Best Brokers For Mutual Funds

Mutual funds are a popular investment choice. As each fund is managed by an expert, they offer potentially high returns while generating passive income. The best brokers with mutual funds offer short, medium and long-term investments for beginners, as well as seasoned investors.

This guide will discuss how to invest in mutual funds, covering the basics of how they work, comparing the different types and popular examples, plus returns calculators. Alternatively, get started with our list of the top mutual fund brokers:

Mutual Fund Brokers UK

-

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA CFXD, MT4, MT5, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $1,000 0.01 Lots 1:30 -

Saxo Markets is a renowned trading brokerage, investment firm, and regulated bank. Featuring over 72,000 trading instruments, alongside investment products and managed portfolios, it provides abundant opportunities for clients. This reputable brand ensures transparent pricing and is protected by top-tier regulations from more than ten agencies, including FINMA, FCA, and ASIC.

Instruments Regulator Platforms Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB TradingView, ProRealTime Min. Deposit Min. Trade Leverage £500 Vary by asset 1:30 -

Firstrade, based in the US, operates as a discount broker-dealer and is authorised by the SEC. The firm is a member of both FINRA and SIPC. Firstrade Securities stands out as a leading online brokerage, offering enticing welcome bonuses, robust tools and apps, and commission-free trading. Opening a new account is straightforward and efficient.

Instruments Regulator Platforms Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed SEC, FINRA Firstrade Invest 3.0, TradingCentral Min. Deposit Min. Trade Leverage $0 $1 -

Zacks Trade, a US broker under FINRA regulation, provides trading services for stocks, ETFs, cryptocurrencies, bonds, and more via a bespoke terminal. Targeting active traders, it offers competitive fees across most assets. Additionally, clients benefit from an app and extensive market data access.

Instruments Regulator Platforms Stocks, ETFs, Cryptos, Options, Bonds FINRA Own Min. Deposit Min. Trade Leverage $2500 $3

Safety Comparison

Compare how safe the Best Brokers For Mutual Funds are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Swissquote | ✔ | ✔ | ✘ | ✔ | |

| Saxo | ✔ | ✘ | ✘ | ✔ | |

| Firstrade | ✘ | ✘ | ✘ | ✘ | |

| ZacksTrade | ✘ | ✘ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Best Brokers For Mutual Funds support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Swissquote | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Saxo | ✔ | ✘ | ✔ | ✘ | ✘ | ✘ |

| Firstrade | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

| ZacksTrade | ✔ | ✘ | ✘ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers For Mutual Funds at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| Swissquote | iOS & Android | ✘ | ||

| Saxo | SaxoTraderGo (iOS, Android, Windows) | ✘ | ||

| Firstrade | iOS & Android | ✘ | ||

| ZacksTrade | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers For Mutual Funds good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| Swissquote | ✔ | $1,000 | 0.01 Lots | ||

| Saxo | ✔ | £500 | Vary by asset | ||

| Firstrade | ✘ | $0 | $1 | ||

| ZacksTrade | ✔ | $2500 | $3 |

Advanced Trading Comparison

Do the Best Brokers For Mutual Funds offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Swissquote | Expert Advisors (EAs) on MetaTrader and FIX API solutions | ✘ | 1:30 | ✘ | ✔ | ✔ | ✘ |

| Saxo | - | ✘ | 1:30 | ✘ | ✘ | ✘ | ✔ |

| Firstrade | - | ✘ | - | ✘ | ✘ | ✘ | ✔ |

| ZacksTrade | Yes (algos) | ✘ | - | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers For Mutual Funds.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| Swissquote | |||||||||

| Saxo | |||||||||

| Firstrade | |||||||||

| ZacksTrade |

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On Swissquote

"Swissquote is ideal for traders seeking a tailor-made platform, like its CXFD, which incorporates Autochartist for automated chart analysis to support trading decisions. Yet, its moderate fees and high $1,000 minimum deposit could deter novice traders."

Pros

- Swissquote offers sophisticated research tools such as Autochartist for technical analysis and real-time news from Dow Jones. The firm's exclusive Market Talk videos and Morning News provide daily expert insights, catering to active traders.

- Swissquote is highly reputable due to its status as a bank, its presence on the Swiss stock exchange, and its authorisations from credible regulators such as FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

- Swissquote is designed for rapid trading strategies, including scalping and high-frequency approaches. With an average execution speed of 9ms and a 98% fill ratio, it also supports FIX API.

Cons

- Swissquote focuses on serving professional and high-net-worth clients, requiring substantial initial deposits, such as $1,000 for Standard accounts. This approach is less favourable for smaller traders who prefer brokers offering higher leverage and no deposit requirements.

- Unlike brokers like eToro that offer social trading capabilities, Swissquote does not provide tools for community interaction or replicating successful traders. This absence can reduce its attractiveness to those who prioritise peer-to-peer learning.

- Analysis indicates that Swissquote's charges are relatively high. Forex spreads on Standard accounts begin at 1.3 pips, whereas brokers such as Pepperstone or IC Markets offer starting spreads of 0.0 pips. Additionally, transaction fees for non-Swiss stocks and ETFs could accumulate significantly for active traders.

Our Take On Saxo

"Saxo suits active traders and high-volume investors, providing unmatched instrument variety, premium research, and fee rebates. With 190 currency pairs offering tight spreads, it excels for forex traders."

Pros

- Outstanding educational materials are available, such as podcasts, webinars, and expert-led videos.

- Elite research centre offering specialised market analysis and exclusive forecasts, including 'Outrageous Predictions'.

- Reduced fees with advanced account levels.

Cons

- Trading accounts require substantial financial investment.

- A subscription is necessary to access Level 2 pricing.

- Clients from certain regions, such as the US and Belgium, are not accepted.

Our Take On Firstrade

"Firstrade suits novice traders in US stocks, offering zero commissions. It provides abundant free education, top-tier research with FirstradeGPT, and trading insights from Morningstar, Briefing.com, Zacks, and Benzinga."

Pros

- Ideal broker for cost-aware traders, offering competitive low fees on OTC trades.

- A reputable US-regulated broker and SIPC member

- Improved trading conditions now include overnight trading and the option to purchase fractional shares.

Cons

- Customer support requires improvement after testing revealed the absence of 24/7 assistance.

- Over 90% of the options assessed lack a demo trading account.

- Firstrade prioritises stocks over forex, restricting opportunities for portfolio diversification.

Our Take On ZacksTrade

"Zacks Trade caters to seasoned traders using advanced platforms. It offers competitive fees, attractive margin rates, and superb market research."

Pros

- 20+ account denominations

- Bespoke trading platform and mobile application

- Authorised by FINRA, with access to the Securities Investor Protection Corporation.

Cons

- No forex, commodities or futures trading

- Withdrawal fees are incurred for multiple fund removals within a month.

- No MT4 or MT5 platform integration

What Are Mutual Funds?

Mutual funds are open-ended investment vehicles that are made up of diversified holdings. Often, these come from several markets such as stocks, bonds, real estate and commodities such as gold. They are different to closed-end investments where only a set number of shares can be bought.

Mutual funds typically have many shareholders that have pooled their investments together to create a portfolio with strong purchasing power. This allows individual clients that have limited capital to participate in investments of a larger size.

The history of having multiple pooled shareholder funds originated in the 1700s in the Netherlands. However, the first instance of an investment akin to modern mutual funds was the Foreign & Colonial Investment Trust launched in 1868 in the UK. This became a popular investment option, as by the beginning of World War One, the total market cap of all funds operating on the LSE totalled more than £60 million. The company is still in operation today and, at the time of writing, has around £5.4 billion in assets under management (AUM).

How Mutual Funds Work

Investing in mutual funds involves having someone else manage the investments and the overall portfolio on your behalf. These are professionals that evaluate different investment opportunities and decide what to buy, what to hold and what to sell. These products are therefore attractive to investors who do not have enough time to manage their own capital or have insufficient knowledge of financial markets.

For this service, mutual fund investors often pay a regular premium, typically on a yearly basis. The fees you pay will vary across different brokers and products. For instance, all Retirement Target funds from Vanguard have a yearly charge of 0.24% whereas the Active UK Equity Fund comes with a 0.45% ongoing charge.

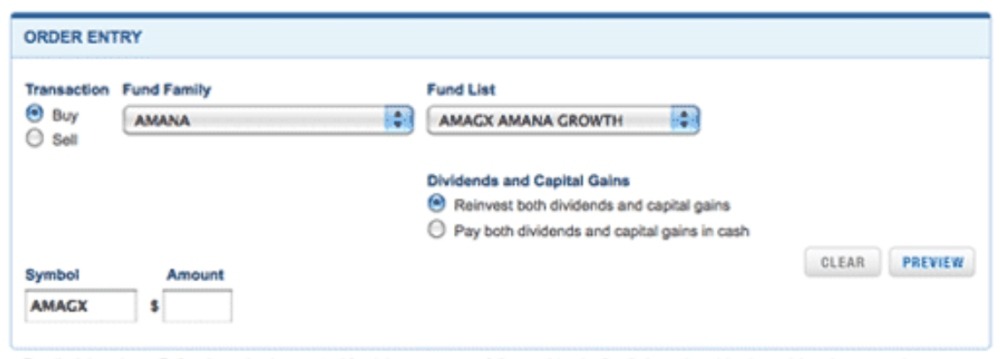

To buy into a mutual fund, the process is simple. After finding a fund to invest in, setting up an account and depositing funds, you will need to complete a trade request. This often involves submitting the amount that you want to invest.

Using the net asset value (NAV) of the mutual fund will tell you how many units you can buy. The NAV is calculated by finding the sum of all assets and taking away liabilities such as expenses and then dividing the result by the number of units. Once the trade request has been processed and the shares of the fund have been purchased, the portfolio manager will then monitor your investments until you sell.

Generating Returns

Profits from the best performing mutual funds are generated in three key ways:

- Dividends and interest paid on positions you are holding. You can then take these gains and reinvest in more of the funds or withdraw them to your bank account as realised profits. These returns are usually distributed every quarter.

- The fund manager can sell certain positions and these gains are then shared amongst the shareholders of the fund.

- You can liquidate your entire position by selling what you are holding. This provides an immediate injection of funds, but you will no longer generate returns from interest rates. This is different from sales by your fund manager as you are the one that makes the decision.

Types Of Mutual Funds

There are 4 main types of mutual funds:

- Bonds – These mutual fund schemes involve investing in government or corporate bonds. With those made up of bonds, the aim is to generate returns from the interest, which are then paid out to the investors of the fund every year.

- Stocks & Shares – Many mutual funds invest in stocks from a range of companies. For instance, brokers offer funds that track indices such as the FTSE 100 and the S&P 500. You can find stocks and shares mutual funds that carry a range of risk levels. However, products made from equities typically carry a higher risk than other funds.

- Money Market – Money market mutual funds are low risk and typically lower cost where investments are in short-term debt, rather than equities or bonds. The debt comes from bodies such as governments and companies that have strong credit ratings. Payments to shareholders then come from interest.

- Target Date – These mutual funds are often a hybrid, formed of both bonds and stocks. Generally, they have a target date in mind, for instance, retirement in 2040 or 2050. They provide a way for people to invest with a long-term view and a final date in mind. The proportion of the fund made up of bonds and stocks can vary over time.

Note, the best brokers for mutual funds offer thousands of different products. Firstrade, for example, has 11,000+ mutual funds available through its advanced screener. Other well-known providers include Fidelity, BlackRock, Charles Schwab, and JP Morgan.

Firstrade Screener

How To Start Investing In Mutual Funds

- Establish your list of investment objectives. This might include average returns over a given time frame (short-term vs long-term gains) while taking into account your risk appetite

- Research and find the mutual fund(s) that is suited to your goals

- Register for an account with a mutual fund provider

- Complete an online KYC form and submit it to the customer service team

- Login and deposit funds into your account

- Begin investing by purchasing units of the mutual fund(s)

- Monitor your positions and make any adjustments if necessary

Risk Appetite

A big part of deciding how to trade mutual funds involves determining your risk appetite, which is how much you are willing to lose for a given reward. Keep in mind that even lower-risk funds still carry risk and you should be wary of any brokers with mutual funds that claims to guarantee a fixed income or high returns over a set period. No investment is guaranteed to increase and there is always a chance of a decline in a fund’s value.

A common measure that is used to evaluate risk level is the Synthetic Risk and Reward Indicator (SRRI). This is a grading system using a one to seven scale to measure the volatility of a mutual fund investment. It was launched in 2009 by the Committee of European Securities Regulators and many of the best mutual fund brokers use it. The grading of one means the lowest risk and typically the lowest returns. A seven means the investment has the highest risk but comes with the potential for higher returns.

Time Frame

When comparing investments and risk appetite, you also need to think about whether you want to focus on short-term gains or on returns that will only be realised in the long term. The desire for higher gains in the short-term will likely mean you need to accept a greater level of risk. If you are interested in investing on an ultra-short-term basis such as day trading, you may be better off seeking other investments such as ETFs.

How To Compare Mutual Funds Brokers

Fees & Prices

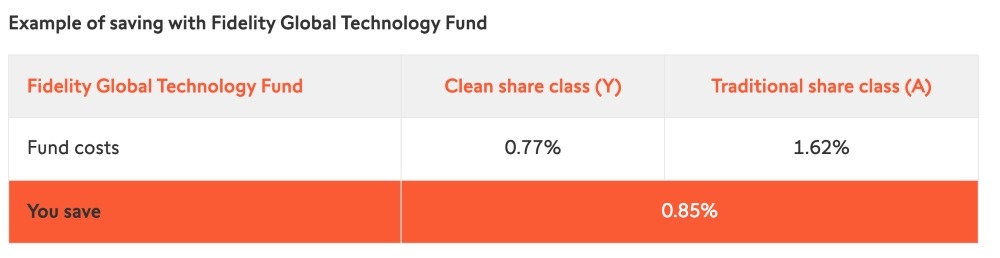

One of the most important factors is the mutual fund broker’s fee structure, which will affect your profits. One of the most common fees is the ongoing charge percentage that is paid on an annual basis. This ongoing charge will vary depending on the broker you choose and the asset you invest in.

