Child Trust Funds

– What is a Child Trust Fund?

A Child Trust Fund (CTF) is a long term savings account designed to give parents, family, and friends a mechanism to save for a child’s future.

A Child Trust Fund (CTF) is a long term savings account designed to give parents, family, and friends a mechanism to save for a child’s future.

CTF eligibility rules

- To be eligible for a CTF, the child must have been born between 1st September 2002 and 2nd January 2011.

- Further, UK child benefit must have been paid for that child for at least one day before 4th January 2011.

- The child must live in the UK, and not be subject to any immigration restrictions

If you have been working oversees, providing you receive child or family benefits from the European Union country where you live and work and meet the other criteria as above (excluding UK child benefit), then you might also be eligible to open a CTF.

How a CTF (Child Trust Fund) Works

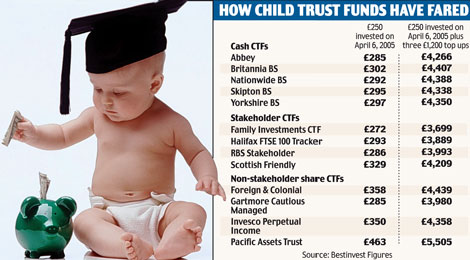

The HM Revenue and Customs sends a voucher to the parent or legal guardian of the child, which will be valued at between £50 and £250. The exact value will depend upon the date of birth of the child.

This voucher can be used to open an account in the child’s name, and then, (since 1st November 2011) further deposits into the account can be made by family and friends. Low income families may be able to get extra money paid into the account: these extra payments depend upon conditions such as age and your tax credit status.

Families and friends can deposit a total of £3600 per year into the CTF.

A CTF has to be opened with an approved CTF provider, using the voucher sent by the HMRC. Though the account belongs to the child, the person who opened the account is responsible for managing it. If this is you, then you will need to keep safe all the paperwork and statements related to the account, make sure the CTF provider is told of changing details, such as address, and you will be the only one who can change any details on the account, including changing providers.

When the child attains the age of 16, he/ she becomes the contact name on the account, and takes it over. All statements will now go to the child, and he/ she is the only one who can change CTF provider.

The money deposited in the trust fund, and any growth on it, accrues no tax liability through the lifetime of the fund, or upon maturity.

At the age of 18, the child can withdraw the funds, and either reinvest them or use them for some other purpose, such as paying for driving lessons or continuing education, perhaps.

What if your child was born after January 2nd 2011?

The CTF was replaced by a Junior ISA. These are available for children under 18 who live in the UK and are not entitled to a CTF. A child can’t have a Junior ISA if he already has a CTF.

How does a Junior ISA work?

Just like normal ISAs, there are two types of Junior ISA (Cash and Stocks and Shares), and a child can have one or both types at the same time.

The total amount that can be paid into a Junior ISA is £3600 per year, and this can be split between the two types of ISA if so wished.

A junior ISA can be opened for any child under the age of 16 who does not have a CTF, but must be opened by a person with parental responsibility. This person will take on the responsibilities of managing the ISA, in the same way that he or she would manage a CTF account.

Just like a CTF, the Junior ISA transfers to the child when the age of 16 is reached, though funds cannot be accessed until the age of 18.

So, is a CTF or Junior ISA right for your child?

In this day and age, we all try to do our very best for our children, and this includes financially. How many times have you heard the phrase ‘I wouldn’t like to be growing up today’ or ‘I don’t know how youngsters today make ends meet’? Perhaps you have said something similar yourself.

CTFs and Junior ISAs are investment vehicles that allow you to build up a fund to give your child a great start in life. Even though ultimately its use is down to the individual child, good education about money will provide the guidance that means the funds could make a real difference to your child’s life. Imagine if you were able to deposit just £1000 per year, throughout your child’s life through tile age 18: this could be the difference between going to university or missing out, or the deposit on a first home, perhaps.

CTFs and Junior ISAs are also a great way for grandparents to give something truly lasting and meaningful to their grandchildren.

Whilst it is not something we care to think about, there is always a possibility that your child will be involved in a bad accident or become terminally ill. Under such circumstances the funds accrued in a CTF or Junior ISA can be released, perhaps to provide for that holiday of a lifetime?

If you want any further information about CTFs and Junior ISAs, then contacting the HMRC is the first step to take:

For CTFs: HMRC CTF contact details

For Junior ISAs: HMRC Junior ISA