Silver

Trading silver isn’t like trading stocks – it has its own risks, costs, and ways to trade, making choosing the right broker is critical. The wrong one can eat into profits or make it harder to manage trades.

See our list of the best silver brokers in the UK, tested by traders with real experience dealing metals.

Top Brokers For Trading Silver

How Investing.co.uk Chose The Top Silver Brokers

We logged into each platform to confirm silver trading access (XAG/USD) and assess the trading environment. Brokers were then sorted by overall ratings, using over 200 data points combined with hands-on platform insights. Our tests were conducted by experienced traders based in the UK.

What To Look For In A Silver Broker For Trading

Access To Silver Markets

The first question is whether the broker even offers silver. Not all do. And those that do may only provide one way in:

- Spot silver: Direct exposure to the metal’s price.

- Silver CFDs: Contracts for difference let you trade on price moves without owning silver.

- Silver futures or options: Less common for retail traders, but some brokers provide access.

- ETFs & funds: Exchange-traded funds backed by silver, often listed in London or New York.

Decide if you short-term trading or long-term exposure. Then check if the broker has the right products.

Regulation & Safety

Silver is volatile. That makes safety more important, not less. Look for brokers regulated by the Financial Conduct Authority. This matters for two reasons:

- Client funds are kept separate from company funds.

- The Financial Services Compensation Scheme (FSCS) may cover you if the broker fails.

If the broker isn’t FCA-regulated, think twice.

Spreads & Commissions

Silver trades on tight margins. Costs matter.

- Spread: The gap between buy and sell. For silver, even a few pence difference adds up if you trade often.

- Commission: Some brokers charge extra per trade. Others roll everything into the spread.

A broker with zero commission might still widen spreads. Always compare the actual cost of opening and closing a trade.

Overnight Financing (Swap Rates)

This one catches people out. If you trade silver using CFDs, you’ll pay (or earn) a financing charge for holding a position overnight. The rates vary by broker. Over time, these costs can be bigger than spreads or commissions.

For long-term positions, look at ETFs instead. They don’t charge overnight fees the way CFDs do.

Leverage & Risk Controls

Many UK brokers offer leverage on silver. That means you can control a large position with less money up front. But leverage cuts both ways. Gains and losses both multiply.

When comparing brokers:

- Check the maximum leverage allowed. In the UK, FCA rules usually cap retail leverage for silver CFDs at 1:20.

- Look for risk tools like stop-loss orders and negative balance protection.

If you’re new, lower leverage is safer.

Platforms & Execution

It’s not about fancy features. It’s about whether trades go through smoothly and prices update fast.

Popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, or web-based apps all handle silver trading. What matters is execution speed and reliability.

If a platform is slow, you’ll notice it most with fast-moving assets like silver. Try the demo trading account first.

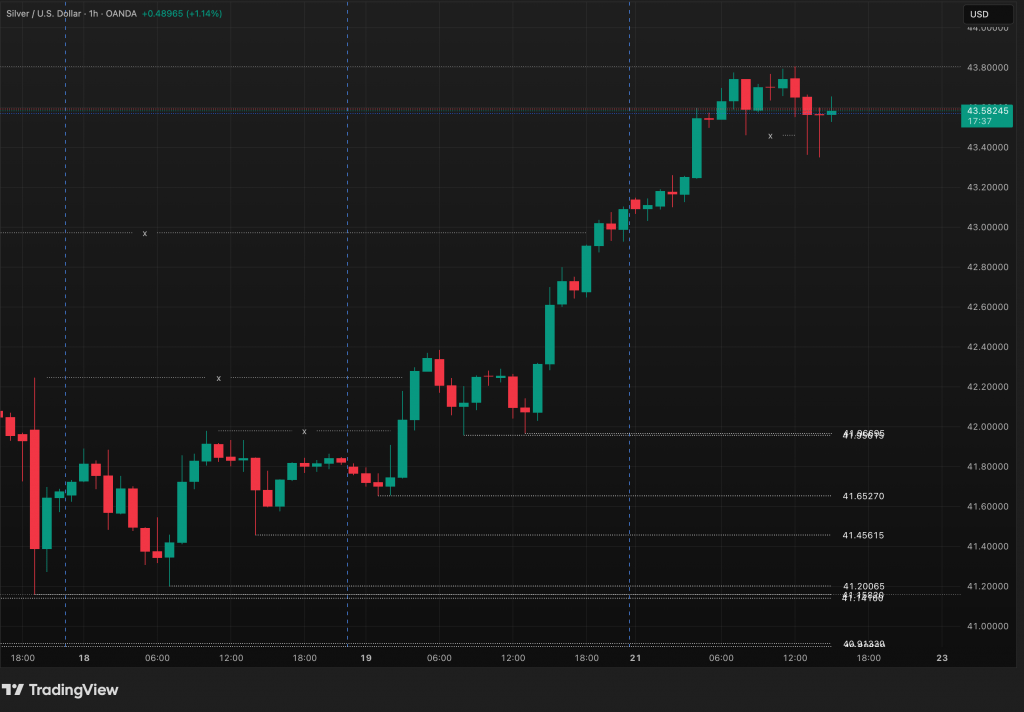

Track live silver prices and test trading ideas straight on TradingView’s charts

Silver ETFs vs Direct Trading

Some traders don’t want the hassle of overnight fees or leverage. For them, silver ETFs can be simpler.

A broker that gives access to the London Stock Exchange should allow you to buy silver-backed ETFs. These track the silver price and can be held in regular trading accounts or even ISAs.

The key is whether the broker gives fair access and charges reasonable commission on ETF trades.

Data, Charts & Research

Silver moves on supply and demand, but also on big global themes: interest rates, inflation, and the US dollar.

Good brokers we’ve tested provide:

- Live silver price charts.

- Historical data.

- Basic news feeds.

Don’t pay extra for this if you don’t need it. But having decent data in the same platform saves time.

Deposits, Withdrawals & Fees

It sounds basic, but check how easy it is to get money in and out.

- Is there a fee for deposits or withdrawals?

- Are funds returned quickly?

- Do they support UK bank transfers, debit cards, or e-wallets (like PayPal and Apple Pay) you actually use?

If withdrawals are slow or expensive, that’s a red flag.

Minimum Account Sizes

Some silver brokers let you start with £10. Others want more. Think about your budget and trading style. If you only want to test silver trading, a broker with low minimums may suit you better.

When I first started trading silver, I chose a broker with a £500 minimum. It forced me to take trades more seriously, but I also realised smaller minimums can be better if you’re learning and want to limit risk.

Customer Support

You may not need it often. But when you do, it matters.

Look for:

- UK-based contact options.

- Clear support hours.

- Fast response to deposits or withdrawals.

It doesn’t have to be 24/7, but it should be reliable.

Final Thoughts

Silver can be rewarding, but it’s not a simple market. When choosing the best silver broker in the UK, focus on what matters for silver specifically: costs, FCA regulation, product choice, and how overnight charges work.

Don’t get distracted by marketing claims or extra features. A broker that gives you clean, fair access to silver at a reasonable cost is the best broker for you.