You should also be aware of any initial charges for buying into a fund, exit charges for selling your position and any performance premiums. If there are no fees for buying or selling a position, the mutual fund is ‘no-load’.

A good way to determine the impact of fees is by using a calculator to determine the expense ratio. This does not account for returns but rather the fees and average NAV.

Alternatively, opt for the best brokers for mutual funds, such as Swissquote, which offer fee savings:

Investments Options

When comparing brokers with mutual funds, research the products that you can invest in. The best brokers will offer a variety of funds, with time frames ranging from short, medium and long-term. When evaluating the different products, also consider the minimum initial investment to ensure you can open a position.

For instance, the UK Mid Cap Fund provided by Franklin Templeton has a minimum investment size of £1,000,000. On the other hand, their UK Smaller Companies Fund which is focused on small-cap companies has an investment size of only £1,000. Each broker will have a full list of all mutual funds on their website – read the contract specifications to have the investment details explained.

Regulation

Ensuring a mutual fund broker is regulated is one of the best ways to determine if it can be trusted with your money. When dealing with brokers as a UK investor, check to see if they are certified by the Financial Conduct Authority, the UK’s financial regulatory body. You can validate that a broker is regulated by confirming that its name and license number appear on the FCA’s registry.

One of the key benefits of a broker being regulated by the FCA is that clients can claim up to £85,000 through the Financial Services Compensation Scheme if the brokerage becomes insolvent.

Pros And Cons Of Mutual Funds

Advantages

- They allow clients to generate a passive income, as investments are managed by experts

- Exposure to multiple sectors based on recent news, including commodity, energy and utility

- Mutual funds are diversified investments that can offer reduced risk exposure

- They offer high liquidity and therefore can be easy to buy and sell

- It is generally easy to learn how to buy mutual funds

- Some mutual fund brokers allow partial investments

- You can apply for a loan against your mutual funds

Disadvantages

- Not a viable option for many short-term traders due to the fee structure and because trades only occur once a day before a cut-off time

- Some mutual funds have high minimum investments, making them inaccessible to many investors

- High premiums for having someone manage your mutual funds

Tax Considerations

Profits that you generate from investing in mutual funds can be liable for taxation. In the UK, these profits usually come under capital gains, which are treated separately from normal income tax.

For instance, at the time of writing, the capital gains tax-free allowance is £12,300, meaning that any profits you generate up to £12,300 are untaxed. Anything greater than this threshold is taxed, however, the amount you are taxed depends on the size of your gains and whether you pay basic, higher or additional tax rates.

If you are unsure about how much tax you should pay on your mutual funds, check the UK government website or seek support from a professional tax advisor.

Bottom Line On Mutual Funds

Mutual funds are suitable for those seeking a more hands-off approach to investing. There are many different types of mutual fund products and providers, so investors have ample choice to diversify their portfolios.

However, mutual funds typically come with higher fees then other investments such as index ETFs, spot trading stocks and derivatives. Mutual funds also often require a high minimum investment.

See our list of the best mutual fund brokers to find a provider with top performing funds.

FAQ

What Is The Best Mutual Fund Broker?

There are various mutual funds to choose from, so there is no single answer. There are many leading mutual fund brokers, such as Firstrade and Swissquote. Alternatively, head to our full list of brokers with mutual funds.

How Do I Choose The Top Mutual Funds To Invest In?

There are various ways to determine which mutual fund is the best for you. While past performance cannot be relied on as an indication of future yield, you can analyse returns over a set period. This could include, for example, the average returns over the past 10 years.

You can also consider what risk level grading the fund is given, as well as moral reasoning such as the ESG rating of the companies in the funds. To help with your research, you can use a mutual fund screener.

Are Mutual Funds A Good Investment?

Mutual funds can be good to invest in. There is the potential for high yield in each fund regardless of the risk level. For instance, they can be features of an ISA for tax saving. However, these returns cannot be guaranteed and there is a chance the price of the holdings go down rather than up. Even so, these products allow clients to invest in the best small-cap, mid-cap and large-cap stocks in international markets.

Do Mutual Funds Pay Dividends?

Yes, you can find stocks and shares mutual funds that pay dividends from growth. Many providers will pay out every quarter made up of companies from a range of sectors in the UK. Be careful not to overlap, however, as many funds focus on companies and stocks that are part of the FTSE 100 and FTSE 250.

Can I Use SIP To Invest In Mutual Funds?

Yes, a systematic investment plan (SIP) is a viable option for investing in mutual funds. A SIP works by having regular payments into a fund to continue increasing the number of units that you hold. To determine how much you could invest from your other income streams, you could use a SIP calculator. It is also worth searching around to find the best mutual funds for a SIP.