Best Brokers With Fixed Spreads In The UK 2026

Looking for price certainty in fast-moving markets? Fixed-spread brokers offer consistent trading costs, making them ideal for traders who need to plan.

We’ve ranked the top UK brokers offering fixed spreads after documenting and evaluating their fixed spread offerings.

Top UK Brokers For Fixed Spreads

-

Testing the TN Trader platform showed EUR/USD fixed spreads consistently at 0.6 pips with no commission, offering more predictability than variable spreads. Execution proved swift, transparency impressive, and spreads remained stable, except for a daily 1-hour rollover widening to about 1.4 pips. Perfect for traders handling volatility.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Our review of Iron FX’s Fixed Spread accounts showed EUR/USD at 2.2 pips on the Micro/Standard tier (starting at $100), narrowing to 1.8 pips (Premium) and 1.6 pips (VIP), with no commissions. The fixed-zero option provided 0 pips, incurring a $18/lot commission. While predictable, it is costly, mainly suiting volatility hedging.

Instruments Regulator Platforms Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) CySEC, FCA, FSCA, BMA / Bermuda MT4, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) -

During our tests, FxPro provided fixed spreads solely through its MT4 Fixed account. The EUR/USD was set at 1.6 pips with no commission, appearing less appealing to high-volume traders. Yet, this fixed pricing proved advantageous during news events, delivering transparency and predictability as variable spread accounts expanded significantly.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

CMC Markets provides fixed spreads on key currency pairs, such as 1.0 pip for EUR/USD, 1.2 pips for GBP/USD, and 1.1 pips for USD/JPY, without any commissions. This ensures predictability and transparency. Such arrangements benefit traders focusing on tight spreads and clear pricing.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

In our tests, City Index provided fixed spreads on certain indices, like 0.4 points on the US S&P 500 and 1 point on the UK 100, from 8:00 AM to 4:30 PM (UK time), with no commission. For forex, spreads are variable, with EUR/USD spreads usually about 0.8 pips. Execution speed was reliably swift, averaging below one second, enhancing fixed spread trading.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting FCA, ASIC, CySEC, MAS Web Trader, MT4, TradingView, TradingCentral Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

In our recent tests, InstaForex's Insta Standard account featured fixed spreads across all instruments, such as forex, shares, indices, commodities, futures, and crypto, with spreads beginning at 2 pips. This setup delivered clear and predictable costs, advantageous for traders wanting stable expenses. Execution speeds were typically swift, and the platform was straightforward to use.

Instruments Regulator Platforms Currencies, Cryptocurrencies, Stocks, Indices, Metals, Oil and Gas, Commodity Futures and InstaFutures BVI FSC MT4, MT5 Min. Deposit Min. Trade Leverage $1 0.10 of the lot (0.0001 of market lot for Cent.Standard and Cent.Eurica) 1:30 for retail clients, 1:500 for professional -

Pepperstone provides fixed spreads on certain index CFDs, such as AUS200 and US30, with an average range of 1 to 2.4 points. Ideal for trading indices, it ensures low, transparent fees. This is particularly appealing to traders seeking a well-regulated broker with reliable execution, suitable for short-term tactics.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro)

Safety Comparison

Compare how safe the Best Brokers With Fixed Spreads In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| IronFX | ✔ | ✔ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ | |

| City Index | ✔ | ✔ | ✔ | ✔ | |

| InstaForex | ✘ | ✔ | ✘ | ✔ | |

| Pepperstone | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With Fixed Spreads In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| IronFX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| City Index | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| InstaForex | ✘ | ✘ | ✘ | ✔ | ✔ | ✘ |

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Mobile Trading Comparison

How good are the Best Brokers With Fixed Spreads In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Trade Nation | iOS & Android | ✘ | ||

| IronFX | Android, iOS, WebTrader | ✘ | ||

| FXPro | iOS & Android | ✘ | ||

| CMC Markets | iOS & Android | ✘ | ||

| City Index | iOS & Android | ✘ | ||

| InstaForex | iOS and Android + browser based platform | ✘ | ||

| Pepperstone | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With Fixed Spreads In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| IronFX | ✔ | $100 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| CMC Markets | ✔ | $0 | 0.01 Lots | ||

| City Index | ✔ | $0 | 0.01 Lots | ||

| InstaForex | ✔ | $1 | 0.10 of the lot (0.0001 of market lot for Cent.Standard and Cent.Eurica) | ||

| Pepperstone | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers With Fixed Spreads In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| IronFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | ✔ | ✘ | ✘ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

| City Index | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 | ✘ | ✔ | ✔ | ✔ |

| InstaForex | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 for retail clients, 1:500 for professional | ✔ | ✘ | ✘ | ✘ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With Fixed Spreads In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Trade Nation | |||||||||

| IronFX | |||||||||

| FXPro | |||||||||

| CMC Markets | |||||||||

| City Index | |||||||||

| InstaForex | |||||||||

| Pepperstone |

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Beginners benefit from a modest initial deposit.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On IronFX

"IronFX is ideal for seasoned forex traders seeking fixed or floating spreads. Offering over 80 currency options, it surpasses many competitors and provides excellent forex market research tools."

Pros

- Traders gain access to the renowned Trading Central research tool, featuring automated AI analytics and round-the-clock support.

- The IronFX Academy provides outstanding educational resources for traders of all levels, from beginners to advanced.

- In addition to MT4, the broker also provides various services such as copy trading, a VPS solution, and PAMM/MAM accounts.

Cons

- Commissions in zero-spread accounts begin at £13.50 per lot, almost twice the industry standard.

- It is unfortunate that the broker lacks advanced software options like MT5 or TradingView, restricting choice for seasoned traders.

- In comparison to top brokers, IronFX provides a limited range of share CFDs.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

Cons

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- The CMC web platform offers an exceptional user experience with sophisticated charting tools for trading and customisable options, suitable for both novice and seasoned traders. It supports MT4 but not MT5, and TradingView will be available from 2025.

- The brokerage excels with an extensive array of valuable resources, such as pattern recognition scanners, webinars, tutorials, news feeds, and research from reputable sources like Morningstar.

- We've upgraded the 'Assets & Markets' rating due to frequent product enhancements in early 2025. These include extended trading hours for US stocks and the introduction of new share CFDs.

Cons

- The CMC Markets app provides a comprehensive trading package; however, its design and user experience lag behind market leaders such as eToro.

- Although there have been improvements, the online platform still needs further refinement to match the user-friendly trading experience offered by competitors such as IG.

- A monthly inactivity charge of $10 is imposed after a year's inactivity, potentially discouraging occasional traders.

Our Take On City Index

"City Index suits active traders perfectly, offering rapid execution speeds averaging 20ms and a customisable web platform with over 90 technical indicators. Its educational resources are exceptional. For UK traders interested in spread betting on 8,500+ instruments tax-free, City Index is an excellent option."

Pros

- City Index offers adaptable trading platforms suited to every expertise level. For newcomers, the Web Trader platform is straightforward and user-friendly. For more in-depth analysis and automated features, MetaTrader 4 (MT4) and TradingView are supported, providing a comprehensive trading experience for all traders.

- City Index offers access to over 13,500 markets, including forex, indices, shares, commodities, bonds, ETFs, and interest rates. The platform's inclusion of niche markets such as interest rates provides traders with unique opportunities not commonly available on other platforms.

- City Index is under the regulation of leading authorities, such as the FCA in the UK, ASIC in Australia, and MAS in Singapore. Its parent company, StoneX Group Inc., is publicly listed, which enhances its credibility.

Cons

- Although many brokers, such as eToro, have broadened their crypto offerings, City Index restricts its clients to crypto CFDs. This limited selection may not meet the needs of traders seeking a wider variety of altcoins.

- City Index does not offer an Islamic account with swap-free conditions, making it less attractive to Muslim traders than brokers such as Eightcap and Pepperstone.

- Unlike brokers like AvaTrade and BlackBull, City Index lacks options for passive trading, such as social copy trading or real ownership of stocks and ETFs. This limitation may reduce its appeal to traders seeking a more hands-off approach.

Our Take On InstaForex

"InstaForex remains a leading forex broker, offering more currency options than most competitors. Tight spreads and low minimum deposits ensure accessibility for traders of all levels, particularly those accustomed to the MT4 and MT5 platforms."

Pros

- The broker is beginner-friendly, offering low minimum deposits and commission-free trading.

- InstaForex provides an excellent trading environment, utilising the robust MT4 and MT5 platforms. These platforms come equipped with numerous technical analysis tools, automation features, and various order types.

- The broker is an excellent choice for dedicated forex traders, offering over 100 currency pairs and competitive spreads starting at 0.0 pips. Additionally, it provides a top-tier collection of forex market resources.

Cons

- The broker's website and client portal seem outdated, making navigation challenging for beginners.

- Customer support is offered exclusively in English, Czech, Polish, and Slovak.

- The broker exclusively offers trading instruments as CFDs.

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

How We Selected The Best Fixed Spread Brokers

We shortlisted brokers with strong reputations in the UK market and evaluated their fixed spread accounts.

Our UK-based team, made up of experienced traders, recorded and evaluated fixed spreads on popular instruments like EUR/USD, GBP/USD, and major indices such as the FTSE 100, where possible.

Each broker was individually rated balancing the quality of their fixed spreads with the overall trading environment for a well-rounded picture of the top fixed spread brokers in the UK.

What Are Fixed Spreads?

Fixed spreads are trading costs that remain constant, regardless of market volatility or time of day.

Unlike variable spreads, which widen or tighten based on market conditions, fixed spreads offer price stability. This makes them especially appealing to short-term investors who rely on cost predictability when opening frequent or time-sensitive positions.

For example, a broker may offer a fixed spread of 1.0 pip on the GBP/USD pair. Whether the market is calm or reacting to economic news, the spread stays at 1.0 pip.

This consistency can be particularly valuable for day traders or scalpers who place multiple trades daily, as sudden spread spikes could eat into profits or trigger stop losses prematurely.

However, it’s important to note that fixed spreads are often slightly wider than the lowest variable spreads seen during stable market conditions.

Still, if you’re focused on fast entries and exits—particularly during high-impact news events or off-peak hours—knowing the exact cost upfront can outweigh the potential savings of a variable model.

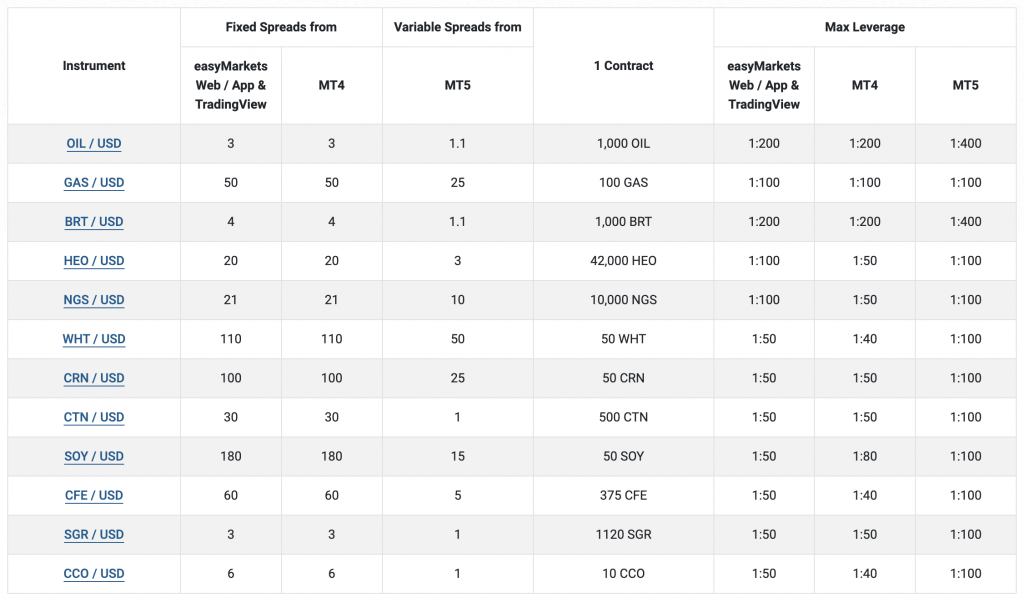

easyMarkets offers fixed spreads on specific platforms for consistent trading costs

Do All Brokers Offer Fixed Spreads?

Not all brokers offer fixed spreads. In fact, less than a quarter of brokers accepting UK clients do from our analysis.

Many online brokers—especially those operating with ECN or STP pricing models—focus on variable spreads that adjust in real time with market liquidity.

These brokers pass on raw market prices, which often result in tighter spreads during calm periods but wider spreads during periods of volatility. While this model appeals to some experienced traders, it can introduce uncertainty for short-term investors who rely on precise cost control and accuracy.

Market-maker brokers more commonly offer fixed-spread accounts. These brokers set their spreads, allowing them to maintain stability regardless of market conditions.

For instance, a UK brokerage like IG offers fixed spreads on popular indices, such as the FTSE 100, during core market hours, which can be beneficial for active traders. Similarly, Trade Nation and easyMarkets offer fixed spreads across a wide range of instruments, even during major news events.

That said, some brokers offer both fixed and variable spread account types, providing you with flexibility depending on your trading strategy.

Example Trade: Fixed vs Variable Spreads

To see how fixed and variable spreads affect real trading outcomes, let’s look at a simple example I set up with the FTSE 100.

My scenario compares the same short-term buy trade under both pricing models, showing how the spread can impact profit depending on market conditions.

My Trade setup:

- Position: Buy 1 lot of FTSE 100 (equivalent to £10 per point movement)

- Entry price: 8,000

- Exit price: 8,010

- Market movement: +10 points in your favour

Scenario 1: Fixed Spread Broker

- Fixed spread: 1.5 points

- Effective entry price: 8,001.5

- Exit price: 8,010

- Net gain: 8.5 points

- Profit: £85

Scenario 2: Variable Spread Broker (Normal Market Conditions)

- Variable spread: 0.8 points

- Effective entry price: 8,000.8

- Exit price: 8,010

- Net gain: 9.2 points

- Profit: £92

Scenario 3: Variable Spread Broker (During Volatility)

- Variable spread: 2.5 points

- Effective entry price: 8,002.5

- Exit price: 8,010

- Net gain: 7.5 points

- Profit: £75

In stable market conditions, a variable spread broker can offer slightly better value, allowing for higher profit margins on the same move.

However, during volatile periods—such as economic news releases or low-liquidity hours—variable spreads can widen significantly.

In these moments, fixed spreads provide a level of cost certainty that could help protect my short-term trades from unexpected slippage in trading costs.

Pros Of Fixed Spreads

- Predictable Trading Costs: Fixed spreads stay the same regardless of market volatility, so you always know your cost per trade. This makes it easier to plan entries, exits, and stop-loss levels—essential for fast-paced strategies like day trading or scalping.

- Protection During Volatility: Unlike variable spreads, fixed spreads don’t widen during major news events or sudden market moves. This helps reduce the risk of unexpected costs eating into your profit or triggering stop-losses prematurely.

- Simpler Strategy Building: With consistent costs, fixed spreads make it easier to backtest and optimise short-term strategies. You’re not constantly adjusting for changing spread conditions, which improves the accuracy of trade models and risk management plans.

Cons Of Fixed Spreads

- Typically Wider Than Variable Spreads: Fixed spreads are often slightly higher than the tightest variable spreads during calm market conditions. Over many trades, this can increase overall costs, especially during high-liquidity periods when variable spreads would otherwise be very low.

- Limited Availability Across Assets & Hours: Not all brokers offer fixed spreads on every instrument or during all trading hours. Some may only guarantee fixed pricing on major forex pairs or indices, and only during specific sessions—reducing flexibility for round-the-clock trading.

- Potential For Requotes Or Slower Execution: To maintain fixed spreads during volatile conditions, some brokers may delay execution, apply trade limits, or issue requotes. This can affect short-term strategies that rely on fast order placement and immediate market access.

Fixed Spreads vs Commissions

Fixed spread brokers build their fees into the spread itself, offering a single, predictable cost per trade. In contrast, commission-based brokers typically provide raw or ultra-tight spreads and charge a separate, transparent fee per trade—often per lot traded.

Both models can be suitable for short-term investors, but the best choice ultimately depends on your trading strategy, frequency, and preferred instruments.

For example, a fixed spread broker might offer a 1.5-point spread on the DAX with no additional charges. That’s the total cost, regardless of trade size.

Meanwhile, a commission-based broker like Pepperstone or IC Markets might offer a much tighter spread—say 0.4 points—but add a commission of £4–£6 per lot round trip. If you’re trading large volumes or multiple times a day, those commissions can add up, even if the raw spreads look attractive.

If you prioritise speed and cost certainty, you may prefer fixed spreads to avoid sudden cost spikes. On the other hand, if you’re an active day trader operating during high-liquidity periods, you may benefit more from lower variable spreads and commissions, especially if your trades are larger or longer in duration.

Ultimately, the key is to compare total trading costs—not just spreads or commission in isolation. In volatile markets or during off-peak hours, fixed spreads provide a layer of predictability that commission-based models often struggle to match.

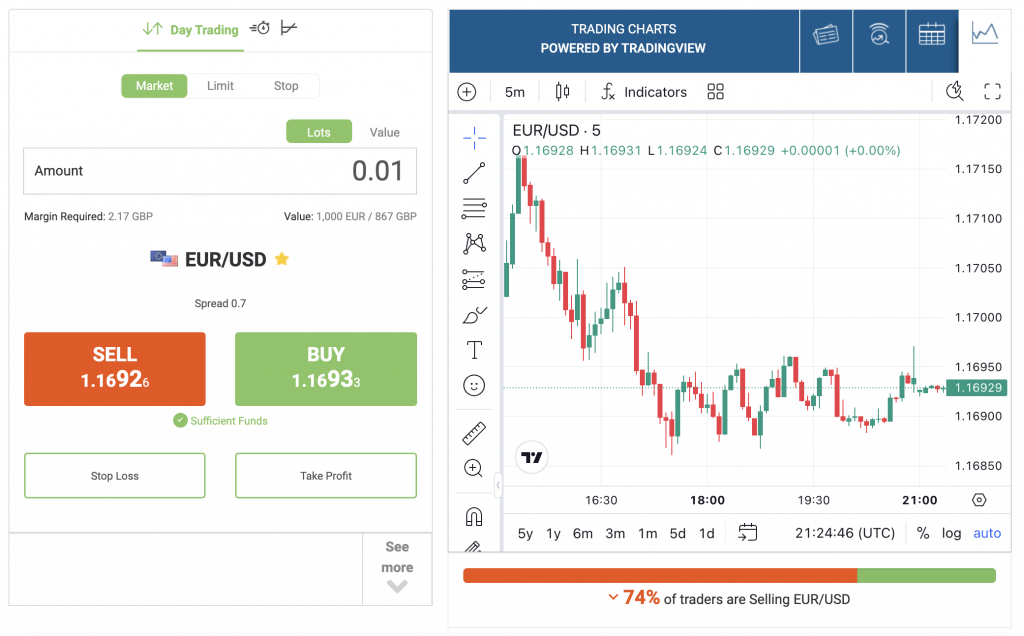

easyMarkets’ fixed spreads on EUR/USD are just 0.7 pips

Bottom Line

The key to choosing a good fixed spread broker is knowing how consistent its pricing is. Look for brokers that offer truly fixed spreads throughout regular trading hours—not just during calm market conditions.

The more reliable the spread, the easier it is to plan trades with confidence.

It’s also worth comparing fixed spread levels across brokers. While fixed pricing offers predictability, some brokers we’ve tested set their spreads wider than others. For short-term investors who place frequent trades, even a half-point difference can add up quickly.

Finally, ensure the broker clearly outlines when fixed spreads apply, particularly during news events or periods of low liquidity. Transparency is essential—if the spreads aren’t fixed when it matters most, the benefit is lost.

To get started, use our list of the top UK brokers for fixed spreads.