Cobra Trading Review 2025

|

|

Cobra Trading is #114 in our rankings of UK brokers. |

| Top 3 alternatives to Cobra Trading |

| Cobra Trading Facts & Figures |

|---|

Established in 2003, Cobra Trading is a US-based brokerage specializing in equities and options contracts. The firm offers 3 powerful platforms and is aimed at professional clients or those looking for retirement accounts. Cobra Trading is regulated by the NFA and SIPC and is a member of FINRA. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, options |

| Demo Account | Yes |

| Min. Deposit | $30,000 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | $1 |

| Regulated By | FINRA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | No |

| Stocks | I was impressed to find a variety of equities and options with commissions as low as $0.0015 per share and $0.30 per options contract. Retail leverage is 1:4 for trading and 1:2 for overnight trading and there’s a choice of 3 feature-rich platforms to execute your strategies. I also appreciated the demo account for those who need to test-drive the terminals. |

Cobra Trading is a US-based direct market access (DMA) broker that provides a personalised client experience for equity and options trading. Institutional clients and individuals are provided with specific trading accounts designed to best suit their needs. This 2025 Cobra Trading review will cover critical features, such as commission pricing, trading fees, regulation and margin capabilities. Read on to discover whether this is the right broker for you.

Cobra Trading Headlines

Cobra Trading Inc has provided advanced trading tools to clients for almost two decades since its establishment in 2004. From its headquarters in Texas, the firm is run by founder and CEO Chadd Hessing, along with a small team of experienced executives and brokers. Both equities and options trading are available through the platform, with its sister broker, Venom Trading, offering futures and options capabilities to traders.

In contrast to many modern brokers, Cobra Trading personalises its brokerage service and emphasises top-quality customer service. As well as operating in all 50 US states and Puerto Rico, the broker is open to international clients in countries such as the UK, Canada, and Australia.

Instruments & Markets

Cobra Trading offers spot stock trading with US equities and options contract trading to its clients, facilitating various investment strategies.

The broker provides access to assets from all US stock exchanges, with thousands of equities available from markets like the NASDAQ and NYSE. However, no overseas markets, such as the UK FTSE 100 or the TSX of Canada, are supported. The primary clearing firm employed by Cobra Trading is Wedbush Securities, though traders can request that Interactive Brokers be used instead.

Cobra Trading supplies numerous routes for borrowing assets, including direct-to-market instruments, to aid in swift and cost-efficient options trading. The system also provides several opportunities to access equities that would be difficult to obtain through other brokerage firms.

Leverage

Cobra Trading provides leverage rates of up to 1:4 for retail traders. However, when holding positions out of hours or through the premarket, this is reduced to 1:2. It is also worth mentioning that traders need to open a retail margin account to use these services – clients with an IRA or cash account cannot trade with margin.

Margin rates stand at 5.25% annual interest, significantly lower than several major competitors. Clients borrowing over $1 million may qualify for reduced rates and should contact the broker group to find out more.

Trading Platforms

Cobra Trading provides three platforms for clients to choose from, each with separate features, layouts and software fees. In addition to its online platforms, the firm provides free broker-assisted trading via live chat or telephone.

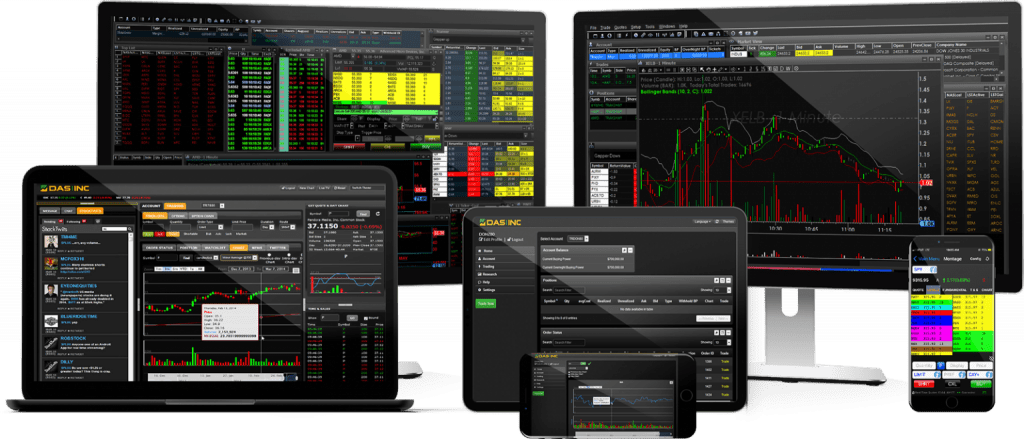

DAS Trader Pro

Cobra Trading offers DAS Trader Pro as one of its three supported platforms. This platform features advanced charting capabilities and over 30 technical indicators for trend analysis. In addition, DAS Trader Pro works on multiple monitor setups and boasts customisable hotkey configurations for faster trading and research.

DAS Trader Pro

This platform costs clients $125 a month, though the fee is waived if more than 250,000 shares are traded over the calendar month.

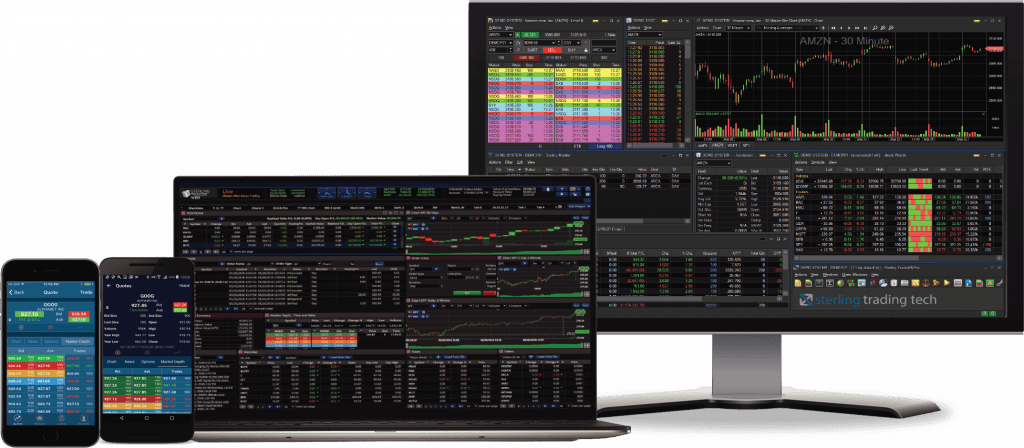

Sterling Trader Pro

Sterling Trader Pro is the most expensive platform provided by Cobra Trading at $200 per month, rising to $230 with options trading enabled. Clients receive access to live Level 2 market data and significant customisation for graphs, watchlists and alerts for this premium. Additionally, customers that exceed 300,000 traded shares over a month can obtain this platform for free.

Sterling Trader Pro

Cobra Trader Pro

For clients that favour the layout and customisation of Sterling Trader Pro but are put off by the cost, Cobra Trading has developed a streamlined version of the options and stock trading platform for individual traders. Cobra Trader Pro retains the key features of the Sterling platform for the more affordable price of $100 a month. Traders that turn over 200,000 shares in a month are granted free access.

Cobra Trader Pro

Mobile Apps

Sterling Trader Pro and DAS Trader Pro have mobile versions available on iOS and Android for clients that like to monitor their portfolios and open positions from anywhere. While there is no proprietary Cobra Trading app for account management purposes, traders on the Venom platform can login to an all-inclusive app for trading and account control.

Trading Accounts

Cobra Trading provides several distinct account options tailored to clients’ individual needs. Customers not operating as part of a corporation or company can choose between an individual or joint account. These can access leverage rates of up to 1:4 in market hours and 1:2 overnight.

Providing stock options to business and professional clients forms a significant portion of Cobra Trading’s dealings. To this end, several pro accounts are provided, with Corporate, LLC, Trust or Partnership accounts available for corporation wealth management.

Cobra Trading Account Minimum

Cobra Trading requires significant account minimums, with a base initial deposit requirement of $25,000 and a capital maintenance level of $10,000.

This is higher still for clients that exceed three intraday trades in a rolling 5-day period. These accounts are classed as pattern day trading (PDT) under FINRA regulations and subject to different rules. For both domestic and international traders, PDT accounts require an initial investment of $30,000 and a sustained maintenance level of $25,000.

Traders searching for a lower account minimum can utilise the Venom by Cobra platform, with accounts starting at $5,000.

Demo Account

A good way to trial the broker and its platform before staking capital with it is to open a Cobra Trading demo account. This boasts complete functionality using simulated funds and real-time market prices to represent as true a customer experience as possible.

Payment Methods

Clients have several options when funding a Cobra Trading account. Firstly, you can transfer an account from another broker, along with all of its funds, though substantial charges may apply depending on the brokerage.

Repeatable deposit methods are also provided, including (ACH) transfer, wire transfer and cheque payments. While ACH transfers can take a matter of minutes, wire transfers, especially international payments, can take up to a few days to process. Cheques may take longer still, due to postal timings. There are no fees for deposits, though returned cheques and wire transfers carry a penalty of $25 and $20, respectively.

These methods are also available for withdrawals, with outgoing ACH transfers free of charge, domestic wire transfers costing $20 and international wire transfers carrying a $25 fee. Cheque requests are free of charge.

While there is no minimum deposit or withdrawal amount stated on the Cobra Trading website, traders should make sure their transactions are significant enough to cover any associated fees or meet the account minimums.

Brokerage Fees

Cobra Trading operates with a pricing system that is based on commissions for equities and options trades. Beyond the aforementioned software costs, clients may be subject to routing fees, market data access charges and account management costs.

Trading Commission

Commissions start at $.003 per share for stock trading but a greater volume entitles clients to advantageous rates. Those who trade between 100K and 500K shares per month only pay $.00275 per share and this discount scales up to $.0015 at the highest trading level. However, highly active traders should contact the broker and discuss further possible discounts.

Options commissions begin at $.50 per contract, falling to $.40 when opening between 2,000 and 10,000 contracts a month and $.30 for clients that trade more. As with the stock trading commissions, Cobra Trading encourages active traders to contact them to discuss potential rebates.

Market Data

Cobra Trading charges $25 per month for its mandatory basic data package, including major US indices, Nasdaq Level 1 and 2 data, NYSE Level 1 and 2 data and Pink Sheet Level 1 data. For $79 a month, clients can upgrade to the pro data package.

Additional market data packages are available as add-ons, such as NYSE ArcaBook, Nasdaq TotalView and OPRA Level 1 and 2, with separate monthly charges.

Routing & Regulatory Fees

Separate fees are also levied for routing equity and options trades through different exchanges. These fees vary by platform, specific exchange and type of trade, ranging from free to $.0035 per share at the highest end.

Both FINRA and the SEC impose regulatory fees. These are passed on to the client, though these are charged at fractions of a cent per share or contract. While Cobra Trading only deals in domestic markets, a foreign transaction tax may apply in some rare cases.

Account Charges

Despite offering free broker-assisted trades and email statements, Cobra Trading implements several account management charges that you should be aware of. For example, an annual fee of $35 applies to IRA accounts, while options contract assignments cost $0.005 per share, on top of a flat fee of $10. Account inactivity fees also apply, with a quarterly $15 charge levied on dormant accounts.

Pros Of Cobra Trading

- Margin trading

- Telephone trading

- Several account types

- Good customer service

- Advanced options features

- Range of trading platforms

Cons Of Cobra Trading

- Inaccessible account minimums

- No free trading platforms

- Limited payment options

- Complex fee structure

- No futures trading

Customer Support

Cobra Trading provides responsive and knowledgeable support to traders and prospective clients, citing reviews from many satisfied traders. Whether you have a general inquiry about the brokerage, want to take advantage of the free broker-assisted trading service or wish to trial a trading platform, clients can contact Cobra Trading through a phone number, fax, email or the website’s live chat feature.

- Phone: 877-792-6272

- Email: info@cobratrading.com

The customer support team operates within office hours from Monday to Friday, 07:00 to 16:30 CST. The broker’s website also has a helpful FAQ section that details answers to various common queries and issues.

Security & Regulation

Regulation from a main financial governing body is one of the best hallmarks of a reputable brokerage. To this end, Cobra Trading is registered with several prominent US regulators: FINRA and the NFA. Membership to the SIPC also provides cover for up to $500,000, should the firm go under. Additional insurance is provided by UK-based Lloyds of London for up to $25,000,000.

All Cobra Trading platforms are protected by username and password, while trades and personal information is secured through encryption. However, the supported trading platforms do not offer two-factor authentication (2FA).

Trading Hours

As Cobra Trading exclusively deals in US markets, the platforms adhere to American exchange hours. Premarket and aftermarket trading is also offered, thus the firm’s trading hours are 03:00 to 19:00 CST. It is worth noting that trades outside of office hours must be placed independently and not on a broker-assisted basis.

Cobra Trading Verdict

Cobra Trading is a regulated and reputable broker that is geared towards those who prefer a personalised trading experience. Clients that employ advanced trading techniques and require significant market data are well provided for, with level 2 market data support and several providers. However, minimum account levels starting at $10,000 and the lack of free trading platforms may push out some less serious or newer clients.

FAQ

Does Cobra Trading Offer Zero Fees?

Cobra Trading charges a commission on stock trading and options, with fees starting at $.003 per share for equities and $.50 per options contract.

Does Cobra Trading Offer API Support?

Cobra Trading does not provide API support but boasts access to three advanced trading platforms with impressive customisation options.

Can Non-US Residents Use Cobra Trading

Cobra Trading welcomes international clients, meaning traders in jurisdictions such as Australia, Canada and the UK can sign up for an account.

What Is The Cobra Trading Account Minimum?

On a standard trading account, Cobra Trading requires an initial deposit of $25,000 and a capital maintenance level of $10,000. For pattern day trading (PDT) accounts, US regulations mandate an initial investment of $30,000 and a maintenance level of $25,000.

Who Is Cobra Trading’s Clearing Firm?

Primarily, Cobra Trading uses Wedbush Securities as its clearing firm. However, new clients can request to use Interactive Brokers.

Top 3 Cobra Trading Alternatives

These brokers are the most similar to Cobra Trading:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Cobra Trading Feature Comparison

| Cobra Trading | IG Index | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 3.3 | 4.7 | 4 | 4.3 |

| Markets | Stocks, options | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Minimum Deposit | $30,000 | $0 | $1,000 | $0 |

| Minimum Trade | $1 | 0.01 Lots | 0.01 Lots | $100 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FINRA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4 | MT4, MT5 | - |

| Leverage | - | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:50 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Cobra Trading Review |

IG Index Review |

Swissquote Review |

Interactive Brokers Review |

Trading Instruments Comparison

| Cobra Trading | IG Index | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | No | Yes | Yes | No |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | No |

Cobra Trading vs Other Brokers

Compare Cobra Trading with any other broker by selecting the other broker below.

Popular Cobra Trading comparisons: