Funded Trading Accounts

Funded trading accounts provide retail investors with sponsorship from a brokerage or prop trading firm, providing talented traders with increased buying power and lower risks so they can earn themselves and their sponsors profits.

If you are looking for information on how to get funding to trade stocks, forex, cryptos and other assets, then our guide has you covered; find out if becoming a funded trader is the route for you.

Top Brokers With Funded Trading Accounts

-

Established in 2007, Axi is a multi-regulated forex and CFD broker that has made strides to improve its trading experience over the years, from expanding its suite of stocks and upgrading the Axi Academy to launching its own copy trading app.

Alternatives to Funded Trading Accounts

Becoming a funded trader is very difficult – only the best traders are accepted. However, there are alternative ways to boost your trading funds:

- Brokers with bonuses offer ‘free’ trading credit when you open an account and make a deposit. Trading bonuses can reach £10,000+.

- Brokers with trading tournaments award cash prizes to winning traders. Prize pools can climb to £100,000+.

- Brokers with high leverage, beyond FCA limits, will amplify your buying power and trading results in return for fewer safeguards. Leverage can hit 1:3000.

- Brokers with copy trading allow you to earn additional revenue by attracting investors who copy your trades. You can often charge a commission per winning trade.

Independent Funded Trading Firms

Funded Trading Accounts Explained

The simple definition of a funded trading account is an arrangement between a trader and a company or third party which supplies the capital to an account that the trader will use to speculate on financial markets.

In exchange for access to these funds, a portion of the profits from the account will be kept by the account’s sponsor, while the trader will receive their own share as well as protection from putting their own funds at risk.

Companies and brokerages that fund traders often require a prospective investor to pass a trading test, often known as a challenge or evaluation. This allows brokers with funded trading accounts to select talented traders with a good track record and who are more likely to turn a profit.

The trader will also have to comply with conditions that the broker and company impose on the funded trading account.

Funded Trading Accounts at FTMO

Some funded trading accounts allow investors to trade most asset classes including forex, cryptos, stocks, futures, commodities and other financial instruments, but many will specialise in one or two specific asset classes.

Additionally, local regulations may also restrict which assets are available to trade in funded accounts, for example, in the UK where cryptocurrency derivatives are banned by the Financial Conduct Authority (FCA).

How Funded Trading Accounts Work

There are several key factors that UK investors should consider when trying to become a funded trader:

Joining Criteria & Verification

It would not make financial sense for a company to sponsor all retail traders who apply for a funded trading account. The entire point of a funded trading account is to select traders with the potential to provide large returns and minimise the risk to investors’ funds. The best way to do this is to make traders pass a test before they get access to funded trading accounts.

Different firms and brokers with funded trading accounts have their own names for this test, but many know them as funded trader programme assessments. The company will usually set specific targets for the trader. Examples include turning a 5% or 10% profit within a given timeframe, such as 30 days.

Limits are also likely to be placed on the amount a funded trader can lose, both in overall drawdown and in a single day of trading. If the trader meets the firm’s criteria, they will be eligible to open a funded account and to keep an agreed share of the proceeds.

Outside of the trading assessment, there may be other rules or criteria that traders have to adhere to, such as a requirement to verify their funded trading account with know-your-customer (KYC) documentation.

Costs

Before the trader signs up, they will need to complete the testing process, and this usually incurs an evaluation fee, ranging from a couple of hundred pounds to thousands.

Some brokerages with funded trading accounts also charge a different fee depending on the amount of capital a trader is applying to manage. A trustworthy broker will provide transparent information on all fees, meaning this information should be easy to find out before you sign up.

Many brokers also charge a subscription fee for funded trading accounts, with some also allowing traders a choice between a lower subscription fee or a higher share of the profits. The level of the subscription fee usually correlates with the amount of capital being provided to the trader.

Also, watch out for brokers that offer to teach beginners how to trade in preparation for applying for a funded trading account. These firms may promise untold wealth to traders who learn their system, but they often charge very high fees for the training programme, and in the end, there’s no guarantee you will recoup that money even if you do qualify for a funded trading account.

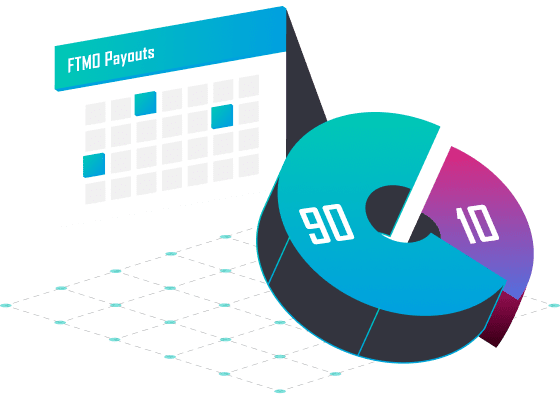

Profit Split

Firms stand to gain from funding retail traders with large amounts of capital because they profit from their trades. The proportion of profit that each side of a funded trading account takes may vary depending on the size of capital being risked and the asset class. Most brokers with funded trading accounts will provide different programmes and options with varying payouts.

The level of capital being used by the trader may also influence what proportion of each trade the broker is demanding.

Importantly, the best brokers with funded trading accounts offer payout splits in favour of the trader, for example, 70/30 or 80/20.

Pros & Cons Of Funded Trading Accounts

Advantages

- Low Risk – Using funded trading accounts means that traders don’t risk their own capital and therefore the only direct financial risk to the trader comes from any fees associated with the account.

- Trading Flexibility – Unless stipulated by the company that is offering funded trading accounts, investors have the flexibility to choose whether they day trade, swing trade, or long-term invest.

- Trading Capital – The most obvious plus to this type of account is the access to greater financial resources than retail traders could provide themselves. This in turn provides more key profit opportunity.

- Experience – Funded trading accounts mean you can have the experience of being a full-time professional trader but without the need for earning professional certificates or licenses.

- Empowerment – Investors usually only select skilled traders to fund. Any retail trader who has been trusted with the funds of a company should feel empowered.

Disadvantages

- Restrictions – Some brokers or companies may impose restrictions on how much can be traded, which assets can be traded and which markets can be entered. This lack of freedom might frustrate some investors.

- Fees – Access to significant amounts of capital may incur high fees which trading firms impose to cover the risk of lending the money to traders. This can be via direct means such as subscription fees or indirectly through low trader take-home margins.

- Hard To Attain – Brokers which offer funded trading accounts require applicants to pass a trading test before they hand over funds. The tests are designed to challenge pro traders so that the brokers are only entering an agreement with the best of the best, which in turn should reduce their risk of losses. Therefore, it is difficult to find brokers with funded trading accounts for beginners.

How To Compare Funded Trading Accounts

When looking for the best funded trading account a list of key factors need to be considered. Companies with funded trading accounts may include additional features such as educational resources, help centers and varying levels of customer service. The section below looks at the key common components that need to be considered when making a comparison.

Starting Capital

Firms with funded trading accounts will provide different levels of financial resources. Typically, the amount of direct equity offered will be based on the company’s risk appetite, fees/payout levels, profit targets and regulation.

Some companies also allow traders to quickly apply for different levels of funding during the evaluation phase. FTMO, for example, offers initial capital of between $10,000 and $200,000 to traders who complete their challenge and verification process, with the trader specifying how much they wish to apply for when they sign up.

Profit Targets

Firms with funded trading accounts can dictate how much money the trader must make to reach the profit target. Profit targets are almost always used as part of the evaluation process, but fully verified traders may also be able to upscale the amount of funding their account receives by meeting profit goals. A target of 10% is standard in both cases.

Here, prospective investors need to compare the profit targets of different programmes and assess whether or not they are attainable. The more aggressive and high-risk programmes often have higher profit targets which can be difficult to achieve.

The 5%ers Assessment Criteria

Leverage/Stop-outs

Some brokers offer leveraged trading, greatly increasing a trader’s buying power and thus their potential to make a profit. Using leverage to increase positions can reap significant rewards but can also put funded traders at risk of higher losses.

Because of this, companies often impose stop-outs or stop-losses to ensure that traders who are funded by the broker do not risk more capital than they can afford.

Payout Splits

One of the most important factors that must be considered when comparing funded trading accounts is the level of earnings the trader will see. These payout rates can be influenced by the amount of capital being provided to the trader, the number of other fees applicable, and other drivers.

There is a great amount of variety among different companies’ pricing structures, so it is not easy to name an average payout split. Some companies offer traders 100% of a certain portion of their proceeds – say the first £5,000 after they begin trading – and a high share such as 90% thereafter. Others limit the trader’s share to a 50/50 split.

Keep in mind that companies with funded trading accounts which offer a generous split may compensate by charging higher subscription fees.

Markets

Different funded trading accounts offer access to different markets, with some specialising in stocks, indices or commodities, while others focus on forex and cryptocurrencies.

One of the most popular funded trading firms, FTMO, offers traders access to a wide range of asset classes, including forex, commodities, indices, cryptocurrencies, stocks and bonds. However, Topstep Trading, another market leader, only trades Chicago Mercantile Exchange futures.

Platforms

Many leading capital firms with funded trading accounts will offer account holders a choice of trading platforms, though some will operate solely using a proprietary platform. Industry-standard platforms such as MetaTrader’s MT4 or MT5 are common.

Most traders will have a preferred live chart to use where they have a good understanding of the key indicators and functionality of the platform. Some leading brokers will also provide a demo account that traders can use to familiarise themselves with the platform.

Make sure the funded trading account’s platform is available to download for Windows, Mac or whichever system you use, and check whether the platform has a mobile app if this is part of your trading routine.

Sign-Up Requirements

Firms with funded trading accounts will need some personal information from the trader in addition to the profit target assessment needed to qualify as a funded trader.

Most brokerages will need traders to validate their identity before they log in online and start trading. This is typically done with a passport or national ID, as well as by providing personal information such as email, address, mobile number, etc.

How To Become A Funded Trader

To start your journey as a funded trader, users need to look for a funded trader programme assessment, event or challenge being offered by a broker. This is a key opportunity to demonstrate your worth.

Most assessments will involve 20 or 30 live trading sessions either direct with the broker or set up by a third party. The amount of equity and profit earned over each day will be assessed against a profit target which will be the key determinant of whether a trader can start to make money as a funded trader or not.

Bottom Line

Funded trading accounts offer traders a great way to access significantly more capital than using their personal finances. However, it is not easy to qualify as a funded trader, as companies will only provide cash to traders with the ability to make a profit. These traders are tested rigorously through multiple profit targets and assessments. Although it is challenging to pass these tests, successful funded traders can reap a wide range of benefits and amass decent earnings.

To get started, use our ranking of the best UK brokers with funded trading accounts.

FAQ

What Is A Funded Trading Account?

Brokerages offer to fund the accounts of traders if they believe a trader has the ability to consistently turn a profit. Traders who prove themselves will receive capital from the firm, sometimes up to £250,000, and will split any profits from their trades, for example, 80/20.

What Does It Mean To Be A Funded Trader?

A funded trader is essentially someone who gains the sponsorship of a capital firm to trade in the financial markets. Typically, a funded trader is very experienced in executing trades and generating earnings from popular markets, such as stocks, forex, futures, and commodities.

What Are The Best Forex Funded Accounts?

There are many good forex funded accounts, including FTMO, Earn2Trade, Fidelcrest and The 5%ers. Make sure you read reviews and compare each provider’s profit splits, account fees, and market access before signing up.

Are Funded Trading Accounts Worth It?

Funded trading accounts offer investors the chance to trade with a higher level of financial resources than possible with their own capital, and without significant financial risk. The funding company or brokerage carries the risk as it is their capital being traded. However, websites often charge monthly subscriptions or other fees, and protect themselves from large losses by setting criteria limiting the amount of drawdown a funded account can take before it is shut down.

How Much Do Funded Traders Make?

The returns a funded trader can make are based on their trading ability, the payout split between the trader and company and any other fees applicable. Traders can calculate their expected margin by researching all the fees a capital firm charges funded account holders. It is also worth noting that not all funded traders make money – some lose capital and come away with nothing.