Best PayRedeem Brokers 2025

PayRedeem is a digital payment system that allows UK investors to transfer funds to online trading accounts using prepaid voucher cards. This guide will give the lowdown on this fast and cost-efficient payment method, with a review of its key pros and cons and a step-by-step breakdown of how PayRedeem fees work. We also rank the top UK brokers that accept PayRedeem deposits and withdrawals in 2025.

PayRedeem Brokers

-

M4Markets is an award-winning broker regulated by the CySEC, FSA and DFSA. Although relatively new, the broker continues to improve its offering with a range of innovative tools, platforms and accounts. Beginners can start with just $5, whilst experienced investors can access leverage up to 1:5000.

-

Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

-

OspreyFX is an ECN broker headquartered in St. Vincent and the Grenadines. Established in 2019, the firm offers 120+ forex and CFD assets with high leverage up to 1:500, tight spreads from 0.1 pips and round-the-clock customer support. OspreyFX also stands out for its funded trading accounts where traders can keep up to 70% of profits.

-

AdroFx is an offshore ECN/STP broker that has offered CFD trading since 2018. The firm supports 100+ tradable assets on the popular MetaTrader 4 platform as well as a web trader, Allpips. Eight live accounts are available with no restrictions on trading strategies.

-

LegacyFX is a multi-asset broker offering an MT5 download & free signals.

About PayRedeem

Formerly known as VLoad, PayRedeem is an e-commerce platform that many traders and investors use to fund their brokerage accounts.

This digital payment system, owned by the US-based Global Primex firm, provides prepaid vouchers that can be used to quickly and securely add funds to PayRedeem brokers. It can also be used to make withdrawals from the same online trading accounts, though most platforms will only allow you to use this method to withdraw money if you have used it to fund your account in the first place.

How PayRedeem Works

The payment system provided by PayRedeem relies on prepaid vouchers which come in predefined amounts of $5, $10, $25, $50, $100 and $250. Alternatively, users can create a custom card that equals the total amount in their online shopping cart.

Some types of merchants and transactions, such as subscriptions, social media sites and crypto exchanges, require PayRedeem vouchers with special ribbons to make transactions. These ‘ribbon’ vouchers can only be used for the specified transaction type, so be sure of the type of voucher your PayRedeem broker requires before you purchase one.

Withdrawals

Should you wish to make a withdrawal from your trading account, you can use a PayRedeem Payout eCard to lodge a request with brokers that accepts PayRedeem. The broker will load the withdrawal to the eCard, which can then be used to make further online purchases.

Alternatively, traders who have attained a specific ‘tier’ can transfer the eCard balance to a bank account via wire transfer or to a crypto wallet.

PayRedeem’s Tier System

After traders sign up, they can increase their spending limits and gain access to cash and crypto withdrawals by providing additional identity verification and climbing the tiers.

The tiers are:

- Tier 0 – Anyone who completes PayRedeem registration and verifies an email address will gain access to up to 1,800 euros of transactions or 72 completed purchases per month.

- Tier 1 – Tier 0 users who provide valid government-issued ID, proof of address and their credit/debit card information will increase their spending limit to 25,000 euros annually. Tier 1 users can also benefit from crypto and bank wire transfer withdrawals from PayRedeem eCards.

- Tier 2 – Users who provide a full-face view photo and verified phone number and sign a declaration of money origin will benefit from a spending limit of up to 100,000 euros per year.

Transfer Times

As a prepaid voucher system, PayRedeem sidesteps the hassle of payment methods such as bank transfers, making it one of the quickest ways to transfer funds. Most trading brokers that accept PayRedeem deposits will process the transaction instantly, including at LegacyFX.

Withdrawals tend to take longer, and this will be at the discretion of each trading platform – check the broker’s website to find out how long a withdrawal will take to process.

Fees & Charges

Many PayRedeem brokers, including Pocket Option and FXChoice, offer 0% fees for deposits using the payment method.

Also, note that some brokers that accept PayRedeem deposits without charging a fee will levy a commission on withdrawals. This is the case with Alpari which charges a 6% commission on PayRedeem withdrawals, and FXChoice, which charges 3.99%.

Another point to factor in is that the payment brand will charge its own fee if you wish to withdraw from a Payout eCard to your bank account. The company does not list the exact amount charged, though an example transaction shows a $20 fee for a $300 withdrawal.

Similarly, there is likely to be a charge for transferring the balance of a Payout eCard to a crypto wallet.

Finally, there is likely to be a transfer charge if you buy a PayRedeem eCard in a different currency than the payment method you use.

Limits

As described above, traders who want to make more frequent transactions of larger amounts will need to provide adequate proof of identification to move up the tier system.

However, there are also likely to be limits on deposits and withdrawals set by PayRedeem brokers. Some trading platforms, such as Pocket Option and FXChoice, have a flat minimum deposit/withdrawal amount for all payment methods, with the minimum transfer set at $50 and $20 respectively and each allowing a minimum withdrawal of $10.

Other PayRedeem brokers may differentiate between payment methods, but most will include the information on their payment methods page.

Security & Support

The transfer system offers a secure and reliable payment method for traders and investors who wish to place limits on the personal information they share online. With a payment account, a user can make secure transactions with any trading broker or online merchant that accepts this payment method – without sharing their bank account details or other sensitive information.

And, while the company does not provide many details of the security protocols it uses to protect users (besides the use of eCard PIN numbers) its excellent Trustpilot rating gives credence to its claim that it can guarantee easy, secure and reliable transfers.

If something does go wrong with a transaction, the company provides 24/7 general support with a UK phone number, a support email address, and a live chat function.

Traders can also submit a ticket through the PayRedeem website’s contact page if they have a specific enquiry.

Pros Of PayRedeem For UK Traders

- Secure and reliable trading deposits and withdrawals

- Most PayRedeem brokers accept instant deposits

- Low-cost transfers

- Crypto support

- 24/7 support

Cons Of PayRedeem For UK Traders

- Transaction limits on lower tiers will frustrate well-funded traders

- A limited number of brokers accept PayRedeem deposits

- No withdrawals allowed for Tier 0 members

- Withdrawal fees lack transparency

How To Make PayRedeem Deposits & Withdrawals

Investors can easily complete transactions with trading brokers that accept PayRedeem deposits by following these simple steps to buy an eCard:

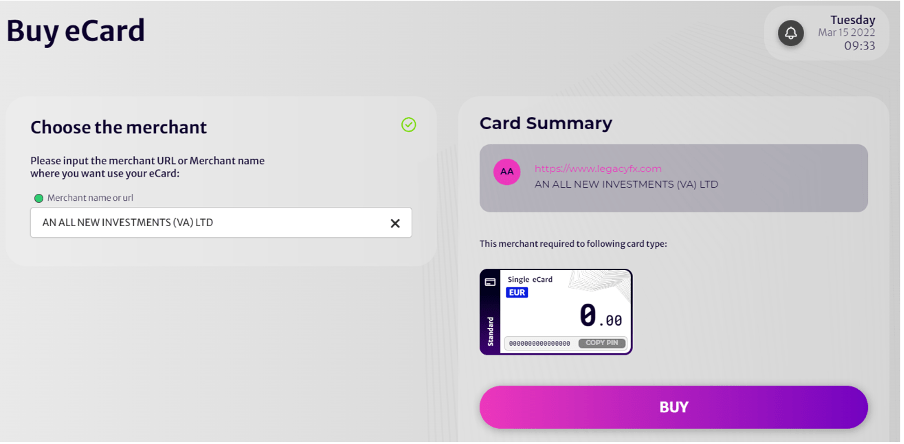

- Login to your PayRedeem account

- Select the merchant you wish to make the payment to. For example, if you wish to deposit funds to your Pocket Option account, type ‘Pocket Option’ or paste the URL into the search bar

- Check that all the details are correct and press ‘buy’

- Select the currency, e.g. GBP, and the amount you want to load to your eCard then click the ‘Checkout’ button

- Select the method you want to use to pay for your eCard – wire transfer, debit/credit card, Automated Clearing House or bitcoin

- Complete the transaction

Once you have followed these steps, you will be able to access your new eCard in the ‘Purchased eCards’ section of PayRedeem’s website. To use it, simply copy the eCard’s PIN and paste it to your PayRedeem broker’s checkout to make an instant deposit.

Withdrawals

Trading brokers that accept PayRedeem deposits will also process withdrawals in the form of Payout eCards.

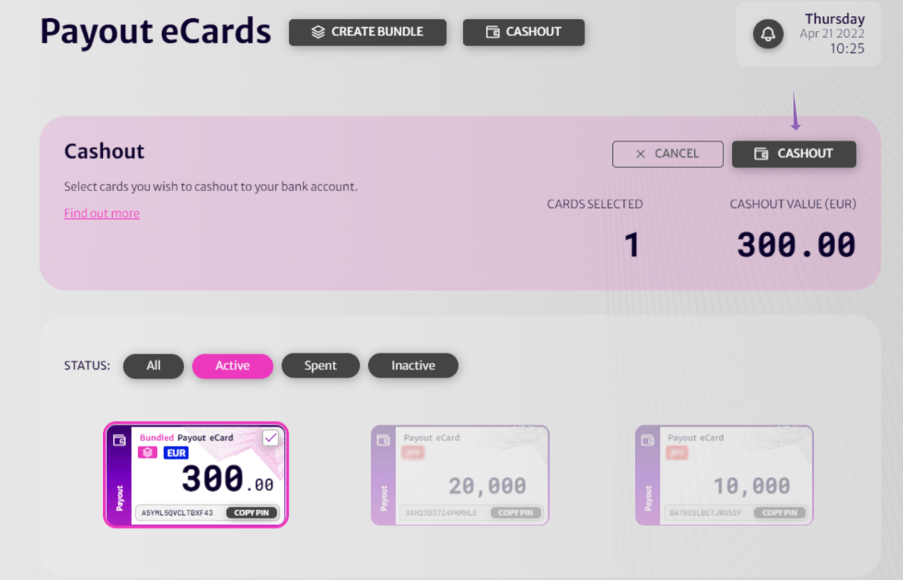

Once your broker has created a Payout eCard, it will appear in your PayRedeem account. As long as you have unlocked Tier 1 and verified your bank account, you can follow a few easy steps to complete the withdrawal:

- Log into your PayRedeem account

- Open the ‘Payouts’ tab

- Choose the Payout eCard that you want to cash out

- Confirm the cashout

Withdrawals to bank accounts usually take between 2 and 5 business days. Note that the process to unlock your payout the first time involves verifying your bank account by uploading a statement, and the verification process can add up to 2 more days to the first withdrawal.

Bottom Line On PayRedeem Brokers

PayRedeem offers a fast, secure and reliable way to transfer funds to the select group of trading brokers that accept this payment method. The instant deposits and added privacy of prepaid vouchers will be attractive to many UK traders, though the transaction limits on lower tiers may be off-putting to some online traders. Additionally, the payment brand’s fees are competitive, but traders should watch out for foreign exchange commissions and withdrawal fees, as these will quickly cut into their profits.

Use our list of the best UK PayRedeem brokers to start online trading.

FAQ

Is PayRedeem Available At UK Trading Brokers?

PayRedeem operates in many countries all over the world, including Britain. In most countries, you will have no problem setting up a PayRedeem account – all you will need to do is find a trading broker that accepts this payment method, and you’re set.

How Do I Trade With PayRedeem?

Trading with PayRedeem is quick and easy, and it can be a cost-effective payment method, depending on the amount and the currency you intend to transfer. To make a deposit to PayRedeem brokers, log into your account, purchase an eCard with the broker’s name and the amount you wish to deposit, and then paste the eCard PIN into your brokerage’s checkout.

Is PayRedeem A Safe Trading Payment Method?

Investors who use PayRedeem to fund their online trading accounts may well find that they are better off than those who use their debit cards or transfer directly from their bank accounts. Since users fund their accounts with prepaid cards, they don’t need to share any sensitive banking information and account codes, protecting themselves from data leaks or unscrupulous brokers.

How Much Do PayRedeem Trading Transfers Cost?

It is usually free both to buy the PayRedeem eCard and to make deposits to a trading broker that accepts this payment method – though some charges may apply, particularly if you use a foreign currency to purchase the card.

Most of the time, the charges come at the withdrawal stage, where it is possible that PayRedeem brokers will charge a commission. This will be added to the charge for withdrawing your funds from a PayRedeem card to your bank account.