Brokers With LAMM Accounts

LAMM (Lot Allocation Management Module) brokers allow investors to allocate funds to professional traders who manage sub-accounts on their behalf. When choosing brokers with LAMM accounts, it is important to evaluate money managers’ track records, the fees and costs involved, and the level of control and risk.

This guide explains how LAMM accounts work, plus the pros and cons of this style of trading. Our team have also reviewed and listed the top UK brokers with LAMM accounts:

Best LAMM Brokers

-

RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

-

FXDD is an established forex and CFD broker founded in 2002. Regulated in Malta, Mauritius, Peru and Malaysia, the broker provides secure trading platforms, competitive ECN spreads and reliable 24/7 customer support. Competitive pricing and ultra-low latency is also offered via the broker's Direct Market Access execution model and tier 1 aggregated liquidity.

-

Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

-

IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

-

RoboMarkets is a Cyprus-based forex, CFD and stock broker aimed at traders from Europe. The broker offers thousands of instruments across six asset classes and provides access to four leading platforms, including MetaTrader 4. With ECN pricing, Cent accounts and algorithmic trading tools, RoboMarkets caters to a range of trading strategies and investing styles.

What Is A LAMM Account?

A LAMM account is a type of managed trading profile typically used in forex. LAMM brokers allow traders to allocate a number of lots to be invested, with returns dependent on the multiple of lots.

The basic premise is that each account owner will receive a standard lot when the professional trader purchases a standard lot. With that said, the client retains control over their account and can adjust the number of lots allocated. Importantly, the profits and losses for each sub-account are in proportion to the number of lots invested.

Brokers with LAMM accounts are often used by investors who wish to diversify their trading portfolio or to benefit from the expertise of professional traders. LAMM account holders typically have a large amount of trading capital.

How LAMM Accounts Work

To started with LAMM brokers:

- The investor opens a LAMM account with a supporting broker and selects the number of lots to invest.

- The investor identifies one or more professional traders to manage their sub-account. The trader can choose this based on their trading style, risk tolerance, and other factors.

- The investor and professional trader(s) agree on the strategy to be used. This includes trade types, trade frequency, risk management parameters, and maximum drawdown limits.

- The professional trader(s) execute trades that are reflected in the respective sub-accounts. The profits and losses generated by the sub-account are based on the actions taken in the manager’s main account.

- The client retains control over their trading account and can adjust the number of lots allocated. The trader can also add or remove professional traders as needed.

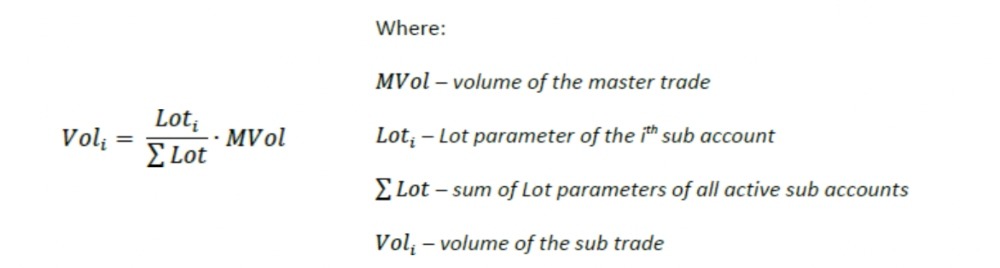

FxPro Lot Allocation Method

Pros Of Brokers With LAMM Accounts

- Diversification: By allocating funds to multiple accounts managed by different traders, LAMM brokers allow investors to diversify their portfolios with different leverages and reduce overall risk.

- Professional Management: Investors benefit from the expertise of professional traders who have a track record of success in a specific market, such as forex. This may result in higher returns than a trader might achieve alone.

- Transparency: Brokers with LAMM accounts provide high transparency, allowing investors to monitor the performance of trades executed by professional traders, often in real time.

- Lower Costs: LAMM accounts often have lower costs than traditional managed accounts, as traders typically pay a performance fee to money managers rather than a fixed management fee – this will either be a percentage or flat rate.

- Flexibility: Investors retain control over their LAMM account and can adjust the lot allocations and add or remove money managers at any time.

Cons Of Brokers With LAMM Accounts

- Control: While investors keep overall control of their LAMM account, they delegate some control to the professional traders managing the sub-accounts. Traders should carefully select and monitor the performance of each money manager.

- Risk: Like any investment, LAMM accounts involve risk. The performance of the sub-accounts can vary significantly based on market conditions, the skill of the professional traders, and other factors.

- Performance Fees: Professional traders managing LAMM sub-accounts typically charge a performance fee based on the profits generated in the sub-account. While this fee structure may be lower than traditional managed accounts, investors must still factor in these fees when evaluating the potential returns.

- Limited Customisation: While traders can allocate funds to different accounts with different strategies, they may have limited ability to customise the specific parameters. Investors often have to work with the approach agreed upon by the professional trader.

- Liquidity: Investors may not be able to withdraw funds immediately. Review the terms and conditions of LAMM brokers to understand restrictions on liquidity.

Comparing LAMM Brokers

There are several factors to compare when choosing brokers with LAMM Accounts:

Money Managers

Consider the qualifications and track record of the professional traders who will be managing the sub-accounts in the LAMM program. Look for traders who have a proven track record of success, a transparent trading history, and a strategy that aligns with your investment goals and risk tolerance.

Specific metrics to consider are average weekly returns, risk ratings, total number of investors, total capital invested, and the length of time the professional trader has been operating.

Minimum Investment

Check the minimum investment requirements for the LAMM program, as well as any other requirements or restrictions on opening and maintaining a LAMM account.

RoboForex, for example, has a minimum investment of £100 and requires traders to invest their funds in a LAMM account for at least one week.

Fees & Costs

Look for LAMM brokers that offer transparent and competitive costs, including any performance fees charged by the professional traders managing the sub-accounts. Also look for any hidden fees, such as deposit or withdrawal charges, that may impact your returns.

IC Markets, for instance, offers spreads from 0.0 pips with its managed trading profiles alongside deep liquidity and rapid order executions.

Regulation

Make sure LAMM brokers are regulated by a reputable body in the jurisdiction where they operate – in the UK the top brokers with LAMM accounts will be licensed by the FCA. This provides assurance that the brokerage is following best practices and operating in a transparent and fair manner.

For example, FxPro and IronFX both offer LAMM accounts and are FCA-regulated.

Customer Service

The best brokers with LAMM accounts offer responsive customer support, including access to contact channels like phone, email, and live chat. LAMM platforms should also have a comprehensive FAQ section and educational resources to help you learn more about LAMM accounts and how they work.

LAMM Vs MAM & PAMM

LAMM, PAMM, and MAM accounts are different types of managed investment solutions that allow investors to allocate their funds to profiles managed by professional traders or money managers.

LAMM accounts are the precursor to PAMM accounts. But while Lot Allocation Management Module accounts assign funds based on the number of lots, Percent Allocation Management Module accounts assign funds based on the client’s allocation percentage. The method of investing is similar across LAMM and PAMM – the trader connects their account to the manager’s who then trades with their own funds. The trades made by the manager will be automatically copied into the client’s account.

Multi-Account Manager (MAM) accounts can be thought of as a cross between PAMM and LAMM. They use the percentage allocation approach of PAMM while also giving money managers the flexibility to change the level of risk and distribute capital. For example, managers can make trades in fixed lots, whereby they can decide the lot size and leverage level for sub-investors based on their account balance and risk appetite.

Bottom Line On LAMM Brokers

Brokers with LAMM accounts offer several benefits, such as diversification, professional management, and flexibility, but they also have drawbacks, including potential losses and fees. Make sure you consider the performance of money managers before assigning lots, considering their average weekly or monthly returns, the number of other investors, and their risk level. Also check the minimum investment requirement and management fees.

To find a suitable provider, see our list of the best UK brokers with LAMM accounts.

FAQ

What Is The Difference Between LAMM And PAMM Accounts?

LAMM and PAMM accounts are both types of managed trading solutions that allow clients to allocate funds to professional traders who trade on behalf of sub-accounts. But while PAMM accounts allocate funds based on a percentage of the trader’s account equity, LAMM accounts allocate funds based on the number of lots. Money managers typically have more control over capital allocation with LAMM accounts.

What Is The Minimum Investment For A LAMM Account?

The minimum investment required varies between brokers with LAMM accounts, ranging from a few hundred pounds to thousands. RoboForex, however, has a relatively low starting investment of £100 with a minimum investment period of one week.

How Do I Choose The Best Professional Traders For My LAMM Account?

The top LAMM brokers rank traders across several metrics, including overall profitability, average returns over a set period, the total number of investors, the total amount of funds invested, plus the length of time the money manager has been active.

How Much Control Will I Have Over My LAMM Account?

As the investor, you can choose the number of lots allocated to the money manager. You can also add or remove professional traders at agreed intervals or in real time.