UK Brokers With Guaranteed Stop Loss Orders (GSLOs)

Brokers with guaranteed stop loss orders provide a beginner-friendly risk management tool. For a premium, investors can specify a price at which a trade will be closed, regardless of volatility and slippage. In this tutorial, we explain how a guaranteed stop loss works with a detailed example. We also look at their pros and cons, conditions, and list the top UK brokers with guaranteed stop loss orders in 2025.

UK Brokers With Guaranteed Stop Loss

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

Established in 2001, easyMarkets has made for a name for itself as a trusted, fixed spread broker. Improvements to its tools over the years, from adding the MetaTrader suite and TradingView to enhancing its exclusive risk management tools like dealCancellation, mark it out from the competition.

-

Established in 2008 and headquartered in Israel, Plus500 is a prominent brokerage that boasts over 25 million registered traders in over 50 countries. Specializing in CFD trading, the company offers an intuitive, proprietary platform and mobile app. It maintains competitive spreads and does not charge commissions or deposit or withdrawal fees. Plus500 also continues to shine as one of the most trusted brokers with licenses from reputable regulators, including the FCA, ASIC and CySEC.

-

Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

-

Markets.com is a respected broker, offering multi-asset trading opportunities through CFDs or spread betting (UK only). Established in 2008, the brand has an impressive 4.3 million registered customers and is overseen by trusted regulators, including the FCA, ASIC and CySEC. 79.1% of retail accounts lose money.

-

Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform, mobile app and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

-

OANDA is an award-winning global broker, established in 1996. The hugely respected brand offers competitive trading accounts and serves clients from 196 countries. It remains a popular option with both beginners and experienced traders thanks to its user-friendly and sophisticated web platform, no minimum deposit and premium currency products and services. The company is also overseen by reputable regulators, including the FCA, ASIC and CIRO.

-

BinaryCent is an unregulated binary options broker that offers 24/7 trading on forex, cryptos and stocks with payouts up to 95%. Despite its lack of regulation, this broker takes client security seriously and stores client funds in European banks. The broker also offers CFDs with very high leverage up to 1:500.

How A Guaranteed Stop Loss Works

A guaranteed stop loss order (GSLO) is a common risk management tool offered by leading trading brokers. Most platforms allow traders to set up a regular stop loss to limit losses if the market moves against them. However in highly volatile markets, prices can swing substantially, causing a discrepancy between the price the trade was requested and the price at which it is executed. This is known as slippage or gapping.

Fortunately, brokers with guaranteed stop loss orders offer a solution. For a fee, traders can specify a price at which a trade will be executed, regardless of any slippage. So GSLOs help traders limit risk exposure when trading in volatile markets, such as commodities, forex or cryptocurrencies.

Example

Let’s assume you want to go long on Barclays stock (BARC), which is currently valued at £165.00.

You buy 100 shares and intend to hold the position for several days. Your total position size is £16,500 (100 x £165).

However, from your research, you believe that market developments may lead to a period of significant volatility, which could result in slippage. With this in mind, you set a guaranteed stop loss order at £160.00 to limit your potential losses.

The GSLO fee is calculated as the premium rate x number of units, which in this case, is £2 x 100 = £200.

Following unexpected geopolitical events and a bleak economic outlook, the value of Barclays stock suddenly falls to £155.00.

Using a regular stop loss, the trade would be closed at the new price (£155), meaning a loss of £1000 (£16,500 – (100 x £155)).

However, with a guaranteed stop loss, the trade would have been closed at £160, meaning a loss of £300 (£16,500 – (100 x £160) – £200)).

Note, most brokers with guaranteed stop loss orders only charge a fee if the GSLO is actually triggered.

How To Set Up A Guaranteed Stop Loss

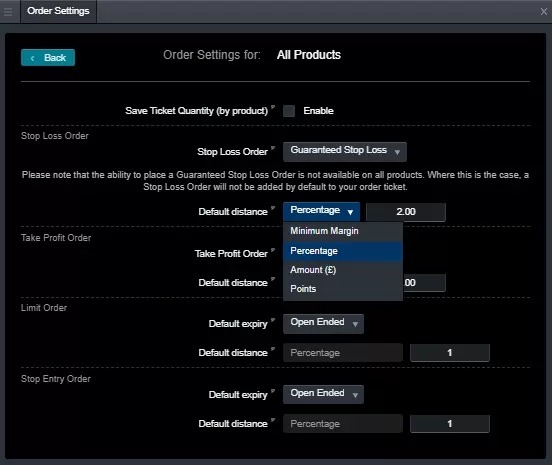

When setting up a regular stop loss on a trading platform, many brokers make it easy to upgrade it to a guaranteed stop loss. At CMC Markets, for example, in the order settings window, clients can choose the type of stop loss order from a drop-down list.

Traders can then set the distance/level of the guaranteed stop loss. This is normally displayed in pips/points or a percentage. There is also usually a minimum distance from the existing market price that the GSLO can be set.

Importantly, guaranteed stop losses can only be set during trading hours. With that said, you may be able to move the GSLO further away from the current market price outside of standard trading hours.

Setting Up A GSLO On CMC Markets

Setting Up Notes & Tips:

- Most brokers do not let you apply a GSLO to an existing/open position

- The GLSO premium is usually displayed on the order screen and is not charged unless it is triggered

- Make sure you have enough capital in your account to cover any increase in margin exposure if you modify your guaranteed stop loss

Advantages & Disadvantages Of Guaranteed Stop Losses

Pros

- Easy to understand and use

- Limits losses in volatile markets

- Protects against slippage and gapping

- Beginner-friendly risk management tool

- There is a long list of UK-regulated brokers with stop loss orders

- The GSLO premium is normally only charged if the stop loss is triggered

Cons

- Brokers usually charge a fee, known as the GSLO premium

- In many cases, regular stop losses will suffice, which are also cheaper

How To Choose Brokers With Guaranteed Stop Losses

Whilst guaranteed stop loss orders are a useful risk management tool, they are not the only option or consideration when choosing an online brokerage. Also look at the following:

Trading Platform

One of the most important factors is the platform(s) a broker offers. This is the interface investors use to navigate the markets, manage their trades, and control their accounts. Some of the most popular options are MetaTrader 4 (MT4) and MetaTrader 5 (MT5), though many brokers with guaranteed stop loss orders also offer a proprietary terminal.

A useful tip is to open a free demo account to test a broker’s platform before committing capital. You can also use a paper trading profile to explore a firm’s suite of risk management alerts and tools.

Fees & Charges

Brokers will have different GSLO premium rates. The fee can vary depending on the market, for example, forex vs commodities vs cryptocurrencies. It’s also worth comparing any spreads, commissions, hedge and overnight fees. In addition, there may be bank deposit and withdrawal charges to factor in. Finally, some brokers offer premium analysis tools and pattern recognition technology in return for a fee.

Consider the full list of trading and non-trading fees to find the best low-cost provider.

Education & Research

For beginners, in particular, it can be worth signing up with a brokerage that offers a good selection of educational materials. Some firms offer dedicated training academies for novice investors. Topics can include how to use risk management tools, such as guaranteed stop loss orders, plus insights into specific markets.

Social trading tools can also be an effective way to learn from seasoned investors.

Assets & Products

Brokers with guaranteed stop loss orders offer access to different markets and products. Do you want to speculate on the LSE or FTSE? Perhaps you want to take positions on foreign stocks listed on the NYSE or NASDAQ? Some firms also specialise in forex trading, offering a long list of currency pairs with the GBP.

Note, most UK-regulated brokers cap leverage to 1:30 on derivatives like CFDs.

Bottom Line On Brokers With Guaranteed Stop Loss

Brokers with guaranteed stop loss offer a user-friendly risk management tool that can protect traders from large losses in highly volatile markets. A GSLO essentially protects against slippage, ensuring a trade will always be executed at the pre-determined price. Some platforms charge when you open a guaranteed stop loss order, but many brokers only charge if the GSLO is triggered. Use our guide above to add a guaranteed stop loss to your next trade.

See our list of the best UK brokers with guaranteed stop loss orders to start trading.

FAQ

What Is A Guaranteed Stop Loss?

A guaranteed stop loss order (GSLO) is a straightforward risk management tool that instructs a broker to automatically close a position at a specified price. It is used to protect against high volatility and gapping, where the price fluctuates significantly without stopping at a level in between. Guaranteed stop loss orders can be used on a range of markets, from forex to stocks, oil, gold and silver.

What Is The Difference Between A Guaranteed Stop Loss And A Regular Stop Loss?

Regular stop losses will close a position at the price level you have specified most of the time. However, during periods of high volatility, slippage can occur whereby the price moves between the time you request a trade and when the trade is executed, which can lead to larger losses. This can be mitigated by using a guaranteed stop loss. This will guarantee that the trade will be executed at the pre-determined price, regardless of any slippage. The caveat is that brokers with guaranteed stop losses usually charge a fee, known as a premium.

What Are GSLO Premium Rates?

The premium rate will determine the fee you pay to exercise a guaranteed stop loss. Brokers with guaranteed stop losses charge different fees, however, many platforms use the following formula: (premium rate x number of units).

What Is The Best Broker With Guaranteed Stop Loss Orders?

There is no universally “best” broker. Each brokerage is different, offering its own risk management tools, market access, spreads and commission, plus trading platforms and investing apps. With that said, we have compiled a list of the top UK brokers with guaranteed stop losses.

When Should I Use A Guaranteed Stop Loss?

Using a guaranteed stop loss too frequently can lead to large fees and a regular stop loss can work effectively in many cases. With that in mind, brokers with guaranteed stop losses are best used during periods of high volatility when slippage and gapping could occur. One example of this could be when prices shift between market close and market open over the weekend.