BUX Markets Review 2025

|

|

BUX Markets is #94 in our rankings of CFD brokers. |

| Top 3 alternatives to BUX Markets |

| BUX Markets Facts & Figures |

|---|

BUX Markets is a forex, CFD and spread betting broker based in the UK. The broker offers over 1,000 instruments through its bespoke trading platform, TradeHub, with a low minimum deposit of $100. BUX Markets boasts over 2 million users and is regulated by the FCA. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Spread Betting, Stocks, Indices, Commodities, Bonds, ETFs |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Commodities |

|

| CFDs | BUX Markets offers a fairly diverse selection of CFDs covering currencies, indices, shares, ETFs, commodities, interest rates and bonds. The broker’s advanced charting package makes it possible to execute complex strategies using 170 technical studies, which is impressive compared to other CFD trading platforms I’ve used. |

| Leverage | 1:30 |

| FTSE Spread | 3 |

| GBPUSD Spread | 1.2 |

| Oil Spread | 0.05 |

| Stocks Spread | 0.1% |

| Forex | My tests uncovered 35+ currency pairs with leverage up to 1:30. This isn’t a particularly wide range of pairs compared to other brands, and I was disappointed that the minimum spread for EUR/USD is not very competitive at 0.7 pips. That said, I like that I can access both web and mobile versions of the platform, so I can trade currencies whilst on the go. |

| GBPUSD Spread | 1.2 |

| EURUSD Spread | 0.7 |

| GBPEUR Spread | 1 |

| Assets | 36 |

| Stocks | I was pleased with the decent range of 1000+ blue chip, large cap, mid cap, and small cap shares from US, European and UK markets. Minimum spreads are from 0.08% and low stake sizes are available. I also appreciate the excellent range of indices, including cash indexes and the US volatility index. My main complaint is the lack of market research tools and education. |

| Spreadbetting | For UK clients, I was glad to find spread betting available on all asset classes at BUX Markets. Traders can enjoy tax-free benefits, as well as zero commissions. Experienced spread betters using the PRO account can also access attractive spread rebates up to 15%. |

BUX Markets is a UK-based, FCA-regulated broker that offers more than 1000 assets via a bespoke trading platform. The brokerage facilitates GBP trading and free transfers, making it accessible to UK traders. In this review of BUX Markets, we will assess the trading instruments, account types, platform features, security and more.

Our Take

- BUX Markets will suit newer investors looking to build a diverse portfolio across popular financial markets

- The broker is regulated by the FCA, providing a secure investing environment for British traders

- Our team rate the user-friendly platform but it falls short in terms of automated trading capabilities

- We were disappointed by the relatively wide spreads and monthly inactivity fees

Market Access

Our team were impressed to find more than 1000 assets offered by BUX Markets for speculation.

All UK clients can invest in indices, stocks, forex, ETFs, commodities, bonds and interest rates, providing diverse investment opportunities to a variety of retail clients. Access to gilts is a particular bonus for British traders looking for a relatively low-risk instrument.

- Indices – 21 index products, including the FTSE 100, NASDAQ 100 and S&P 500

- Shares – 1000+ shares, including UK, US, French, German and Swiss companies

- Forex – 36 forex pairs, including GBP/USD, EUR/CAD and NZD/JPY

- ETFs – Seven ETFs, including the iShares FTSE 100, Vanguard MSCI Emerging Markets and Powershares QQQ Nasdaq

- Commodities – Nine commodity assets, including gold, silver and metal futures & spot products, wheat futures US crude oil and Brent crude oil

- Interest Rates & Bonds – Seven products, including UK gilt futures, German bund futures and Euroswiss futures

Fees

Our team was disappointed by the high cost of investing with BUX Markets. The broker derives most of its income from large spread markups, although other charges include overnight margin financing costs, currency conversion fees, inactivity fees and supplementary premiums.

Average spreads for the EUR/USD are 5.8 pips, several times greater than competitor brokers like eToro or Plus500, which both demonstrate average spreads below 1.0 pips for liquid forex pairs. This is very disappointing to see, especially given the quality of most of the other services offered by BUX Markets.

Inactivity fees of £10 are charged to accounts for which there has been an inactive period of 180 calendar days. This charge is then repeated every 30 inactive calendar days. These fees only apply when the account has a balance above £0.00.

Supplementary premiums are also applied on illiquid equities to open a short position. These vary by company.

BUX Markets Accounts

BUX Market offers a single account type to most traders using its services, with an advanced Pro account for high-value professional clients that meet standard industry prerequisites.

The Standard account offered by BUX Markets gives access to the TradeHub trading platform, over 1000 assets, 100% UK share dividends, 85% US share dividends and leverage up to 1:30.

We like the simplicity this provides to traders. However, we are disappointed by the lack of swap-free, Islamic account options for investors looking to abide by Sharia law. This is something that is offered by most of the top UK firms, such as XTB and CMC Markets.

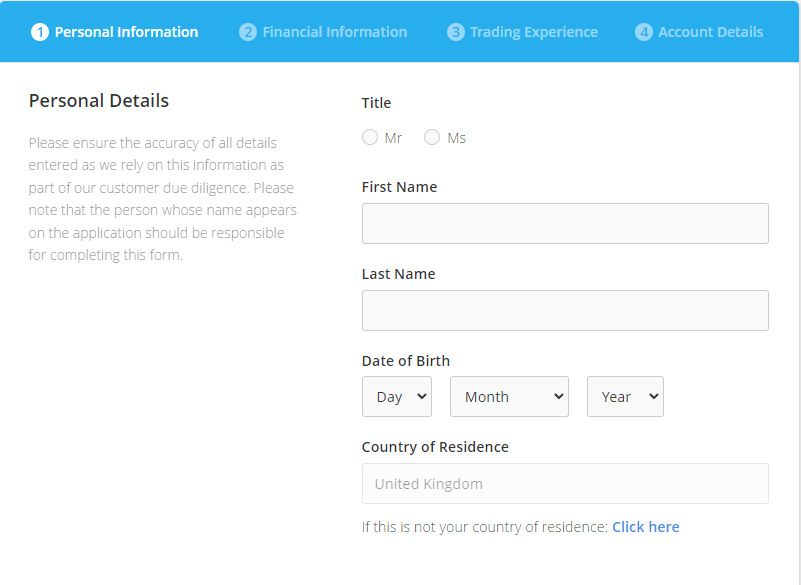

How To Open An Account

On a lighter note, we didn’t find the registration process long or cumbersome. To sign up:

- Click the Open Account button at the top of the BUX Markets homepage

- Provide your country of residence, such as the UK

- Fill out a registration form comprising four sections: Personal Information, Financial Information, Trading Experience and Account Details

- Provide your name, nationality, address, employment information, etc

- Once you have submitted this application, it will be reviewed and your live account will be opened

- Verify your account through the email sent to your provided email address

- Login to the BUX Markets portal through its website

- Deposit funds and begin trading

BUX Markets Account Application Form

Funding Options

Our team found BUX Markets’s funding options to be somewhat limited, though appreciated the lack of any charges for UK clients. The firm offers two main payment methods: credit/debit cards and bank wire transfers, though the broker also supports Klarna payments.

BUX Markets does not generally charge fees for transfers. The only exception to this is when deposits are made via credit/debit cards outside of the EEA. In this case, a 1.75% transaction fee is charged.

Credit and debit transfers are usually processed within 24 hours, though bank wire transfers can generally take up to five working days. Withdrawals are returned in the same method used to deposit and are processed within five working days.

There is a minimum £100 deposit for credit/debit cards but no limit for wire transfers.

UK Regulation

We were very pleased to see that BUX Financial Services Limited is authorised and regulated by the Financial Conduct Authority with FCA register number 184333.

The FCA sets the golden standard for financial services regulation, ensuring that retail investors are best protected from financial malpractice. This includes requiring every broker to separate client funds, produce financial reports, provide membership to the Financial Services Compensation Scheme (FSCS) and employ KYC and anti-money laundering schemes.

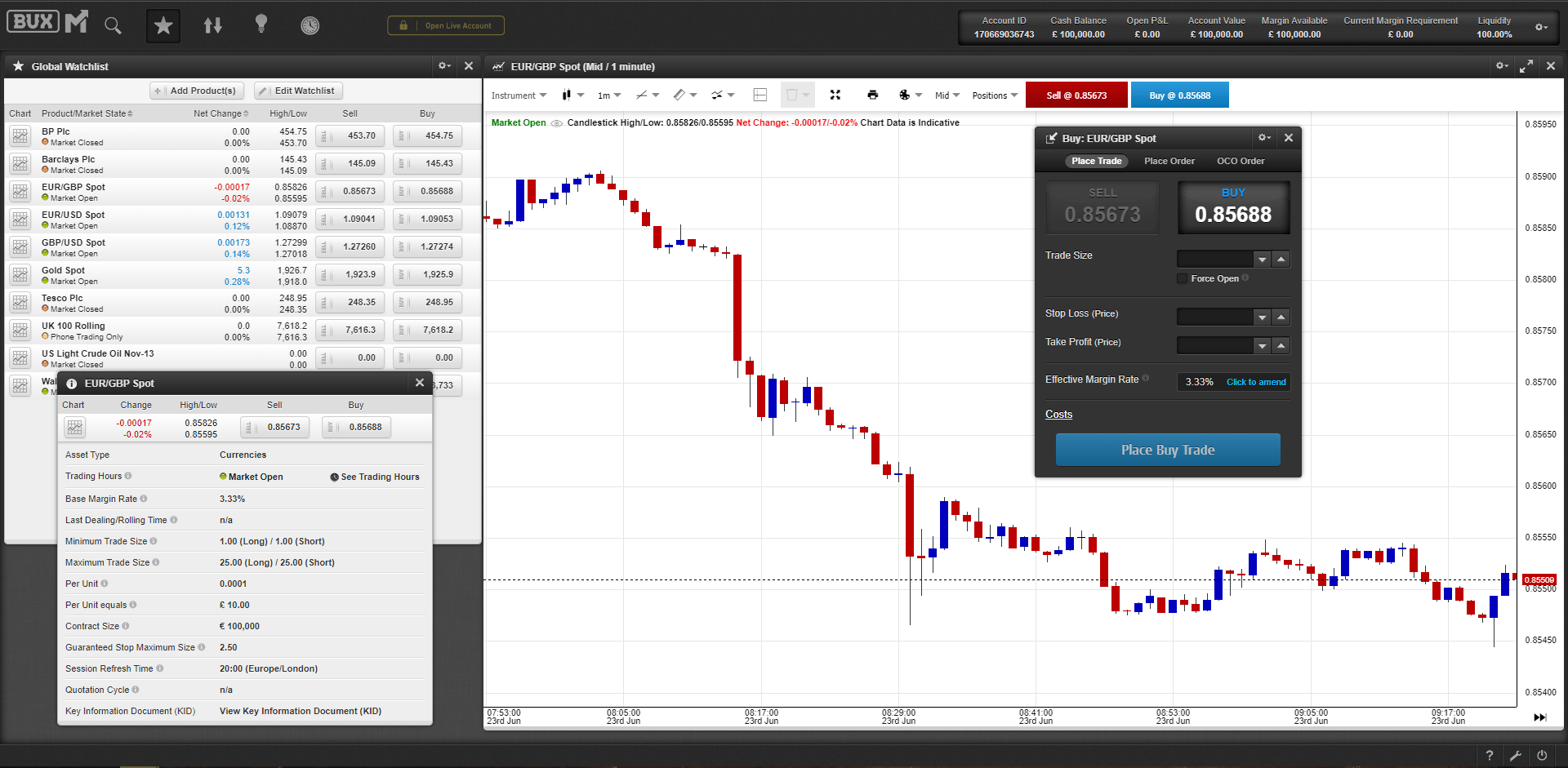

Trading Platforms

BUX Markets provides its own bespoke and sophisticated TradeHub platform. This is the only trading platform offered, which means that the popular MetaTrader 4, MetaTrader 5, cTrader and TradingView platforms are not available to clients.

Despite this, our experts were impressed by the capabilities of the TradeHub platform. The software comes with 13 chart types, over 170 technical analysis tools, eight timeframes, a sleek design and an intuitive UI.

The platform is available on web browsers or mobile devices through the Apple App Store or Google Play Store.

When we used the platform, we liked its careful balance between simplicity and functionality. The built-in tools and features make the platform powerful enough to implement complex trading strategies, while its design and customisability make it easy to use for newer traders.

On the negative side, the platform does fall short in terms of algorithmic and copy trading capabilities compared to popular alternatives like MetaTrader 5.

BUX TradeHub

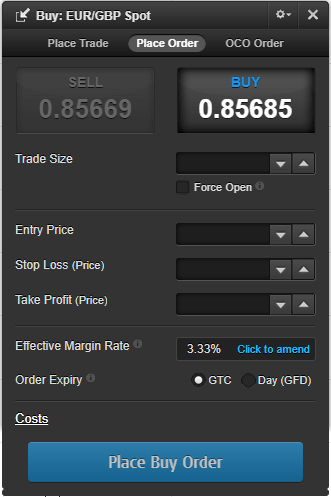

How To Place A Trade

New traders shouldn’t have any issues navigating the order process:

- Log into your BUX Markets trading account

- Choose which asset you would like to trade

- Click the Buy or Sell button at the top of the screen to choose the direction of your order

- Fill in the details of your trade within the order window that pops up (trade size, stop loss, take profit, etc.)

- Click the Place Trade button at the bottom of the window to submit your order

BUX TradeHub Order Window

Mobile App

BUX Markets has created a dedicated mobile analysis and order management platform available on Android and iOS mobile devices. The platform is called BUX Markets and can be downloaded from the respective app stores.

The application is easy to navigate and understand, allowing traders to track markets, chart prices and place orders on the go.

On the downside, our experts sadly found that the software has a rather outdated design and holds low ratings (2.4/5 on the Google Play Store at the time of writing). This is something we would expect the broker to take seriously and put some effort into fixing and improving. It is disappointing to see no evidence of this.

Leverage

BUX Markets offers leveraged trading up to 1:30, varying by market and asset. While lower than some major offshore brokers, this is the maximum limit allowed by the FCA.

The limits for each market type are given below:

- Forex – 1:20

- Indices – 1:20

- Shares – Up to 1:30

- Commodities – 1:10

- Interest Rates & Bonds – 1:5

Demo Account

We happily found that BUX Markets offers a free demo account in which users are given £100,000 in virtual funds to invest using the TradeHub platform.

This is a great way for clients to become accustomed to the bespoke platform and test out new investment strategies before implementing them in live accounts.

Bonus Deals

BUX Markets have provided offers and deals in the past, although the last recorded offers date back to 2018. Since then, no offers have been provided.

This leads us to believe that BUX Markets no longer plans to offer any deals and promotions, especially given the FCA’s stance on financial incentives.

Extra Tools & Features

Our experts found that the additional tools and educational material offered by the firm leave a lot to be desired. The BUX Markets website features a Learn section for newer traders, containing some pages of educational and guidance information on a variety of topics, including CFDs, spread betting, financing, pricing and dividends, plus a glossary of key terms.

However, the overall educational offering is very limited. Top brokers usually provide extensive webinar, video and e-book resources to help new and experienced traders further their understanding of different investing topics. We would have liked to see more from BUX Markets to help it stand up against other major brokers, like IG Index and CMC Markets.

BUX Markets also provides economic calendars on the TradeHub platform and on the main website with which investors can plan for future events by keeping up to date with dividend report releases, earning releases and more.

Company Details & History

BUX Markets became a part of the BUX Group in June 2019, a group that provides online financial services to over two million traders across 100+ countries.

BUX Markets is based in London, UK and is regulated by the Financial Conduct Authority. Furthermore, there are international offices across the world to service global clients.

Customer Service

We found that the broker offers fairly standard customer service, which can be contacted via mobile phone or email. When making use of the contact methods, our team was impressed by the support offered, though the responsiveness could have been improved.

- Telephone Contact Number: +44 (0) 20 3326 2135

- Email Address: support@buxmarkets.com

Security

As BUX Markets is FCA-regulated, you can rest assured that the broker provides high-security services to its clients.

All payment card transfers use 3D-Secure technology to ensure that payment details and transfers are safe. Furthermore, the broker’s website and trading platform are encrypted.

The broker segregates client funds from company funds and ensures capital is only held at reputable global banks.

The FSCS is provided to all retail traders, meaning investors may be entitled to up to £85,000 in compensation if the broker is unable to fulfil its financial commitments.

Overall, our experts found BUX Markets to demonstrate effective and reassuring security measures, complying with the FCA’s stringent regulations.

Trading Hours

Opening hours vary by assets and classes. Many assets can usually be invested only when their underlying exchanges are open.

For example, UK shares can only be traded when the London Stock Exchange (LSE) is open. However, some assets, like forex, are available out-of-hours, though with typically higher spreads.

Should You Trade With BUX Markets?

Our team rate most of BUX Markets’ services quite highly, though some key areas could do with work. The firm boasts an impressive 1000+ investment products, even branching into interest-rate assets and bonds.

However, the broker’s spreads are much higher than other companies. Moreover, the firm charges monthly inactivity fees and offers only a proprietary mobile application that has low customer reviews.

That being said, the firm’s desktop platform has a good range of functionality and usability, all while maintaining strong levels of cybersecurity.

While the firm has several strong points, we find it difficult to recommend BUX Markets given the high cost of investments. Instead, we recommend a top-tier, low-cost FCA-regulated CFD broker.

FAQ

Is BUX Markets Good For UK Traders?

BUX Markets is authorised and based in the UK, meaning British traders can sign up and invest with the firm. Investment opportunities are more than 1000 strong, consisting of indices, forex pairs, stocks and more, all available with competitive spreads. On the downside, fees are higher than many alternatives, especially in terms of spreads and inactivity fees. As a result, it isn’t our first pick for British investors.

Can You Trade In GBP With BUX Markets?

GBP is available as a base currency and deposit option with BUX Markets, so no foreign exchange fee must be paid by UK investors.

Is BUX Markets Safe?

BUX Markets is regulated by the FCA, a top financial regulator. This means that the broker is under stringent security regulations to protect retail traders. The firm is required to separate client funds from company funds, perform complete KYC checks, encrypt the website and platform, provide transparent and clear fees, have negative balance protection and more. The broker is also under the FSCS, allowing traders to claim up to £85,000 in compensation if the broker fails.

Which Trading Platforms Do BUX Markets Offer?

Only the bespoke TradeHub software package is compatible with a BUX Markets account. This toolset features many of the packages and functionality provided by big names like MT5 and cTrader, though it does make automated strategy development a little tougher.

Can You Trade Cryptocurrency With BUX Markets UK?

BUX Markets offers more than 1000 tradable assets, although cryptocurrency assets are not part of that selection. Instead, investors can trade CFDs of shares, indices, commodities, bonds, ETFs and forex.

Article Sources

Top 3 BUX Markets Alternatives

These brokers are the most similar to BUX Markets:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- ActivTrades - ActivTrades is a UK-headquartered CFD and forex broker established in 2001. The award-winning brokerage has secured licenses from trusted bodies, notably the UK’s FCA, and facilitates trading on over 1000 instruments spanning 7 asset classes, with over 93.60% of orders are executed at the requested price.

BUX Markets Feature Comparison

| BUX Markets | IG Index | Swissquote | ActivTrades | |

|---|---|---|---|---|

| Rating | 3.5 | 4.7 | 4 | 4 |

| Markets | CFDs, Spread Betting, Stocks, Indices, Commodities, Bonds, ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Futures, Cryptos (location dependent) |

| Minimum Deposit | $100 | $0 | $1,000 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, CMVM, CSSF, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4 | MT4, MT5 | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 (UK and EU), 1:400 (Global & Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | BUX Markets Review |

IG Index Review |

Swissquote Review |

ActivTrades Review |

Trading Instruments Comparison

| BUX Markets | IG Index | Swissquote | ActivTrades | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

BUX Markets vs Other Brokers

Compare BUX Markets with any other broker by selecting the other broker below.

Popular BUX Markets comparisons: