CPT Markets Review 2025

|

|

CPT Markets is #94 in our rankings of CFD brokers. |

| Top 3 alternatives to CPT Markets |

| CPT Markets Facts & Figures |

|---|

CPT Markets is a London-based forex and CFD broker regulated by the FCA. Founded in 2008, this established brokerage offers trading across currencies, equities, commodities, futures and bonds with leverage up to 1:30. The broker's services are more limited than other firms, with just the MT4 platform on offer and no additional trading features. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, futures, options |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, IFSC (Belize) |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade CFDs across metals, energies and indices with leverage up to 1:30. Traders can access 50+ indicators and charting tools, although no other analysis tools or software are offered. |

| Leverage | 1:30 |

| FTSE Spread | From 1.8 |

| GBPUSD Spread | From 1.8 |

| Oil Spread | From 1.8 |

| Stocks Spread | From 1.8 |

| Forex | There is an impressive selection of 100 forex pairs in the MT4 platform. However, spreads start from 1.8 pips for retail traders, which is not competitive vs other brokers. |

| GBPUSD Spread | From 1.8 |

| EURUSD Spread | From 1.8 |

| GBPEUR Spread | From 1.8 |

| Assets | 100 |

| Stocks | CPT Markets offers a range of single stock CFDs, although transparency around specific equities is lacking. Algorithmic stock traders can also implement custom Expert Advisors in MT4. |

CPT Markets is an online broker specialising in CFDs and forex trading. UK customers can trade with this FCA-regulated broker across two account types on the MT4 platform. Our review covers account registration, minimum deposit requirements, leverage and fees, bonuses and more. Find out if you should sign up and start trading today.

About CPT Markets

CPT Markets is the trading name of CPT Markets Limited, and is registered and based in Belize. The global company is licensed by the International Financial Services Commission (IFSC) of Belize, but it has a UK branch regulated by the Financial Conduct Authority (FCA) in England and Wales.

Originally named Citypoint Trading Ltd, the UK arm was established in 2008 with headquarters in London. The board of directors are equipped with a wealth of experience in the financial services sector, with a background in risk management and regulation.

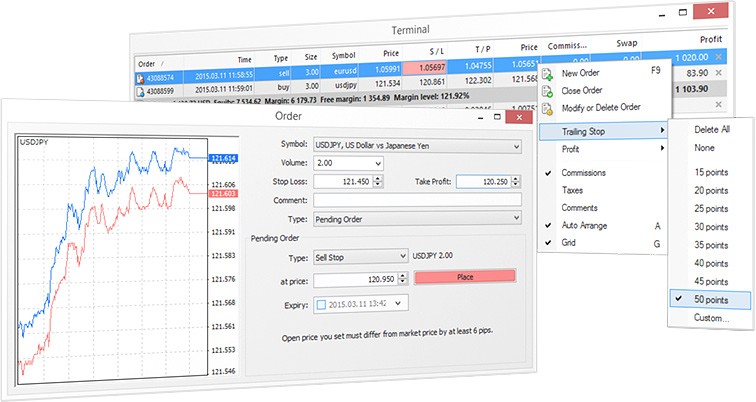

MetaTrader 4 Platform

CPT Markets offers the globally recognised and industry-leading MetaTrader 4 platform. MT4 has a user-friendly interface that is suitable for new traders. However, it is also highly customisable, with plenty of tools and technical indicators to suit advanced traders too. Users can benefit from:

- 9 timeframes

- Support in 30+ languages

- Custom technical indicators

- Secure encryption protocols

- 30 built-in technical indicators

- Expert advisors for automated trading

MetaTrader 4

MT4 is available to download on PC, Mac, Android or iOS devices.

Products

CPT Markets UK offers a wide range of tradable assets.

Forex and CFD trading highlights include:

- 100 forex pairs

- Precious metals and energy markets

- Major European, US and other global indices

Futures and options trading includes:

- Forex

- Stocks

- Equity indices

- Soft commodities

- Metals & oil futures

- Bonds & government debt

While the CPT Markets UK website does not provide a detailed list of assets, a full list is available on the MT4 platform once an account is created.

Fees & Commission

CPT Markets UK offers variable and floating spreads from 1.8 pips on retail trading accounts. Typical spreads on CFDs are 1.2 pips on every 1 lot traded. There is no commission on retail accounts, however, fees may be applied if a client needs a specific trading setup. An ongoing fee is charged for positions held overnight.

Leverage

Maximum leverage rates depend on the account type and instrument being traded. In line with ESMA regulations, leverage on retail accounts is capped at 1:30 and professional accounts have a maximum of 1:200.

Leverage By Instrument

Retail

- Forex: 1:30

- Indices: 1:20

- Commodities: 1:20

Professional

- Forex: 1:200

- Indices: 1:200

- Commodities: 1:100

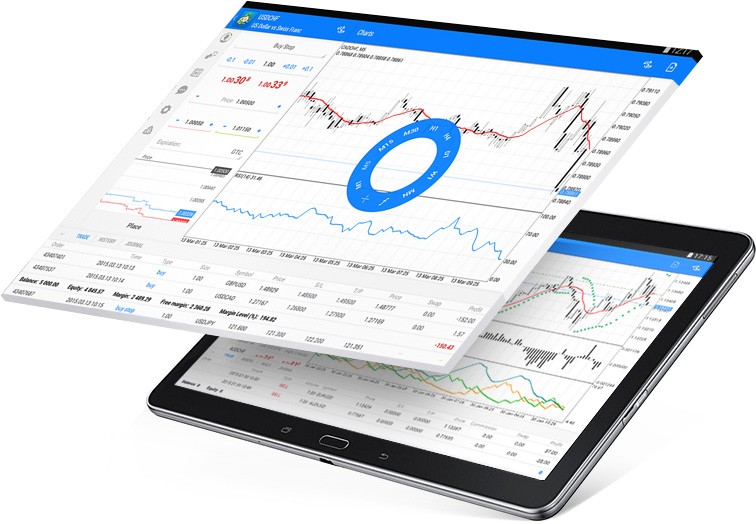

Mobile Trading

CPT Markets does not offer a proprietary mobile app. However, clients can trade on-the-go with the MT4 mobile trading platform. The app has the same functionality as the desktop version and has received positive customer reviews. It allows you to manage your account, execute trades, access technical indicators and more.

MT4 app

The MT4 mobile app is available to download on iOS and Android.

Deposits & Withdrawals

CPT Markets offers the all of the most popular forms of payment, including:

- Debit/Credit cards i.e. Visa and Mastercard

- E-wallets i.e. Skrill and Neteller

- Bank transfer

The standard retail trading account has a minimum deposit requirement of $100. Professional accounts require a higher minimum deposit which you can check with the customer support team.

To withdraw earnings, clients must submit a request form on the website. Withdrawals are generally processed within one business day and must be made using the original deposit option. Requests will be rejected if accounts are below margin levels.

The broker does not charge any fees on deposits or withdrawals, however fees may be incurred via banks and payment providers.

Demo Account

Users can access a free demo account by filling out a simple registration form on the website. A trial account allows you to test strategies on the MT4 platform and access the broker’s markets without risking real money. For new traders, practicing on a demo account is always recommended.

Regulation Review

CPT Markets UK is authorised and regulated by the Financial Conduct Authority (FCA) under license number 606110. The FCA is one of the most respected authorities in the world. Brokers who obtain FCA regulation would have to meet strict requirements while maintaining high regulatory standards. Therefore, UK traders can be assured that they are trading with a reputable broker.

Additionally, CPT Markets Limited, which is the Belize entity is registered with the International Financial Services Commission (IFSC) of Belize under license number IFSC/60/430/18(33)h.

Additional Features

CPT Markets offers an online educational course with video tutorials that progress from beginner to advanced topics. Subjects include the fundamentals of forex trading, risk management, advanced MT4 installation and more.

The broker also provides in-depth market research on everything from the S&P 500 index to the gold market to central bank policies. The ‘Weekly Market Wraps’ can be found on their website and Facebook page, and provide traders with solid fundamental analysis on a regular basis.

Account Types

The broker offers two account types:

- Retail – Comes with client money protection, negative balance protection, Financial Services Compensation Scheme (FSCS) and access to Financial Ombudsman Service (FOS). Maximum leverage is capped at 1:30, while the minimum deposit is $100.

- Professional – Account holders are not granted any financial protection, except access to the FSCS. However, maximum leverage is much higher at 1:200.

To open a live retail account, users must provide contact details, trading experience as well as identification documents. In order to be eligible for a professional account, traders must meet at least 2 out of 3 below criteria.

- Performing a minimum average of 10 significantly-sized transactions per quarter.

- Own a financial instrument portfolio worth more than €500,000.

- At least a year of relevant professional experience in the financial sector.

Once you’ve opened an account, you can log in via the ‘Client Portal’. Unfortunately, CPT Markets UK does not offer Islamic, swap-free accounts.

Pros

- MT4 trading platform

- Free demo account

- Commission-free trading

- Negative balance protection

- Free weekly market research

- No deposit or withdrawal fees

- FCA-regulated & FSCS protection

- Extensive educational resources

Cons

- Undiversified account types

- Non-competitive spreads

- Lack of no deposit bonus

- No Islamic account

- No MT5 platform

Trading Hours

Clients are free to trade on the platform 24/7. However, opening and closing times vary by instrument. For example, the forex market is only open Monday to Friday. Each market’s trading hours can be accessed on the MT4 terminal.

Contact Details

Clients can contact CPT Markets UK customer support via:

- Email: info@cptmarkets.co.uk (Replies within 24 hours)

- Phone: +44 (0) 203 988 2277 (Open 7 am to 10 pm Monday to Friday)

- Address: 40 Bank Street, 30th Floor Canary Wharf, London, England, E14 5NR

- UK website: www.cptmarkets.co.uk

Security

CPT Markets places heavy importance on transparency and security through a robust privacy policy. In line with FCA regulationw, retail traders receive negative balance protection and client funds are kept in segregated accounts.

Furthermore, all accounts are covered by the Financial Services Compensation Scheme (FSCS), which guarantees indemnity up to 50,000 GBP in the event that CPT Markets goes bankrupt. Other client protection features include a Financial Ombudsman Service (FOS) for retail accounts. Additionally, the MT4 platform ensures secure logins and high-encryption technology.

Should You Trade With CPT Markets?

CPT Markets offers good trading opportunities across a number of instruments on the established MT4 platform. On top of commission-free trading, UK customers can be assured by FCA regulation, good security and client protection. Overall, CPT Markets is a strong broker to start trading with.

FAQ

How Much Capital Do I Need To Trade With CPT Markets?

The minimum deposit required to trade on with a retail account is $100. However, professional accounts will require a higher capital, details of which are available through customer support.

What Is The Difference Between CPT Markets And CPT Markets UK?

CPT Markets and CPT Markets UK are both entities under CPT Markets Limited. CPTMarkets.com is based in Belize, while CPTMarkets.co.uk is based in London. The Belize entity abides by IFSC regulation, while the UK arm is regulated by the FCA.

How Do I Open A Live Trading Account With CPT Markets UK?

You can apply for a live trading account on their website. Traders must complete an online account registration by filling out contact details, trading experience and providing identification. Alternatively, you can open an account by contacting customer support via telephone or email.

What Is The Leverage Cap On CPT Markets UK?

In line with FCA regulation, UK retail traders using CPT Markets are granted a leverage cap of 1:30. However, professional accounts can access the maximum leverage of 1:200.

Does CPT Markets Offer A Demo Account?

Yes, the broker offers a free demo account. All you need is to complete an online registration form on the website. Then, you will be able to access different markets on the MT4 platform without risking real money.

Top 3 CPT Markets Alternatives

These brokers are the most similar to CPT Markets:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FXPrimus - FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage.

CPT Markets Feature Comparison

| CPT Markets | Swissquote | IG Index | FXPrimus | |

|---|---|---|---|---|

| Rating | 3 | 4 | 4.7 | 2.3 |

| Markets | CFDs, futures, options | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Cryptos, Futures, Options, Commodities, Bonds |

| Minimum Deposit | $100 | $1,000 | $0 | $15 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, IFSC (Belize) | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | CYSEC, MIFID, ICF, FCA, BaFin, VFSC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:1000 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | CPT Markets Review |

Swissquote Review |

IG Index Review |

FXPrimus Review |

Trading Instruments Comparison

| CPT Markets | Swissquote | IG Index | FXPrimus | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | No |

CPT Markets vs Other Brokers

Compare CPT Markets with any other broker by selecting the other broker below.

Popular CPT Markets comparisons: