Credit Default Swaps

Credit default swaps (CDSs) are financial derivatives that act as securitised insurance products. They are agreements between two parties: the protection buyer, who makes regular payments to the other party, the protection seller, in return for a promise that the seller will compensate them if a borrower (known as the reference entity) cannot meet a debt obligation.

This guide will run through what credit default swaps are, explain why investors may wish to deal with them for speculation, hedging or arbitrage purposes, and explain the pros and cons of adding them to a portfolio.

Alternatives For UK Investors

Credit default swaps are mainly for institutional investors due to their complexity and risk. However, retail traders in the UK have alternatives:

- Bonds: Investing in corporate bonds can be a simpler way to gain exposure to credit risk. You can select bonds from issuers with varying creditworthiness with higher yields generally bringing higher risks. Alternatively, you can invest in government bonds, known as Gilts in the UK. The returns might be lower, but the risk of default is very low for stable governments.

- ETFs and Mutual Funds: These funds can invest in a diversified portfolio of bonds, reducing the risk of any single issuer defaulting. There are funds that focus on high-yield (junk) bonds, investment-grade bonds, municipal bonds, and more, allowing you to choose according to your risk appetite.

What Is A Credit Default Swap?

A credit default swap is a contract in which two parties agree to transfer the risk that a borrower will fail to pay back a loan or bond.

The buyer of the swap will make a periodic payment, known as the premium, to the seller, and in return, the seller will provide protection if a ‘credit event’ occurs.

CDSs are available for a broad range of entities, including companies, national governments, and local government bodies. They can also be obtained on specific indices and baskets of entities, or on asset-backed securities (like mortgages or car loans).

The swap contract will specify what category or categories of credit events it will cover. The main ones – as defined by the International Swaps and Derivatives Association (ISDA) – can be seen in the following table.

| Credit Event | Description |

|---|---|

| Bankruptcy | The initiation of liquidation proceedings, or similar events related to insolvency |

| Failure to pay | The reference entity fails to make interest or capital repayments when they are due |

| Obligation default | The entity’s financial obligations become due before the scheduled maturity date due to missed payment/s |

| Obligation acceleration | The reference entity’s contract obligations are changed, thus bringing forward repayment dates |

| Repudiation/moratorium | The entity disputes the terms of the debt contract |

| Restructuring | The terms of the debt obligation are substantially altered or modified |

| Government intervention | The terms of the contract are impacted by involvement from a government body/bodies |

Individuals and companies that hold debt securities can use a CDS to hedge against the chance of a credit event occurring. This allows them to manage risk without having to sell the underlying asset.

Like all financial derivatives, CDSs can also be used by traders who wish to speculate. In this case, they can be employed to bet on changes in credit quality or market conditions, over both a short and long time horizon.

Individuals can also try and profit with these instruments by exploiting arbitrage opportunities.

A Brief History

The CDS market was invented in the 1990s and experienced rapid growth in the build up to the 2008 financial crisis.

By the time the US housing market collapsed, banks had sold complex financial securities that incorporated swaps on mortgage-backed securities. As these underlying mortgages were defaulted upon, banks and insurance companies who had written the CDS contracts were forced to cover investors’ losses.

During this period, banks and financial institutions created complex financial securities that included swaps on mortgage-backed securities. When the US housing market collapsed in 2007 and underlying mortgages defaulted, companies that had written CDS contracts found themselves obligated to cover investors’ thumping losses.

This contributed to the collapse of financial heavyweights such as Lehman Brothers and Bear Stearns, and resulted in significant losses for others, including insurance giant AIG.

These financial instruments can be highly lucrative, but they remain massively controversial. Billionaire investor Warren Buffett described them as “financial weapons of mass destruction” five years before the financial crisis.

But what is really the problem with credit default swaps? It essentially boils down to two things: human nature and the very nature of the credit default swaps. The credit default swaps were created knowing that there were bound to be defaults on credit facilities. But what the creators of credit default swaps did not factor in was:

- The size of the defaults in the loans on which credit default swaps were based.

- The extent of exposure of companies purchasing these credit defaults, and the extent of exposure of other global companies in the firms directly acquiring these CDS assets or providing insurance for credit default swap transactions.

- Credit default swaps did not solve the problem of loan defaults. They merely transferred the risk in a magnified manner to others who were by the nature of their operations, unable to mitigate such risk.

- The necessary credit checks that were supposed to be carried out to determine who actually qualified to receive some of the subprime mortgage loans that eventually went bad were not done, so as to increase a large pool of people into the market in the hope that the real estate market would just keep rising.

So when every Tom, Dick and Harry in the US began taking loans to buy homes in order to cash in on the boom in prices of real estate that were supposed to keep rising without end, a time bomb was created.

As subprime mortgage institutions began giving out loans to people who had very awful credit and would ordinarily not have qualified to be given loans, the risk of defaults was increased and the buck was simply passed on to other investors.

These events showed clearly, that credit default swaps should be used only when a proper system of credit checks, credible credit ratings by the relevant agencies and proper regulation of this market is all in place to prevent the abuses of the past.

The Credit Default Swap Market

The popularity of CDSs fell sharply following the financial crisis. And it has failed to reclaim those pre-crash heights, with volumes declining steadily since then.

This reflects regulatory tightening in the aftermath of the crisis; a negative public perception of the risks they carry; and the emergence of new financial instruments.

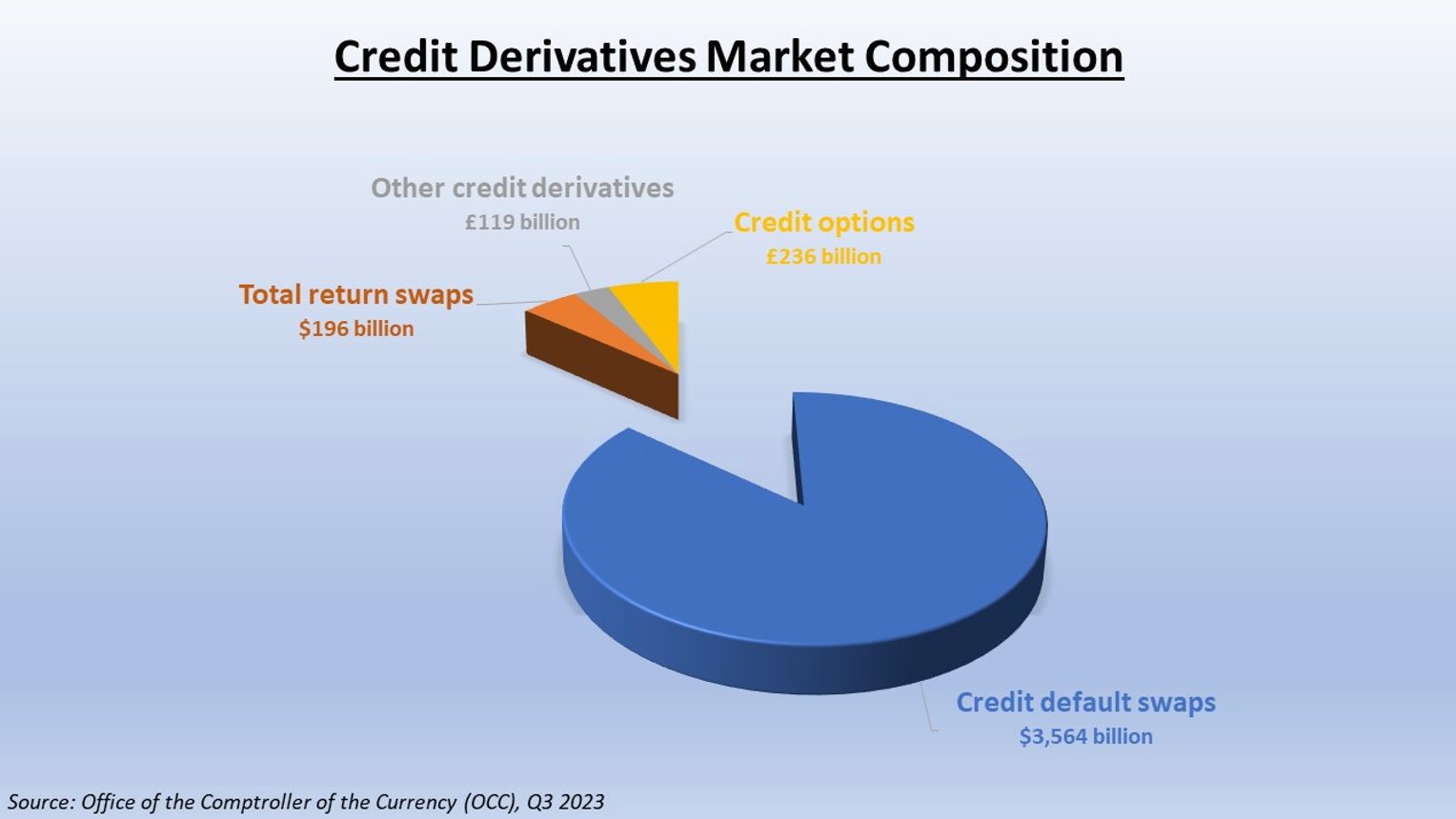

That said the global CDS market remains significant. According to the Office of the Comptroller of the Currency (OCC), the global CDS market was worth in the region of $3.6trn as of the third quarter of 2023. That represented almost nine-tenths of the entire credit derivatives market.

There are three main reasons why investors may decide to trade in CDSs:

Speculation

Traders use CDSs to bet on the creditworthiness of a specific entity without having to own its debt. They are popular with both short- and long-term investors who wish to speculate on market movements.

Let’s say that I expect a company’s credit quality to deteriorate. I would aim to make money on this by purchasing CDS protection on its debt.

Should things go to plan and a credit event occur, the value of the contract would increase, and I could make a healthy profit (depending on issues like market liquidity and trading costs).

Note: CDS prices are quoted in the form of credit spreads. These spreads – which widen as the estimated risk of a credit event increases – represent the premium that the contract seller charges the buyer for providing protection.

Hedging

Investors who already have exposure to an entity’s debt can hedge the risk by buying a CDS.

By obtaining protection through one of these derivative instruments, I can offset the losses I make should a credit event occur.

Arbitrage

Traders can use these swaps to capitalise on pricing discrepancies between related financial markets or securities. This can involve lower risk than many other trading strategies, and CDS traders often try to exploit differences between the values of contracts and the underlying bonds of the same reference entity.

Let’s say that the CDS spreads are currently wider than the bond spreads of a company. This scenario would indicate that CDS protection is relatively costly compared to the underlying bonds. I would seek to capitalise on this by:

- Buying relatively cheap bonds in the cash market.

- Simultaneously selling the CDS to take advantage of the higher premium.

- Waiting for the price discrepancy between the two instruments to tighten, or disappear.

- Selling the bonds and buying the CDS to capture a profit.

Note: CDS prices fluctuate according to changes in the entity’s credit risk. However, values also depend on factors such as economic conditions, interest rates and market liquidity.

Pros And Cons Of Credit Default Swaps

Pros

- Versatility: These financial instruments can be used to speculate, hedge and exploit arbitrage opportunities, which can make them a valuable and multifunctional security to trade.

- Liquidity: The CDS market enjoys deep liquidity, a quality that helps keep trading costs down and enables investors to enter and exit positions quickly and easily.

- No ownership: Traders can bet on changes in credit risk without having to own the underlying debt securities.

- Diversification: CDS investors have access to a wide variety of industries, regions and credit ratings. As such, they can be a useful way for investors to manage risk in their portfolios.

- Leverage: Like any derivative product, CDSs are designed with high levels of leverage in mind. The use of borrowed funds can amplify a trader’s profits, but beware: they can also exacerbate losses when prices move the ‘wrong’ way.

Cons

- Potentially large payouts: Sellers of CDS contracts can end up nursing large losses if a credit event occurs.

- Trading venue: These swaps are primarily traded over the counter (OTC) rather than on regulated exchanges. This can cause problems like a lack of transparency and counterparty risk (where one party fails to meet their trading obligations).

- Complexity: Trading CDSs can be complicated and require a sound understanding of intricate matters (like contract terms and swap pricing). This can make it a challenging asset class for new investors.

- Regulatory risks: The CDS market is watched closely by regulators in the aftermath of the 2008 financial crisis. This means it may be more susceptible to changes that could pose risks to investors.

Final Thoughts

CDS contracts remain a highly controversial asset class. But their flexibility and ability to create large profits means they remain popular with many short- and long-term investors.

However, these financial derivatives can be tricky to understand, and often involve traders taking on more risk than with other asset classes. For this reason, they should only be used by experienced traders who have a sound understanding of how they work.

Also, for many retail investors in the UK, bonds, ETFs and mutual funds are more accessible.