Bullwaves Review 2025

|

|

Bullwaves is #20 in our rankings of CFD brokers. |

| Top 3 alternatives to Bullwaves |

| Bullwaves Facts & Figures |

|---|

Established in 2024 and headquartered in Seychelles, Bullwaves is a MetaTrader-only broker offering access to a modest collection of 250+ assets including forex, metals and indices. Traders can choose from three accounts; Classic, VIP and Elite, catering to different experience levels and budgets. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Metals, Indices |

| Demo Account | Yes |

| Min. Deposit | $250 |

| Mobile Apps | iOS & Android |

| Trading App |

Bullwaves licenses the MT5 platform, which are accessible on iOS and Android devices. Yet while MetaTrader is popular among experienced traders, the lack of a proprietary app is a drawback for novices, as dedicated apps often feature simplified interfaces and a gentler learning curve. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSA |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Bullwaves offers CFDs with leverage up to 1:500, providing short-term trading opportunities on upward/downward price movements. However, the selection of CFDs is extremely narrow, with just 33 currency pairs, six indices and two metals. Notably, there are no stocks, commodities or cryptos. |

| Leverage | 1:500 |

| FTSE Spread | Variable |

| GBPUSD Spread | Variable |

| Oil Spread | NA |

| Stocks Spread | NA |

| GBPUSD Spread | Variable |

| EURUSD Spread | Variable |

| GBPEUR Spread | Variable |

| Assets | 33 |

Bullwaves is an offshore broker that offers CFD trading services in forex, commodities, indices, and stocks. Our team of trading experts and financial analysts from the UK has conducted this Bullwaves review to assess its features, reliability, and overall trading conditions, to determine its suitability for investors in the British market.

Our Take

- Bullwaves is registered in Seychelles, not the UK, and the Financial Conduct Authority (FCA) does not regulate it. That means you don’t get UK-level protections like the Financial Services Compensation Scheme (FSCS), a significant consideration for UK traders who want peace of mind regarding fund safety.

- If you have experience and know how to manage risk, Bullwaves’ generous 1:500 leverage could be a plus. It’s way above the 1:30 cap that UK-regulated brokers offer—but with great power comes significant risk, so use it wisely.

- Bullwaves has gone all-in on MetaTrader 5 (MT5), which is a solid platform—fast, powerful, and great for automated trading—but you’re out of luck if you prefer MT4, cTrader, or TradingView.

- If you’re new to trading, this might sting: there are no tutorials, webinars, or built-in tools like an economic calendar or market analysis platform. You’re basically on your own unless you do your own research or use third-party resources.

- The live chat claims to be 24/7, but… it’s hit or miss based on our tests. When you need help, you might end up staring at a blank screen or waiting forever for an email response that may never arrive.

Is Bullwaves Regulated In The UK?

Bullwaves is a trading name of Equitex Capital Limited (Registration No. 8434948-1), a company authorized and regulated by the Seychelles Financial Services Authority (license number SD185).

The broker is not regulated by the UK’s top-tier Financial Conduct Authority (FCA), which means it does not follow the regulator’s stringent investor safeguards.

Although the Seychelles Financial Services Authority (FSA) provides a basic regulatory framework, it does not include a compensation scheme like the UK’s Financial Services Compensation Scheme (FSCS), which ensures your deposits up to £85,000 if the broker becomes insolvent.

While Bullwaves segregates client funds and offers negative balance protection to limit trading losses, the absence of FSCS coverage means you could face greater financial exposure if the broker fails.

Accounts

Live Accounts

Bullwaves offers three trading account types, each granting access to the popular MetaTrader 5 (MT5) platform.

While the accounts share core features such as support for Expert Advisors (EAs), scalping, hedging, and VPS hosting, they differ in terms of spreads, leverage, trade sizes, and required deposits.

- The Classic Account is the most entry-level option, requiring a minimum deposit of £250. It offers spreads starting from 2.0 pips, a minimum trade size of 0.01 lots, and leverage up to 1:200, making it a more accessible choice for beginners. There are no commissions and the stop-out level is 50%.

- The VIP Account requires a £10,000 minimum deposit for more experienced traders. Spreads are tighter, starting from 1.5 pips, but the minimum trade size increases to 0.05 lots. There are no commissions and the stop-out level is 35%.

- The top tier is the Elite Account, which caters to high-net-worth traders. It offers the lowest spreads from 1.1 pips and higher leverage up to 1:500, but it requires a substantial £50,000 deposit and has a larger minimum trade size of 0.1 lots. There are no commissions and the stop-out level is 25%.

A notable feature is the ability to open and manage up to six accounts—two of each type—through the Bullwaves client dashboard. This flexibility can be helpful if you’re looking to test different strategies or manage multiple portfolios.

However, Bullwaves does not support PAMM accounts, which may be a drawback for money managers seeking to oversee multiple investor accounts under one structure.

The account registration process from the UK is relatively fast, typically taking just a few minutes.That said, during setup, I encountered several broken links on the website—including the primary ‘Sign Up’ button—which made the experience unnecessarily tricky.

To proceed, I had to locate an alternative registration link manually.

Demo Account

Bullwaves offers the option to open a demo account on the MT5 platform. This allows you to practice trading and experiment with strategies without risking real money.

A standout feature is that it’s a non-expiring demo account, which is ideal as many other brokers place time limits on demo access. This allows you to practice indefinitely, test strategies at your own pace, and gain confidence before committing real capital.

Funding Options

Deposits

Bullwaves offers various funding methods, including debit cards, credit cards, Neteller, international bank transfers, and USDT (TRC20 and ERC20) for crypto-based deposits.

The minimum deposit starts at £100, depending on the account type you choose.

Bullwaves offers various funding methods, including debit cards, credit cards, Neteller, international bank transfers, and USDT (TRC20 and ERC20) for crypto-based deposits.

One notable advantage for UK-based clients is that Bullwaves supports GBP, alongside EUR and USD, as base currencies. This can help avoid unnecessary currency conversion fees when depositing or withdrawing in pounds, making transactions smoother and potentially more cost-effective for UK traders.

That said, some limitations remain—Bullwaves does not currently support popular e-wallets like PayPal or Skrill, nor does it accept major cryptocurrencies such as Bitcoin or Litecoin, which are commonly used by traders looking for fast, low-cost transfers.

When I tested an international bank transfer, the funds arrived in my Bullwaves account in three to five business days, which is typical for cross-border payments.

Suppose you’re using cryptocurrency to fund your account. In that case, it’s automatically converted into one of the supported fiat currencies (GBP, EUR, or USD), which could lead to additional fees depending on your crypto wallet or exchange.

Withdrawals

Bullwaves requires a minimum withdrawal of £50 when using bank cards or e-wallets, while crypto withdrawals start from as little as £5.

To comply with standard security procedures, withdrawals must be made using the same payment method used for funding your account, and full identity verification is required before any withdrawal can be processed.

These limits may feel restrictive, especially if you’re used to platforms like FP Markets, which allow withdrawals of any amount with no minimum threshold – ideal if you prefer to withdraw smaller sums more frequently.

Market Access

Bullwaves is primarily geared toward forex and CFD trading, but its product offering is quite narrow compared to many established UK and global brokers we’ve evaluated. You won’t find real stocks, ETFs or options on the platform.

Bullwaves provides access to over 100 currency pairs, 13 metal pairs, 12 major indices, three commodities, 96 stocks (European and American), and over 100 crypto pairs.

By comparison, CMC Markets offers over 300 forex pairs and XTB features thousands of global markets across various asset classes including ETFs.

Given that the broker accepts cryptocurrency deposits, it’s surprising that no crypto trading options are available. If you’re interested in actively trading digital assets, platforms like eToro (which offers over 100 cryptocurrencies) may be a better fit.

Leverage

Bullwaves gives you access to high leverage up to 1:500, which is considerably above the limits imposed by regulators in regions like the UK.

The FCA in the UK cap leverage for retail clients at 1:30. These restrictions protect less experienced traders from the amplified risks associated with high leverage.

While 1:500 leverage might sound appealing, especially if you hope to boost potential returns, it dramatically increases your exposure to market movements. Even small price fluctuations can wipe out your account balance if you’re over-leveraged.

The ability to access 1:500 leverage is one of the reasons offshore brokers like Bullwaves attract traders. Still, it also means you’re taking on significantly more risk than trading with a regulated UK broker.

Pricing

Bullwaves tries to appeal to traders by promoting a commission-free pricing model, which can seem attractive at first glance. However, the catch lies in its spread structure, which varies depending on your account type.

For example, if you’re using the Classic Account, spreads on major pairs like EUR/USD or USD/JPY start from 2.0 pips—relatively wide compared to the industry average from our analysis.

This setup might be fine for casual or long-term traders, but if you’re a day trader or scalper who relies on squeezing value from every pip, those wider spreads can eat into your profits.

In comparison, brokers like IC Markets or Pepperstone offer tighter spreads (often near zero) with small commissions, making them more cost-effective for high-frequency trading styles.

When it comes to withdrawal fees, Bullwaves isn’t the most forgiving either. A £10 fee applies to bank wire transfers of £100 or less, and the same charge also applies to non-card withdrawals of £20 or below. This feels a bit steep, especially if you’re testing the waters with a smaller account or withdrawing frequently in smaller amounts.

Also worth noting is the £10 inactivity fee Bullwaves applies if your account is idle for 30 days—a much shorter grace period than many leading brokers, which typically start charging inactivity fees after three to six months.

In short, while Bullwaves’ ‘no commission’ pitch might sound appealing, the wider spreads, transaction charges, and aggressive inactivity policy make it less competitive for active or low-volume traders than more transparent, trader-friendly brokers.

Trading Platform

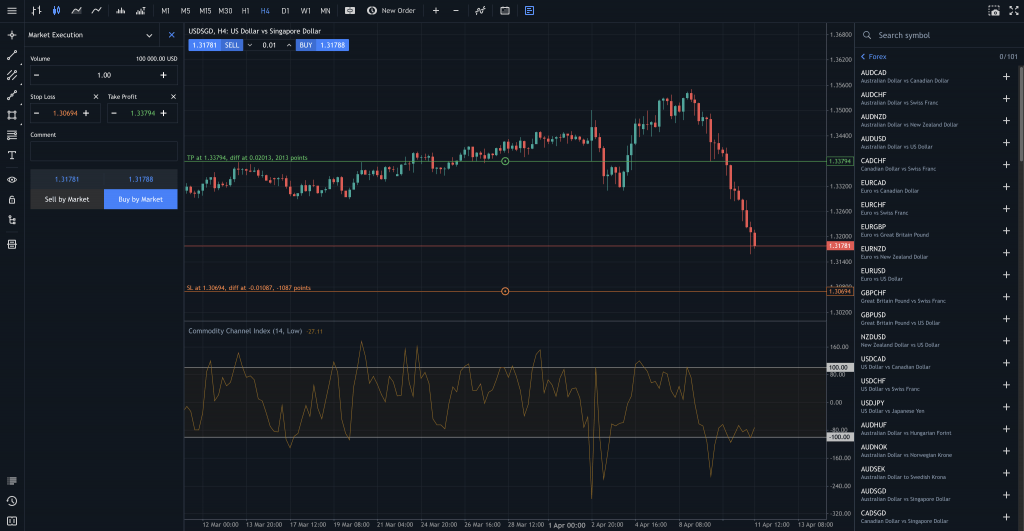

Bullwaves exclusively supports MT5, which means you are limited to this platform for all your trading activities—whether on desktop or mobile.

While MT5 offers notable improvements over its predecessor, MT4, such as a wider variety of market access and advanced charting features, the lack of MT4 or other popular platforms like TradingView or cTrader may feel restrictive for those accustomed to greater flexibility.

MT5’s charting capabilities are significantly enhanced compared to MT4. It offers 21 timeframes and more than 80 built-in technical indicators, which allows for more detailed analysis and greater customisation if you rely heavily on technical strategies.

Additionally, unlike MT4, which supports only hedging, MT5 allows both netting and hedging options, providing increased flexibility if you need to implement specific trading methods or strategies.

Another advantage of MT5 is its support for algorithmic trading. This enables you to automate your trading strategies, which can be a huge time saver and allow more efficient trading in fast-moving markets.

However, there are drawbacks. MT5’s interface can be overwhelming, especially for beginners, as it has features that may take time to grasp fully.

One challenge I encountered when using MT5 was the complexity of customising chart setups.While the platform offers a ton of technical indicators and drawing tools, configuring them to match my exact strategy requires navigating through multiple settings menus, which can be clunky.

MT5’s copy trading feature lets you automatically replicate the trades of signal providers directly within the platform. It’s integrated into the MT5 interface, where you can browse and subscribe to signal providers based on performance, risk level, and trading history.

While it offers a high degree of flexibility—such as adjusting lot sizes, setting risk parameters, and combining manual trading or EAs with copied trades—it can be a bit technical for beginners to navigate.

For those looking for a more user-friendly and socially interactive copy trading experience, platforms like eToro may be easier to get started with.

Overall, while MT5 is a solid platform with numerous advanced features, the lack of alternative platform support and the learning curve might make it less ideal if you prefer a more intuitive or flexible trading environment.

Extra Tools

Unlike many established brokers, which enhance their platforms by integrating third-party tools like Trading Central or Autochartist, Bullwaves offers no advanced analysis features.

We’ve found these tools are often used by brokers who don’t produce their in-house content but still want to provide traders with professional-grade insights, signals, and charting tools.

Adding to this shortfall, Bullwaves lacks even the most basic trading tools, such as an economic calendar and profit/loss calculators.

While the broker maintains a daily blog on its website with brief market updates, this content is limited and lacks the depth or actionable insights that many competing brokers like FXTM provide as standard.

Educational support is also noticeably missing. The site does not offer tutorials, webinars, trading guides, or learning modules covering topics like risk management, chart analysis, and trading psychology—crucial for long-term success.

Customer Service

Compared to top-tier brokers that provide round-the-clock customer support across multiple channels—like live chat, dedicated email assistance, and local phone hotlines—Bullwaves falls short.

The broker’s support system is limited to a contact form, an email address, and a Seychelles-based phone number, which isn’t particularly convenient for UK traders looking for quick, accessible help in their time zone.

Although the website advertises 24/7 live chat support, I find the chat widget is often unavailable, even during standard market hours.This was especially frustrating when I ran into issues setting up my account and needed real-time assistance. A functioning live chat would’ve saved me a lot of time and hassle, but I had to resort to email support instead.

Unfortunately, my email inquiry went utterly unanswered. This lack of responsiveness does little to instil confidence, especially when most reputable brokers pride themselves on prompt and helpful customer service.

For UK-based traders or anyone expecting reliable and timely support, Bullwaves’ current offering is underwhelming. Relying on accessible help during technical or account-related issues could be a dealbreaker.

Bottom Line

Bullwaves presents both opportunities and risks for UK traders. On the one hand, the broker offers a high leverage of up to 1:500, which can appeal to more experienced traders and the convenience of trading in GBP.

However, Bullwaves is registered offshore in Seychelles and is not regulated by the UK’s FCA, meaning it lacks the same level of investor protection and security that FCA-regulated brokers provide.

The platform also has a limited selection of assets, and the choice of trading platforms is restricted to MT5, which may not satisfy you if you’re seeking alternative options like cTrader or TradingView.

Given the high leverage, limited assets, and lack of regulatory oversight, UK traders should carefully consider the risks before choosing Bullwaves.

FAQ

Can You Invest In GBP With Bullwaves?

Yes, you can invest in GBP with Bullwaves. The broker supports GBP as one of its base currencies, alongside USD and EUR.

This means UK traders can fund their accounts, trade, and withdraw in pounds sterling without converting currencies, which helps avoid unnecessary exchange fees.

Is Bullwaves Safe For UK Traders?

Bullwaves may not be the safest option for UK traders, primarily because it is not regulated by the FCA, the UK’s financial watchdog known for enforcing strict rules on client protection, fund segregation, and compensation schemes.

Instead, Bullwaves is an offshore broker registered in Seychelles, which means it operates under a much looser regulatory framework. While it does offer some standard security features like negative balance protection, it does not provide the same level of fund safety as FCA-regulated brokers.

Does Bullwaves Offer A Mobile Trading App?

Yes, Bullwaves supports mobile trading through the MT5 platform, which is available for iOS and Android devices.

This allows you to access your accounts, monitor real-time market data, execute trades, manage positions, and conveniently utilise a range of analytical tools while on the go.

However, Bullwaves does not offer a proprietary mobile trading app. Instead, it relies on the MT5 mobile application to provide mobile trading capabilities.

Can You Invest In Cryptocurrency With Bullwaves In The UK?

You can trade cryptocurrency CFDs with Bullwaves, which means you can speculate on the price movements of digital assets like Bitcoin or Ethereum without owning the actual coins. This allows for both long and short positions with leverage, but you won’t be able to buy and hold real crypto through the platform.

So, if you’re a UK trader looking to profit from crypto market volatility without dealing with wallets or exchanges, Bullwaves can offer that flexibility.

However, if your goal is to own cryptocurrencies, you’ll need to look elsewhere—platforms like eToro and Coinbase are better suited.

Article Sources

Seychelles Financial Services Authority

Financial Services Compensation Scheme (FSCS)

Top 3 Bullwaves Alternatives

These brokers are the most similar to Bullwaves:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Bullwaves Feature Comparison

| Bullwaves | IG Index | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 3.9 | 4.7 | 4 | 4.3 |

| Markets | CFDs, Forex, Metals, Indices | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Minimum Deposit | $250 | $0 | $1,000 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4 | MT4, MT5 | - |

| Leverage | 1:500 | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:50 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Bullwaves Review |

IG Index Review |

Swissquote Review |

Interactive Brokers Review |

Trading Instruments Comparison

| Bullwaves | IG Index | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | No |

Bullwaves vs Other Brokers

Compare Bullwaves with any other broker by selecting the other broker below.