CFD Trading for Beginners

Contracts for difference, also known as CFDs, allow investors to speculate on the price of financial markets without taking ownership of the underlying asset. CFDs are also usually traded with leverage, meaning clients can increase their position size (and potential profits), in return for a small deposit. Both characteristics make CFD trading popular with beginners.

This guide explains how to get started trading CFDs. We cover the merits and drawbacks of contracts for difference, beginner-friendly trading strategies, plus the top brokers in 2025. Use our CFD trading for beginners tutorial to get started.

Best CFD Brokers

-

Pepperstone maintains its position as one of the fastest and most dependable CFD brokers during our latest round of testing. With execution speeds averaging around 30ms and an outstanding fill rate of 99.90%, the broker ensures a seamless trading experience without requotes or dealing desk interference. It also provides ample trading opportunities across over 1,300 assets.

-

XTB offers a huge selection of more than 2,100 CFDs spanning forex, indices, commodities, stocks, ETFs, and cryptos (location-dependant). Leverage up to 1:30 is available in the EU and UK, while global clients and pro traders can access up to 1:500. XTB stands out for its CFD trading resources and tutorials to assist traders in developing short-term trading strategies.

-

CMC lets you trade CFDs on 12,000+ assets across currencies, indices, commodities, shares, ETFs and treasuries with new equities spanning quantum computing, AI learning, and digital car sales in 2025. Spreads are tight, there are no hidden fees and the industry-leading MetaTrader 4 platform is also supported for leveraged trading. Year after year, CMC shines as one of the best CFD brokers in the market.

-

FXCC offers a narrow range of CFDs beyond forex with a limited selection of metals, energies, indices and cryptos. However, it stands out with its high leverage up to 1:500, which will serve experienced traders looking to maximize their buying power while speculating on rising and falling prices.

-

You gain access to over 2,250 CFDs, available for trading 24/5 across popular markets such as forex, commodities, indices, stocks, and bonds. Utilizing deep liquidity and advanced bridge technology, IC Markets ensures optimal conditions for scalpers, hedgers, and algo traders alike.

-

RoboForex offers a growing suite of over 12,000 CFDs, encompassing forex, stocks, indices, commodities, futures and ETFs. With an initial deposit of $10 and micro lot trading through to very high leverage up to 1:2000, RoboForex caters to a broad range of derivative traders. On the downside, analysis reveals execution speeds of 1-3 seconds, noticeably slower than IC Markets at 0.35 seconds, and suboptimal for fast-paced strategies like scalping.

-

FxPro offers thousands of CFDs on forex, commodities, indices, shares and futures, expanded over the years. The broker's analysis and charting capabilities continue to stand as some of the best in the industry, with Trading Central integration, advanced order types and access to custom indicators.

-

IG offers a huge selection of 17,000+ CFDs, providing more trading opportunities than most CFD brokers. Traders can go long or short on popular markets like stocks, currencies, commodities and cryptos, while custom price alerts and the IG Academy continue to enhance the trading experience.

-

Eightcap offers a wide range of trading options with 800+ CFDs across stocks, indices, bonds, commodities, and cryptocurrencies (depending on location), with leverage up to 1:30/1:500. It excels in its tools, notably the AI-enabled economic calendar covering 25+ countries with impact filters (high, medium, low). However, its commodities offering, particularly in softs like cotton and wheat, as well as the limited precious metal and energy assets, is its weakest area.

-

With the ability to take both long and short positions on 5,500+ CFDs across forex, stocks, indices, commodities, and cryptocurrencies, FOREX.com excels. Its exclusive Web Trader platform offers an excellent trading experience, equipped with over 80 technical indicators and average execution speeds of just 20 milliseconds, ensuring an optimal environment for serious traders.

-

You can go long or short on a range of CFDs covering forex, commodities, shares, indices and cryptos. High leverage up to 1:500 is available for experienced traders in some locations, whilst beginners will appreciate access to micro-lots. There are no restrictions on short-term trading strategies using CFDs.

-

You can trade CFDs on over 3,000 assets and access rich market data through the integrated TradingView charts. There are also comprehensive free learning tools available for beginners via the eToro Academy, including dedicated CFD trading courses and guides.

-

Trade leveraged CFDs on over 1000 assets with low-cost spreads. You can also take advantage of the broker's integrated signals to help you determine when to enter and exit positions.

-

BlackBull is an obvious choice for CFD traders, providing leveraged trading up to 1:500, low spreads from 0.0 pips, and 24/7 support that performed excellently during testing, providing a sense of confidence for active traders operating in fast-moving markets.

-

You can speculate on popular financial assets covering forex, commodities, indices, metals and bonds. You can get started with $0 minimum deposit, making the broker a good pick for beginners. There’s also over 130 technical indicators available collectively in the MT4 and OANDA Trade platforms.

-

While the growing selection of 275+ CFDs still trails category leaders like BlackBull with its 26,000+ underlying assets, easyMarkets shines for its proprietary risk management tools. These include easyTrade which caps your risk to dealCancellation that provides a 1, 3, or 6-hour margin to cancel your order if the market moves against you.

-

Traders can speculate on 1000+ financial markets with high leverage up to 1:500. You can bet on rising and falling prices in currencies, commodities, indices, shares, and more without owning the underlying asset. With the comprehensive choice of CFD trading platforms, users can also switch between desktop, web and mobile for a seamless trading experience.

-

City Index has one of the most extensive suite of CFDs we’ve seen, providing short-term trading opportunities on diverse assets, sectors and regions. Its ‘Trade Ideas’ also excel for active traders looking for information to inform decisions while the Web Trader boasts extensive charting capabilities with 90+ technical indicators.

-

Bullwaves offers CFDs with leverage up to 1:500, providing short-term trading opportunities on upward/downward price movements. However, the selection of CFDs is extremely narrow, with just 33 currency pairs, six indices and two metals. Notably, there are no stocks, commodities or cryptos.

-

UnitedPips supports CFD trading on a narrow selection of currencies, metals and cryptos. It somewhat compensates for the meagre asset range with high leverage up to 1:1000, seriously amplifying potential profits or losses, and spreads that don’t change with market conditions.

-

RedMars caters to various short-term trading styles across popular asset classes, including 7 commodities, 14 indices, and 120+ stocks. Leverage is available up to 1:30 (retail) and 1:500 (pro), amplifying results. However, there is no calculator to help with understanding margin requirements and the depth of investments is limited.

-

Access highly leveraged CFDs across forex, commodities, indices, stocks and bonds with 24/5 customer support. Build a diverse portfolio with hundreds of CFD assets.

-

CFDs are available on forex, stocks, indices, metals, oil and cryptos, with support on MT4 and MT5. Execution speeds are also decent, averaging 0.5 seconds, though there is also a VPS service facilitating 24/7 connectivity for algo strategies.

-

CFDs are available on forex, indices, commodities and cryptos, although the range of 100+ instruments is limited compared to alternatives such as Quotex with 400+. Leverage is available up to 1:500 but the $250 minimum deposit is noticeably higher than competitors.

-

Markets.com offers a strong variety of CFD products, not only covering popular asset classes but also more interesting markets such as IPOs and Bonds. The low fees and educational resources will appeal to beginners, whilst seasoned CFD traders will appreciate the feature-rich charting platforms.

-

You can trade a range of CFD instruments across forex, shares, indices and commodities. There’s an excellent selection of platforms for traders, including TradingView and MT4, plus additional tools for experienced algo traders including API solutions.

-

Trade CFDs on Spreadex's diverse list of instruments with leverage up to 1:30 and highly competitive spreads. While this broker's USP is spread betting, the excellent trading terms and range of markets makes it an equally good choice for CFD trading.

-

Axi offers a growing suite of CFDs covering currencies, shares, indices, commodities and crypto (location dependent). It’s clearly built with active traders in mind with zero restrictions on scalping or algo trading, extensive leverage opportunities, and fast execution with latency under 100ms.

-

EagleFX offers just 100+ CFD instruments, but it stands out with its high leverage up to 1:500, round turn commissions coming in at $6 alongside competitive spreads, and support for trading strategies like scalping.

-

VT Markets offers over 1000+ CFDs spanning currencies, stocks, indices, ETFs and commodities. The MetaTrader charting platforms provide dozens of technical tools alongside integrated market analysis resources and zero restrictions on short-term trading strategies.

-

My tests uncovered around 100 CFD products covering forex, indices, commodities and cryptos. Leverage is available up to 1:400 and it’s good to see that scalping, hedging and EA strategies are permitted.

-

The range of CFDs at Capitalcore is narrow, with 6 precious metals, 6 indices, and a slim suite of stocks. Notably, there are no commodities such as oil or gas and spreads vary greatly. Tiered leverage is available depending on the account, from 1:100 to 1:2000.

-

PrimeXBT offers CFDs across four asset classes with very high leverage up to 1:1000. Beginners can also take advantage of the broker’s useful technical analysis guides and CFD education, plus 24/7 in-platform support via live chat.

-

Traders can access CFDs across forex, indices, commodities and stocks. There are no restrictions on short-term strategies, which is good news for scalpers and algo traders. There’s also an excellent range of free tools on offer, including a custom price ticker.

-

FXTrading offers CFDs on a wide range of assets, including forex, stocks, commodities, indices and cryptocurrencies. Commodities include a selection of softs as well as metals and energies, and the eight indices offered include the US30, US500 and UK100. Flexible leverage is available with excellent risk management tools.

-

M4Markets offers CFD trading across forex, stocks, indices, commodities and cryptocurrencies. Traders can access powerful charting platforms with multiple order types and built-in indicators. There’s also a good selection of data-driven analysis tools supplied by reputable provider, Acuity.

-

ThinkMarkets continues to offer an excellent range of around 3500 CFD instruments covering forex, indices, stocks and commodities. Leverage is available up to 1:30 in the EU and UK, while global clients can access up to 1:500.

-

Over 8,000 CFDs are offered on a vast array of instruments, encompassing stocks, indices, forex, and commodities. Moreover, the TWS platform lends itself to seasoned traders, offering a comprehensive selection of over 100 order types and algorithms, alongside premium market data sourced from reputable sources such as Reuters and Dow Jones.

-

Access over 2,000 CFDs across diverse markets including indices, commodities and bonds. There is also premium daily analysis and strategy resources for savvy traders.

-

Trade CFDs on 100+ instruments from popular asset classes. Leverage up to 1:200 is available on precious metals, while stocks, indices and energies can access 1:20 max leverage and 1:10 for commodities. On the negative side, the depth of assets is limited vs other CFD brokers.

-

Videforex CFDs are available on forex, indices, cryptocurrencies and commodities with up to 1:500 leverage and tight spreads from near zero. CFDs incur a commission fee of 1%–2.5% and up to 5% for leveraged trades.

-

Trade 400+ CFDs on forex, stocks, commodities, indices and cryptocurrencies with the choice of commission-free or raw-spread accounts with transparent fees. Speculate on rising and falling prices with no hidden charges.

-

IronFX’s asset list of 300+ instruments covers forex, stocks, commodities and index CFDs. Maximum leverage from 1:30 to 1:1000 is available depending on account location. Traders can access superb technical analysis features, including 30 pre-integrated indicators and 9 charting time frames.

-

Ingot Brokers offers CFD trading on 1000+ instruments including stocks, commodities and cryptocurrencies. The MT4 and MT5 platforms offer comprehensive features for active CFD traders, including multiple order types and pre-integrated technical tools.

-

Trade CFDs on forex, stocks, metals, energies, indices, cryptos and dollar futures. Sage FX offers tight spreads and high leverage on all instruments from 1:100 to 1:500.

-

You can trade CFDs across a range of diverse markets with flexible account types and leverage up to 1:1000. With access to both MT4 and MT5, traders can execute multiple short-term CFD trading strategies using the dozens of pre-integrated technical indicators and graphical objects.

-

Trade CFDs on forex, stocks, indices, commodities and cryptos with high leverage up to 1:500 on the no-commission ClassiQ account. The raw spread account options have low commissions from $4 round-turn and offer lower maximum of leverage of 1:200 or 1:400, which is still competitive.

-

You can trade hundreds of CFDs on major asset classes including currencies, shares and futures. Spreads are not overly competitive starting at 0.9 pips, although the $50 minimum deposit and zero commissions will allow active traders to keep their costs down.

-

Trade CFDs on forex, indices, metals, oil and cryptocurrencies with high leverage up to 1:500 and competitive spreads, with the choice between zero commission or raw spreads.

-

The 300+ instruments offered by FXGiants span seven asset classes, including indices, equities, futures and commodities. In particular, our team was impressed by the breadth of commodities, covering hard, soft and energy products.

-

Rock Global offers low-price CFDs on forex, shares, indices and commodities. The broker charges zero-commission trading on commodities and indices, and zero-spread, commission-only trading on shares. Leverage varies by instrument with 1:200 available on indices and 1:10 on blue-chip stocks.

-

You can trade a competitive range of CFDs encompassing crypto, indices, energies and metals, with very high leverage up to 1:1000. ECN pricing is available, with spreads from 0.0 pips and low commissions from $2.50. A Cent account is also available for those on a smaller budget.

-

Trade CFDs on forex, indices, stocks, commodities and cryptocurrencies with leverage up to 1:3000. Swap-free trading is available, and all account types trade with competitive spreads and are commission-free except the Go Pro account, which charges a $7 round-turn commission.

-

Access a modest range of CFD instruments across key markets, including indices and commodities. Clients can trade directly from charts with high leverage up to 1:500 and customisable time intervals.

-

Focus Option offers CFD trading through an intuitive mobile app, with 300+ tradeable instruments spanning forex, cryptocurrencies, commodities, shares and indices. Leverage ranges from 1:20 to 1:50 and spreads are variable, starting from 1 pip, with no commission.

-

Trade over 200 CFDs with high leverage up to 1:1000 on a user-friendly if not basic proprietary platform. Underlying assets include stocks, forex and cryptos with ECN execution, though annoyingly market analysis isn’t provided consistently to inform trading decisions.

-

OspreyFX offers leveraged CFDs on forex, commodities, stocks, cryptos and indices. Deep liquidity is available from 50+ providers with a competitive ECN account that will suit active trading strategies, including scalping.

-

Errante customers can trade stocks, indices, commodities and cryptocurrencies with leveraged CFDs. The level of leverage available depends on regulatory oversight, with 1:30 the maximum allowed in the EU though this varies by asset.

-

Trade flexible CFDs on forex, commodities, indices and cryptos with tight spreads, fast execution, micro-lot trading and leverage up to 1:500. There are also no restrictions on trading strategies.

-

Trade a decent range of markets via CFDs, with commissions of $6 per lot. There is also a reasonable $10 minimum deposit and 24/7 customer support for new traders.

-

Trade CFDs on a broad range of asset classes including forex, energies, precious metals, company shares, indices and cryptos. The excellent trade execution and opportunity to trade with direct market access pricing sets this broker apart from rivals.

-

Anzo Capital clients can use MetaTrader 4 and MetaTrader 5 to trade CFDs on stocks, equity indices, crude oil and precious metals with competitive price levels.

-

Switch Markets offers 180+ CFD instruments with 1:500 leverage and fast order execution speeds of <76 ms. I find commissions are also fairly competitive, coming in at $7 per round turn for Pro account holders.

-

PU Prime offers CFD trading on hundreds of shares, as well as indices, commodities, bonds and cryptocurrencies. The leverage available varies by asset, and spreads also vary greatly between instruments and account types with the tightest near zero and the widest in the hundreds of pips. Stock, index, commodity and bond CFDs are traded on the leading MT4 platform.

-

AdroFx offers a most selection of around 100 CFDs on stocks, cryptos, indices and commodities. Its appeal lies in the high leverage up to 1:500 which you can't find in heavily regulated jurisdictions and the commission-free pricing model which will serve beginners. You can speculate on both rising and falling prices from the same product with CFDs.

-

Trade all markets via CFDs, with retail leverage up to 1:30. With the RStocks Trader account, clients can access over 12,000 CFDs with algorithmic analysis tools and intuitive charts.

-

Access thousands of CFDs with competitive pricing and leverage up to 1:500. A range of asset classes are available, including currencies, shares, indices, metals and commodities. CFDs can be traded on the market-leading MetaTrader platforms.

-

Global Prime offers CFD trading opportunities on 150+ global markets including forex, indices, commodities, cryptocurrencies and bonds. Spreads are tight with a raw ECN account available starting from zero.

-

ActivTrades specializes in CFD trading, offering over 1000 instruments spanning currencies, shares, indices, commodities, and more. The broker has picked up industry awards for its CFD trading environment, delivering fast and reliable order execution with transparent margin requirements for traders.

-

Swissquote has emerged as a dependable CFD broker, providing short-term trading opportunities on an extensive selection of global markets with fast execution, its intuitive CFXD platform alongside MetaTrader, plus insights from trusted third parties like Autochartist and Trading Central.

-

SimpleFX stands out with highly leveraged trading options up to 1:1000 covering popular asset classes, including stocks, indices, currencies and commodities. Additionally, the social community serves as an excellent resource for gathering CFD strategy tips and short-term trading ideas.

-

EZ Invest offers leveraged CFDs on popular asset classes, including forex, stocks, indices and commodities. Execution speeds are decent but a large deposit is needed for the best pricing conditions.

-

Fortrade's list of leveraged CFDs covers a wide range of asset classes including forex, stocks, bonds, indices, commodities and cryptocurrencies. Traders can access leverage up to 1:30 and will trade with zero commission, fast execution and low latency on MetaTrader 4 or the bespoke platform.

-

FP Markets offers CFD trading on a first-rate selection of financial markets, spanning stocks, major global indices, commodities, metals, cryptocurrencies, and bonds. With tight spreads, fast execution speeds, leverage up to 1:500 and top-tier liquidity, short-term traders get an efficient and seamless trading experience.

-

HYCM traders can access CFDs on a range of stocks, indices, commodities and ETFs with floating spreads and maximum leverage varying by instrument. Clients also have a choice between two industry-leading platforms.

-

FXOpen has a compelling CFD offering, complete with 700+ underlying assets, from shares and indices to currencies, commodities, cryptos, and an expanded range of ETFs. With access to top-tier tools, especially since adding TradingView in 2022 and improving its TickTrader platform, FXOpen provides a complete CFD trading experience.

-

Trade CFDs on forex, stocks, commodities and indices with tight spreads and leverage limited to the FCA-sanctioned maximum of 1:30. Infinox traders benefit from lightning-fast execution speeds and a choice between STP and ECN pricing, making this a flexible option for beginner and serious traders.

-

Traders have the opportunity to engage in CFD trading across a broad spectrum of assets, including currency pairs, stocks, commodities, bullion (gold and silver), indices, and cryptocurrencies. Experienced traders can access high leverage up to 1:1000 in certain jurisdictions. However, a notable downside is the restriction of scalping strategies which may deter experienced traders.

-

Trade 8,900+ CFDs spanning forex, stocks, indices, commodities, options and bonds with powerful tools and signals.

-

SuperForex offers CFDs on a good range of assets, though it only really shines when it comes to forex, thanks to its very diverse list. On the other hand, the significant leverage available on most assets increases profit potential, though traders will need to watch out for spreads, which compare poorly to some competitors.

-

Trade CFDs on forex, stocks, indices, commodities, ETFs, bonds and cryptocurrencies with variable leverage up to 1:30. The broker provides great value to traders with six free trades per day on US, UK and European stocks, tight spreads on forex and low commissions on ETFs.

-

With CFDs on 20+ Polish and 30+ US stocks, as well as energies and seven global stock indices covering US, UK, European, Australian and Japanese markets, Just2Trade offers a superb selection of global assets.

-

You can take positions on a range of popular trading markets including forex, stocks, energies and metals. Leverage is high at 1:500 and live spreads can be viewed in the web-accessible platform and app.

-

World Forex's leveraged CFDs are available on a modest suite of 100+ instruments, including stocks, commodities and forex. Very high leverage up to 1:1000 is available for account balances up to $1000, with lower levels available to accounts with higher balances.

-

Trade CFDs on forex, stocks, metals, energies, cryptos and indices with high leverage up to 1:1000 on major currency pairs, 1:200 on metals, 1:100 on indices, 1:33 on stocks and energies, and 1:5 on cryptocurrencies. The range of 200+ instruments is not the biggest on the market, but the variety of asset classes provides flexible trading options for most traders.

-

Trade commission-free CFDs on 3000+ instruments from forex, stock and commodities markets with volumes starting from 0.1 lots, a low minimum deposit of $10 and tight floating spreads. The selection of CFDs beats most competitors.

-

Trade CFDs on forex, commodities, indices and crypto assets. With spreads from 0 pips and generous incentives and bonus offers setting Vault Markets apart from competitors, this Namibian broker will appeal to aspiring traders.

-

Trade CFDs on forex, stocks, indices, energies and metals with fast execution and variable leverage. Spreads are tight and commission-free trading is available on some assets.

-

FXTM’s CFD offering spans 600+ forex, stocks, commodities and indices, plus crypto (location dependent), with spreads lowered in recent years. Advanced traders can also get industry-topping leverage up to 1:3000 through Exinity Ltd, amplifying results but necessitating strict risk management.

-

Trade CFDs on an array of assets with ultra-low spreads

-

Engage in leveraged CFD trading across a wide array of instruments, encompassing forex, stocks, commodities, and indices. Yet while the selection of asset classes is satisfactory, the charting software and floating spreads for short-term traders fall behind that of competitors.

-

Trade leveraged CFDs in a range of financial markets.

CFD Trading Basics For Beginners

CFDs are placed using the trader’s understanding of the market, and the trader is hoping that the price of the underlying asset will rise or fall so that the position can be sold for a profit. Investors make money from the difference between the buy price and the sell price.

Because CFDs are leveraged products, there are also financing costs that must be paid on the borrowed funds that the broker provides. The formula to work out your returns when CFD trading is:

Closing sell / buy price – initial buy / sell price – (interest x number of days) – transaction costs = profit/loss

Importantly, CFDs are different from shares because there is no yield, so you can only make money from the transaction itself. This is because CFDs are a derivative – the trader does not actually own the underlying asset, for example a UK stock or gold. Instead, traders simply speculate on the price.

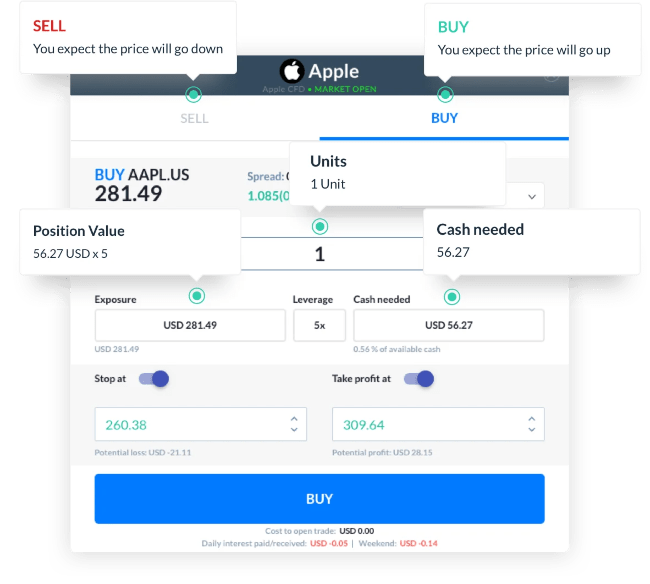

Credit: Skilling

Trading On Margin

Margin trading refers to investing a percentage of the total cost of an asset, and having the rest lent to you by a broker. This allows traders to take on bigger positions when they don’t necessarily have big capital to invest. The percentage paid by the investor is determined by the broker, regulatory requirements, and the asset traded, but typically it’s between 5% and 20% of the total position size. If the market moves in the way you have predicted, you can keep the return, and pay the same amount of money back to the broker (minus any fees).

Importantly, most FCA-regulated brokers cap leverage to 1:30 for retail traders. As outlined above, margin trading opportunities also vary depending on the asset traded, with most brokers offering lower leverage rates on volatile markets like cryptos.

Let’s look at an example of a leveraged CFD trade:

If you are looking to buy a share in a company that costs $200, and your broker offers CFDs with a 20% margin, then you are able to buy one share for $40 while your broker lends you $160. If your position is closed when the share price is $250, then you return the same $160 to your broker, get your $40 investment back, and also get the additional $50 from your trade. Subtract any fees, and that is what you are left with.

Credit: CMC Markets

The downside of margin trading is that the borrowed money always needs to be returned to the broker, even if the market moves against you. As a result, leveraged CFD trading can lead to large losses if a careful approach to risk management isn’t taken. Fortunately, many of the best CFD brokers offer negative balance protection, meaning you cannot lose more than your account balance.

How To Start CFD Trading

The first decision is which broker to sign up with. A useful tip is to find a brokerage that offers a free demo account. This will let you practice trading CFDs with virtual funds and gives you the opportunity to find a strategy that works, without risking your own money. You can then upgrade to a real-money account when you feel confident.

Here are a few other things to keep in mind when choosing a CFD broker:

What Are The Fees?

Brokers don’t tend to charge sign-up fees for CFD trading accounts. This is because platforms often make their money from spreads, commissions and margin losses. All of these costs should be compared. It’s also worth checking for deposit and withdrawal fees, plus hidden charges like account inactivity penalties.

Is The Platform Beginner-Friendly?

Some platforms are not suitable for CFD trading beginners. One terminal that is, however, is MetaTrader 4. MT4 is offered by many of the top brokers and provides a user-friendly interface alongside a decent breadth of analysis tools. Users benefit from 3 execution modes, 2 market orders, 4 pending orders, 2 stop orders and a trailing stop. Multiple charting views, including basic candlestick charts, are also provided.

MT4 is available as a software download, browser terminal, plus via a mobile app. And because it’s so popular, there is a wealth of guides and tutorials online to help beginners get started.

Are They Reliable?

Unfortunately, not all CFD brokers can be trusted. This is why it is important that British traders sign up with a brokerage regulated by the Financial Conduct Authority (FCA). This will provide new traders with several benefits, from negative balance protection and segregated client accounts to a ban on misleading promotions and a cap on trading leverage.

CFD Trading Strategies For Beginners

When looking at trading CFDs for beginners, there are two basic approaches for novices to get familiar with:

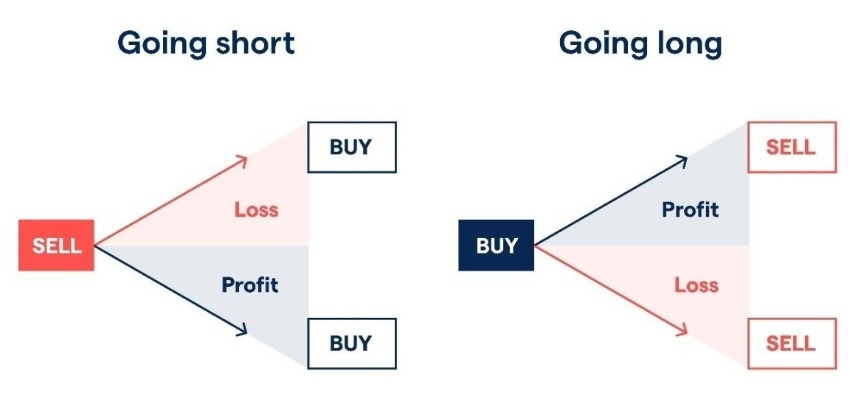

Long Buy

A long buy position is taken when you believe the value of an asset will rise. Let’s say you think the value of oil will increase following supply and demand challenges caused by the Russia-Ukraine war. A long CFD position could see you generate a return if the price increases beyond its current value.

Note, when we refer to buying, we are referring to opening the position, which does not actually mean you are purchasing the underlying asset (barrels of oil). What you are purchasing is a contract that allows you to exchange the difference in price between when you open the contract and when you close it.

Short Sell

The short sell might appear to be the more complicated strategy for CFD trading beginners, but the best way to look at it is as a reverse long buy. When you short sell, you borrow the asset in order to sell it, before buying it back at a lower price further down the line. This is done when you believe that the value of the underlying asset is going to decrease.

So, if you believe that the value of Bitcoin will decline, then opening a short position with a CFD could lead to a profit. If the price of BTC does indeed drop, then you will make money equivalent to the difference in unit price at open compared to the current price, multiplied by the size of the position, minus any broker fees.

Credit: IG

Learning

Having a basic strategy is a great place to start as a beginner to CFDs. But unless you continue to consume relevant material and commit to learning, you may see limited returns. We recommend setting aside time every week to get better acquainted with CFDs through the following:

- Books – Books are one of the best ways you can immerse yourself in CFD trading. There are lots of great CFD trading books out there that come in the form of eBooks, audiobooks and physical copies, and many are specifically aimed at beginner traders. Content can cover everything from leveraged trading to risk management.

- Courses – Courses are a great alternative to reading website content about CFDs or watching YouTube videos. Many courses are enough to help you progress from the beginner stage of CFD trading towards more advanced strategies and setups. Find a course from a highly rated provider that aligns with your budget. Note, some leading CFD brokers also offer free trading academies and tutorials when you open an account.

- Online Community – Beginners can also turn to active investing communities available on social media channels and trading forums. Another great place to start is copy trading platforms. These applications allow traders to engage with experienced investors while mirroring their positions and strategies.

CFD Trading Tips For Beginners

It can be daunting to start trading with CFDs as a total beginner, however, with a supportive broker and the right mindset, it is possible to make money. We have also compiled a list of tips for CFD trading beginners.

Setting Up

One of the most important things to do before opening any positions is to research the market and confirm your predictions with technical and fundamental analysis. Also make sure you utilise stop-loss and take-profit orders to protect potential profits and limit any losses.

Discipline

When you start out, it’s easy to listen to a gut feeling or give in to emotions like fear or greed. However, this can derail an effective strategy and dampen the trading experience. Try and stay disciplined and follow your original approach. You can then review your progress and amend your trading system after it has run its course.

Broker

Finding a CFD broker might seem more like a formality than an important decision, but it can have a significant impact on your trading experience. Brokerages offer access to different markets with various fee structures, leveraged trading opportunities, supporting tools and more.

With this in mind, sign up with a reliable brand that comes recommended. Use our list of suggested brokers to start on the right foot.

Leverage

The leverage aspect of CFD trading can make investing risky. Beginners may not want to use all the leverage offered by an online broker. It’s also worth testing trading on leverage in a demo account before investing real money. This will help you understand the impact leverage can have on potential profits and losses.

Note, many of the top CFD brokers will lower your available leverage if you contact their support team.

Bottom Line On CFD Trading For Beginners

CFD trading for beginners can be a lucrative way to get into investing in the financial markets. Traders make a simple prediction on the value of an asset without actually taking ownership of the stock, precious metal or currency, for example. Trading on margin also means novice investors can get started with a relatively small capital outlay.

Use this beginner-friendly guide to trading CFDs to get started today and check out our list of recommended brokers here.

FAQ

What Are CFDs?

CFDs are contracts between an investor and a financial broker where both parties agree to exchange the difference between the opening price and the value of the asset when the contract is closed (minus any fees). CFDs are usually traded with leverage, meaning clients only need to put down a small amount of the total position size.

What Markets Can CFDs Be Used To Speculate On?

Novice traders can use contracts for difference to speculate on a long list of markets, from equities and commodities to forex and cryptocurrencies. Market access varies between brokers so make sure you check out reviews and ratings before opening a live account.

Are CFDs Legal In The UK?

It is legal to trade CFDs in the United Kingdom. However, not all online brokers and trading platforms are regulated by the country’s financial watchdog – the Financial Conduct Authority (FCA). Trading CFDs with a regulated firm normally provides retail investors with better trading conditions and greater customer protection.

Can You Make Money With CFDs?

Trading CFDs can be profitable, but it can also lead to large losses. The leverage element, in particular, makes contracts for difference a risky product. That’s why beginners may want to start with a demo account to build up their market knowledge and confidence.

Is CFD Trading Good For Beginners?

CFDs appeal to beginner traders for several reasons. Firstly, most brokers offer leveraged CFD trading, so investors only need to deposit a small amount of the total position, usually between 5% and 20%. CFDs are also a derivative, meaning traders don’t actually take ownership of the underlying asset, for example a precious metal like gold or silver. CFDs are also available on a wide range of traditional financial markets, plus new markets like cryptocurrencies.