Best FasaPay Brokers 2026

FasaPay is an e-wallet that investors can use to transfer funds between their bank account and a trading broker. As a reliable and low-cost payment method, FasaPay is a viable deposit option for UK-based traders.

This guide will detail how it works and review transfer fees, processing times, pros, cons and anything else traders should know before signing up with FasaPay brokers. We have also ranked the best brokers that accept FasaPay deposits in 2026.

FasaPay Brokers

-

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000 -

Founded in 2007, Axi is a forex and CFD broker operating under multiple regulations. Over the years, it has enhanced the trading experience by broadening its stock offerings, upgrading the Axi Academy, and launching a proprietary copy trading app.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

IronFX, established in 2010, is a highly regulated broker specialising in forex and CFDs. This acclaimed company provides access to over 500 markets for more than 1.5 million clients in 180 countries. Traders benefit from multiple account options with competitive rates via the MT4 platform, alongside 24/5 customer support available in 30 languages.

Instruments Regulator Platforms Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) CySEC, FCA, FSCA, BMA / Bermuda MT4, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) -

Founded in 2005, FXOpen is a well-regulated broker that has drawn over one million traders. Tailored for active trading, it offers a diverse range of over 700 markets. The platform facilitates high-frequency trading, scalping, and various algorithmic strategies through the use of expert advisors (EAs).

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs FCA, CySEC, FC TickTrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (EU, UK), 1:1000 (Global) -

Fusion Markets, an online broker since 2017, operates under the regulation of ASIC, VFSC, and FSA. Renowned for offering cost-effective forex and CFD trading, it provides various account options and copy trading solutions to suit diverse trading needs. New clients can begin trading with a simple three-step registration process.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto ASIC, VFSC, FSA MT4, MT5, cTrader, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500

Safety Comparison

Compare how safe the Best FasaPay Brokers 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ | |

| Axi | ✔ | ✔ | ✘ | ✔ | |

| IronFX | ✔ | ✔ | ✘ | ✔ | |

| FXOpen | ✔ | ✔ | ✘ | ✔ | |

| Fusion Markets | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best FasaPay Brokers 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IronFX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXOpen | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Fusion Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best FasaPay Brokers 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Eightcap | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ | ||

| Axi | iOS & Android | ✘ | ||

| IronFX | Android, iOS, WebTrader | ✘ | ||

| FXOpen | iOS & Android | ✘ | ||

| Fusion Markets | iOS & Android | ✘ |

Beginners Comparison

Are the Best FasaPay Brokers 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots | ||

| Axi | ✔ | $0 | 0.01 Lots | ||

| IronFX | ✔ | $100 | 0.01 Lots | ||

| FXOpen | ✔ | $100 | 0.01 Lots | ||

| Fusion Markets | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best FasaPay Brokers 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| IronFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | ✔ | ✘ | ✘ | ✘ |

| FXOpen | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (EU, UK), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| Fusion Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best FasaPay Brokers 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Eightcap | |||||||||

| Vantage FX | |||||||||

| Tickmill | |||||||||

| Axi | |||||||||

| IronFX | |||||||||

| FXOpen | |||||||||

| Fusion Markets |

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

- Hedging and scalping strategies are fully permitted without any short-term restrictions.

- Vantage addresses the needs of passive investors through user-friendly social trading on ZuluTrade and Myfxbook.

Cons

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

Cons

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Axi Academy offers a wealth of educational resources, from free eBooks and video tutorials to interactive quizzes. These are particularly beneficial for novice traders.

- Axi provides an excellent MT4 experience, enhanced by the NextGen plug-in for sophisticated order management and analytics, with low execution latency around 30ms.

- Experienced traders are invited to join the Axi Select funded trader programme via the broker's international branch. This scheme offers up to $1 million in capital with the benefit of a 90% profit share.

Cons

- Although Axi delivers excellent performance, its support is not available 24/7. This unavailability can be inconvenient for traders operating in different time zones or requiring help beyond regular trading hours.

- Axi lags by solely providing MT4, while competitors have upgraded to MT5, cTrader, TradingView, and bespoke platforms, delivering a smoother user experience with enhanced tools.

- Axi retains our confidence. However, recent issues with ASIC and FMA require it to maintain a secure environment and comply with licensing standards.

Our Take On IronFX

"IronFX is ideal for seasoned forex traders seeking fixed or floating spreads. Offering over 80 currency options, it surpasses many competitors and provides excellent forex market research tools."

Pros

- The broker regularly hosts trading competitions with cash rewards and provides welcome bonuses for new clients.

- In addition to MT4, the broker also provides various services such as copy trading, a VPS solution, and PAMM/MAM accounts.

- The IronFX Academy provides outstanding educational resources for traders of all levels, from beginners to advanced.

Cons

- Commissions in zero-spread accounts begin at £13.50 per lot, almost twice the industry standard.

- It is unfortunate that the broker lacks advanced software options like MT5 or TradingView, restricting choice for seasoned traders.

- In comparison to top brokers, IronFX provides a limited range of share CFDs.

Our Take On FXOpen

"FXOpen is perfect for high-volume traders, providing swift execution via its ECN system, spreads starting at 0 pips, and reduced commissions as low as $1.50 per lot."

Pros

- In 2024, FXOpen simplified its account options. Traders now benefit from ECN accounts with raw spreads starting at 0.0 pips. The platform offers rapid execution and reduced commissions for those with high trading volumes, enhancing user experience.

- FXOpen integrated TradingView in 2022 and enhanced its TickTrader platform in 2024. This upgrade delivers Level 2 pricing, over 1,200 trading instruments, and sophisticated order options. The platform appeals to both seasoned and high-frequency traders.

- FXOpen significantly cut FX spreads by over 40% in 2022. In 2023, they launched commission-free index trading. These changes make trading more economical for traders.

Cons

- Though FXOpen remains a trusted broker with authorizations from the FCA and CySEC, it lost its ASIC license in 2024 due to 'serious concerns.' Consequently, it no longer accepts traders from Australia.

- FXOpen's educational resources are quite limited, with a scarcity of courses and webinars commonly available at brokers such as IG. This deficiency may deter novice traders looking to enhance their understanding.

- Even with an expanded asset portfolio, FXOpen provides a more limited selection of global stocks, commodities, and cryptocurrencies compared to the leading firm BlackBull. This results in fewer diverse trading opportunities for traders.

Our Take On Fusion Markets

"Fusion Markets offers forex traders competitive pricing with minimal spreads, low commissions, and new TradingView integration. It is an excellent choice, especially for Australian traders, given its base and regulation by ASIC."

Pros

- Fusion Markets consistently impresses traders with its competitive pricing, featuring tight spreads and lower-than-average commissions. These cost-effective options are particularly attractive to those engaging in frequent trading.

- With an average execution speed of approximately 37 milliseconds, traders can secure optimal prices more effectively, outpacing many competitors in rapidly changing markets.

- The market analysis tools, Market Buzz and Analyst Views, are excellent for identifying opportunities and are seamlessly incorporated into the client dashboard.

Cons

- Fusion Market falls short compared to competitors like IG in education, offering few guides and live video sessions for enhancing trader skills.

- Traders from outside Australia need to register with loosely regulated international firms that offer limited protection, lacking both safeguards and negative balance protection.

- Unlike AvaTrade, there is no specialised trading platform or app tailored for beginners, which is a significant disadvantage.

About FasaPay

Operated by Fasa Centra Solutions Ltd., FasaPay is an online payment service that connects customers such as traders, with merchants like online brokers.

Launched in 2011, it has become a popular payment method with over 560,000 members and more than 400 merchants across 222 supported countries, including the UK.

The company is based in Kuala Lumpur, Malaysia and there is an additional office in Dubai, UAE.

Importantly, FasaPay only supports transfers made using USD and IDR. If you want to make trading deposits using Pound Sterling (GBP) or crypto like Bitcoin (BTC), you will need to account for currency conversion charges.

How FasaPay Works

Your membership status impacts the features and limits available. The three different membership types are registered, active and verified. If you want to use FasaPay for depositing funds to a trading broker or withdrawing funds back to your bank account, you need to have a verified member status.

To become verified, you will need to upload a scan of your passport and a photo of yourself after you register a new account. In addition, you must submit a billing statement to prove your address is correct.

The verification process typically takes between one and three business days.

Transfer Times

FasaPay is generally a fast method for funding trading accounts. Most brokers that accept FasaPay deposits will process payments instantly, including Axi and FP Markets.

You can expect withdrawals to take longer. Withdrawals at Axi, for instance, take between one and three business days while clients of FP Markets must wait at least one business day.

Fortunately, this is not always the case as funds are transferred immediately when using FasaPay for both deposits and withdrawals at Global GT.

Fees & Limits

FasaPay does not impose any charges on users when they deposit and withdraw funds. The only transfer fees come from merchants and customers sending money between accounts.

Many brokers that accept FasaPay deposits and withdrawals do not charge a fee. For instance, both Axi and Global GT offer free transfers, with minimum deposit and withdrawal limits of $5 and $10, respectively.

However, there are certain FasaPay brokers that do impose fees. For example, FP Markets charges a 0.5% commission across all withdrawals. Furthermore, Alpari charges a flat 0.5% rate for both deposits and withdrawals, up to a maximum withdrawal fee of $5.

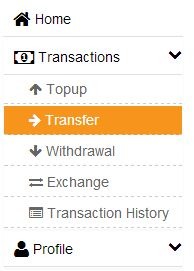

How To Make Deposits & Withdrawals With FasaPay

Deposits

- Ensure that you have topped up your FasaPay account with sufficient funds to cover the trading deposit. This can be done using Payment Gateway, Master Changer or bank transfer

- Log into your brokerage account

- Go to the section of the mobile app, platform or website relating to funding

- Select FasaPay as the chosen payment method

- Specify the amount you wish to deposit

- Submit the request

- You will be taken to the FasaPay portal where you must input your account details

- Confirm the deposit

Withdrawals

- Sign into your account with respective FasaPay brokers

- Navigate to the funding section of your broker’s platform

- Click ‘Withdraw’ and choose FasaPay as the method

- Type the amount that you want to withdraw. You may also be asked to choose the currency

- Input your FasaPay destination account details

- Confirm the request and complete any verification steps

- The funds will then be withdrawn to your FasaPay account rather than directly to your bank account

Payment Security

The payment solution offers a number of protective measures to its customers. These provide traders with validation tools to ensure that only authorised people can use their accounts. This includes a six-digit master code asked before changing account information, PINs used to confirm sign-in attempts and transactions, as well as API security to blacklist certain IP addresses. These tools altogether can help to keep your trading funds secure, even if your profile login ID is compromised.

To improve your safety, only use FCA-regulated brokers that accept FasaPay deposits. Trading firms licensed by the Financial Conduct Authority must abide by various safety and security standards, including providing compensation of up to £85,000 through the Financial Services Compensation Scheme if the broker defaults and offering negative balance protection.

Customer Support

If you experience an error when attempting to deposit trading funds at FasaPay brokers, contact the support team. The customer service desk is available via the following channels:

- Skype call

- Contact form

- Live chat on the website

- Email support@fasapay.com

- Social media accounts on Facebook and Twitter

- FAQ section on the payment provider’s website

Alternatively, you can contact your broker’s customer support team for an update on deposit or withdrawal requests.

Mobile App

FasaPay has launched a mobile app for Android but not yet for iOS devices.

To download the app on your Android device, there is a link to Google Play on the e-wallet’s website. If you are using an iPhone or iPad, you may be able to find an unofficial APK app from a third-party website online.

Pros Of FasaPay For UK Traders

- Multiple security measures

- Easy to set up an account and make payments to FasaPay brokers

- There is a decent list of UK brokers that accept FasaPay deposits

- Low-cost or free deposits and withdrawals

- Instant account funding

Cons Of FasaPay For UK Traders

- Withdrawn funds from brokers are transferred to your FasaPay account rather than back to your bank account

- Traders must submit private documents before they can deposit funds with the payment solution

- UK traders cannot hold funds in GBP

Bottomline On FasaPay Brokers

FasaPay offers a useful way of sending funds to and receiving withdrawals from your trading broker. It is an inexpensive online payment method that processes transactions quickly. It is also free and easy to open an account, making it an option worth considering. On the downside, it is not as widely accepted as alternative e-wallets, such as Neteller, Skrill, PayPal, plus prepaid Visa cards.

To make a deposit and start trading today, head to our ranking of the top FasaPay brokers.

FAQs

Can UK-Based Traders Use FasaPay To Fund Brokerage Accounts?

Yes, UK-based investors that are looking to deposit funds to online brokers can sign up with FasaPay. However, clients can only hold funds in USD or IDR so you will need to pay conversion fees from GBP to use the service.

Do All UK Brokers Accept FasaPay Deposits?

While there are some brokers that accept FasaPay deposits, there are many platforms that do not. See our toplist of best brokers with FasaPay to find the right platform for you.

How Quickly Are Trading Deposits Using FasaPay Processed?

In general, FasaPay is a fast method with many brokers advertising immediate deposits, such as Alpari. On the other hand, withdrawals will take longer. For instance, Alpari says that customers must wait one working day while Axi says withdrawals typically take up to three working days.

Can I Trust FasaPay To Fund My Online Trading Account?

FasaPay is a legitimate and reliable online wallet and payment method with over 400 reputable merchant partners, including trading brokers. You can trust it to keep your account and funds secure through various protective measures, such as two-factor authentication and IP blacklisting.