Capitalcore Review 2025

|

|

Capitalcore is #3 in our rankings of binary options brokers. |

| Top 3 alternatives to Capitalcore |

| Capitalcore Facts & Figures |

|---|

Capitalcore is an offshore broker, based in Saint Vincent and the Grenadines and established in 2019. Traders can choose from four accounts (Classic, Silver, Gold, VIP) with lower spreads and larger bonuses as you move through the tiers. Where Capitalcore distinguishes itself is its high leverage up to 1:2000 and zero swap fees, though these don’t compensate for the weak oversight from the IFSA and paltry education and research. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Trading App |

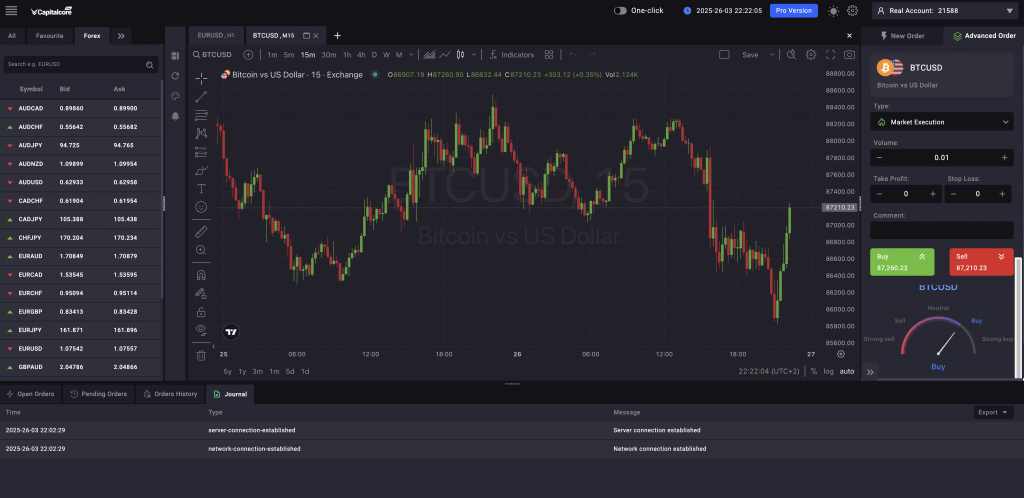

One of Capitalcore’s main advantages is its proprietary platform, which is well-designed and accessible via web browsers on mobile. Powered by TradingView, it offers a variety of features, including advanced charting tools. There’s even a ‘Pro’ version, which isn’t as simple to use but offers a more native TradingView experience. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | IFSA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Commodities |

|

| CFDs | The range of CFDs at Capitalcore is narrow, with 6 precious metals, 6 indices, and a slim suite of stocks. Notably, there are no commodities such as oil or gas and spreads vary greatly. Tiered leverage is available depending on the account, from 1:100 to 1:2000. |

| Leverage | 1:2000 |

| FTSE Spread | 25 |

| GBPUSD Spread | 0.5 |

| Oil Spread | NA |

| Stocks Spread | 1.5 (Apple) |

| Forex | Capitalcore offers a modest selection of around 35 currency pairs, which is very limited compared to CMC Markets' 300+ pairs. Spreads are lowest on the VIP account (0.4 pips on EUR/USD), but become less competitive in Classic and Silver accounts (1.5 pips on EUR/USD), and there aren't any zero spreads. |

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.4 |

| GBPEUR Spread | 0.5 |

| Assets | 35+ |

| Stocks | Capitalcore offers just 18 stocks spanning major US firms like Apple, Netflix and Nvidia and a handful of futures indices. However, this falls way short of the 16,000+ global stocks and indices at alternatives like IG. Also, the lack of screeners and market insights results in a very limiting stock trading experience. |

| Cryptocurrency | Capitalcore allows traders to speculate on the price movements of just five cryptocurrencies through CFDs. Popular options like Bitcoin (BTC/USD), Ethereum (ETH/USD), and Litecoin (LTC/USD) are available. However, unlike competitors like eToro, you cannot purchase the underlying crypto directly. |

| Coins |

|

| Spreads | $45 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Binary Options | Capitalcore has expanded its suite of trading products, introducing binary options on forex, metals and crypto with payouts up to 95%. Geared towards short-term traders, contract lengths range from 1 minute to 1 hour. It’s a snap to place trades on the intuitive web platform, requiring just the click of the button – ‘Call’ if you think the price will rise and ‘Put’ if you think it will fall. |

| Expiry Times | 1 minute - 1 hour |

| Payout Percent | 95% |

| Ladder Options | No |

| Boundary Options | No |

Founded in 2019 and registered in Saint Vincent and the Grenadines, Capitalcore is a broker offering CFD trading on forex, metals, stocks, indices, and crypto. In 2025, the broker added binary options trading.

This Capitalcore review, conducted by British traders and industry experts, examines its features, reliability, and overall trading experience to determine whether it’s a worthwhile choice for UK traders.

Our Take

- Capitalcore lets you start with as little as $10 or a demo account, making it accessible to test the platform before committing significant funds.

- The broker offers very high leverage up to 1:2000. This may appeal to experienced traders seeking aggressive trading strategies, but also significantly increases risk.

- Capitalcore does not hold an FCA license, so Brits may not get key investor protections like segregated client accounts, negative balance protection, or compensation through FSCS.

- All deposits are converted to USD, meaning you may face currency conversion fees when using GBP to fund your trading account.

- Trading on Capitalcore’s WebTrader platform feels smooth and intuitive, with TradingView-powered charts making analysis effortless – but the lack of MetaTrader support may be a dealbreaker for advanced traders.

- Capitalcore does not offer real-time news feeds or third-party research tools, making it harder to make informed decisions, especially compared to category leaders such as IG.

- I always find Capitalcore’s 24/7 live chat responsive and helpful, but the lack of active social media support is a missed opportunity for engagement.

Is Capitalcore Regulated In The UK?

Capitalcore is not regulated by the Financial Conduct Authority (FCA) in the UK.

The FCA provides robust investor protection and oversight, including features such as segregated client accounts and participation in the Financial Services Compensation Scheme (FSCS), ensuring deposits of up to £85,000 are safeguarded in the event of the broker’s insolvency.

Capitalcore does not have these protections in place, making it a risky choice for UK investors.

Instead, the broker is registered offshore in Saint Vincent and the Grenadines and regulated by the International Financial Services Authentication (IFSA).

Accounts

Live Accounts

Capitalcore provides four account types, allowing trading in currency pairs, stocks, metals, and indices. These accounts support scalping and hedging, catering to different trading strategies.

The Classic account, with a minimum deposit of around £8, may seem attractive to new investors.

However, you should be cautious of the high leverage offered (up to 1:2000), which can lead to substantial losses. This is why FCA-regulated brokers cap leverage at 1:30 to protect consumers.

While the Silver, Gold, and VIP accounts offer additional features like tighter spreads and free VPS, higher minimum deposits (ranging from about £800 to £8,000) creates higher risk.

Demo Account

Unlike many brokers we’ve tested, Capitalcore offers unlimited-duration demo accounts. These are ideal for experimenting with various instruments and leverage settings before committing to real funds.

However, it’s worth remembering that numerous FCA-regulated brokers offer demo accounts with similar features to Capitalcore if you are seeking to practice trading strategies without risking real capital.

For instance, eToro provides a demo account with £100,000 in virtual funds and no time limit, allowing you to test strategies across various asset classes.

Similarly, IG, popular for spread betting in the UK, offers a £10,000 demo account that closely mirrors its live trading environment.

Funding Options

Deposits

Funding methods are very restrictive for UK traders and include only PayPal and crypto (Bitcoin, Ethereum, Dogecoin, Tether, Tron). Over 90% of brokers we’ve tested offer more popular options like bank wire transfers, debit card, and credit card.

Deposit minimums also vary based on the payment method, ranging from $1 to $50.

One notable downside for British traders is the lack of a GBP trading account. Instead, all funds are converted to USD, potentially resulting in conversion fees for deposits and withdrawals.

As a comparison, IC Markets, lets you choose from 10 base currencies, including GBP.

Like some other offshore brokers, Capitalcore offers a 40% deposit bonus, but you should be cautious and consider trading conditions rather than promotional incentives.

Withdrawals

Withdrawal options are the same as the deposit options, but fees and minimum amounts depend on the method used.

For example, PayPal’s minimum withdrawal amount is $1, and fees range from 0% to 5%.

The minimum withdrawal amount for crypto is $20, with fees including the network fee plus an additional 0% to 5% on certain transactions.

From my personal experience using Capitalcore, withdrawals typically take up to 48 hours.

Market Access

Capitalcore offers a limited selection of trading assets. This covers major forex pairs like GBP/USD, precious metals like gold, key stock indices like FTSE 100, US equities, and a handful of cryptocurrency CFDs like Bitcoin.

Disappointingly, it does not provide real UK stocks or ETFs for long-term investing.

Brokers like CMC Markets and eToro offer a much wider range of global markets, including stocks, ETFs, and bonds. eToro also facilitates the purchase of ‘real’ cryptocurrencies.

Crypto trading on Capitalcore is only available through CFDs and binary options, allowing you to speculate on price movements without owning the asset.

In 2025, Capitalcore expanded its offerings by introducing binary trading. Contracts range from 1 minute to 1 hour, and stakes range between $1 and $10,000. While this appeals to short-term traders, binary options trading is highly speculative and carries significant risk.

Additionally, Capitalcore lacks a proprietary copy trading service, which may be a drawback for beginners. Unlike eToro, which offers a leading social trading platform and interest on uninvested cash, Capitalcore does not provide interest on idle funds.

While Capitalcore offers high-risk trading opportunities, those seeking a safer, FCA-regulated broker with better asset variety and investor protections may prefer alternatives like Plus500 and CMC Markets.

Leverage

Capitalcore offers leverage of up to 1:2000, significantly higher than most regulated brokers allow.

For UK retail traders, FCA regulations cap leverage at 1:30 for significant forex pairs and 1:20 for minors and exotics.

Since Capitalcore is not FCA-regulated, it can offer far higher leverage, but this comes with substantial risks.

Higher leverage magnifies potential gains and losses, meaning you can quickly wipe out your capital if the market moves against you.

While Capitalcore’s high leverage may appeal to aggressive traders, you should be cautious as you will be trading without FCA protections and risk excessive losses.

FCA-regulated brokers like IG and FOREX.com offer safer, FCA-compliant trading conditions, especially for beginners.

Pricing

Capitalcore structures its spreads based on account type with average pricing based on our analysis.

Classic and Silver accounts start with 2.5 pips on GBP/USD, for example, while Gold accounts see tighter spreads at 1.0 pips, and VIP accounts go as low as 0.5 pips.

Higher-tier accounts mean lower trading costs, which is ideal for scalpers.

The broker charges zero commissions, but its spreads remain wider than competitors like IC Markets, which is a consideration for active traders.

A rare perk is no swap fees, allowing you to hold positions indefinitely without extra costs.

Deposits are mostly free, but PayPal and crypto withdrawals incur fees. Funds must also be withdrawn using the same method and currency as the deposit.

Unlike XTB and other brokers we’ve tested, Capitalcore doesn’t charge inactivity fees, making it a more flexible option for occasional trading.

Trading Platform

Capitalcore offers two proprietary trading platforms powered by TradingView: WebTrader and Pro Platform.

I’ve used both and they are clearly designed to cater to different trader preferences while maintaining user-friendliness and ease of use, making them suitable for beginners and more advanced traders.

The WebTrader platform provides a sleek and uncluttered interface that facilitates effortless trading on desktop and mobile devices.

It features an impressive library of over 100 technical indicators and drawing tools, 16 chart types (including bars, candles, Heikin Ashi and Renko), and timeframes ranging from 1 minute to 1 month.

To trade binary options, a separate platform lets you place ‘Put’ and ‘Call’ trades with a single click. Testing shows you can trade binaries on forex, metals and digital currencies with returns up to 95%, You can configure your binary trade parameters in under one minute using the right-hand panel.

The Pro Platform removes the WebTrader interface, providing a more ‘vanilla’ TradingView environment. While it doesn’t offer additional tools compared to WebTrader, it caters to traders who prefer a simpler, more straightforward interface without the Capitalcore add-ons.

While these platforms are user-friendly and feature-rich, experienced traders like myself might find them lacking advanced features compared to popular third-party solutions like MetaTrader 5 or cTrader.

The absence of these widely used platforms might be a drawback for some traders accustomed to advanced charting and automation tools.

Extra Tools

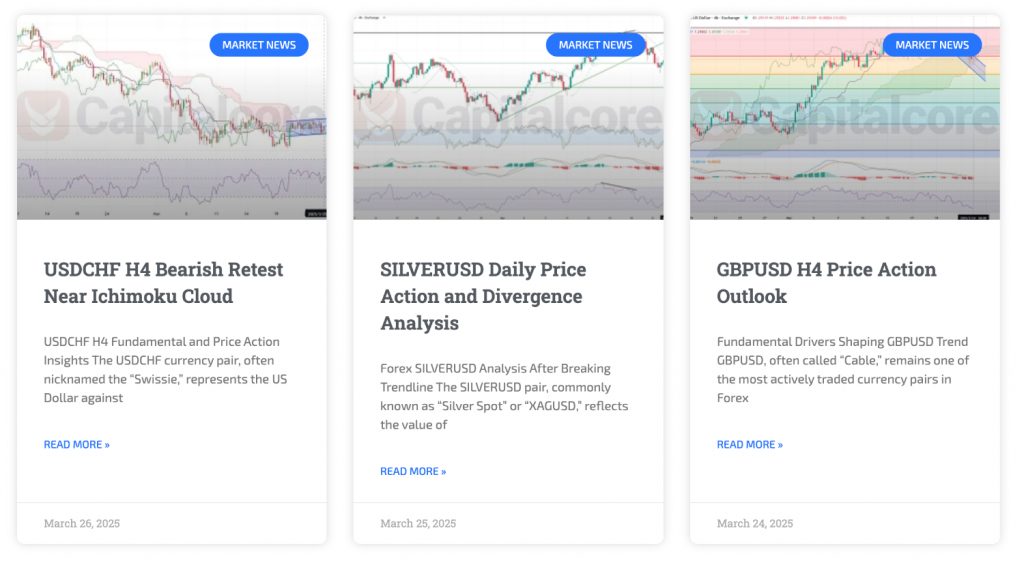

Capitalcore focuses purely on order execution, meaning it lacks advanced research tools from brokers like IG, which offer comprehensive market insights.

You won’t find real-time news feeds, detailed economic calendars, or third-party research from providers like Autochartist.

This absence of integrated tools may make tracking market trends and informing trading decisions harder.

However, Capitalcore does provide an updated ‘Market News’ blog with technical and market analysis.

For beginners, there’s a small library of essential forex guides covering topics like ‘What is Forex Trading?’ and ‘Coins vs. Tokens,’ along with a glossary and FAQs.

While useful for newcomers, these resources are still limited compared to brokers like CMC Markets and eToro, which offer in-depth webinars, tutorials, and expert market analysis.

Customer Service

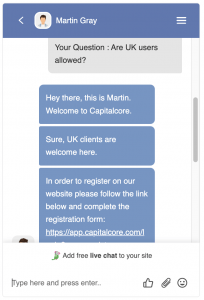

Capitalcore offers 24/7 customer support via live chat, email, a ticket system, and phone (not localised), assisting from registration to withdrawals.

During platform testing, I found live chat responses to be fast and knowledgeable. When an agent couldn’t provide an immediate answer, I received a follow-up email later.

Accessing live chat and support tickets directly from the client dashboard is convenient, though adding phone contact details there would improve accessibility.

One downside is that all social media links on the website are non-functioning, which Capitalcore should fix to maintain a professional image.

Bottom Line

Whether you should trade with Capitalcore depends on your priorities and risk tolerance.

On the positive side, Capitalcore offers a variety of CFDs. It provides high leverage up to 1:2000 and a low $10 minimum deposit for entry-level accounts.

However, there are significant drawbacks for UK traders. Capitalcore is not regulated by the FCA, meaning it lacks key investor protections like segregated accounts and FSCS compensation.

Additionally, the lack of GBP accounts may be a downside for Brits seeking hassle-free account and transaction management.

FAQ

Can You Invest In GBP With Capitalcore?

Capitalcore primarily facilitates trading in USD. All deposits are converted to USD for trading purposes, regardless of the original currency.

However, the broker doesn’t offer a choice of base account currencies, unlike some other brokers, such as IC Markets, which allows accounts in multiple currencies, including GBP.

Is Capitalcore Safe For UK Traders?

Capitalcore is less safe for UK traders. Its lack of regulation by the UK’s FCA or any other significant financial authority exposes you to significant risks.

Also, UK investors using Capitalcore cannot access crucial safeguards like the FSCS or the Financial Ombudsman Service.

Does Capitalcore Offer A Mobile Trading App?

The Capitalcore platform supports mobile trading across various devices, allowing you to trade anytime and anywhere.

The web-based mobile app is part of Capitalcore’s multi-platform strategy, ensuring you can access markets on different operating systems and devices.

On the downside, I quickly discovered it’s not a dedicated app optimised for small screens.

Can You Invest In Cryptocurrency With Capitalcore In The UK?

Due to FCA regulations, UK retail traders are banned from trading crypto CFDs. However, Capitalcore’s lack of regulation means UK traders can speculate on crypto price movements without owning the underlying assets through binaries and CFDs.

FCA-regulated eToro, by comparison, facilitates the buying and selling of ‘real’ digital currencies, including Bitcoin, Ethereum, and Solana.

Article Sources

International Financial Services Authentication (IFSA)

Top 3 Capitalcore Alternatives

These brokers are the most similar to Capitalcore:

- World Forex - World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- AZAforex - Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

- Videforex - Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform, mobile app and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

Capitalcore Feature Comparison

| Capitalcore | World Forex | AZAforex | Videforex | |

|---|---|---|---|---|

| Rating | 3.9 | 4 | 3.4 | 3.5 |

| Markets | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options | Binary Options, CFDs, Forex, Indices, Commodities, Crypto |

| Minimum Deposit | $10 | $1 | $1 | $250 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.0001 Lots | $0.01 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | IFSA | SVGFSA | GLOFSA | - |

| Bonus | - | - | - | 20% to 200% Deposit Bonus |

| Education | No | No | No | No |

| Platforms | - | MT4, MT5 | - | - |

| Leverage | 1:2000 | 1:1000 | 1:1000 | 1:500 |

| Visit | ||||

| Review | Capitalcore Review |

World Forex Review |

AZAforex Review |

Videforex Review |

Trading Instruments Comparison

| Capitalcore | World Forex | AZAforex | Videforex | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Futures | Yes | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | No | No | No |

| Bonds | No | No | No | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Capitalcore vs Other Brokers

Compare Capitalcore with any other broker by selecting the other broker below.