Best Brokers With PAMM Accounts In The UK 2026

Looking to grow your capital without trading a single chart? PAMM (Percentage Allocation Management Module) accounts offer a hands-free way to invest by letting seasoned traders manage your funds—while you sit back and track the results.

Following our hands-on tests, we reveal the best brokers offering PAMM accounts so that you can invest smarter with confidence.

Top PAMM Account Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000 -

Founded in 2006, FxPro has built a reputation as a reliable non-dealing desk (NDD) broker, providing trading access across more than 2,100 markets to over 2 million clients globally. It has received over 100 industry awards, reflecting its favourable conditions for active traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 2007, Axi is a forex and CFD broker operating under multiple regulations. Over the years, it has enhanced the trading experience by broadening its stock offerings, upgrading the Axi Academy, and launching a proprietary copy trading app.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

IronFX, established in 2010, is a highly regulated broker specialising in forex and CFDs. This acclaimed company provides access to over 500 markets for more than 1.5 million clients in 180 countries. Traders benefit from multiple account options with competitive rates via the MT4 platform, alongside 24/5 customer support available in 30 languages.

Instruments Regulator Platforms Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) CySEC, FCA, FSCA, BMA / Bermuda MT4, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) -

Founded in 2005, FXOpen is a well-regulated broker that has drawn over one million traders. Tailored for active trading, it offers a diverse range of over 700 markets. The platform facilitates high-frequency trading, scalping, and various algorithmic strategies through the use of expert advisors (EAs).

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs FCA, CySEC, FC TickTrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (EU, UK), 1:1000 (Global)

Safety Comparison

Compare how safe the Best Brokers With PAMM Accounts In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| Axi | ✔ | ✔ | ✘ | ✔ | |

| IronFX | ✔ | ✔ | ✘ | ✔ | |

| FXOpen | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With PAMM Accounts In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IronFX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXOpen | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With PAMM Accounts In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ | ||

| FXPro | iOS & Android | ✘ | ||

| Axi | iOS & Android | ✘ | ||

| IronFX | Android, iOS, WebTrader | ✘ | ||

| FXOpen | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With PAMM Accounts In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| Axi | ✔ | $0 | 0.01 Lots | ||

| IronFX | ✔ | $100 | 0.01 Lots | ||

| FXOpen | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers With PAMM Accounts In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| IronFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | ✔ | ✘ | ✘ | ✘ |

| FXOpen | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (EU, UK), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With PAMM Accounts In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| Vantage FX | |||||||||

| Tickmill | |||||||||

| FXPro | |||||||||

| Axi | |||||||||

| IronFX | |||||||||

| FXOpen |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- The broker recently expanded its range of CFDs, offering more trading opportunities.

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

- ECN accounts offer competitive terms, featuring spreads starting at 0.0 pips and a commission of $1.50 per trade side.

Cons

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

Cons

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

Cons

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Axi provides an excellent MT4 experience, enhanced by the NextGen plug-in for sophisticated order management and analytics, with low execution latency around 30ms.

- Experienced traders are invited to join the Axi Select funded trader programme via the broker's international branch. This scheme offers up to $1 million in capital with the benefit of a 90% profit share.

- Axi Academy offers a wealth of educational resources, from free eBooks and video tutorials to interactive quizzes. These are particularly beneficial for novice traders.

Cons

- Axi retains our confidence. However, recent issues with ASIC and FMA require it to maintain a secure environment and comply with licensing standards.

- Even with the expansion of stock CFDs in the US, UK, and EU markets, its range still falls short compared to companies like BlackBull, which provide thousands of equities for varied trading opportunities.

- Although Axi delivers excellent performance, its support is not available 24/7. This unavailability can be inconvenient for traders operating in different time zones or requiring help beyond regular trading hours.

Our Take On IronFX

"IronFX is ideal for seasoned forex traders seeking fixed or floating spreads. Offering over 80 currency options, it surpasses many competitors and provides excellent forex market research tools."

Pros

- In addition to MT4, the broker also provides various services such as copy trading, a VPS solution, and PAMM/MAM accounts.

- The broker regularly hosts trading competitions with cash rewards and provides welcome bonuses for new clients.

- IronFX offers both fixed and floating spread accounts, appealing to novices and seasoned traders alike.

Cons

- It is unfortunate that the broker lacks advanced software options like MT5 or TradingView, restricting choice for seasoned traders.

- Commissions in zero-spread accounts begin at £13.50 per lot, almost twice the industry standard.

- In comparison to top brokers, IronFX provides a limited range of share CFDs.

Our Take On FXOpen

"FXOpen is perfect for high-volume traders, providing swift execution via its ECN system, spreads starting at 0 pips, and reduced commissions as low as $1.50 per lot."

Pros

- FXOpen significantly cut FX spreads by over 40% in 2022. In 2023, they launched commission-free index trading. These changes make trading more economical for traders.

- In 2024, FXOpen simplified its account options. Traders now benefit from ECN accounts with raw spreads starting at 0.0 pips. The platform offers rapid execution and reduced commissions for those with high trading volumes, enhancing user experience.

- FXOpen integrated TradingView in 2022 and enhanced its TickTrader platform in 2024. This upgrade delivers Level 2 pricing, over 1,200 trading instruments, and sophisticated order options. The platform appeals to both seasoned and high-frequency traders.

Cons

- Though FXOpen remains a trusted broker with authorizations from the FCA and CySEC, it lost its ASIC license in 2024 due to 'serious concerns.' Consequently, it no longer accepts traders from Australia.

- Even with an expanded asset portfolio, FXOpen provides a more limited selection of global stocks, commodities, and cryptocurrencies compared to the leading firm BlackBull. This results in fewer diverse trading opportunities for traders.

- FXOpen's educational resources are quite limited, with a scarcity of courses and webinars commonly available at brokers such as IG. This deficiency may deter novice traders looking to enhance their understanding.

How Investing.co.uk Chose The Best PAMM Account Brokers

To find the top PAMM brokers, we carried out hands-on testing of each platform’s PAMM tools.

We assessed transparency, execution quality, and how easily investors could track performance in real time. Our team also reviewed asset range, from forex and indices to crypto and commodities, as well as cost structures including spreads and commissions.

We then ranked brokers by their overall ratings for a definitive list that takes into account their entire offering.

How To Pick A PAMM Broker

- Infrastructure and technology determine how smoothly and transparently your investments are managed. Brokers using trusted platforms like MT4 and MT5 benefit from proven, secure systems that automatically allocate profits and losses, thereby reducing errors and delays. Real-time performance reporting with verified trade histories enables you to monitor your investment’s progress accurately, helping you avoid misleading or manipulated data. A fair, automated allocation system ensures that returns are distributed precisely based on your share, which is crucial in fast-moving markets where manual calculations could lead to delays or discrepancies.

- Strategy choice and transparency are crucial because your returns depend entirely on the trader’s skill and strategy. Access to detailed, verified trading histories—including drawdowns, win-loss ratios, and equity curves—allows you to assess how consistently a manager performs and the level of risk they take. Being able to filter managers by strategy type, risk level, or investment duration helps you align your portfolio with your risk tolerance and goals. Without this transparency, you’re essentially investing blind, increasing the chance of unexpected losses or mismatched risk profiles.

- Fees and costs directly impact your net returns. Performance fees, typically ranging from 20% to 40%, mean the manager only earns when they generate profits. Still, other expenses—like management, withdrawal, or inactivity charges—can quietly eat into your gains over time. A fee structure based on a high-water mark ensures you only pay performance fees on new profits, not on recovered losses, protecting you from being charged repeatedly for the same gains. Knowing these details helps you avoid unexpected costs that reduce the effectiveness of your investment.

- Minimum deposit and investment flexibility determine how easily you can enter and exit PAMM accounts without being locked in. Some brokers require high minimum deposits, which might limit access for smaller investors. The ability to withdraw or reallocate funds quickly is crucial, especially in volatile markets where you may want to reduce exposure or switch managers. Watch out for penalties or lock-in periods that restrict your access to capital, as these can reduce your control and increase risk during market downturns.

- Risk management tools empower you to protect your investment by setting limits on potential losses, like maximum drawdown thresholds or auto-withdrawal triggers that automatically secure profits or cut losses. Without these controls, you rely entirely on the manager’s risk appetite, which might not align with yours. Additionally, the ability to diversify across multiple PAMM managers spreads risk, reducing the impact of any single trader’s poor performance and improving overall portfolio stability—an essential feature for managing volatility in forex markets.

- Platform usability and support make it easier to track your investments, understand performance metrics, and make informed decisions without confusion. Mobile apps and desktop dashboards offer flexibility, allowing you to monitor your PAMM accounts anytime, anywhere—essential in fast-moving markets. Responsive customer support, especially with PAMM-specific expertise, ensures you can quickly resolve issues or get guidance, reducing stress and protecting your investment from avoidable errors or delays.

- Regulation and licensing ensure that a PAMM broker operates under strict financial standards and oversight, which protects you from fraud, mismanagement, or misuse of funds. In the UK, FCA-regulated brokers must hold client funds in segregated accounts, meaning your money is kept separate from the broker’s operating capital and can’t be used to cover their debts. This structure reduces the risk of losing your investment if the broker becomes insolvent. Additionally, schemes like the Financial Services Compensation Scheme (FSCS) can reimburse up to £85,000 if the broker fails, offering an added layer of security that unregulated offshore brokers can’t match.

When I invest in a PAMM account, I’m handing control to an expert trader while still staying involved enough to know when to adjust or step away.For me, it’s all about finding the right balance between trust, oversight, and timing to unlock real growth.

What Is A PAMM Account?

A PAMM account is a type of investment system in which your funds are pooled with those of others and managed by a professional trader. Each investor owns a proportional share of the account, and profits or losses are distributed accordingly.

Unlike copy trading, PAMM accounts allow the manager to execute trades in bulk, improving efficiency and risk management. It’s a hands-off way to access financial markets, but performance depends entirely on the manager’s skill, making due diligence essential.

The PAMM trading system is primarily used in forex, but some brokers, such as FXOpen, also offer PAMM accounts for cryptocurrencies, including Bitcoin and Litecoin.

How Do PAMM Accounts Work?

Each investor decides how much to allocate (often there are minimum requirements), and the PAMM software calculates the investor’s share as a percentage of the total fund.

The manager places trades from the master account, and the results—whether profit or loss—are automatically distributed to each investor based on their percentage share.

What sets PAMM apart from simple copy trading is the structural design: all trades are executed centrally, not duplicated across individual accounts. This reduces execution lag, slippage, and potential pricing discrepancies, especially in volatile markets.

Investors don’t interact directly with the market—they rely entirely on the manager’s decisions, which makes trust and transparency paramount.

Managers are typically incentivised through performance-based fees, meaning they only earn a percentage of profits if they generate returns.

Many brokers offer detailed performance analytics, including drawdown history and trade frequency, allowing investors to assess risk before allocating funds.

However, PAMM systems don’t provide stop-loss control or trade approval to investors—making manager selection, fee awareness, and ongoing monitoring crucial components of responsible participation.

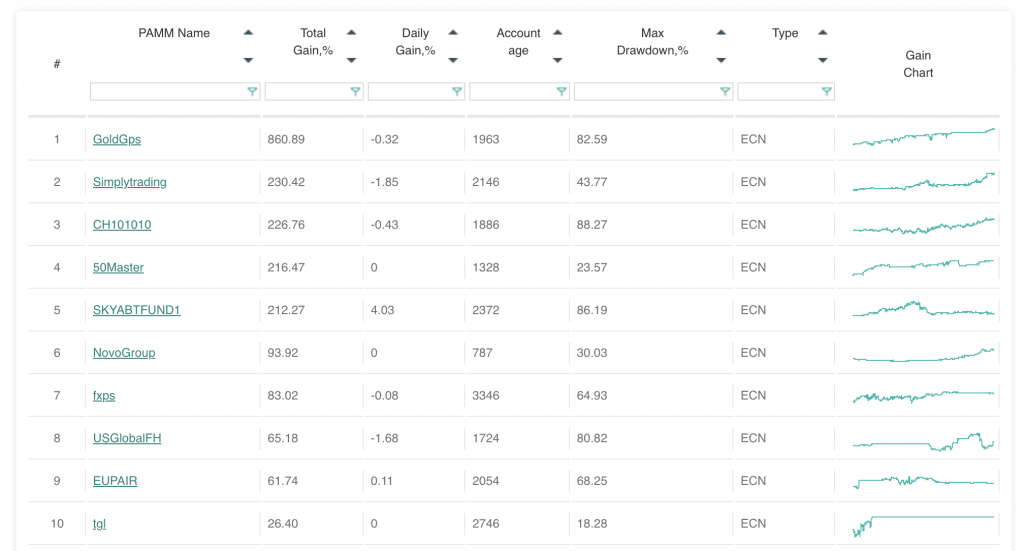

Top performing PAMM accounts at FXPrimus

Pros Of PAMM Accounts

- Professional management: PAMM accounts are managed by experienced traders who often use algorithmic strategies, risk-adjusted position sizing, and technical or fundamental analysis to identify high-probability trade setups. Investors benefit from this expertise without needing to understand chart patterns, leverage, or market timing. The manager’s capital is typically co-invested, creating alignment and reducing the likelihood of reckless trading behaviour.

- Performance-based incentives: Unlike fixed management fees, PAMM structures usually include a high-water mark or profit-sharing model—e.g., the manager earns a 20% fee only on new net profits above the previous peak. This incentivises consistent performance while protecting investors from being charged during losing periods. It also discourages excessive risk-taking, as the manager must recover any losses before earning fees again.

- Efficient trade execution: Instead of duplicating trades across multiple investor accounts (as with traditional copy trading), PAMM systems execute all trades from a single master account and dynamically allocate profits and losses. This centralised execution reduces slippage, maintains accurate order fills during volatile market conditions, and avoids the liquidity fragmentation that can occur when hundreds of accounts submit identical trades at once.

Cons Of PAMM Accounts

- No control over trades: Once you allocate funds to a PAMM account, you surrender all control over trade entries, exits, and risk exposure. Unlike copy trading on platforms like eToro, for example, where you can sometimes modify or close trades manually, PAMM accounts operate on a pooled structure—meaning you’re entirely dependent on the manager’s strategy and timing, even during high-risk market conditions or drawdowns.

- Manager risk & limited transparency: While past performance data is often available, PAMM systems don’t always reveal the manager’s complete strategy or risk profile. Some may use high-leverage, grid systems, or martingale approaches that appear profitable in the short term but carry hidden risks. Since you’re not privy to the trader’s decision-making or live strategy changes, poor risk management can result in significant losses.

- Performance fees, regardless of volatility: Although performance fees are typically aligned with returns, they are often calculated based on profitable periods and may not account for overall account volatility. For example, a manager might earn a fee after a good month, even if it followed a significant loss. Without a robust high-water mark or drawdown-based fee structure, you may pay for gains that recover prior losses, thereby reducing your net performance over time.

One thing I’ve realised about PAMM investing is that it’s not just about picking the highest returns—it’s about understanding the trader’s strategy and risk style.A great manager who matches your comfort level can make all the difference between steady growth and unexpected losses.

Bottom Line

PAMM accounts provide you with a hands-off way to participate in forex and other markets by letting experienced traders manage your funds.

However, selecting the right broker is crucial to ensure strong regulation, transparent performance tracking, and fair fee structures.

Choosing wisely can help you navigate the complexities of managed accounts and maximise your investment potential.

See our list of the best brokers with PAMM accounts to get started.