CFD Trading Strategies

CFD trading strategies are based on derivative products that enable investing without owning the underlying asset, by paying or collecting the difference in price between the beginning and end of the contract. The key advantage of CFDs is the ability to use highly leveraged positions, providing access to assets at a lower cost than buying them outright. This can reap rewards for reduced outlay, but also increases the risk. In this tutorial, we cover some of the best CFD trading strategies, so you can find out how to profit when investing in the UK. Plus, we’ll give tips on how to start CFD trading for beginners.

Top 3 CFD Brokers

-

Pepperstone maintains its position as one of the fastest and most dependable CFD brokers during our latest round of testing. With execution speeds averaging around 30ms and an outstanding fill rate of 99.90%, the broker ensures a seamless trading experience without requotes or dealing desk interference. It also provides ample trading opportunities across over 1,300 assets.

-

XTB offers a huge selection of more than 2,100 CFDs spanning forex, indices, commodities, stocks, ETFs, and cryptos (location-dependant). Leverage up to 1:30 is available in the EU and UK, while global clients and pro traders can access up to 1:500. XTB stands out for its CFD trading resources and tutorials to assist traders in developing short-term trading strategies.

-

CMC lets you trade CFDs on 12,000+ assets across currencies, indices, commodities, shares, ETFs and treasuries with new equities spanning quantum computing, AI learning, and digital car sales in 2025. Spreads are tight, there are no hidden fees and the industry-leading MetaTrader 4 platform is also supported for leveraged trading. Year after year, CMC shines as one of the best CFD brokers in the market.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The Best CFD Trading Strategies

CFD trading can be applied to a vast range of markets including stocks, indices, forex and cryptos. CFDs can also be traded using various timeframes, but the option to use leverage means it can be particularly advantageous for intraday trading. Here, we cover specific CFD trading strategies for beginners and experienced traders alike.

Fundamental Trading

Fundamental trading relies on following economic news in detail to make trading decisions. It is generally more suited to longer-term trades as it can take time for fundamentals to influence price, but short term traders can take advantage of volatility surrounding company announcements in particular.

It’s common to use fundamental trading in combination with technical analysis, to provide extra confidence in the CFD trading strategy. Day traders should look out for historical patterns following previous company announcements.

Positions can then be opened just before the announcement (by trying to anticipate what information it will contain), or just afterwards, when the price can become very volatile. This makes it particularly suited to very short-term trading such as scalping.

In the chart below, the Rolls-Royce share price is seen to repeatedly increase before company announcements and drop afterwards.

Rolls-Royce Share Price Impact from Company Announcements

Pair Trading

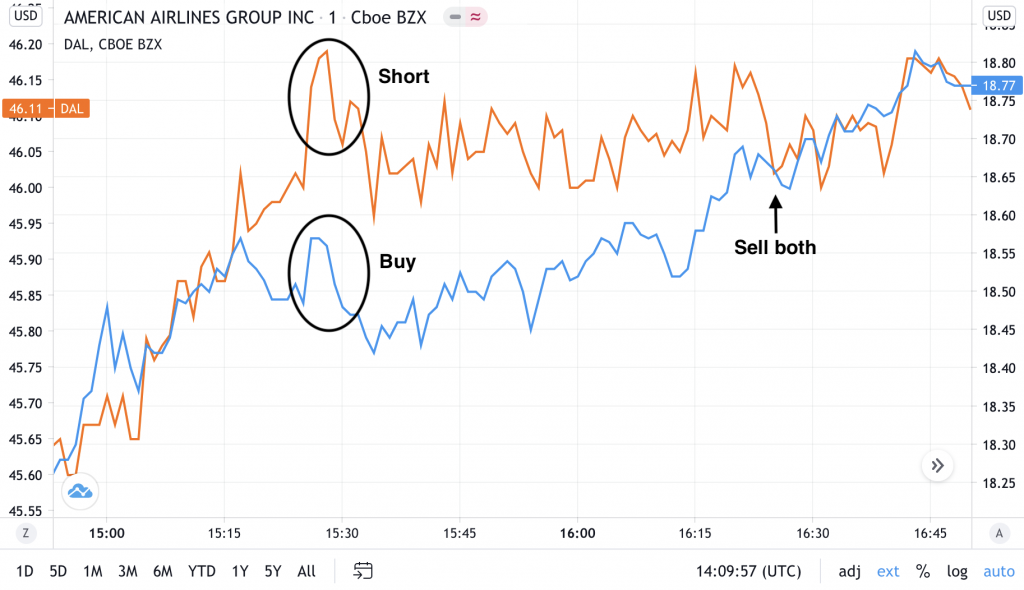

Pair investing is also popular among CFD trading strategies and involves taking a long and a short position on two correlated assets in the same sector, with the aim of taking advantage of future convergences or divergences in their underlying share price.

Pair trading is done by trading both assets at exactly the same time with exactly the same underlying value. For the CFD pair trading strategy to be executed successfully, traders need to be able to identify market anomalies and quickly open positions as the stocks begin to diverge. A short position should be entered on the over performing stock and a long position on the underperforming stock. Both stocks should be sold when the underlying value converges.

Pair Trading with Correlated Stocks American Airlines and Delta Airlines

Ideally, the price of the over performing stock will fall and the underperforming stock will rise, as shown by the Delta and American Airline shares. However, the CFD pair trading strategy can still be successful if one stock makes a profit while the other remains stable, or the profit of one stock outweighs the loss from the other stock.

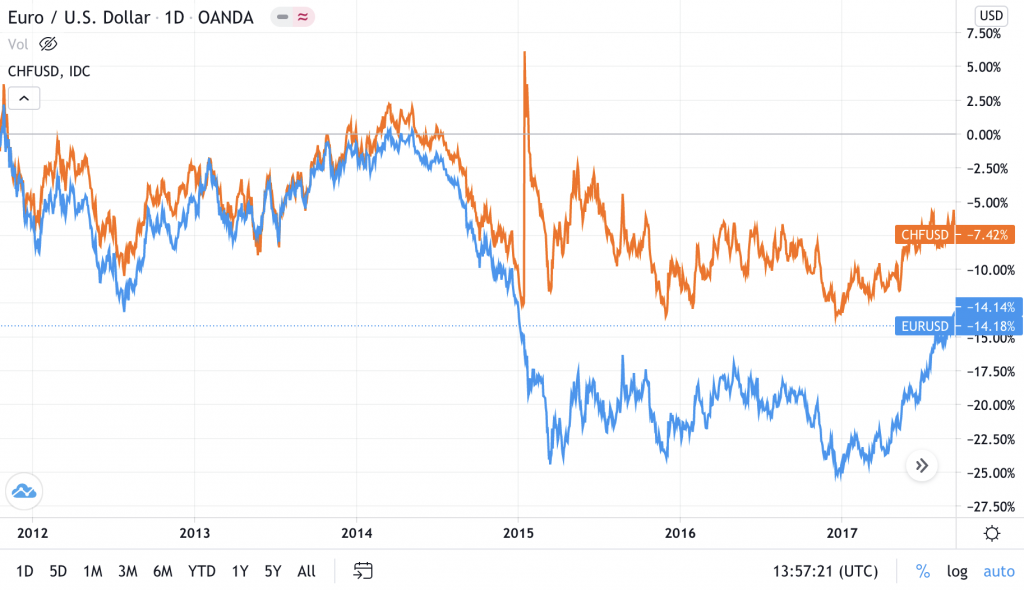

Pair trading isn’t just applicable to CFD stocks and can also be applied to indices such as the UK100 and US500. However, CFD pair trading strategies are less suited to forex. Although some currency pairs are highly correlated, certain events can quickly undo this. For example, the Euro and Swiss Franc observe similar growth rates. However, in 2015, the Swiss National Bank announced decoupling from the Euro, leading to an instant long-term divergence:

Divergence of the Euro and Swiss Franc

Hedging

Hedging falls within popular CFD trading strategies and is used to protect from losses, rather than make a profit. However, hedging is particularly suited to CFDs, because of the ability to open a short position for the exact hedging position required. Hedging allows traders to offset potential losses in investments by opening up an opposite position in a related asset. Of course, by reducing the risk, potential profits may also diminish.

One scenario where hedging can be a useful strategy is if you are confident of a company’s performance in the longer term, but think there could be a short term drop in price. Rather than selling and re-buying all the shares, which can be costly, hedging can be used to reduce potential losses.

Example:

- You buy 100 shares in Company X for £10 each, giving you a shareholding of £1000

- Additionally, you buy a put option on CFDs equivalent to 100 shares, with a strike price of £9. This gives you the option to sell 100 shares at £9, before the contract expires. Assume the put option costs £100.

- If the price of Company X shares drops to £7, your shareholding has reduced to £700 (a £300 loss). However, the put option is in profit by £100 (£2 x 100 shares, minus the cost of the put option). This means you have lost £200, rather than £300.

- If the share price increases to £13, you would choose not to exercise the option. This means you would lose £100 spent on the put option, but your shareholding has increased by £300 to £1300. Because of the cost of the put option, you have made a £200 profit, instead of £300.

How to Trade CFDs

Select A Broker

Before implementing any CFD trading strategies, you’ll first need to select a broker. It’s important to consider whether they are regulated, as well as the features they offer.

- Regulation – Traders should stick to regulated CFD brokers. However, not all regulation authorities offer the same level of protection, so it’s essential to check how your funds will be protected. The FCA is the key UK regulator.

- Leverage – Although regulation means greater protection, it can come with limitations such as leverage limits. For example, the FCA restricts leverage to 1:30. Make sure you consider these limitations when developing your trading plan.

- Markets and fees – Check that the broker offers the markets you are looking to trade. Also, check what spreads and commission fees they charge, as these can quickly eat into profits. Generally speaking, brokers make money from CFD spreads, which is the difference between the buy and sell price. However, stocks often have commission fees associated with them too.

Practice With A Demo Account

Demo accounts are the best way to practice CFD trading strategies risk-free. Practicing with a demo account allows you to get familiar with the trading platform software and try out the indicators that best support your CFD trading strategy.

Have A Plan

Having a plan is key to success when putting CFD trading strategies into action. A good plan will help prevent poor decision making in the heat of the moment. There are several things to consider when putting together an investing plan:

- Trading strategy – This includes whether you will use fundamental analysis, technical analysis, specific CFD trading strategies such as pair trading, or a combination.

- Trading timescales – Options include scalping, intraday trading and long-term CFD investing.

- What to trade – Which instrument and specific asset will you trade, eg crypto CFDs? Consider the volatility of the asset when selecting the trading duration and whether you need leverage.

- When to trade – Decide how long you will be trading for and when. This will also be dependent on the market opening hours.

- How to trade – You can enter CFD trading positions manually, or using trading robots.

Risk Tools

Traders should beware of overtrading, which can happen if the correct risk mitigations are not in place. For example, traders may try and regain lost capital, by increasing the size and number of trades, which can result in poor performance and incur even larger losses. This can be particularly dangerous when using CFD trading strategies with high leverage.

A trading plan should therefore have pre-defined entry and exit positions. Stop losses can be used to exit the market at a price that is less favourable than the entered position, to limit the potential losses incurred from a trade. Equally, exit strategies can be applied to profitable positions, to ensure you lock in profits once your target has been achieved.

Your risk-reward ratio can be used to define your stop-loss, which is the amount of capital you’re willing to lose versus the profit you would earn on the trade. The most common risk to reward ratios are 1:2 and 1:3.

Overall, adhering to a pre-defined plan and using stop losses are the best ways to ensure you don’t make emotionally-driven decisions when implementing a CFD trading strategy.

Final Word On CFD Trading Strategies

CFDs are versatile financial derivatives that can be traded on leverage, meaning traders can enter positions with smaller deposits. This can increase profits, but also leaves the trader exposed to higher potential losses.

Successful CFD trading strategies are possible, provided the trader has a clear plan and risk mitigations such as stop-loss orders. Fundamental trading, pair trading and hedging are relatively straightforward concepts that don’t rely heavily on technical analysis. Because of this, they are some of the best CFD trading strategies for beginners.

FAQ

Is CFD Trading The Same As Day Trading?

A contract for difference (CFD) allows traders to easily speculate on the future price of an asset across a range of timescales, including day trading, but can be used for any trading style. CFDs can be a good tool for day traders who need high leverage to enter a trade with a smaller outlay. See our guide to developing a CFD trading strategy above, including examples.

How Do I Start CFD Trading?

To start trading CFDs successfully, traders should open an account with a regulated broker that offers CFD trading. Researching a trading strategy, practicing on a demo account and having a clear exit plan is also key.

How Do I Learn CFD Trading Strategies?

Beginners can read about CFD trading strategies and tips in a range of books, PDFs and online resources. The best way is to practice though, by opening a demo account and using virtual funds first. See our list of top CFD brokers, many of whom offer free demo accounts.

What Are The Most Successful CFD Trading Strategies?

Pair trading and hedging are adaptable CFD trading strategies that can be applied to short-term trading such as intraday trading, as well as longer-term investments. However, no trading is risk-free and traders should set appropriate stop-loss orders.

Is CFD Trading Legal?

CFD trading is allowed in most countries, including in the UK, though the industry is not highly regulated so traders should look for reputable CFD trading brokers. Unfortunately, CFD trading is banned in the United States and some other countries.