Coinexx Review 2025

|

|

Coinexx is #60 in our rankings of CFD brokers. |

| Top 3 alternatives to Coinexx |

| Coinexx Facts & Figures |

|---|

Coinexx is an unregulated broker that provides leverage up to 1:500 on forex, commodities, indices and cryptocurrencies with deep liquidity, pure ECN spreads and negative balance protection. The broker uses crypto as base currencies and has low minimum deposit requirements of 0.001 BTC. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, Commodities, Indices, Cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | 0.001 BTC |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade flexible CFDs on forex, commodities, indices and cryptos with tight spreads, fast execution, micro-lot trading and leverage up to 1:500. There are also no restrictions on trading strategies. |

| Leverage | 1:500 |

| FTSE Spread | From 0.0 pips |

| GBPUSD Spread | From 0.0 pips |

| Oil Spread | From 0.0 pips |

| Stocks Spread | NA |

| Forex | Coinexx offers an excellent selection of 70+ major, minor and exotics currency pairs, presenting diverse opportunities with a forex calculator to aid trading decisions. It’s also one of a select few brokers to support forex trading on the ActTrader platform, alongside MT4 and MT5. |

| GBPUSD Spread | 0.0 |

| EURUSD Spread | 0.0 |

| GBPEUR Spread | 0.0 |

| Assets | 60+ |

| Stocks | Coinexx traders can speculate on broad movements of global markets via five indices covering exchanges in the US, UK, Germany, and China. On the downside, there are no individual stocks which is a significant drawback. |

| Cryptocurrency | Trade CFDs on BTC, ETH, LTC and XRP with 1:5 leverage, market execution and 0.01 micro lot trading. However, we weren't impressed with the narrow choice of cryptos with no emerging, smaller-cap tokens available. |

| Coins |

|

| Spreads | From 0.0 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Coinexx is a cryptocurrency-based multi-asset ECN broker offering UK traders access to over 80 investment products, instant deposits, the popular MT4 and MT5 and super fast executions. In this 2025 review, we will outline what our experts found while using the broker, including who Coinexx is, how to open an account, demo account support, deposit and withdrawal fees, spreads, leverage, commission and more.

Coinexx is an advanced but unregulated cryptocurrency and CFD brokerage based in Seychelles with MT4 and MT5 access, low-cost investing and algorithmic trading support.

Company History & Overview

Coinexx is a multi-asset, unlicensed online broker based in Seychelles. Established in 2017, the brokerage offers over 80 tradable instruments, including cryptocurrencies, currency pairs, indices and commodities.

The broker prides itself as a true ECN broker, meaning that clients gain direct access to markets, allowing for faster executions and deep liquidity.

Markets & Instruments

Coinexx offers more than 80 investment assets, including some highly popular products. This is a notably limited number of instruments, especially compared to competitors that can offer hundreds or even thousands of tradable instruments. However, this still provides enough for those looking to invest in the more popular assets.

Instruments include:

- Cryptocurrencies – 4+ crypto pairs, including LTC/USD, XRP/USD, BTC/USD and ETH/USD

- Forex – Over 60 currency pairs, including major, minor & exotic pairs, such as EUR/USD, GBP/USD, NOK/SEK and AUD/CHF

- Indices – 5+ global stock indices, including the FTSE 100, DJ 30, DAX 40 and HK 50

- Commodities – Over 8 commodities, including XAU/USD, XAG/USD, USO/USD and UKO/USD

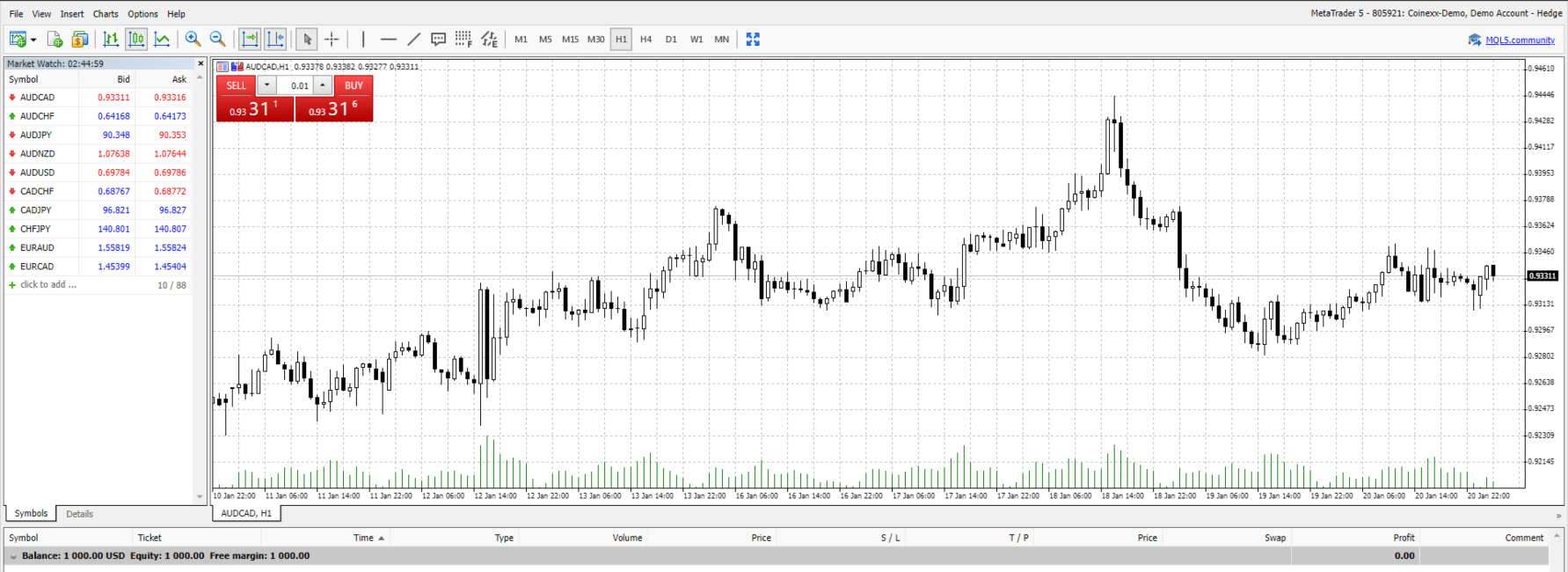

Investment Platforms

Coinexx offers the MetaTrader 4 and MetaTrader 5 terminals. These are two of the most popular online trading platforms with both beginner retail traders and adept investors. The terminals boast various advanced features that enable the implementation of complex investment strategies, sophisticated algorithms and advanced technical analysis.

The desktop clients for MT4 and MT5 can be downloaded on Windows and Mac for free from the Coinexx website.

MetaTrader 4

The MT4 platform is a highly customisable solution that allows users to easily and effortlessly apply existing investment strategies and develop new ones. Key features include:

- Over 30 in-built technical indicators, including moving averages, Bollinger bands and RSI

- Algorithmic trading via MQL4 expert advisors (EAs)

- Online MQL4 marketplace for indicators and EAs

- Market, stop and limit order types

- Customisable interface

- 24 analytical objects

- One-click trading

- Hedging support

- Nine timeframes

MetaTrader 5

Coinexx’s MT5 is the latest trading platform released by the MetaQuotes corporation. This platform provides more advanced features than MT4 while maintaining its customisability and accessibility for beginners. Key features include:

- 44 analytical objects, including Fibonacci retracements and Gann tools

- Online MQL4 & MQL5 marketplace for indicators and EAs

- Algorithmic trading via MQL5 expert advisor bots

- Over 38 in-built technical indicators

- Hedging and netting support

- Built-in economic calendar

- Six pending order types

- Customisable interface

- One-click trading

- 21 timeframes

MetaTrader 5

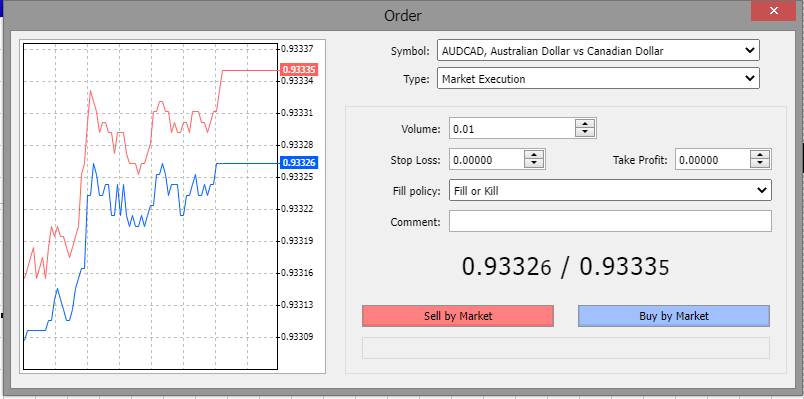

How To Place A Trade On MT4 & MT5

- Sign up and open an account with Coinexx

- Sign into the client portal and download either the MT4 or MT5 terminal

- Login within the platform using the details provided by email

- Choose the asset you would like to trade from the top left of the window

- Click New Order

- Enter the trade parameters (volume, market/pending, stop loss, take profit)

- Choose Sell by Market or Buy by Market to confirm your trade

MetaTrader Order Placement

Fees & Charges

Coinexx only offers one account type, the Pro ECN account. When we used this account we experienced typical commissions of £1.60 per lot, which is a competitive rate. Thanks to the depth of liquidity offered, alongside low latency connectivity to top-tier providers, investors experience raw market spreads. We were offered spreads of 0.00011 pips for EUR/GBP and 0.00326 pips for GBP/USD.

Swap fees do apply when holding a position open after 00:00 server time (GMT + 3) according to whether the position is long or short. These fees are calculated based on the interest rate differential between the two pairs. Coinexx provides a swap fee value calculator on its website.

There are no account management or inactivity fees to be aware of and both deposits and withdrawals are also free.

Coinexx Mobile App

The MetaTrader 4 and MetaTrader 5 platforms both have mobile applications available on both the Apple iOS App Store and Android Google Play Store. These apps provide much of the same functionality as the desktop and web trader versions, allowing traders to chart assets, perform technical analysis and open/close trades. However, there are limitations when it comes to advanced strategy creation and algorithm building.

Payment Methods

Coinexx accepts deposits and withdrawals via more than 25 different digital currency cryptos and altcoins. These include Bitcoin, Litecoin, Dash and Ethereum. Transfers in and out of your account go through crypto wallets, with the broker’s cold storage cryptocurrency wallets implementing multiple layers of security authentication.

Deposits

Deposits can be made via any of the supported digital currencies, with a minimum limit of 0.001 BTC or equivalent. Deposit speeds vary with the blockchain used but are usually same-day transfers.

How To Deposit Money Into A Live Account On Coinexx

- Log into the Coinexx client portal

- Choose the Deposit option from the top menu

- Input your live trading ID

- Choose the currency you wish to deposit from the drop-down menu

- Click Proceed

- Your funds will then be processed and deposited into your trading account once the transaction is cleared on the blockchain

Withdrawals

Withdrawals from your Coinexx account need to be requested and the broker will usually process this within 48 hours. The time it takes for the funds to clear depends on the blockchain’s confirmation and will be processed in the same digital currency used for funding your account.

While there is no maximum withdrawal limit, the minimum requirement is 0.001 BTC or equivalent. As long as margin requirements are met, clients can withdraw their entire account value.

Those wondering how to withdraw money from Coinexx should follow the depositing steps above but click the Withdrawal button within the client portal.

Account Types

Coinexx offers a single account type: the Pro ECN Account. With this account, users have access to all the investment assets offered by the firm. The account also includes:

- Up to 1:500 leverage

- Commission of ≈ £2 per lot

- Maximum trade size of 100 lots

- Minimum trade size of 0.01 lots

- Account base currencies of BTC, BCC, LTC, ETH & USD

- 100% deposit bonus

- 70% margin call level

- 50% stop out level

How To Open A Live Account With Coinexx

- Click the Open An Account button on Coinexx’s website

- Sign up by inputting all the required details in the form that pops up (name, email address, phone number, etc.)

- Choose the Live Account option and select which platform you want to use

- Finalise the account and deposit funds using one of the supported methods

- Log into your account on one of the trading platforms and begin investing

Demo Account

Coinexx allows clients to open demo paper trading accounts on both the MT4 and MT5 platforms. Users can open as many demo accounts as they wish directly from your client portal dashboard by clicking the Demo Account button. You then choose the parameters of your account, including the available maximum leverage rate and base currency.

We recommend traders make use of demo investing accounts to better learn how to use the platforms and get a feel for how position execution works with this broker.

Bonuses & Promos

Coinexx offers a 100% deposit bonus. This acts as an additional margin to your trading account, allowing you to double up on your investment positions. This deposit bonus can be redeemed only upon opening your first trading account. The account must also have a leverage limit of 1:200 and a minimum deposit of £100.

UK Regulation

Coinexx is an unregulated brokerage firm, which means the company can provide more favourable investing conditions (lower spreads, higher leverage, commissions, etc.). However, this comes at the cost of no independent, regulatory oversight over the firm’s operations. With no financial body to ensure financial fairness on Coinexx’s side, client funds are potentially at a higher risk.

Leverage Review

Coinexx offers high leverage rates of up to 1:500. This means that clients can have access to £500 (or equivalent) worth of purchasing power for every £1 deposited. This works by essentially borrowing funds from the broker to take much larger positions. However, this also means that losses can build up more quickly.

Make sure to only invest with leverage if you have experience and are sure you can afford to lose your deposit.

Extra Tools & Features

Virtual Private Server

Coinexx includes a virtual private server (VPS) in its offering to any trader with an account. A VPS is a cloud-based server that has reduced latency and uninterrupted connectivity, allowing investors to take advantage of faster execution speeds. Those with at least £5,000 held in a live account gain access to a VPS for free. Otherwise, they can pay £25 per month for access.

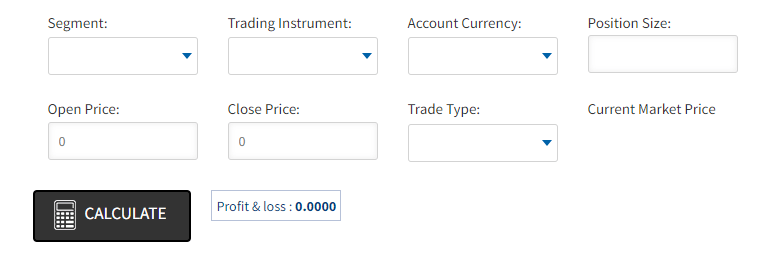

Tools

While the broker does not offer any educational resources, it does offer several different technical tools to traders. On the Coinexx website, you can access forex, margin, pip, currency, profit and loss (PNL), commission and swap calculators. These are all free and help speed up the processes of technical analysis and position management.

Coinexx PNL Calculator

Coinexx Trading Hours

Coinexx’s platform server runs on the GMT + 3 time zone. However, individual trading hours vary by instrument.

- Cryptocurrencies – All crypto assets are open 24/7 given the decentralised nature of the markets. There are no overnight closures or trading holidays.

- Forex – Foreign exchange markets are open 24/5 from 22:00 GMT Sunday to 22:00 GMT Friday each week.

- Indices & Commodities – Index and commodity products are available to trade during the opening hours of their respective exchanges

Customer Service

24/7 customer service is provided by Coinexx’s support team. The broker can be contacted via email, an online support form or live chat. The company does not have a telephone support number to call, nor does it provide a physical address for contact.

- Live Chat: Lower-right corner of the website

- Support Email Address: support@coinexx.com

- Complaints Email Address: compliance@coinexx.com

- General Contact Email Address: contactus@coinexx.com

You can also interact with Coinexx through its social media platforms. You can find the company on Facebook and Twitter.

Client Security

Coinexx protects clients’ funds by using cold storage wallets, manual monitoring, dual authentications and end-to-end encryption. Cold storage wallets store keys and assets offline to make them much more difficult to break into. These measures ensure that funds are kept away from any potential hackers.

The broker also uses one-time passwords and offers 2-factor authentication (2FA) to further protect client accounts. Moreover, Coinexx claims to implement negative balance protection, ensuring users cannot lose more than they deposit into the account when investing on margin.

Should You Invest With Coinexx?

Coinexx boasts competitive pricing and fees, fast ECN execution speeds, high leverage rates and access to versatile trading platforms in MT4 and MT5. The broker allows its clients to transfer funds in a variety of different crypto coins and altcoins, making deposits and withdrawals fast, easy and secure. However, the limited range of instruments, lack of educational resources and unregulated nature make this broker difficult to recommend to less experienced traders.

FAQ

Is Coinexx A Good Broker?

Coinexx offers traders fast ECN execution, raw spreads, low commissions, access to MT4/5, no deposit or withdrawal fees, mobile investing and many more desirable features. However, the broker is unregulated and only supports 80 instruments, limiting diversification opportunities and increasing risk. Furthermore, the accepted base currencies do not include GBP, making the brokerage less accessible to UK traders.

Is Coinexx A Safe Broker?

Coinexx is an unregulated broker, so there is a risk that comes with entrusting any funds to the firm. However, the company claims to have negative balance protection, as well as use many safety features, such as offline key storage and end-to-end encryption.

Can I Practise Trading On A Coinexx Demo Account?

Coinexx allows traders to open as many demo accounts as they want. The parameters of these accounts can be set upon creating them, including custom leverage limits and base currencies. You can open a demo account for both the MetaTrader 4 and MetaTrader 5 platforms.

How Much Do I Need To Deposit To Start Trading With Coinexx?

The minimum deposit amount for the Pro ECN account is 0.001 BTC (or equivalent).

Does Coinexx Offer Good Trading Platforms?

Both the MetaTrader 4 and MetaTrader 5 platforms are offered by the firm. These can be accessed through online web trader clients, desktop applications or mobile apps. Both of these are highly popular and versatile investing platforms, giving clients a host of tools to perform technical analysis and implement complex investing strategies.

Top 3 Coinexx Alternatives

These brokers are the most similar to Coinexx:

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Coinexx Feature Comparison

| Coinexx | FP Markets | IC Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 2.5 | 4 | 4.8 | 4.8 |

| Markets | Forex, Commodities, Indices, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | 0.001 BTC | $40 | $200 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (UK), 1:500 (Global) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Coinexx Review |

FP Markets Review |

IC Markets Review |

Pepperstone Review |

Trading Instruments Comparison

| Coinexx | FP Markets | IC Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Coinexx vs Other Brokers

Compare Coinexx with any other broker by selecting the other broker below.

Popular Coinexx comparisons: