Best DMA Brokers In The UK 2026

Looking to trade like a pro? Direct Market Access (DMA) puts you in the fast lane, giving you direct access to the order books of global exchanges—no middlemen, no markups, just pure market action.

We break down the best DMA brokers in the UK so that you can trade smarter, faster, and with complete control.

Top DMA Brokers in the UK

-

In evaluating Pepperstone’s DMA access through cTrader, order book engagement was smooth, with rapid execution and minimal slippage, even amidst high volatility. Liquidity depth was notable, and commissions averaged $3.50 per lot per side. It provides cost-efficiency for high-volume traders seeking speed, transparency, and genuine market pricing.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

In our practical tests, Interactive Brokers provided institutional-level direct market access with exceptional order book depth, swift execution, and minimal slippage, even in turbulent markets. Commissions varied by volume, typically averaging $2–$3 per lot. Its SmartRouting system guaranteed superior fills, perfect for frequent and professional traders requiring accuracy and control.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

In our tests, IG provided DMA access via its L2 Dealer platform for equities and certain CFDs. Execution was consistent, offering deep liquidity and full order book transparency. Spreads were narrow, with commissions from £6 per lot. It suits high-volume traders seeking transparency, speed, and detailed control.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

During our assessment of FOREX.com, true DMA was exclusive to their DMA account. Execution was swift, featuring complete order book visibility and raw spreads. Commissions commenced at $6 per lot round turn. This setup suits professional traders who value transparency and direct market engagement.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

In our recent tests, FxPro's DMA through cTrader provided accurate execution, visible order book depth, and swift fills. The commission was $4.50 per lot each side, with spreads from near zero. Slippage was minimal on major FX pairs, making it ideal for active traders looking for transparent pricing and market engagement.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

In testing, Swissquote offered true DMA access, robust liquidity, and full order book transparency for forex and equities. Execution proved efficient, with spreads from 0.0 pips and commissions at $3.50–$5 per lot per side. Minimal slippage and clear pricing cater well to high-volume trading strategies.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA CFXD, MT4, MT5, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $1,000 0.01 Lots 1:30 -

When testing FXOpen, the DMA execution was efficient with direct access to the order book, raw spreads starting at 0.0 pips, and commissions at $3.50 per lot per side. Liquidity was robust, and slippage remained low, even during volatility. This offers traders a cost-effective solution.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs FCA, CySEC, FC TickTrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (EU, UK), 1:1000 (Global)

Safety Comparison

Compare how safe the Best DMA Brokers In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| Swissquote | ✔ | ✔ | ✘ | ✔ | |

| FXOpen | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best DMA Brokers In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Swissquote | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| FXOpen | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best DMA Brokers In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ | ||

| FXPro | iOS & Android | ✘ | ||

| Swissquote | iOS & Android | ✘ | ||

| FXOpen | iOS & Android | ✘ |

Beginners Comparison

Are the Best DMA Brokers In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| Swissquote | ✔ | $1,000 | 0.01 Lots | ||

| FXOpen | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best DMA Brokers In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| Swissquote | Expert Advisors (EAs) on MetaTrader and FIX API solutions | ✘ | 1:30 | ✘ | ✔ | ✔ | ✘ |

| FXOpen | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (EU, UK), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best DMA Brokers In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| Interactive Brokers | |||||||||

| IG | |||||||||

| Forex.com | |||||||||

| FXPro | |||||||||

| Swissquote | |||||||||

| FXOpen |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

Cons

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring traders with a slick design and over 80 technical indicators for market analysis.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

Cons

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

Our Take On Swissquote

"Swissquote is ideal for traders seeking a tailor-made platform, like its CXFD, which incorporates Autochartist for automated chart analysis to support trading decisions. Yet, its moderate fees and high $1,000 minimum deposit could deter novice traders."

Pros

- Swissquote offers robust platforms for traders, including MetaTrader 4/5 and its proprietary CFXD (formerly Advanced Trader). During testing, these platforms stood out with their adaptable layouts, advanced charting tools, and comprehensive technical indicators.

- Swissquote is designed for rapid trading strategies, including scalping and high-frequency approaches. With an average execution speed of 9ms and a 98% fill ratio, it also supports FIX API.

- Swissquote offers sophisticated research tools such as Autochartist for technical analysis and real-time news from Dow Jones. The firm's exclusive Market Talk videos and Morning News provide daily expert insights, catering to active traders.

Cons

- Swissquote focuses on serving professional and high-net-worth clients, requiring substantial initial deposits, such as $1,000 for Standard accounts. This approach is less favourable for smaller traders who prefer brokers offering higher leverage and no deposit requirements.

- Analysis indicates that Swissquote's charges are relatively high. Forex spreads on Standard accounts begin at 1.3 pips, whereas brokers such as Pepperstone or IC Markets offer starting spreads of 0.0 pips. Additionally, transaction fees for non-Swiss stocks and ETFs could accumulate significantly for active traders.

- Unlike brokers like eToro that offer social trading capabilities, Swissquote does not provide tools for community interaction or replicating successful traders. This absence can reduce its attractiveness to those who prioritise peer-to-peer learning.

Our Take On FXOpen

"FXOpen is perfect for high-volume traders, providing swift execution via its ECN system, spreads starting at 0 pips, and reduced commissions as low as $1.50 per lot."

Pros

- FXOpen significantly cut FX spreads by over 40% in 2022. In 2023, they launched commission-free index trading. These changes make trading more economical for traders.

- In 2024, FXOpen simplified its account options. Traders now benefit from ECN accounts with raw spreads starting at 0.0 pips. The platform offers rapid execution and reduced commissions for those with high trading volumes, enhancing user experience.

- FXOpen integrated TradingView in 2022 and enhanced its TickTrader platform in 2024. This upgrade delivers Level 2 pricing, over 1,200 trading instruments, and sophisticated order options. The platform appeals to both seasoned and high-frequency traders.

Cons

- Though FXOpen remains a trusted broker with authorizations from the FCA and CySEC, it lost its ASIC license in 2024 due to 'serious concerns.' Consequently, it no longer accepts traders from Australia.

- Even with an expanded asset portfolio, FXOpen provides a more limited selection of global stocks, commodities, and cryptocurrencies compared to the leading firm BlackBull. This results in fewer diverse trading opportunities for traders.

- FXOpen's educational resources are quite limited, with a scarcity of courses and webinars commonly available at brokers such as IG. This deficiency may deter novice traders looking to enhance their understanding.

How We Picked The Top DMA Brokers

We prioritised FCA-regulated brokers offering genuine DMA access to UK traders.

Our team of experienced British traders carried out hands-on testing, assessing key factors such as Level 2 market depth, execution quality, order routing transparency, and software support.

How To Choose A Broker For Direct Market Access

- Market access determines which exchanges you can trade on through your DMA broker. For example, access to the London Stock Exchange (LSE) is essential if you want to trade UK-listed stocks, while international exchange access opens the door to global markets. The wider the access, the more opportunities you have to trade different instruments and across various time zones—useful for diversifying or finding the most active markets.

- Trading platforms are the primary tools you’ll use to place trades, analyse markets, and manage your positions. Some brokers offer user-friendly platforms, such as MetaTrader and TradingView, which are ideal for beginners. Others provide advanced tools, including FIX API or proprietary systems, designed for high-speed or automated trading. Choosing the right platform can significantly impact how quickly you trade, the features you have access to, and the overall smoothness of your trading experience on both desktop and mobile devices.

- Speed and quality of execution determine how quickly and accurately your trades are carried out. In fast-moving markets, even small delays can lead to missed opportunities or worse prices than expected. A good DMA broker should offer reliable, fast execution with minimal slippage, helping you get the price you see when you place your order—especially important for short-term traders who rely on precision.

- Fee structure directly affects your overall trading costs and potential profits. DMA brokers often charge commissions per trade, along with possible fees for live market data, platform access, or inactivity. These costs can add up quickly, especially if you’re an active trader. By comparing fee structures, you can select a broker that aligns with your budget and trading style, without any unexpected charges.

- Trading tools like Level 2 data, algorithms, and advanced charting help you make more informed decisions. Level 2 data displays the entire order book, providing insight into market depth and potential price movements. Algorithmic tools can help automate trades based on set rules, saving time and improving speed. Advanced charting lets you spot trends and patterns more clearly. For short-term traders, these tools can provide a real edge in timing entries and exits.

- Account types—such as professional and retail—offer varying levels of access, protection, and trading features. Retail accounts are designed for everyday investors and include robust safeguards, such as negative balance protection and FCA oversight. Professional accounts, while offering higher leverage and more advanced tools, have fewer regulatory protections. It’s essential to choose the right type based on your experience, trading volume, and risk tolerance.

- Minimum deposit requirements and funding options affect how easily you can get started and manage your account. Some DMA brokers require a higher initial deposit, which may not be suitable for beginners or smaller investors. It’s also helpful to check how you can fund your account—whether by bank transfer, debit card, or other methods—and how fast and flexible those options are. Choosing a broker that matches your budget and preferred payment methods can make your trading experience smoother from the start.

- Good customer service and support ensure you can get help quickly if something goes wrong or if you have questions about your account or trades. This is especially valuable for beginners who may need guidance with setting up platforms, funding accounts, or understanding trading tools. A broker with responsive, knowledgeable support—available through chat, phone, and email—can make your trading experience more secure and less stressful.

- A regulated broker helps protect your money and personal information. FCA-regulated brokers must adhere to rules that promote fair trading and transparency, thereby reducing the risk of fraud. This oversight provides you with peace of mind, ensuring the broker operates honestly and meets industry standards.

Based on my experience, having a DMA broker in the UK with responsive and technically proficient support is crucial—fast resolution of platform glitches or execution issues ensures uninterrupted connectivity and prevents costly delays in high-frequency trading environments.

DMA vs Traditional Brokers

A DMA broker allows you to place your orders—stocks, forex, CFDs etc—straight onto the exchange’s order book, where they interact directly with other market participants. This means you see real-time market prices, giving you greater transparency and control over your trades.

For instance, if you want to buy Google shares, which are listed on NASDAQ under Alphabet Inc., a DMA platform lets you purchase these shares directly from the exchange. This way, you avoid intermediaries and trade straight with the market.

In contrast, market makers act as the counterparty to your trades, often setting their bid and ask prices. They may profit from the spread between these prices, which can sometimes create a conflict of interest since they trade against you.

When choosing between DMA and traditional brokers, consider how important real-time pricing and execution speed are to your strategy, as DMA brokers excel in these areas.

ECN (Electronic Communication Network) brokers and STP (Straight Through Processing) brokers operate differently—they route your orders to a pool of external liquidity providers, such as banks and hedge funds.

These brokers don’t directly connect you to the exchange but instead match orders within their network, offering fast execution and tight spreads without dealing desk intervention. However, you won’t see the entire exchange order book, as with DMA.

While DMA offers the highest level of market transparency and direct interaction with the exchange, it often comes with commission fees and requires a deeper understanding of market mechanics.

Market makers might be more straightforward and more cost-effective for beginners, while ECN and STP offer a middle ground with fast execution and variable spreads.

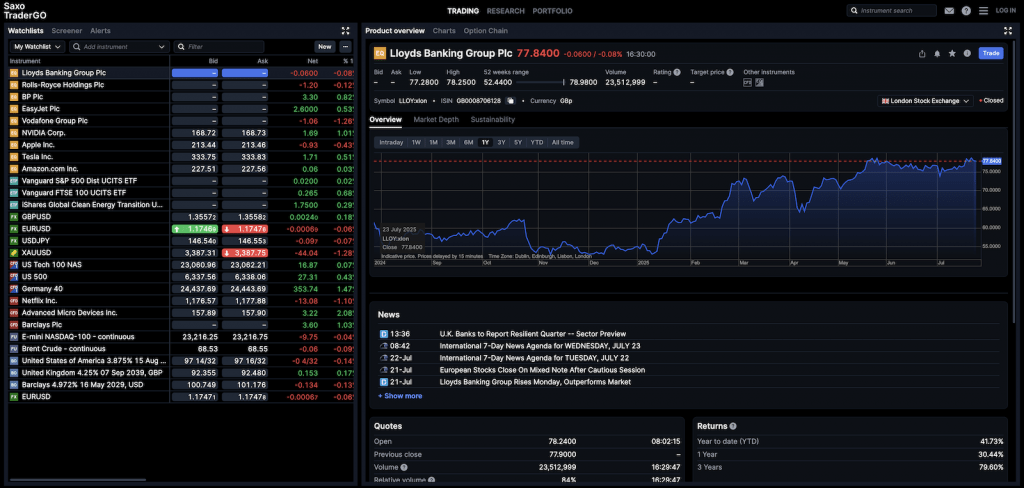

Saxo offers CFD trading with direct market access

Pros Of DMA Brokers

- Direct market access: You place orders directly on the exchange, providing real-time pricing and complete market transparency.

- Faster execution: Trades are processed quickly without broker intervention, which is crucial for short-term traders.

- Lower costs: Since there’s no dealing desk markup, you often get tighter spreads and pay only commissions or fees.

Cons Of DMA Brokers

- Liquidity issues: Every trade needs a buyer and seller. Using only one exchange can limit liquidity, making it harder to trade quickly.

- More complex: The trading platforms and tools can be advanced, making it harder for beginners to navigate.

- Minimum requirements: Some DMA brokers require higher minimum deposits or trade sizes, which might not suit smaller investors.

Through extensive trading experience, I’ve seen that the true advantage of a DMA broker is its ability to provide direct order placement on exchange order books with minimal latency and full market depth visibility, enabling precise execution and better trade management.

Bottom Line

When selecting a DMA broker, focus on the quality of the trading platform and the speed at which orders are executed.

It’s important to understand all costs involved, including commissions and data fees, to avoid unexpected expenses.

Additionally, ensure the broker is regulated and offers reliable customer support to assist you whenever needed.

To get started, dig into our rankings of the top brokers with DMA.