Charles Schwab Review 2025

|

|

Charles Schwab is #114 in our rankings of UK brokers. |

| Top 3 alternatives to Charles Schwab |

| Charles Schwab Facts & Figures |

|---|

Charles Schwab is a large US investment broker offering a massive range of stocks, ETFs and equity derivatives in a variety of savings and investment accounts. The trustworthy brand has been offering financial services for 45+ years with over 35 million brokerage accounts and $870+ billion in assets under management. Charles Schwab is also regulated by top-tier watchdogs including the SEC and FCA. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, ETFs, Cryptos, Futures, Options, Commodities, Bonds |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | $1 |

| Regulated By | SEC, FINRA, FCA1 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | No |

| Commodities |

|

| Stocks | Charles Schwab offers access to all US-listed stocks plus IPOs and ADRs. Fractional shares on the S&P 50 are also available from just $5, as well as access to some foreign equities. We particularly rate the advanced stock screeners and watchlists that help you analyze and compare investments. |

| Cryptocurrency | Charles Schwab supports indirect crypto trading through digital coin trusts and crypto-related stocks. You can get exposure to popular digital currencies such as Bitcoin, Ripple and Ethereum. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Charles Schwab is a popular brokerage with personal investing and managed account solutions. The brand provides US market access to international traders, alongside a wealth of resources and extra tools. This UK review will outline the account types, products and fees applicable to retail investors. We also cover how to open a Charles Schwab account and get the most out of the platform and app.

Our Take

- Charles Schwab is suitable for UK investors looking for low-cost trading opportunities in the US & Canada

- A wealth of tailored tools and expert insights can help British traders navigate US markets

- The broker isn’t a viable option if you want to trade UK stocks or currencies

- The limited range of payment methods and £25 withdrawal fee are notable drawbacks

Market Access

Charles Schwab offers a range of products that cover the US financial market. As such, the platform is a good option if you want to speculate on large US companies, including tech firms like Tesla, Amazon and Apple.

The provision of products like bonds and ETFs also makes the firm suitable for individuals seeking long-term investment opportunities. Alternative instruments include stocks, options, mutual funds, and ADRs.

On the negative side, some popular asset classes including forex and commodities are not available. In addition, we were disappointed to see that the penny stocks and fractional shares offering is not available to UK clients, which would have been attractive to beginners and casual investors.

Charles Schwab Fees

We were reassured to see that Charles Schwab is transparent about its fees, and aside from a relatively high minimum account balance, rates are competitive.

This £1000 minimum is not presented as a minimum deposit balance – instead, Schwab’s T&Cs state that at least this account balance must be maintained to keep an International Account active.

We were thrilled to find no charges for trading US securities online, though OTC market securities do have a $6.95 commission. Mutual funds are also fee-free, and options have zero base commission, though a small contract fee of £0.65 applies.

Futures trading is relatively inexpensive with a £2.25 charge per contract. However, be prepared to pay an additional fee if you want to open positions via the automated phone channel or using broker-assisted services. These range between £5 and £25 plus the relevant online commission fees.

One of the biggest perks of trading with Charles Schwab UK is that there are no costs to use the services of one of the company’s consultants. However, if you choose to sign up for the fully managed, Wealth Advisory service, fees will apply based on the value of your assets. This starts from 0.80%, which is industry standard. It is worth noting, however, that the minimum investment amount is $1,000,000, which is unrealistic for most retail traders.

The managed profiles are slightly cheaper, with lower minimum thresholds which vary by instrument:

- Equities – $100,000 minimum investment, fees from 1%

- Fixed Income – $250,000 minimum investment, fees from 0.65%

- Balanced – $250,000 minimum investment, fees from 0.95%

UK traders should also be aware of a foreign currency transaction fee that often includes an exchange rate markup, which varies depending on the amount of currency converted. For values under $100,000, a 1% fee will apply per transaction.

On a lighter note, we like that inactivity charges are not applied, which puts Charles Schwab on an even footing with rivals like Fidelity and Vanguard.

Our experts were less thrilled to find that Charles Schwab has outgoing wire transfer charges, which are expensive at £25 per transfer. Fortunately, there are fee waivers for eligible clients, such as those who meet minimum asset levels; households with £100,000 or more are allowed three fee-free wire transfers per quarter.

Account Types

UK investors may be frustrated by the account options available as these are more limited than what’s on offer to US traders. While using Charles Schwab, we could not open a retirement, college or pension account or a stocks & shares ISA. Instead, UK investors only have access to a basic brokerage account. This is a major downside given that investors can gain tax benefits by opening an ISA or pension available from leading competitors, such as Interactive Investor.

On the upside, Charles Schwab’s all-in-one UK product does provide access to all the US-denominated instruments, plus personalised support, access to US-specific investing education, and top-tier research. And, you can open a joint, trust, or corporate account upon request if you need one of these.

You can also subscribe to a managed account service, which is ideal for hands-off investing, or for those looking for tailored guidance. We found both options have a very high minimum investment amount, however, with at least $100,000 required for a Managed Account Select and $1 million for a Schwab Wealth Advisory account. This will put these solutions out of reach for the majority of retail investors.

- Managed Account Select – Your money manager will work with you to create and maintain a portfolio of individual securities. You can choose from three strategies: US and international equities, fixed-income bonds, or balanced portfolios across multiple asset classes

- Schwab Wealth Advisor – Access to a financial consultant and two wealth advisors to provide strategic information and recommendations for your money. The more personalised wealth management service offers continuous updates and changes to reflect your goals and life changes

How To Open A Live Account

UK clients must register with Charles Schwab’s ‘International Account’. Our team found that having the following documents to hand will speed up the process:

- Identity documents such as a passport or driving license

- Proof of address such as a utility bill

- W-8BEN form

- National Insurance number

These are standard requirements for FCA-regulated firms. However, the W-8BEN concerns US trading for tax purposes related to income from dividends and interest from US investments.

Unfortunately, the Charles Schwab registration process is lengthy, even with the relevant documentation. In fact, it took us longer to sign up for an account than it has at any alternative.

- Select the ‘Open An Account’ icon from the header of the broker’s website

- Choose ‘United Kingdom’ from the country of residency menu dropdown

- Click ‘Got It’ on the following five pages to confirm you have your required documents to hand

- Choose the account type to open (individual, joint, or trust) and select ‘Continue’ below the options

- Review the terms and conditions and use the tickbox to agree to the terms. Select ‘Next’ to proceed

- Complete your personal details on the first page including name, email, DOB, and government ID type. Select ‘Next’ to proceed

- Create a client login ID, password, and security question for your account. Select ‘Next’ to proceed

- Add your address and contact number

- Add your employment details including job status and annual income

- Provide additional account details such as your source of funds and the purpose of the trading account

- Confirm if you would like to access options trading by selecting the tickbox (available upon request)

- Review and accept the terms and conditions and submit the application

Payment Methods

We were disappointed to find a small selection of deposit options for Charles Schwab’s overseas accounts, as UK investors can add GBP funds to a brokerage account using bank wire transfer or cheque only. There is no credit/debit card or e-wallet solutions for global clients, which will frustrate some users.

The corresponding bank account number will be provided once your account is verified, and you will need to use these details to make a wire transfer deposit to your Charles Schwab account. You must also ensure your eight-digit account number and the name listed on your Schwab account are referenced when making the deposit.

On the positive side, we were pleased to find that bank transfers to Charles Schwab are usually processed on the same day. It is also reassuring that no fees are charged to deposit to a trading account. However, the expensive £25 charge applied to withdrawals is a let-down that will put off investors who have access to cheaper alternatives, such as Interactive Investor, where there is no fee.

Trading Platforms

Charles Schwab offers three proprietary trading platforms: a web trader, the desktop StreetSmart Edge and a mobile app.

Our experts tested the terminals and found all of them to be stable, with access to a wealth of resources and trading tools. You can view your full investment portfolio with realised profit & loss and performance history.

The platforms are also easy to use with clear navigation between functions. However, we recommend StreetSmart Edge for more experienced investors, who will benefit from access to live streaming news from Reuters, interactive and customisable charts, plus a selection of in-built technical indicators such as Bollinger Bands. Other features we rated include:

- Risk and reward trade calculator

- Real-time price quotes and signal alerts

- Open multiple trades and orders in one window

- A range of financial metrics including options Greeks

- Portfolio performance dashboard with gain/loss analysis

- Customisable market screener to pinpoint trading opportunities

- Analysis and commentary from Market Edge, Morningstar, Credit Suisse, and Briefing.com

- View fundamental metric data such as quarterly company earnings reports and dividend payments

- Schwab Equity Ratings – a bespoke tool to identify and grade prosperous company stocks from A to F

How To Place A Trade At Charles Schwab

You can open new orders using the All-In-One trade ticket, which we found straightforward to get to grips with, allowing for the trading of multiple products on the same order ticket.

- Log in to your Charles Schwab account and select ‘Trade’ from the top menu

- Select ‘All-In-One Trade Ticket’ from the dropdown

- Choose the account to place the order

- Search for the instrument to trade

- Select a strategy (options or equity)

- Select ‘Buy’ or ‘Sell’

- Input the volume to trade

- Choose the order type (market, limit, stop, stop limit, or trailing stop) and execution timing

- Select ‘Review Order’ and then ‘Place Order’ to confirm the position

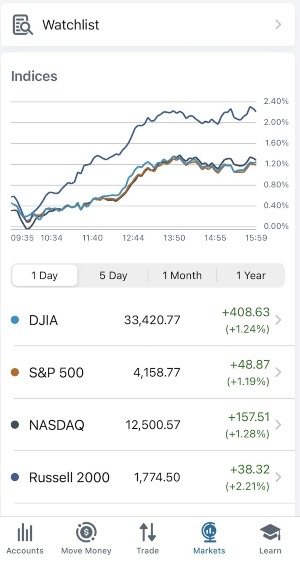

Mobile App

The Charles Schwab mobile app is available for free download to iOS and Android (APK) devices. We also appreciated the Apple Watch compatibility, whereby you can receive news headlines and the latest stock quotes to your wrist.

Importantly, when we used Charles Schwab, we found that the mobile app provides a seamless link between platforms, meaning you can stay up to date with investments while on the go. We also liked the straightforward navigation, with all the important features available at a glance, including gains and losses, current order status, real-time price quotes, Schwab Equity Ratings, and watchlist creation. Most importantly, we were pleased to find that you can easily place trades and set alerts.

Demo Account

We were glad to see that Charles Schwab offers practice conditions, though the demo account is not a separate profile. Instead, a demo mode is available on the StreetSmart Edge platform, allowing Schwab traders to test the functions and features. This includes accessing investment management tools, viewing level 2 market data quotes, and observing charts.

To access the practice account, simply tick the ‘Demo Log In’ box under your password upon signing in.

Is Charles Schwab Regulated?

Charles Schwab operates with the highest levels of customer safeguarding and financial protection for UK customers. The brand is regulated by the Financial Conduct Authority (FCA), license number 225116. This is one of the most reputable financial watchdogs in the world, with stringent compliance requirements.

Our expert review did find that the company faced a £9 million fine in 2020 for failing to provide appropriate asset protection for its customers, including the failure to segregate and hold client funds in separate bank accounts. This is a breach of industry-standard safety measures, though it is not considered a scam – there were no reports of client losses, and rectifying procedures have since been put in place.

UK clients are covered by Securities Investor Protection Corporation (SIPC), in the case of business failure, providing protection up to £500,000. We were also pleased to see additional broker-dealer insurance via Lloyds of London.

Overall, our team is comfortable that Charles Schwab is trustworthy.

Bonuses

Charles Schwab does not offer UK clients a welcome bonus or other financial incentives, which is unsurprising given FCA restrictions.

Nonetheless, there is plenty of educational content and support from US trading specialists to help enhance the trading experience. In addition, you can be assured of competitive costs with no trade minimums.

Extra Tools & Features

We were impressed with the resources and insights that Charles Schwab offers to UK traders, which includes a wealth of information that is tailored to support the US market, including understanding tax requirements. The broker also offers live webinars and occasional in-person workshops from their London office.

We also rate the alternative learning materials, which include video tutorials, articles and a podcast channel. Insights from the brand’s team of experts include daily market updates, commentary on major market movements, and investment trend reports.

While using Charles Schwab, we felt that the video content was most suitable for beginners, whereas some of the articles cover complex topics that are better suited to experienced investors.

Customer Service

Charles Schwab customer support is available from 10:30 PM Sunday to 6 AM Saturday (GMT) via contact methods including email and telephone. We were pleased with the contact options and availability, and especially glad to find UK-specific contact numbers, saving clients from paying international call rates.

On the downside, it is a shame there is no live chat service, though the FAQ section is well-organised and provides a decent amount of self-help guidance. Questions include how to open an international account, foreign transaction fees for trading, and how to apply for 2-factor authentication (2FA) login protection.

Contact details:

- Email – Online form via the ‘Contact Us’ webpage

- UK Phone Number – 0800 917 1039 (new customers) or 0808 234 6306 (existing customers)

- UK Office Address – Charles Schwab UK Limited, 33 Ludgate Hill, London, EC4M 7JN

Company Details & History

Charles Schwab is a US financial services firm that was founded in 1971. The brand has been providing UK clients access to the US investment market for almost 30 years and has offices worldwide, including a UK headquarters address in London.

Charles Schwab UK Ltd is a registered private limited company in the UK and is authorised and regulated by the Financial Conduct Authority. The group is also traded publicly on the New York Stock Exchange (NYSE), under the ticker symbol SCHW.

Today, Charles Schwab has over 34 million active customer accounts around the world, with a substantial $7.4 trillion in assets under management (AUM). The firm also processes an impressive average of 5.3 million trades per day.

These are all good signs that the brokerage is respected and reputable.

Trading Hours

As you will be trading on the US market only, orders will be executed during the opening hours of US exchanges such as the New York Stock Exchange (NYSE). This means that ordinary trading hours are generally between 9:30 AM and 4 PM ET, which is four hours behind GMT.

With that said, we appreciated that the brand offers extended hours of trading, with pre-market and after-hours available. These timings span from 7 AM to 9:25 AM and 4:05 PM to 8 PM.

Remember, you may experience significant price fluctuations outside of standard market hours due to lower trading volumes.

Should You Invest With Charles Schwab?

Charles Schwab is a globally recognised brokerage with competitive fees, a comprehensive set of educational resources and trading tools, and an excellent reputation.

Our team were sorry to find that services and assets are limited for UK traders vs global customers, especially since rivals offer tax-efficient accounts such as ISAs that will be more attractive for many UK investors. Overall though, the FCA-regulated brand provides good value for traders who want access to US financial markets.

FAQ

Is Charles Schwab A Good Broker?

Charles Schwab is an adequate broker if you’re looking to invest in US securities. The brand provides an individual brokerage account with the flexibility to trade on a proprietary terminal, or managed investment services for a hands-off approach. You can also make use of US-specific resources such as market insights, plus access to financial consultants.

Are Charles Schwab Investing Fees Low?

Charles Schwab’s trading fees are generally competitive. There are no charges to trade US securities or mutual funds. You can trade options with no base commission, though a £0.65 contract fee is applicable. Futures can be invested with a £2.25 fee per contract.

Is Charles Schwab Regulated In The UK?

Yes, Charles Schwab is authorised and regulated by the Financial Conduct Authority (FCA), license number 225116. This makes the firm a relatively safe pick for UK traders.

Does Charles Schwab Have A Mobile App?

Charles Schwab offers a proprietary mobile app available for free download to iOS and Android devices. The app is simple to navigate and provides all the features and functions of the desktop solution. This includes the ability to open and close trades, and to set custom notifications for price movements.

What Payment Methods Does Charles Schwab Accept?

UK investors can fund a Charles Schwab account via bank wire transfer or cheque only. There is no credit/debit card or e-wallet funding options.

Article Sources

Top 3 Charles Schwab Alternatives

These brokers are the most similar to Charles Schwab:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Charles Schwab Feature Comparison

| Charles Schwab | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| Rating | 2.8 | 4.3 | 4 | 4.7 |

| Markets | Stocks, ETFs, Cryptos, Futures, Options, Commodities, Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $0 | $0 | $1,000 | $0 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SEC, FINRA, FCA1 | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | - | MT4, MT5 | MT4 |

| Leverage | - | 1:50 | 1:30 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Charles Schwab Review |

Interactive Brokers Review |

Swissquote Review |

IG Index Review |

Trading Instruments Comparison

| Charles Schwab | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | Yes | Yes |

Charles Schwab vs Other Brokers

Compare Charles Schwab with any other broker by selecting the other broker below.

Popular Charles Schwab comparisons: