Bybit Review 2025

|

|

Bybit is #81 in our rankings of crypto brokers. |

| Top 3 alternatives to Bybit |

| Bybit Facts & Figures |

|---|

Bybit is an established crypto exchange aimed at online traders. Clients can speculate on leading tokens like Bitcoin, access crypto staking and loans, or trade NFTs using the firm's digital marketplace. Millions of users have signed up with the firm since it launched in 2018. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Cryptos, Futures |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | Yes (iOS & Android) |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.001 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Via 3rd party software |

| Islamic Account | No |

| Cryptocurrency | Buy dozens of crypto tokens with one click, or choose between hundreds of tokens to trade on spot markets, with more options than many alternatives. Crypto derivative products include perpetual futures and options. |

| Coins |

|

| Spreads | Market maker, derivatives fee: 0.01%, spot fee: 0.1% Market taker: derivatives fee: 0.06%, spot fee: 0.1% |

| Crypto Lending | Yes |

| Crypto Mining | Yes |

| Crypto Staking | Yes |

| Auto Market Maker | No |

Bybit is a global crypto exchange that provides access to spot and derivative DeFi markets, as well as opportunities to earn interest on cryptocurrencies and trade NFTs. With many investors looking for more innovative ways to speculate upon cryptos, this exchange is aiming to fill the void. This 2025 broker review will explain more about what Bybit offers, from its trading platform to deposit and withdrawal options.

ByBit Company History & Overview

Although Bybit was only established in 2018, it has rapidly built a large customer base and now boasts around 10 million users. It is a global exchange and has its headquarters in Singapore. Ben Zhou is the company’s co-founder and CEO. The exchange is unregulated and investors should note that watchdogs such as the FCA in the UK have taken a tough stance on ensuring that crypto derivatives are not allowed to take off and even decided to have them banned due to their risk and volatility. Customers’ IP addresses may not be supported if they reside in one of the exchange’s banned or restricted countries (although the UK is not one of these).

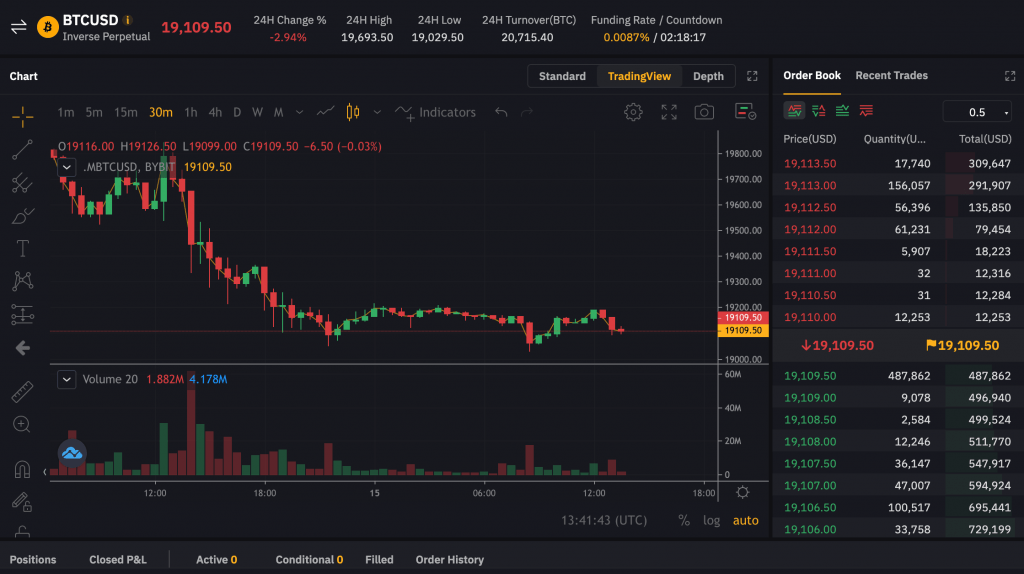

Trading Platform

Bybit uses an in-house trading platform that has a mixture of basic and advanced features. The platform is intuitive, with orders that are simple to place and each of the different features easy to navigate. Pop-up tutorials help guide investors through the platform. Our experts also found the following features:

- Six order types

- Eight timeframes

- Good market depth

- TradingView indicators

- 20-millisecond market updates

ByBit Trading Platform

In addition, Bybit traders can also connect to the industry-renowned MetaTrader 4 (MT4) platform (although not MetaTrader 5). MT4 is trusted by millions of investors around the world and provides a secure and fulfilling trading experience. Its features include:

- Advanced API

- VPS hosting service

- Advanced indicators

- Financial news alerts

- Backtesting of trading strategies

- Desktop, web and mobile versions

- Over 6,000 importable expert advisors (EAs)

Markets & Instruments

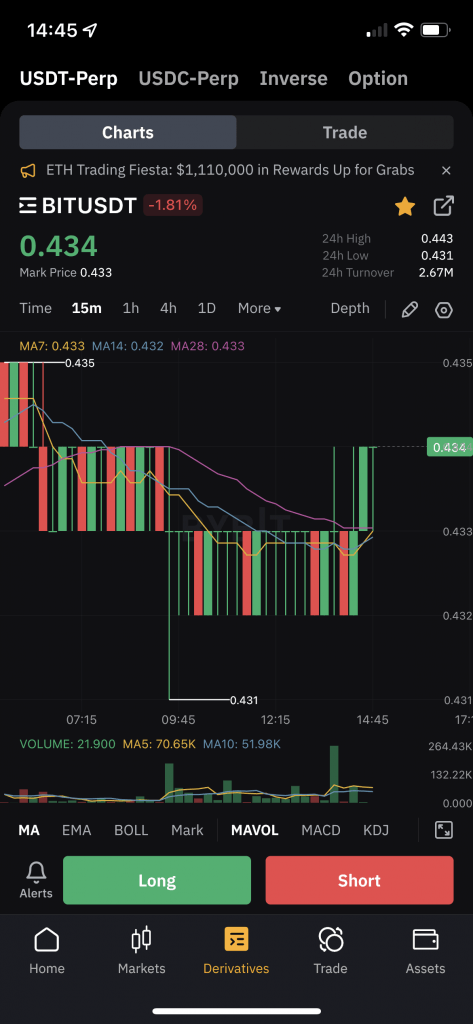

With 100 crypto assets in the spot market and over 180 derivative contracts, traders on Bybit have plenty of choices. The spot market includes the following popular pairs:

- BIT/USDT

- BTC/USDT

- ETH/USDT

- XLM/USDT

- AAVE/USDT

There are several types of derivatives contracts available on Bybit: USDT and USDC perpetual swaps, USDC options, inverse contracts and quarterly futures. A perpetual contract is an agreement to buy or sell at an unspecified point in the future. This is similar to a futures contract, although futures have an expiry date. Options, on the other hand, give traders the right but not the obligation to buy or sell at the end of the specified period.

An inverse perpetual contract has a cryptocurrency as the base currency. This means the contract is margined using crypto and settled in crypto, which can mean the returns are more exposed to the volatility of the underlying market.

Fees

To understand the Bybit fee structure, traders need to differentiate between a market maker and a market taker. A market maker is someone that provides liquidity to the market and increases the depth of the order book, whereas a market taker is someone that removes liquidity.

There are currently zero fees on all crypto spot pairs, although this is a temporary promotion. Before the bonus deal, both market makers and takers were charged 0.1%. With a non-VIP account, USDT, inverse contracts and USDT perpetual contracts have a taker fee of 0.06% and a maker fee of 0.01%. For USDC options trading, the marker maker and market taker fees are both 0.03%. Funding fees may also be applicable, which are transferred between the buyer and seller every eight hours. The exchange does not charge overnight fees.

Other fees on Bybit relating to options trading include a delivery fee of 0.015% paid by both the buyer and seller (but only when the option is exercised) and an additional fee of 0.2% for liquidations.

Investors can reduce their trading fees by using post-only orders, as an addition to limit or conditional limit orders, which ensure that the order is placed into the order book.

VIP status can earn discounts on trading fees but generally comes with minimum equity requirements. For example, to access VIP 1 perks, traders need £50,000 in equity.

There are zero transaction fees on the P2P platform (where traders can buy and sell cryptos and fiat money amongst themselves). Payment provider fees may be applicable.

Leverage

Leverage rates of up to 1:100 are available on Bybit, which means £1 invested in Ripple (XRP) would generate exposure of £100 (100x the deposit amount). Always remember that leveraging assets in the crypto market can be risky and lead to increased losses. Leverage will also magnify your trading fees, so we recommend that you always account for this in any decisions you make. For example, 1:2 leverage will mean fees are twice as large.

Mobile Trading

Bybit has a mobile app available on iOS and Android, which clients can download from the App Store and Google Play. The mobile app is easy to use and provides all the main functions, including making trades, buying crypto and depositing funds.

ByBit Mobile App

Payment Methods

How To Deposit With ByBit

Traders can either make deposits into their Bybit trading account using crypto they already own or they can purchase crypto using fiat money through a third-party provider such as Banxa, MoonPay or Mercuryo. Only BTC, ETH and USDT are available to purchase using fiat money. If you require a different cryptocurrency, you should buy USDT and trade it for your preferred crypto on the spot market. Several fiat currencies are accepted, including GBP, EUR and USD.

Note that there are different conversion rates depending on the payment channel you use. Some will, therefore, give you more crypto for a given amount of fiat money. The method used to make the payment also varies depending on the channel you use. Banxa accepts Visa, MasterCard, bank transfer, Apple Pay and Google Pay.

While Bybit does not charge a transaction fee to purchase crypto, most service providers will. The cryptocurrency usually takes 2-30 minutes to deposit into your trading account, although this depends on the blockchain and the service provider’s capacity. It can also take up to one day for new users.

Another way to purchase cryptocurrency is through the peer-to-peer (P2P) platform. There are no transaction fees but it does come with risks, particularly if the person on the other side of the transaction does not honour the agreement (although Bybit does have an appeal process).

For direct deposits (if you already have cryptocurrency in a wallet), Bybit currently supports the following cryptocurrencies (there are no minimum deposit amounts):

- BTC

- ETH

- XRP

- EOS

- DOT

- LTC

- XLM

- USDT

- DOGE

Withdrawals

It is not possible to withdraw fiat currency – only crypto. There is also no option to transfer crypto back into GBP on Bybit. Withdrawals are processed through the spot account, so funds in a derivatives account must be transferred to a spot account first. The minimum withdrawal amounts and fees vary depending on the token in question. Examples are as follows:

- XRP – withdrawal fee is 0.25 XRP and the minimum withdrawal is 20 XRP

- ETH – withdrawal fee is 0.005 ETH and the minimum withdrawal is 0.02 ETH

- BTC – withdrawal fee is 0.0005 BTC and the minimum withdrawal is 0.001 BTC

- USDT (ERC-20) – withdrawal fee is 10 USDT (ERC-20) and the minimum withdrawal is 20 USDT (ERC-20)

Withdrawals usually take between 30 minutes and one hour but this depends on blockchain traffic. Withdrawal limits can be increased if customers complete KYC verification.

Demo Account

Bybit provides a Testnet demo account with which traders can experiment with live spot prices using virtual funds. There is also the MT4 demo account that can be used to practice trading strategies and explore the markets.

Bonuses & Promotions

The exchange has various promotions on offer, including deposit sign-up/joining bonuses and zero fees on the spot market. There is also the Market Maker Incentive Program, where qualified market makers can earn up to 0.01% on the spot market and 0.005% on derivatives from rebates.

In the past, this exchange has offered annual percentage yield (APY) booster vouchers to help traders generate additional yield. In April 2021, the 7-day challenge was introduced where investors competed against each other in terms of the profit and loss of their trades.

ByBit Regulation

Bybit is not regulated, which is commonplace in the DeFi world. This means it does not need to meet the requirements imposed on regulated brokers and exchanges or be subject to the same level of monitoring. As a result, investors should approach the exchange with caution as such firms generally come with greater risk. That said, an unregulated exchange does not necessarily imply that it is not legitimate.

Account Types

In addition to Bybit’s Spot Account, there are three types of derivatives accounts:

Derivatives Account

- USDT perpetual contracts

- Position-based risk management

- Cross-margin and isolated margin mode

USDC Derivatives Account

- Only cross-margin mode

- Account-based risk management

- USDC perpetual and USDC options contracts

Unified Margin Account

- Only cross-margin mode

- Account-based risk management

- £1,000 required to upgrade to this account

- Trade any derivative contract from a single account

- USDT perpetual, USDC perpetual and USDC options

In addition to the non-VIP accounts, there are the VIP 1, VIP 2 and VIP 3 accounts. These accounts have fee discounts but higher equity and trading volume requirements. Professional traders may be eligible for the Pro 1, Pro 2 or Pro 3 accounts. There is also the Bybit Custodial Trading Subaccount, whose holders can have their assets managed by professional trading teams.

How To Get Started With Bybit

1) Open An Account

It is quick to sign-up for an account on Bybit. Although no KYC is initially required when signing up, verification is sometimes necessary to complete other actions or for larger withdrawal limits. This may require the need to upload your UK ID and a selfie, which can be done online or through the mobile app.

2) Deposit Or Buy Crypto

Traders who already own cryptocurrency can transfer this from their external wallet directly into their Bybit wallet. We would recommend this as it means you are not exposed to the conversion rates set by third-party providers if you purchase crypto. Those who do not have tokens can purchase them easily using multiple currencies including GBP. Those looking for more obscure cryptocurrencies should first purchase USDT and then trade on the spot market.

3) Choose A Market

The main choice here is whether to speculate on the spot or derivatives markets. In the former, traders will take direct ownership of the cryptocurrency. In the derivatives market, clients simply speculate on the price movement of the asset without actually owning it. Derivatives allow for leveraged investing, which can increase profits. However, this also involves increased risk, particularly in a volatile market like crypto and can increase the fees charged by the exchange, as explained earlier.

4) Open A Position

ByBit clients may wish to use technical analysis to successfully time the opening of their position and to choose an appropriate quantity. Traders have access to the MT4 platform, which comes with a range of basic and advanced technical analysis features, as does the in-house platform. A profit and loss (P&L) calculator can be used to better plan your investments and avoid the need to do a calculation yourself. Alternatively, the Custodial Trading Subaccount may be more appropriate for those wanting professionals to take control of their assets.

Benefits Of Bybit

- MT4 access

- 100 spot products

- 24/7 crypto trading

- Fee reduction systems

- Good customer support

- 180+ derivative contracts

- No fees on crypto purchases

Drawbacks Of Bybit

- Unregulated

- Cannot withdraw fiat money

- Can only directly purchase three cryptocurrencies

- Most service providers will charge fees for crypto purchases

Additional Features

The Bybit blog is a useful tool that contains numerous articles with insight into the crypto markets. Traders can also find market analysis features on the website, including a market sentiment indicator, a graph showing the market cap distribution amongst major cryptocurrencies and order book and open interest data. In addition, the Bybit Learn section contains useful information guides – particularly for beginner investors – on various topics, including the blockchain, DeFi, how auto-deleveraging (ADL) works and what the Grayscale Bitcoin Trust (GBTC) is. Tutorial videos help supplement traders’ understanding of what this exchange offers.

Other features include the P2P platform, where investors can trade cryptos and fiat currencies directly with other users at zero cost. The NFT Marketplace provides a virtual forum to buy and sell NFTs. Traders can even access new crypto tokens before they are launched with ByBit Launch. Both copy trading and automated trading are also supported.

Investors looking to save their crypto holdings and earn a passive income can do so. Bybit Savings allows clients to earn up to 4.5% APY on Bitcoin. With Dual Asset, traders can earn a higher yield by correctly predicting the direction of price within a specified period. A yield can also be earned from cryptos through Bybit Liquidity Mining, Shark Fin and Launchpool.

Traders that lack the funds needed to purchase a cryptocurrency can take out a crypto loan on the spot or derivative market, using another crypto as collateral. The loan term ranges from 7 days to 180 days. Traders can use the loan to invest and earn a yield.

Trading Hours

The cryptocurrency market is open 24/7, meaning there are no opening or closing times on Bybit. Time zones on computers will need to be correctly linked to ensure accurate chart data.

Customer Support

Given the continuous nature of the crypto market, multilingual customer support is available 24/7. Whether you have withdrawal issues or trading platform faults, the following support options are available:

- Email: support@bybit.com

- Live Chat

- Request Ticket

Many customer enquiries can be resolved through the Help Center, particularly regarding account matters like how to login using a QR code. This part of the exchange’s website contains many useful ‘how to’ guides.

This exchange is on multiple social media sites including Facebook, Instagram and YouTube.

Safety

Bybit uses an industry-standard cold wallet system to protect customers’ crypto assets, whilst also maintaining a hot wallet to allow for all-day withdrawals. Every withdrawal request is manually reviewed by the exchange. The company also has segregated accounts, so that the funds belonging to the firm are not mixed with those belonging to clients. An insurance fund is available to protect against excessive losses (negative equity) caused by positions closed at ‘worse than bankruptcy prices’.

Other security measures include the ability to use two-factor authentication (2FA) with Google Authenticator, as well as a 3D secure code to verify payments. Despite all these measures, we recommend clients remain cautious, particularly when using the P2P Platform, as there can be scammers operating on this. A good virtual private network (VPN) – either from the UK or elsewhere – can also help protect sensitive data.

ByBit Verdict

Bybit has built a successful company and intends to take a large share of the crypto derivative and exchange market. The exchange offers a wide range of DeFi services, including staking, P2P trading, spot trading, derivatives speculation and liquidity mining. While the firm does not itself handle fiat deposits, new clients can fund their accounts via partnering companies.

FAQ

Is Bybit A Wallet?

Bybit is a cryptocurrency exchange that provides wallets to customers so they can store crypto for their account or from any external wallets they may hold.

Why Does Bybit Use Cold Wallets?

Cold wallets are more secure because they store funds offline and make it more difficult for hackers to gain access. They are also not as easily accessible, though, so brokers and exchanges often combine their use with a hot wallet for all-day transactions.

Does Bybit Have A Demo Account?

Bybit has a demo account (Testnet) where traders can familiarise themselves with the trading platform or practise a trading strategy. MT4 also has a practice account version.

What Is An Inverse Perpetual Contract On Bybit?

An inverse perpetual contract is similar to a perpetual contract in that it is an agreement to buy or sell an asset at an unspecified point in the future. The difference is that inverse contracts are margined and settled in crypto.

How Is It Possible To Take Partial Profit On Bybit?

Traders can set multiple take-profit orders to partially liquidate a position in the market.

Top 3 Bybit Alternatives

These brokers are the most similar to Bybit:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Bybit Feature Comparison

| Bybit | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.1 | 4.8 | 4.8 | 4.7 |

| Markets | Cryptos, Futures | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | 0.001 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | - | MT4 |

| Leverage | - | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | Bybit Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Bybit | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | Yes | No | No | No |

| Options | Yes | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Bybit vs Other Brokers

Compare Bybit with any other broker by selecting the other broker below.

Popular Bybit comparisons: