

The dt Pro platform is the proprietary offering from Daniels Trading, designed exclusively for futures speculation with ease of use as a critical consideration. The system boasts advanced drawing tools, automated trading support and live quotes from global exchanges.

dt Pro

Clients can either jump straight into investing or use the free 14-day demo account to get to grips with the platform. Additionally, there are many video guides to help new clients navigate the platform and take advantage of its advanced charts and indicators.

dt Pro is available on Windows or as a mobile app for Android (APK) and Apple (iOS) devices.

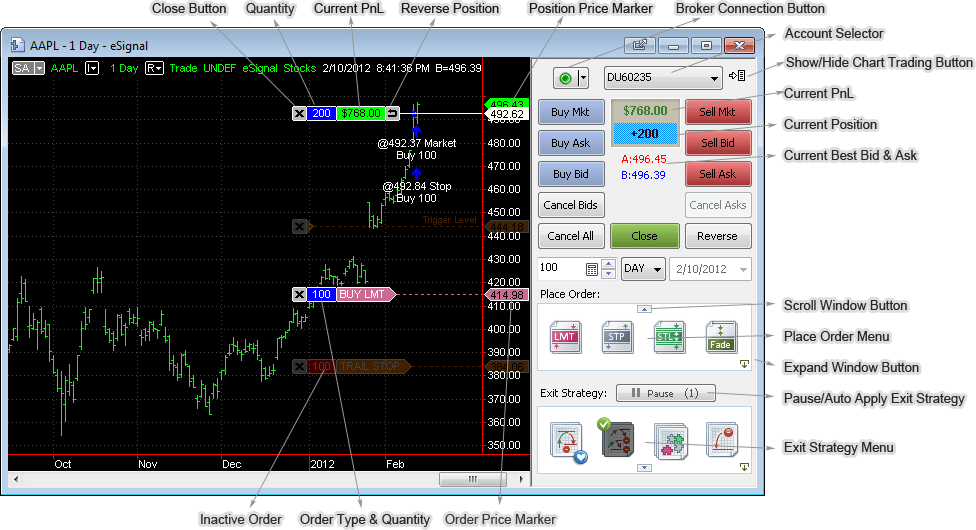

MultiCharts

The second platform option is MultiCharts, a standalone platform licenced by Daniels Trading to provide a complete trading experience to its clients. The platform supports over 20 simultaneous data feeds, more than 300 stock indicators and strategies plus comprehensive backtesting features.

MultiCharts

Available on Windows PC only with no mobile app, MultiCharts can be trialled for 30 days using a demo account.

Payment Methods

The account funding options provided by Daniels Trading are limited, with clients restricted to bank wire transfers, cheque payments and broker-to-broker transfers. E-wallet solutions such as Skrill, Neteller and PayPal are absent, as are credit and debit card transactions.

The firm does not provide clearing times for any deposit or withdrawal methods. However, its supported payment options generally take several working days to process with most brokers. Similarly, the company does not specify minimum deposit or withdrawal amounts, though a minimum account level of $2,000 is required for initial funding.

Deposit & Withdrawal Fees

Daniels Trading does not charge commissions for depositing funds into a trading account. However, wire transfers are often subject to bank fees, especially for the international transactions that UK clients would have to make.

Fees for withdrawals are subject to a set structure. One cheque withdrawal per month is free, with $5 commissions for each additional request. Domestic wire transfer withdrawals cost $25, while international wire transfers are subject to a $30 fee.

Trading Fees

Trading fees are often a significant factor when choosing a new broker. The fees and commissions levied by Daniels Trading will depend on the specific needs of each client and are decided on during a consultation with a broker representative.

The firm levies a monthly dormancy charge on accounts that have not been active for three months, though it does not specify the amount. Moreover, Daniels Trading charges liquidation fees of $50 per contract when closing a contract to meet a margin call.

Security & Regulation

Daniels Trading employs several methods to ensure client security, such as storing funds in segregated bank accounts through approved futures commission merchants (FCMs). The firm is also licensed by America’s Commodity Futures Trading Commission (CTFC).

Unfortunately, there is no two-factor authentication login protection for maximum security.

Customer Support

As a customer-service oriented broker offering bespoke futures and wealth management solutions, exceptional communication is a significant focus of the Daniels Trading group. To this end, investors can contact the broker through several phone numbers, a query form on the broker’s website or even meet in person at the Chicago headquarters.

For UK traders, the most viable contact method is either the international phone number or contact form. However, additional virtual contact methods may be made available to registered clients.

- International Contact Number: +1 312 706 7600

Educational Content

As well as links to the library of content on futures and trading produced by CME Group, the broker also provides a free beginner’s guide to futures, plus several technical analysis and indicator pieces. Clients can also access frequent blog articles on tips and strategies for current market conditions.

Advantages Of Daniels Trading

- Team of experts

- Exotic commodities

- Several account types

- Regulated by the CFTC

- Bespoke investing strategies

- Wide range of futures assets

- Strong automated trading support

Disadvantages Of Daniels Trading

- Lack of fee transparency

- Futures-only speculation

- Large withdrawal charges

- $2,000 account minimum

- Limited transaction options

Promotions

Daniels Trading has no promotional schemes available to new or existing clients. However, high net worth investors may be able to negotiate preferential trading commissions with the broker.

Additional Features

The broker offers several additional features to enhance the trading experience of clients. The first is a futures calendar marked with notable upcoming market events and the first notice day (FND) and last trading day (LTD) of all tradable contracts.

Daniels Trading also provides a futures calculator with which clients can review the potential profits or losses incurred by trading specific assets. Users can input projected entry and exit points and the overall market sentiment to help decide whether to enter a position.

An exclusive newsletter and podcast are also available to traders, featuring specialist insight from the company’s Senior Broker, Craig Turner.

Trading Hours

As its markets are sourced from many different global exchanges, Daniels Trading does not have strict market trading hours. However, broker-assisted services will only be available during US office hours, so UK traders may wish to factor in the timezone difference before committing to an account.

Daniels Trading Verdict

There is likely no substitute for the market depth and industry experience offered by Daniels Trading for agriculture and soft commodity-focused traders. Less specialised futures investors may also appreciate the varying levels of autonomy available with each account and the automated trading and hedging opportunities offered by the broker. Regulated by the CTFC, Daniels Trading is a respected and reputable broker, though clients pay for this through higher commissions, greater fees and a $2,000 minimum account funding requirement.

FAQ

Does Daniels Trading Provide A Profit Calculator?

The Daniels Trading website includes a futures calculator with which clients can preview potential profits at different position entry and exit points.

Is Daniels Trading Regulated?

Daniels Trading is licensed by the Commodity Futures Trading Commission (CFTC). It holds client funds in segregated bank accounts to provide additional protection.

Can I Sign Up For A Daniels Trading Demo Account?

A 14-day trial for the dt Pro platform and a 30-day demo account on the MultiCharts platform are available with Daniels Trading. Active clients are also given unlimited access to the dt Pro demo account for risk-free paper trading.

What Commissions Does Daniels Trading Charge?

Fees and commissions for using the Daniels Trading brokerage are only available upon request, with prices varying depending on the type of service required and invested wealth.

Does Daniels Trading Offer Futures?

Daniels Trading is a futures-only brokerage, providing instruments on currency, soft commodities, major global indices and several other asset types.

Top 3 Daniels Trading Alternatives

These brokers are the most similar to Daniels Trading:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Daniels Trading Feature Comparison

| Daniels Trading | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| Rating | 2.8 | 4.3 | 4.7 | 4 |

| Markets | Forex, indices, commodities, futures, interest rates | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $2000 | $0 | $0 | $1,000 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | National Futures Association (NFA) | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | - | MT4 | MT4, MT5 |

| Leverage | - | 1:50 | 1:30 (Retail), 1:222 (Pro) | 1:30 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Daniels Trading Review |

Interactive Brokers Review |

IG Index Review |

Swissquote Review |

Trading Instruments Comparison

| Daniels Trading | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | Yes |

Daniels Trading vs Other Brokers

Compare Daniels Trading with any other broker by selecting the other broker below.

Popular Daniels Trading comparisons: