Best Google Pay Brokers 2025

Google Pay is an established e-wallet and online payment system. It offers a convenient way to make payments from portable devices. This includes mobile apps, websites and physical stores. Our review will cover how to use the payment solution to make deposits to trading accounts. We also explain how Google Pay works, associated fees and we compare it to alternative e-wallets like Apple Pay. In addition, we list the best trading brokers that accept Google Pay deposits and withdrawals.

Google Pay Brokers

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

-

FXCM is a respected forex and CFD broker, established since 1999. The British-headquartered broker has won multiple awards and operates in various jurisdictions, including the UK and Australia. With zero commissions, over 400 assets, and a range of analysis tools, FXCM remains a popular choice for traders. The broker is also regulated by top-tier authorities including the FCA, ASIC, CySEC, FSCA, BaFin.

-

Founded in 2015, VT Markets maintains its position as a top Australian multi-asset CFD broker. With 1000+ tradeable instruments and support for the MetaTrader 4 and MetaTrader 5 platforms, this broker delivers a wide range of trading opportunities to over 200,000 clients worldwide. VT Markets is regulated by the ASIC, FSCA, and FSC.

-

OKX is a respected cryptocurrency firm, established in 2017, that offers a large suite of products, from mining pools to NFTs. Traders can access over 400 crypto tokens via OTC trading and derivatives. With an excellent web platform, developer tools and dynamic charts, OKX is a popular choice for technical traders.

-

Founded in 2010, ThinkMarkets is a reputable CFD and forex broker with regulation from several top-tier bodies including the FCA and ASIC. The broker provides services to over 450,000 accounts from 11 global offices. Traders can use a bespoke platform, MT4 or MT5 to access a wide variety of assets including 3500+ stocks and ETFs, 46 forex pairs and over 20 cryptocurrencies.

-

Revolut has emerged as the most downloaded financial app in 11 countries with over 45 million users and more than $23 billion held in customer balances. It facilitates commission-free trading on over 2000 stocks and commodities, alongside 185 cryptos with a minimum investment of just $1. The mobile trading experience remains market-leading for casual investors seeking low, transparent fees.

-

Nexo is a centralized crypto exchange founded in 2018 in Bulgaria and today operates across some 200 jurisdictions from its base in Switzerland. It provides services including spot trading, futures trading, peer-to-peer loans, cold wallet storage and fiat-on ramps to buy crypto tokens. The crypto firm is registered with some respected financial authorities, such as the ASIC, and offers some fairly unique additional services including a credit card.

-

Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

-

Kucoin is a crypto exchange that offers trading on 1000+ tokens as well as leveraged trading opportunities via futures and perpetual swaps. This exchange has a slick trading platform that supports robots, allowing traders to implement automated strategies. Other attractive features include a demo account, flexible funding methods and DeFi features like staking and mining.

-

Launched in 2012 as a platform enabling users to buy and sell Bitcoin via bank transfers, Coinbase has emerged as a crypto behemoth, expanding its services to include 240+ crypto assets, developing sophisticated trading platforms for retail investors, listing on the US Nasdaq, and securing licenses with multiple regulators.

-

World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

-

Binance is one of the best-known crypto exchanges. The company is available in more than 180 countries with over 120 million registered customers. The platform offers a suite of crypto trading products, from staking and NFTs to derivatives.

-

Trading 212 is a European and UK-regulated CFD broker that also offers stock investing and ISAs. It’s best known for its commission-free trading model and beginner-friendly app, which has helped it attract 2.5 million users and £3.5 billion in client assets.

What is Google Pay?

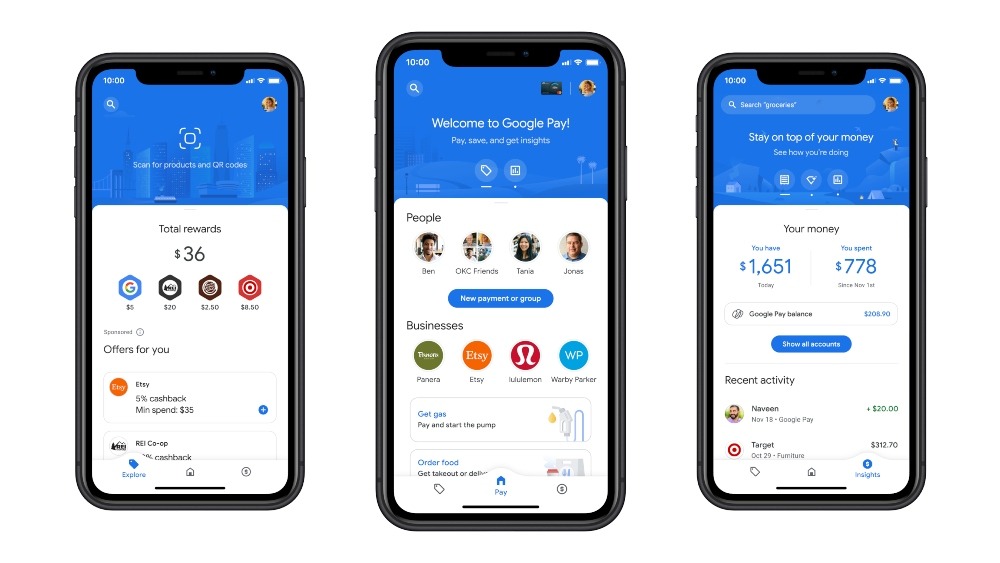

Google Pay is a digital wallet launched in 2011. Users can pay for products and services directly from phones, tablets and smart watches. The technology also facilitates deposits to trading accounts with the click of a button. Importantly, personal payment information is protected with multiple layers of security and a virtual account number.

Originally launched in the UK as Android Pay, the company promptly received support from leading banks, including Halifax, HSBC and Lloyds Bank. The digital wallet is now recognised in more than 40 countries. With that said, the payment app is not the largest digital wallet solution, Apple Pay leads the way with an estimated 227 million users vs Google Pay’s 100 million customers.

How Does Google Pay Work?

Customers can use the solution for online payments, contactless purchases, in-app transactions and more. There is also the option to share money between friends and family, similar to PayPal.

UK clients essentially purchase products and services through a compatible portable device using near-field communication (NFC) chips. This process involves EMV tokenisation. All personal details including credit/debit card numbers are replaced with a dynamic security code generated for each transaction.

Devices are effectively given a virtual card number, in line with the process followed by similar e-wallet solutions, such as Samsung Pay and Apple Pay. In fact, Samsung Pay uses both NFC and Magnetic Secure Transmission (MST) technology, ensuring it works with nearly all popular payment terminals.

Importantly, it is quick and easy to link payment cards to your Google Pay account. You can find YouTube videos with details on how to update/remove a card, the app download process (where the sign-up process is explained in full), how to view a receipt, typical refund times, and more.

Fees

Debit card transactions via Google Pay typically incur a 1.5% fee. There is no charge to transfer funds from your bank account to your Google Pay balance. Trading brokers may apply their own charge for deposits and withdrawals, though Google Pay transfers are free at many top brands. The app is also free to download from the relevant app store.

Since 2020, credit card payments are no longer supported via the application. Instead, you can use credit card services to make contactless payments in merchant stores. However, this is limited to Android users only and subject to charges from your credit card provider (often up to 4% of the transaction value).

Fortunately, UK traders will be pleased to see high maximum transaction limits of £25,000. With that said, brokers may have their own thresholds. This is also much higher than requirements for US investors who are subject to a maximum limit per transaction of $5,000 with a maximum withdrawal amount over a seven-day period of $20,000. This is lower vs PayPal, which has a transfer limit of $10,000 per transaction.

Speed

Google Pay is a relatively fast payment method making it ideal for funding trading accounts. Still, processing times may vary based on the form of payment used. Brokers also have their own timelines.

Typical processing times:

Sending Money

- With A Bank Account – Payments take three to five working days

- With Google Pay Balance – Transactions are typically processed within a few minutes

- With A Linked Debit Card – Transactions are typically processed within a few minutes, though can take up to 24 hours

Receiving Money

The time it takes to receive money, perhaps a profit withdrawal from your brokerage account, will depend on the payment method used by the sender. Typically, payments are processed instantly back to your Google account unless the sender is paying via a bank account. These transactions can take up to five working days to settle.

Alternative e-payment solution, Venmo, guarantees withdrawals to a bank account will be processed within one working day. Instead, a 1% fee (maximum £10) can be paid for an instant transfer.

Note, to remove funds from your Google Pay account to a debit card or bank account, allow a further one to three days.

Security

Google Pay is a secure payment solution. The app is independently verified by the Open Web Application Security Project (OWASP) and follows their Mobile Application Security Verification Standard (MASVS). This is industry prevailing criteria for all developers to adhere to.

Data is transferred over a secure connection with full encryption. Successful payments rely on near-field communication to transmit transaction information. Also, when you pay with your Google Pay account, the digital wallet does not actually share or transmit card numbers. And as WiFi is not required, it reduces the likelihood of interception from hackers.

To use Google Pay, your mobile phone needs to be unlocked using biometrics. Whether you own an iPhone or an Android, permitted verification includes fingerprint, 4 or 6-digit pin passcodes or facial identification. Lock screen payment limits can also be set for iPhone and Android devices.

Remember, no online payment gateway is completely safe. Be aware of potential scams or phishing emails requesting payments.

Customer Service

Google Pay has comprehensive support services for UK customers. This includes an email address, phone number and live chat. Customer care phone numbers and live chat contact channels are available 24/7. Simply login to your Google account to quickly access all helpline methods.

In addition, there are plenty of self-help FAQs available on the official website. Topics include how to access transaction history, how to delete a card, understanding error number messages, activating a balance transfer and viewing personal usage statistics.

How to Make a Deposit & Withdrawal Using Google Pay

To make a transfer, first check that your broker supports Google Pay. Visit the broker’s deposit and withdrawal section and look out for the payment logo. Contact the customer service team if details cannot be found. The payment solution is integrated via APIs so requirements can be incorporated within your broker’s platform.

To make a deposit, follow these steps:

- Download Google Pay from the relevant app store. It is compatible with iOS and Android (APK) devices, including Samsung Galaxy watches

- Link a debit card. Accepted brands and UK banks include Barclays, Monzo, Lloyds, Halifax, AMEX, Revolut and NatWest. This will be the payment card interlinked with your Google account

- Login to your trading account and locate the Google Pay icon on the deposit / withdrawal web page

- Enter the deposit amount and complete the required verification details. Remember, brokers may have their own minimum deposit requirement

- Processing times may vary but contact the broker if any significant delays occur or issues arise

Note, make sure the broker accepts payments in GBP to save exchange rate fees.

Pros of Google Pay

- Available On Many Devices – Google Pay can be integrated into several portable devices including iPhones, Androids, Huawei devices and even Samsung watches.

- Inexpensive – In addition to being free to download, the app is cheap to use and many international brokers support the solution at no charge. With that said, be cautious of charges to debit your account balance. Receipts can also be quickly downloaded free of charge.

- Convenient – As well as being a one-stop payment solution, Google Pay can conveniently store loyalty cards, gift cards, rewards points, boarding passes, and more.

- Secure – Google uses encryption and several layers of authentication to protect transactions. All personal payment details are replaced using tokenisation meaning your card number is never shared

Cons of Google Pay

- Processing Times – Transfers back to a Google account can take up to five working days to settle. This is slower vs Samsung Pay and Apple Pay, which offer instant processing.

- Reliance On Technology – App performance issues or update requirements can outweigh the benefits of the convenient payment solution. There may be times that the Google Pay app is down, a compatible card is not working or a payment is declined.

- Limited Number Of Brokers Accept Google Pay – The number of brokers accepting Google Pay is still limited versus traditional payment methods. Nevertheless, demand for e-wallet solutions continues to rise so there will likely be more accepted providers in the future.

Supported Banks & Cards

Google Pay works with credit and debit cards from several UK financial institutions, including MasterCard, Visa and AMEX. Note, that Barclaycard is not compatible with the e-wallet. The UK bank opted to provide proprietary facilities to their customers via their own application.

UK banks that support Google Pay include the Bank of Scotland, First Direct, Halifax, HSBC, Lloyds Bank, MBNA, Nationwide Building Society, NatWest, and Revolut.

Google Pay Verdict

Google Pay is a secure, cheap and convenient payment solution. Pairing top-tier safety standards with various compatible payment methods is a great addition to the e-wallet landscape. Nevertheless, for UK investors, it isn’t the most readily available deposit solution given the limited number of supporting brokers. Fortunately, we expect this to change in the future.

See our list of Google Pay brokers to start trading today.

FAQ

How Long Do Google Pay Transactions Take To Reach My Trading Account?

Google Pay is a relatively fast payment method. However, processing times vary based on the form of payment used. Brokers may also have their own timelines. Bank wire transfer payments, for example, can take up to five working days.

What UK Banks Support Google Pay?

UK banks that support Google Pay include the Bank of Scotland, First Direct, Halifax, HSBC, Lloyds Bank, M&S Bank, MBNA, Nationwide Building Society, NatWest, and Revolut, amongst others.

Is Google Pay Safe?

Google Pay is a secure payment method. The service integrates multiple layers of security including tokenisation of personal payment details, transaction encryption and biometric unlocking requirements.

Is Google Pay Free?

Google Pay is a free application. With that said, there may be charges to fund trading accounts. Check your broker’s payment terms and conditions before making a deposit. Note, some trading platforms also offer free demo accounts for new investors.

My Google Pay Won’t Work, How Can I Fix It?

The most common reason for the app to not work is a failure to install the latest version. Visit the app store and make sure you are running the most up-to-date software. Alternatively, reach out to the customer service team for diagnostic support.