Core Spreads Review 2025

|

|

Core Spreads is #94 in our rankings of CFD brokers. |

| Top 3 alternatives to Core Spreads |

| Core Spreads Facts & Figures |

|---|

Core Spreads is an FCA-licensed broker offering CFD and spread betting opportunities on a proprietary platform or MetaTrader 4. Traders can access more than 1000 instruments, including company shares, commodities, indices and forex. Spread bets have fixed spreads that start from 0.4 with no commission, while CFDs start from 1 pip plus a $1.50 charge per lot. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Spread betting, forex, commodities, indices, equities |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | Yes (iOS & Android) |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Core Spreads offers CFD trading on 40 forex pairs plus 13 commodities, including metals and energies, and 13 global stock indices including the UK100 and US30. CFDs are traded through the MT4 platform with leverage up to 1:30 in line with UK regulations. |

| Leverage | 1:30 |

| FTSE Spread | 1.0 |

| GBPUSD Spread | 0.6 |

| Oil Spread | 3.5 |

| Stocks Spread | Variable |

| Forex | Core Spreads offers trading on 34 forex pairs through spread betting and 40 currencies through CFDs, with both vehicles covering major and minor pairs. Spread betting spreads start from 0.6 for EUR/GBP; CFD spreads are variable and start from 1.2 pips on EUR/GBP. |

| GBPUSD Spread | 1.2 |

| EURUSD Spread | 0.6 |

| GBPEUR Spread | 1.2 |

| Assets | 40 |

| Stocks | Core Spreads traders can access spread betting on 1000+ UK, US and European stocks and shares, a decent selection. However, CFD stock trading is not available and clients cannot directly buy and own shares through this broker. |

| Spreadbetting | Spread betting is available with very tight fixed spreads starting from 0.4 with no commissions. Core Spreads has a full asset list for spread betting, including 1000+ stocks and shares, 34 forex pairs, 16 global stock indices and five metals and energies. |

Core Spreads is an FCA regulated broker that specialises in CFD trading and spread betting. The broker offers over 1,000 instruments on their proprietary CoreTrader platform and CoreMT4. This UK review covers fees, mobile apps, minimum deposit requirements, spreads, leverage, demo accounts and more. Find out whether you should sign up with Core Spreads.

Core Spreads Is Moving…

Core Spreads has announced that they will no longer accept new account applications as they transition to their new global brand – Trade Nation. This is the latest step to bring the established brokers with a long-standing history under the same umbrella.

Trade Nation promises the same company, staff and top-tier regulatory protections as Core Spreads, but with a clean new look.

For now, you can follow the sign-up link through the Core Spreads website. Alternatively, you can open an account directly at Trade Nation.

About Core Spreads

Core Spreads was established in 2009 and is headquartered in London, UK. The broker operates under Finsa Europe Ltd, which is authorised and regulated by the Financial Conduct Authority. It is also fully compliant with the European Securities and Markets Authority (ESMA) and client funds are protected under the Financial Services Compensation Scheme (FSCS).

Trading Platforms

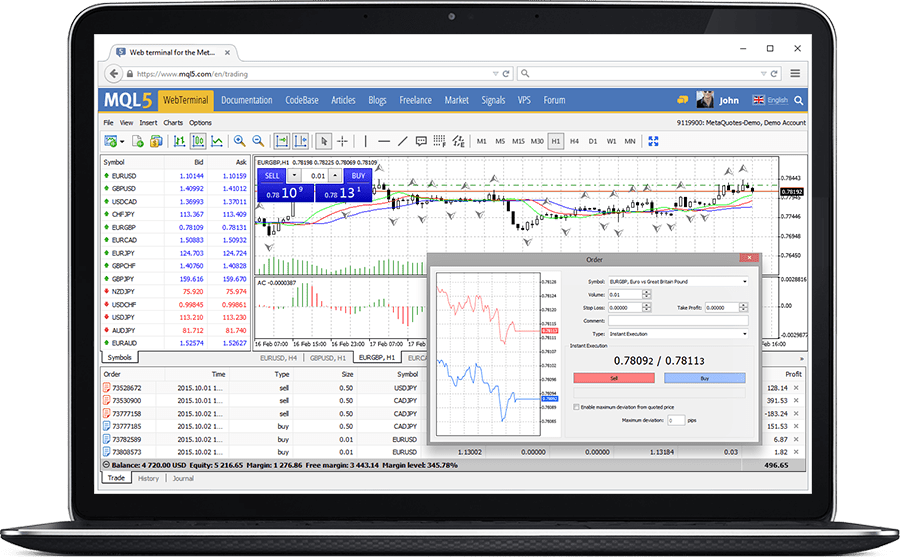

MetaTrader 4

MT4 is an industry-leading platform that offers a user-friendly interface to cater for all trading abilities. The CoreMT4 platform is designed exclusively for CFD trading. Clients benefit from:

- 24/5 customer support

- 50+ technical indicators

- Ultra-fast execution speeds

- 9 timeframes and multiple chart types

- Multiple order types & one-click trading

- Automated trading via expert advisors (EAs)

MetaTrader 4

CoreMT4 can be downloaded on any desktop device or as a mobile app.

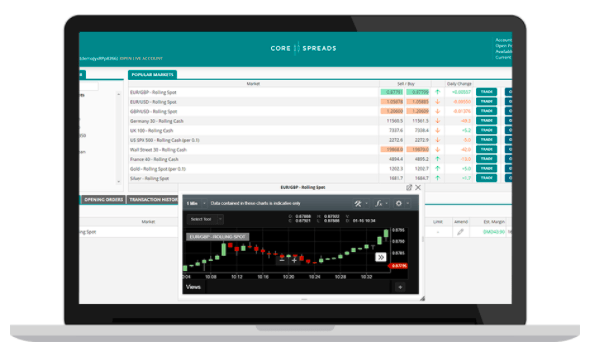

CoreTrader

CoreTrader is the broker’s proprietary web platform. This platform has a simple interface with sharp execution speeds and comprehensive risk management features. CoreTrader is designed exclusively for spread betting clients.

Features include:

- One-click trading

- 24/5 customer support

- One-click demo account

- Fully customisable charts

- Advanced technical analysis

CoreTrader

CoreTrader can be accessed via any web browser or as a mobile app.

Products

Core Spreads offers a wide range of 1,000+ assets. However, access to markets depend on the account type and platform.

CFDs

- Commodities – 13 metals and energies i.e. gold, silver and oil

- Indices – 13 global stock indices i.e. JAPAN225, UK100 and US30

- Forex – 40 major and minor currency pairs i.e. EUR/CAD and GBP/USD

Spread Betting

- Commodities – 5 metals and energies i.e. gold and oil

- Equities – Access to 1,000+ shares from the UK, EU and US

- Forex – 34 major and minor currency pairs i.e. GBP/ZAR and USD/JPY

- Indices – 16 global stock indices i.e. FRANCE40, HONGKONG50 and US500

Trading Fees

Spread betting accounts on CoreTrader have fixed spreads with no commission charges. Spreads on this account differ depending on the time of day. For example, typical spreads on EUR/USD are 0.6 pips and come with a standard margin of 3.33%.

On the other hand, CFD trading accounts on CoreMT4 come with variable spreads and a £1.25 commission per lot. Typical spreads on GBP/USD start at 1.2 pips with a margin of 3.33%.

Full details on each asset can be found under market information on the broker’s website.

UK Leverage

In line with UK trading regulations, leverage is capped at a maximum of 1:30:

- Equities – 1:5

- Commodities – 1:10

- Major FX pairs – 1:30

- Minor FX pairs and indices – 1:20

Mobile App

You can download a mobile app version of both CoreMT4 and CoreTrader platforms. The mobile app offers full access to markets, trading features and technical analysis tools. While the trading experience is much easier on the desktop, mobile trading allows you to respond to market shifts on the go. They are both available to download on iOS and Android devices.

MT4 mobile

Deposits

Core Spreads offers a range of deposit methods for UK traders:

- Skrill

- Bank wire transfer

- Debit and credit cards i.e. Visa, MasterCard and Amex

The broker does not charge any deposit fees. There is also no minimum deposit requirement to open a live account. E-wallet and debit and credit card payments are usually instant, while bank wire transfers can take a few days.

Withdrawals

Core Spreads does not charge any withdrawal fees. However, a minimum withdrawal amount of £50 is required and must be funded back to the same deposit source. Withdrawal requests are usually processed within 24 hours. However, funds may take a while to appear in your account depending on the payment method chosen.

Demo Account

Core Spreads offers a free demo account on both CoreTrader and CoreMT4 platforms. Upon registration, you have to choose whether you want a spread betting or CFD trading account. You can then access up to £10,000 in funds. Once you’ve signed up, the demo login portal can be found on the broker’s website.

Before committing to a live account, you can practice your strategies with full access to markets and simulated trading conditions without risking real money.

Welcome Bonus

In line with UK regulations, Core Spreads is not able to offer sign-up bonuses to UK traders. This is because regulators restrict financial incentives to avoid unfair terms and conditions. However, exclusive offers and promotions may be found on the broker’s Twitter, LinkedIn and Facebook pages.

UK Regulation

Core Spreads is a trading name of Finsa Europe Ltd, which is registered in England and Wales. The company is regulated by the UK’s Financial Conduct Authority (FCA) under reference number 525164. FCA is a well-respected body with stringent regulations, such as strict auditing procedures, risk management and financial compliance.

In addition, Core Spreads UK retail clients are protected under the FSCS compensation scheme. Traders are insured with up to £85,000 should the broker go insolvent. The broker also adheres to the rules set by the European Securities and Markets Authority (ESMA).

Additional Features

Clients can access the Core Spreads blog, which provides daily trading insights and the latest market news. The blog is contributed to by experts like David Buik, Michael Wilson and Philip Konchar. The broker also offers tutorials on their platforms. You can learn how to utilise financial signals, trailing stops plus forex trading strategies like hedging, scalping, margin and more.

In addition, the website offers useful information on market holidays, expiry dates on futures, plus trading time changes in GMT.

Live Accounts

Core Spreads offers two account types with different features. They are distinguished by the type of trading and the exclusive platform.

CoreMT4

This account is designed for CFD trading i.e. forex, indices and commodities. Features include:

- £1.25 commission per lot

- Minimum order of 0.01 lot

- No minimum deposit

- Variable spreads

CoreTrader

This account is designed for spread betting on indices, forex, commodities, UK, US and EU equities. Features include:

- Minimum order of £0.50

- No minimum deposit

- No commission

- Fixed spreads

To register for an account, simply visit the ‘Create Account’ on the company’s website. In line with KYC policies, you will need to provide identification documents. You will also need to state your trading experience. Once your UK account has been verified, you can log in via the broker’s website.

Pros

- FCA regulation & FSCS compensation scheme

- No commission on CoreTrader account

- No minimum deposit requirement

- Negative balance protection

- Fixed and variable spreads

- Strong UK trader reviews

- MetaTrader 4 platform

- Proprietary platform

- Free demo account

Cons

- No Islamic swap-free accounts

- Limited educational materials

- No cryptocurrencies

- No MT5 platform

- No bonuses

Trading Hours

Core Spreads clients can access the platforms 24/7. However, trading hours will vary by instrument. For example, the forex market is only available from Monday to Friday. The broker is also closed on holidays to align with global financial markets. For more detailed information on opening and closing times by asset, visit the Markets section on the website.

Customer Support

You can contact the Core Spreads customer support team from Sunday 10 pm to Friday 10 pm GMT via:

- Email – support@corespreads.com

- Free UK telephone number – 0800 862 0780

- LinkedIn – Regular updates and exclusive offers

- London offices – 9th Floor 30 Crown Place, London, United Kingdom, EC2A 4ES

Safety

Client funds are secured in segregated accounts at Barclays Bank. Furthermore, clients are covered by the Financial Services Compensation Scheme (FSCS) scheme if the company goes out of business. Both platforms are also secured with data encryption, password protection and industry-standard privacy policies. Thus, clients can trust their funds with Core Spreads.

Should You Trade With Core Spreads?

Core Spreads is a legitimate, secure and FCA regulated broker with a wide range of assets, tight spreads and low to zero commissions. The broker also offers the reliable CoreMT4 and bespoke CoreTrader platform to suit different trading needs. Overall, CoreSpreads can provide a well-rounded trading experience for CFD traders and spread betting investors.

FAQ

Does Core Spreads Offer A Demo Account?

Yes, Core Spreads offers a free demo account. This allows access to both trading platforms and up to £10,000 in virtual funds. To sign up, you simply need to provide basic personal information.

Is Core Spreads A Legitimate Broker?

Core Spreads is a legitimate and safe broker for UK retail traders. The broker is FCA regulated and adheres to ESMA guidelines to protect clients. Funds are also held in segregated bank accounts and are protected by the FSCS scheme. We are confident that Core Spreads is not a scam.

Is Core Spreads Regulated?

Yes. Core Spreads operates under Finsa Europe Ltd. The company is licensed and regulated by the Financial Conduct Authority (FCA) under firm reference number 525164.

How Much Capital Do I Need To Trade On Core Spreads?

The broker does not have a minimum deposit requirement on either account. So you don’t need a large pot of capital to open a live account and start trading. Deposits can be made in GBP so UK traders won’t have to pay currency conversion fees.

What Trading Platforms Does Core Spreads Offer?

Core Spreads offers two trading platforms. This includes the bespoke CoreTrader platform for spread betting and the industry-leading CoreMT4 platform for CFD traders. Each platform is tied to the account type and offers different features. For example, the spread betting account offers fixed spreads with no commission. On the other hand, the CFD trading account comes with variable spreads and a £1.25 commission per lot.

Top 3 Core Spreads Alternatives

These brokers are the most similar to Core Spreads:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Core Spreads Feature Comparison

| Core Spreads | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.9 | 4.8 | 4.8 | 4.7 |

| Markets | Spread betting, forex, commodities, indices, equities | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | Core Spreads Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Core Spreads | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | Yes | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Core Spreads vs Other Brokers

Compare Core Spreads with any other broker by selecting the other broker below.

Popular Core Spreads comparisons: