Capital.com Review 2025

|

|

Capital.com is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to Capital.com |

| Capital.com Facts & Figures |

|---|

Capital.com offer CFDs on a range of markets with competitive spreads and zero commissions. The broker also offers the Investmate app, negative balance protection and leveraged trading. |

| Awards |

|

|---|---|

| Instruments | CFDs, forex, indices, shares, commodities, spread betting (only available in the UK), cryptos (not available in the UK) |

| Demo Account | Yes |

| Min. Deposit | $20 (By credit card - varies by payment method) |

| Mobile Apps | iOS & Android + InvestMate |

| Payments | |

| Min. Trade | $1 |

| Regulated By | FCA, CySEC, ASIC, FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade CFDs on an array of assets with ultra-low spreads |

| Leverage | 1:30 |

| FTSE Spread | 0.9 pt var |

| GBPUSD Spread | 0.00013 pips var |

| Oil Spread | 0.03 pips var |

| Stocks Spread | Var |

| Forex | Capital.com offer a long list of forex CFD pairs for trading. All have competitive spreads. The firm also ensures negative balance protection |

| GBPUSD Spread | 0.00013 pips (var) |

| EURUSD Spread | 0.00007 pips (var) |

| GBPEUR Spread | 0.00015 pips (var) |

| Assets | 130+ |

| Stocks | Capital.com offer 5,600+ stocks from around the globe. They also offer tight spreads, ideal for active traders |

| Spreadbetting | Spread betting is only available in the UK and Ireland |

Capital.com takes a technology-driven approach to online CFD trading. The company was the first broker in Europe to offer traders a mobile app that now caters to over 700,000 customers. The brokerage has been featured in multiple publications such as The Guardian and City AM and has sponsored prominent La Liga team, Valencia CF. This review will break down the main services provided by Capital.com for UK traders, including their demo account, leverage, minimum deposits, fees and more.

About Capital.com

Capital.com was founded in 2017 and has offices in London, Gibraltar and Limassol, Cyprus. The company has focussed on incorporating artificial intelligence into their platform as well as building for mobile first. The broker has a dedicated research centre is in Minsk, Belarus and is regulated by the Financial Conduct Authority (FCA) in the UK.

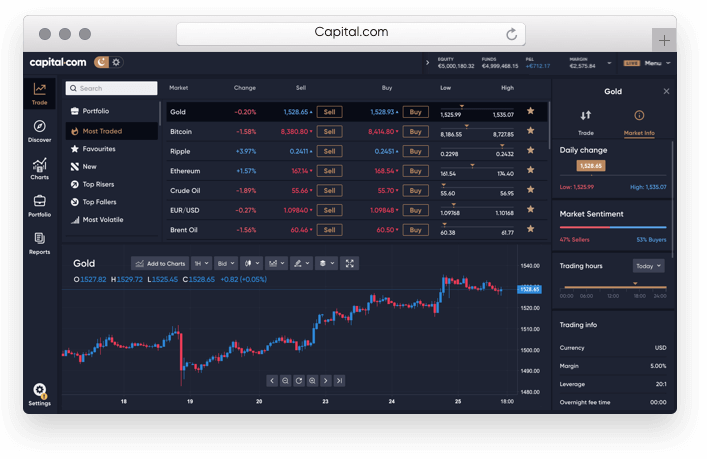

Trading Platforms

Having built from the mobile up, Capital.com boasts an award-winning platform available on web and mobile. The platform features a spacious interface, designed for usability and ideal for beginners. Users can take advantage of a number of features:

- Extensive drawing tools

- Interactive financial calendar

- Multi-chart toggling up to 6 tabs

- Hedging and risk management tools

- Personalised watchlists and price alerts

- More than 70 technical analysis indicators

- News, articles and webinars with industry professionals

Web platform

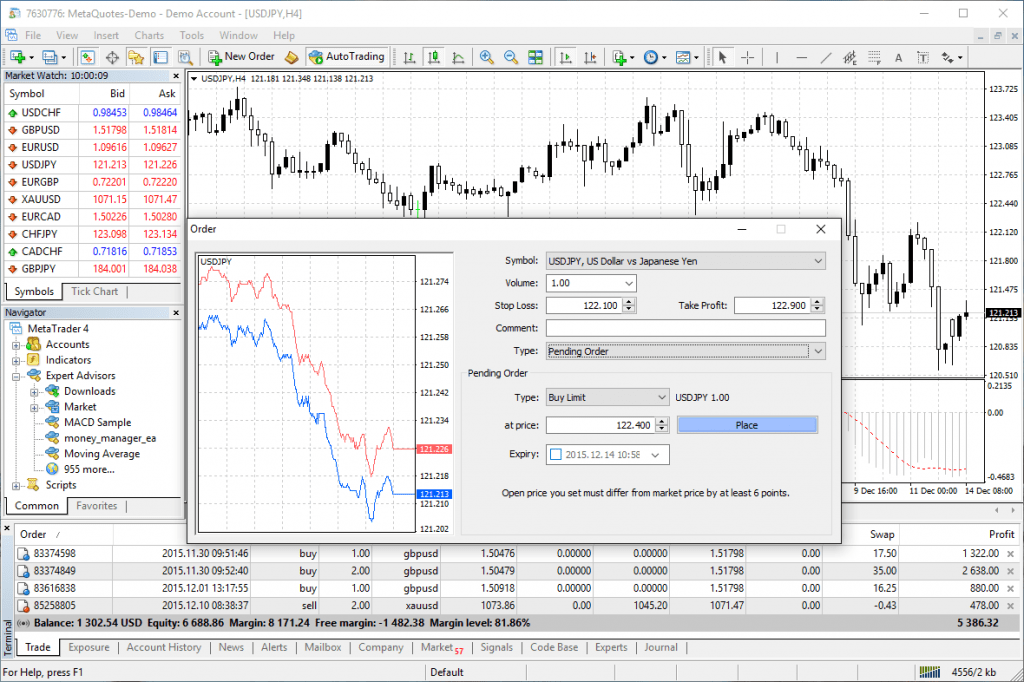

Clients can also access the financial markets using MetaTrader 4. Simply create an account at Capital.com as a CySEC client and click to activate MT4 integration. Offering manual and automated trading, the downloadable terminal is an industry favourite with:

- 85 pre-installed custom indicators

- 30 popular technical indicators

- Guardian angel feedback

- 24 analytical objects

- Free trading signals

- 24/7 trading

MetaTrader 4

Products

Capital.com offers CFDs on more than 3,000 markets including:

- Shares – over 3,000 equities including Tesla, AMC and GameStop

- Indices – 24 options including the FTSE 100, S&P 500 and DAX 30

- Commodities – 37 including Gold, Silver and Crude Oil

- Forex – 138 pairs including GBP/USD and EUR/GBP

As of 6th January 2021, the FCA has brought in a ban concerning CFDs on cryptocurrencies. This means UK customers can no longer trade crypto on Capital.com. Tax-free spread betting is available on major financial markets, however.

Fees

Capital.com offers the majority of its service at no cost with users incurring no commission, deposit or withdrawal fees. The company makes its money by charging spreads but offers highly competitive rates, for example, 0.9 pips on the EUR/GBP.

If you want to hold a position overnight, the company also charges a rollover fee which varies by currency and position. Capital.com only charges overnight fees on the leveraged portion of the trade – not on the total trade size.

UK Leverage

Capital.com offers a range of leverage options across assets that are capped in compliance with ESMA requirements. For popular forex pairs, such as GBP/USD, leverage up to 1:30 is available. On non-major forex pairs, gold and indices, leverage is capped at 1:20. Users can trade with 1:10 for commodities other than gold and non-major equity indices, and 1:5 for individual equities.

With a professional account, which requires sufficient capital and proof of trading experience, users can trade with leverage up to 1:500.

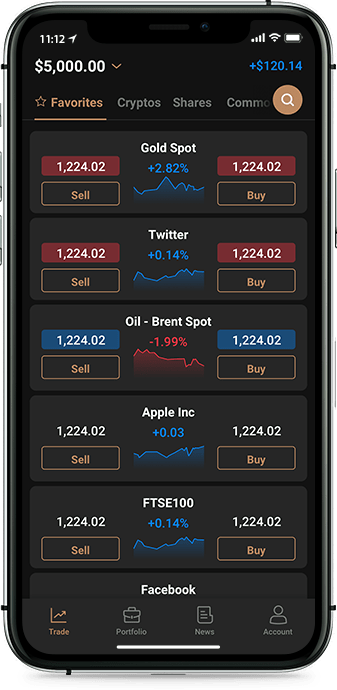

Mobile Trading

Capital.com was the first broker in Europe to launch a mobile CFD trading platform. Users can take advantage of all the same features available on the desktop platform including access to more than 3,000 markets and popular indicators such as Bollinger bands alongside automated trading bots. In-app price alerts and market signals are also available. Additionally, clients can make deposits and withdrawals from the application.

Capital.com app

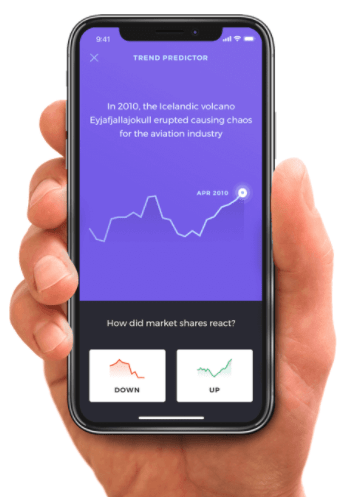

Captial.com has also launched Investmate – an educational app with more than 30 courses designed to up-skill beginners and ensure investors trade smart. Both apps are available to download for iOS on the App Store and Android (APK) on Google Play.

Deposits

Deposits can be made using a debit card, credit card, bank wire transfer, Sofort, iDeal and many more. The minimum deposit is 20 GBP. A low deposit means that even with minimal capital, clients can get started quickly. There are no deposit fees to take into account.

Withdrawals

For security reasons, profits are returned to the same method by which you initially funded the account, i.e if you deposit with a debit/credit card, cash will be returned to that same account. Capital.com charge zero commission for withdrawals. Processing times vary depending on the payment method and UK traders may need to provide identity documents in line with KYC procedures.

Demo Trading

Capital.com’s demo solution is a safe and useful way to learn the ropes of day trading. Users can open multiple demo accounts and each comes funded with £1,000 in virtual funds. All of the broker’s features are functional on the demo platform, including the innovative AI monitoring and self-improvement system which informs users of potential gaps in strategies. Switching between live and demo accounts is seamless and possible in a few clicks.

UK Regulation

As well as being regulated by the Financial Conduct Authority (FCA), Capital.com is also compliant with European Security and Markets Authority (ESMA) and CySEC regulations. The established platform has been featured in many dependable publications and leverage is capped to reduce risk.

Capital.com is a reliable platform for traders of all experience levels and picked up the European’s Global Business Award for Most Transparent Brokerage Service Provider in 2019.

Additional Features

Investmate is an educational app from Capital.com which is designed to provide newcomers with an easy transition into the world of trading as well as offering experienced traders the opportunity to recap or advance their knowledge. Users can download Investmate alongside the Capital.com app on iOS and Android devices.

Investmate

Capital.com has also built a machine learning system, which they call eQ, to help users trade better. The patented AI trade bias detection system provides traders with personalised feedback, tips and post-trade performance breakdowns to encourage more risk-aware decisions on future trades. Recent research from Capital.com suggested that users who take advantage of the eQ system are 11% more likely to trade profitably than those who don’t. This system earned Capital.com an award for the Most Innovative Broker Europe in 2020.

Live Accounts

There are three types of accounts available on Capital.com; Standard, Plus and Premier. You can create up to 10 demo and 10 live accounts in different currencies. The same leverage, range of markets and access to charts is available on all three accounts with extra features available on Plus and Premier.

The Plus account has a minimum deposit of £3,000 and access to custom analytics and a dedicated account manager. The Premier account, which has a minimum deposit of £10,000, features all of these perks plus the opportunity to attend exclusive webinars and Premier events.

Some clients may be eligible for a professional account with leverage up to 1:500. This solution requires a set amount of capital and demonstrable trading experience. Get in touch with Capital.com to find out if this option is right for you.

Pros

Capital.com offers several benefits for prospective traders:

- Secure login

- London office

- Promo vouchers

- Fully regulated by the FCA

- AI powered tailored advice

- Personalised watchlists and price alerts

- More than 70 technical analysis indicators

- Opportunity to trade CFDs on over 3,000 markets

- News, articles and webinars with industry professionals

Cons

Downsides to opening a Capital.com account include:

- Experienced traders may prefer a more traditional platform without tailored advice

- Due to regulations, crypto trading is unavailable to UK traders

Opening Hours

Users can trade on Capital.com 24/7, subject to the availability of markets. Clients should be aware that holding overnight positions may incur a fee and that spreads widen during periods of low liquidity. Information on market opening times is available on the broker’s website.

Contact Details

Capital.com is available to contact 24/7 via live chat, WhatsApp, Telegram, Viber and Facebook. We found their operators to be on hand and helpful. Customers can call the UK contact number +44 20 8089 7893 or email support@capital.com. You can also follow Capital.com on one of their many social media platforms which provide news and analysis, plus tips and tutorials.

Security

Capital.com is a trustworthy and tightly regulated broker. As well as complying with FCA and European trading regulations, client funds are stored in separate bank accounts. The broker’s platforms also offer dual-factor authentication and personal data is encrypted using industry-standard security protocols.

Should You Start Trading With Capital.com?

With competitive spreads, tailored advice and no hidden fees, users can trade on Capital.com with confidence. Features like the nifty Investmate app and well-explained news articles also help open up the world of trading to beginners. Although full FCA compliance is a real benefit for users looking to trade with peace of mind, crypto traders in the UK will have to look elsewhere.

FAQ

How Do I Open An Account With Capital.com?

To register and start trading, you will need to fill out a brief registration form, verify your identity and make a deposit. The account activation process takes a few minutes and is in line with other regulated brokers.

What Markets Can I Trade At Capital.com?

Traders in the UK can trade CFDs on stocks, commodities, indices and currency pairs. Spread betting is also available, though leveraged cryptocurrencies are not offered due to regulatory restrictions.

Is Capital.com Safe?

Capital.com is a fully licensed and regulated broker that keeps its clients’ money in separate bank accounts. Users can trust the broker is as an established and dependable brand with a long list of awards to its name.

What Is The Minimum Deposit At Capital.com?

The minimum account deposit at Capital.com is £20. Users can deposit using a debit card, credit card, bank wire transfer, Sofort, iDeal, Giropay, and several other payment solutions. Deposits are usually processed instantly and there are no fees.

How Do I Withdraw Money From My Capital.com Account?

Making a withdrawal is a quick and easy process at Capital.com. Clients can request a withdrawal from the account area on the broker’s website. For added security, funds can only be withdrawn via the same method used to make the deposit.

Top 3 Capital.com Alternatives

These brokers are the most similar to Capital.com:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- City Index - Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

Capital.com Feature Comparison

| Capital.com | IG Index | Pepperstone | City Index | |

|---|---|---|---|---|

| Rating | 1.8 | 4.7 | 4.8 | 4.4 |

| Markets | CFDs, forex, indices, shares, commodities, spread betting (only available in the UK), cryptos (not available in the UK) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting |

| Minimum Deposit | $20 (By credit card - varies by payment method) | $0 | $0 | $0 |

| Minimum Trade | $1 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySEC, ASIC, FSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, CySEC, MAS |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4 | MT4 | MT4, MT5, cTrader | MT4 |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 |

| Visit | 84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

|

| Review | Capital.com Review |

IG Index Review |

Pepperstone Review |

City Index Review |

Trading Instruments Comparison

| Capital.com | IG Index | Pepperstone | City Index | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | Yes | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Capital.com vs Other Brokers

Compare Capital.com with any other broker by selecting the other broker below.

Popular Capital.com comparisons: