Cryptobo Review 2025

|

|

Cryptobo is #11 in our rankings of binary options brokers. |

| Top 3 alternatives to Cryptobo |

| Cryptobo Facts & Figures |

|---|

Cryptobo claims to be the first Bitcoin-based binary options broker, with 1.5 million registered clients and 50,000 trades executed on average per day. Users benefit from 24/7 trading opportunities with up to 91% payouts, alongside no minimum deposit and three-hour withdrawals. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, Stocks |

| Demo Account | No |

| Min. Deposit | 0.0000001 BTC |

| Mobile Apps | No |

| Min. Trade | 0.0000001 BTC |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Forex | You can trade binary options on a range of major, minor and exotic currency pairs such as EUR/USD, USD/JPY and GBP/USD. You can choose the currency asset and timeframe in a few clicks on the web platform. |

| GBPUSD Spread | N/A |

| EURUSD Spread | N/A |

| GBPEUR Spread | N/A |

| Assets | 16 |

| Stocks | Cryptobo offers 22 stocks to trade as binary options including Amazon, JP Morgan and P&G. On the negative side, the range of shares trails the best binary options brokers. |

| Binary Options | Cryptobo is a binary options-only broker with high payouts and a sleek, intuitive trading platform. With no minimum deposit, payouts up to 91% and a minimum trade size 0.0000001 BTC, you can get started quickly. |

| Expiry Times | Up to 5 hours |

| Payout Percent | 91 |

| Ladder Options | No |

| Boundary Options | No |

Cryptobo is an online cryptocurrency binary options broker. The firm also claims to offer derivatives from a range of different markets, including stocks, indices, and forex. In this review, we will cover whether UK traders should invest with Cryptobo, its account types offered, its fee structure, deposit and withdrawal methods and more.

Our Take

- Cryptobo is worryingly hard to get hold of and there are many conspicuous issues with the company’s website

- The brokerage is unregulated and does not appear to implement any crypto-specific security measures

- We would not recommend Cryptobo to UK investors

Market Access

Cryptobo, despite its name, offers more than just cryptocurrency for binary options trading. The broker also offers stocks, forex and indices. However, this list only reaches a total of 60 assets, much lower than other major firms. For example, Pocket Option boasts more than 130 products.

That being said, Cryptobo is fairly unusual in its offering of binary options on cryptocurrency assets, making it more enticing for those with a desire to trade digital currencies.

The total range of assets:

- Cryptocurrency Pairs – Nine crypto/fiat pairs, two crypto/Ethereum pairs and one crypto/Litecoin pair. Pairs include BTC/EUR, ETH/JPY, LTC/USD, ETH/BTC, ETH/LTC and LTC/BTC

- Stocks – 22 different stocks, including Amazon, Ferrari, Tesla and eBay

- Forex Pairs – 16 currency pairs, such as EUR/USD, GBP/JPY and USD/CHF

- Stock Indices – 10 stock indices, including the FTSE 100, DAX 40, Nasdaq and Dow Jones

Fees

Like most binary options brokers, Cryptobo does not charge fees on trades, instead making money from losing contracts. As a result, there are no spreads or commissions to consider, unlike with CFD brokers.

Our team was also impressed to see that there are no deposit fees, account holding fees or inactivity fees charged by the firm.

However, a withdrawal fee of 0.002 BTC is charged and external fees for transferring Bitcoin may apply when depositing or withdrawing.

Payout

As a binary options broker, Cryptobo offers payouts as an incentive to trade, taking the initial investment for failed contracts. The payouts offered by the firm are anywhere up to 91%, depending on the asset, market and contract details. These are decent payouts are compare well with other binary options brands.

For example, suppose the strike price of an asset is £100 and you perform technical analysis, resulting in the expectation that the asset’s price will rise. As such, you open a 5-minute call (long) binary option on the asset worth £10 with a 91% payout.

When the five minutes are up, the contract will automatically expire and, if the price has risen above £100, you will finish in the money. This means that you will receive your initial investment plus the payout, £10 + £9.10 = £19.10 in total. If the price had stayed below £100, you would have lost your initial investment, -£10 in total.

Cryptobo Accounts

Cryptobo only offers a single account type, giving every client access to all the binary options assets offered by the firm, as well as the proprietary trading platform.

Unfortunately, our team was unable to open an account with the company, despite many attempts using different web clients and devices. These issues suggest to us that the broker is down, having extended issues or is intentionally holding back from clients, which our experts find worrying.

As such, we recommend that clients look at other binary options brokers, like Focus Option, for a more reliable binary options trading experience.

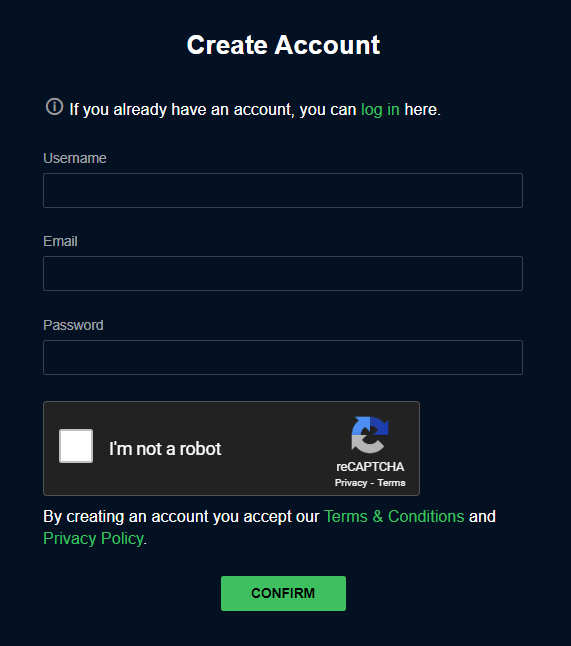

Cryptobo Registration Form

Funding Options

Cryptobo only accepts funding via Bitcoin transfers and does not support any other forms of deposit or withdrawals. As such, traders will have to purchase Bitcoin from third-party entry-level exchanges and store it in independent crypto wallets to fund their accounts.

The company does not charge deposit fees and has no minimum deposit amount, though external transfer fees may apply. Deposit speeds vary depending on the size of the deposit and the state of the blockchain, although the firm claims that this will take roughly 10 minutes on average.

Cryptobo charges a 0.00004 BTC commission for all withdrawals and has a minimum withdrawal of 0.002 BTC. External transfer charges may apply and withdrawals typically take between 10 minutes and 24 hours to process after the withdrawal request is made.

Overall, our team was disappointed by the lack of funding options provided by Cryptobo. Only supporting a single method makes this broker highly inflexible for many clients, especially those new to DeFi. The top brokerages offer multiple methods, such as wire transfers, payment cards, e-wallets and other crypto coins.

UK Regulation

Cryptobo is an unregulated broker, meaning it holds no license with a regulatory body, such as the FCA or CySEC. This means that there are no enforced safety measures in place to protect traders’ funds and investments, nor any avenues for recourse in the event of malpractice.

Furthermore, the broker may not need to perform any identification and KYC checks or separate clients’ funds from the firm’s operating funds, both important things to ensure the security of client funds.

Our experts generally suggest avoiding companies with no regulation or commitment to client security.

Trading Platforms

Like many online binary options brokers, Cryptobo offers its own, bespoke trading platform for speculators to open contracts on.

The company claims that the platform has an intuitive, sleek design with many built-in indicators and features. A wide range of expiration times can supposedly be selected, ranging from very short 1-minute contracts to longer multi-hour products.

However, our team has been unable to validate this information, so we cannot make a proper comparison to competitor platforms and brokerages.

How To Place A Trade With Cryptobo

- Log into your Cryptobo account

- Choose the asset you would like to trade

- Use the graph to perform technical analysis to predict the direction of price movement

- Decide your time horizon and choose whether to place a call or put option

- Click the call or put buttons at the bottom of the platform to place the trade, your investment will be removed from your account

- When the expiration time is met, the contract will close and you will receive your payout if you are in the money

Mobile App

We were disappointed to see that Cryptobo does not offer a mobile app on any device, Apple, Android or otherwise. However, traders can access the platform through their mobile device’s browser, still allowing them to speculate while on the move.

The platform is supported on mobile browsers with all its features intact, though clients may find it difficult to carry out analysis and portfolio management on a platform not optimised for such a small screen.

Demo Account

Cryptobo does not offer a demo trading account. This is a shame as it is often useful to practise on a demo account to get to grips with things before opening a live account and investing money.

That being said, when opening a live account, clients are given 500 Satoshi (0.0000005 BTC) to start with. While this is a small amount, it is marketed as a training bonus. This can also be received again upon reaching a zero balance in your account.

Bonus Deals

Cryptobo has offered a variety of promotions and financial incentives over its lifetime, such as a 10% deposit bonus, though these are often timebound. However, the 500 satoshi training bonus is an ongoing promotion that provides all new clients with 500 satoshis to get started with.

On the downside, this is a particularly measly quantity (worth less than 30 pence at Bitcoin’s November 2021 high). Therefore, upon comparison with other firms like FXChoice that offer up to 50% deposit bonuses, this is not a sufficient incentive to overcome the broker’s suite of other shortcomings.

Extra Tools & Features

The Cryptobo website features a glossary that covers some of the widely used terms in binary options and crypto trading. Clients also have access to several support pages on the broker’s website, such as one that runs through how to deposit Bitcoin.

Overall, we were disappointed by the lack of additional features offered by the firm. We would have preferred to see a range of educational services, market analysis reports and expert tips.

Company Details & History

Not much information is available about Cryptobo’s origins. The broker was founded in 2017 with claims to be the first binary options broker offering crypto/crypto pairs rather than just crypto/fiat.

Beyond this, our experts were unable to find any details about the company, which we find troubling. Any trustworthy financial service provider that is behaving fairly would not hide away details about its management and company history.

Customer Service

Cryptobo claims to offer 24/7 customer support through several online channels, though our team was unable to contact the firm upon testing.

- Skype – cryptobo.com

- Support Email Address: support@cryptobo.com

- General Email Address: cryptobo.com@gmail.com

The broker also has an inactive Facebook account and YouTube channel with the cryptobocom handle.

However, after repeated attempts to contact the broker, our team did not manage to get in touch with them to solve our issues. This suggests that the service is, if not just very slow, incompetent or non-existent. Coupled with so few methods of contact, we recommend traders look elsewhere for binary options trading.

Security

Beyond the encryption of its website, the broker does not claim to implement any additional safety features for traders. As a minimum, we would have liked to see some form of KYC, ID verification, two-factor authentication (2FA), segregation of funds or an insurance scheme in case the broker failed financially.

Moreover, our experts believe that rigorous wallet management, cold storage and cybersecurity measures are important in a decentralised brokerage to help protect funds. None of these measures is in place with this firm, suggesting a lack of legitimacy and worryingly poor customer focus.

Trading Hours

Cryptocurrency markets are available 24/7, thanks to their inherent decentralisation. However, forex products are only available 24/5, while stocks and indices are available in line with their underlying exchange opening times.

Should You Trade With Cryptobo?

Our team was disappointed all around with the presentation and services of Cryptobo. Despite standing out for its offering of cryptocurrency binary options, the firm falls well short in every other area. Primarily, the firm is unregulated, though it expounds on this by claiming no sufficient level of cybersecurity or crypto storage protection, not to mention its buggy website that struggles to sign up new clients and the customer service that team that cannot be reached.

All these issues add up to a company that seems to have been created in a rush with no consideration for client experience or safety. Therefore, we recommend that investors steer clear of Cryptobo. Many other legitimate firms offer binary options, such as Pocket Option and IQCent.

FAQ

Can UK Traders Speculate With Cryptobo?

Cryptobo claims to accept UK traders. However, we were neither able to log into an existing account nor open a new account with the firm due to a failure of the website’s registration form and an inability to contact the company’s support email address.

What Deposit Methods Does Cryptobo Provide?

You can only deposit or withdraw from Cryptobo via Bitcoin. The broker does not accept any other cryptocurrencies or fiat currencies, restricting the firm’s accessibility to DeFi newcomers.

What Trading Platform Does Cryptobo Offer?

Cryptobo offers its own, bespoke trading platform on par with many other online binary options brokers. It has a sleek, intuitive user interface with clearly placed buttons and icons to make navigating the platform easy. However, the scope for advanced technical and fundamental analysis is limited.

Is Cryptobo Regulated?

Cryptobo is an unregulated firm, meaning there is no third party overseeing the operation of the business. As such, safety features that you would expect from top brokers are not enforced or required.

Does Cryptobo Offer A Demo Account?

Cryptobo does not offer any kind of demo account. However, the broker does offer a 500 Satoshi “training” bonus, intended to provide clients with a small sum to practise with in place of a full-blown demo account.

Article Sources

Top 3 Cryptobo Alternatives

These brokers are the most similar to Cryptobo:

- World Forex - World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Videforex - Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform, mobile app and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

- Grand Capital - Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

Cryptobo Feature Comparison

| Cryptobo | World Forex | Videforex | Grand Capital | |

|---|---|---|---|---|

| Rating | 1.5 | 4 | 3.5 | 3.9 |

| Markets | Forex, Stocks | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Binary Options, CFDs, Forex, Indices, Commodities, Crypto | CFDs, Forex, Indices, Shares, Energies, Metals, Cryptocurrencies, Binary Options |

| Minimum Deposit | 0.0000001 BTC | $1 | $250 | $10 |

| Minimum Trade | 0.0000001 BTC | 0.01 Lots | $0.01 | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | - | SVGFSA | - | FinaCom |

| Bonus | - | - | 20% to 200% Deposit Bonus | - |

| Education | No | No | No | No |

| Platforms | - | MT4, MT5 | - | MT4, MT5 |

| Leverage | - | 1:1000 | 1:500 | 1:500 |

| Visit | ||||

| Review | Cryptobo Review |

World Forex Review |

Videforex Review |

Grand Capital Review |

Trading Instruments Comparison

| Cryptobo | World Forex | Videforex | Grand Capital | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | No | No |

| ETFs | No | No | No | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

Cryptobo vs Other Brokers

Compare Cryptobo with any other broker by selecting the other broker below.

Popular Cryptobo comparisons: