BP Prime Review 2025

|

|

BP Prime is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to BP Prime |

| BP Prime Facts & Figures |

|---|

BP Prime offers MT4 trading with fast executions and a mobile app solution. |

| Awards |

|

|---|---|

| Instruments | Forex, CFDs, indices, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $5000 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | Invest in online CFDs with 1:30 leverage. |

| Leverage | 1:30 |

| FTSE Spread | 1.0 |

| GBPUSD Spread | 1.4 |

| Oil Spread | 3.8 |

| Stocks Spread | N/A |

| Forex | Trade two-dozen+ FX pairs with low spreads. |

| GBPUSD Spread | 1.4 |

| EURUSD Spread | 1.4 |

| GBPEUR Spread | 1.4 |

| Assets | 27 |

| Stocks | Trade 10 well-known indices including the FTSE 100. |

| Cryptocurrency | Trade cryptocurrencies with 1:10 leverage. |

| Coins |

|

| Spreads | BTC, LTC, ETH, XRP |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

BP Prime is a UK-based forex and CFD provider operating since 2013. The broker is regulated by the Financial Conduct Authority (FCA) and offers a range of accounts to suit every investing style. This review covers the most important aspects of the firm for new and experienced speculators. Read on to learn about deposits and withdrawals, spreads and commissions, supported markets and whether the platform offers a mobile app.

About BP Prime

BP Prime has offered CFD trading services to retail and professional clients from its London headquarters for almost a decade. Formerly known as Black Pearl Securities Limited, the award-winning broker is regulated by the FCA and operates across Europe, Asia and South America, as well as domestically in the UK.

As a non-dealing desk (NDD) firm, BP Prime makes its money from commissions and spread mark-ups. It passes trades on to liquidity providers through ECN or STP execution, rather than taking positions against its clients.

Markets

BP Prime offers three markets to UK clients: forex, indices and commodities CFDs. While the global brokerage supports Bitcoin and Ethereum CFDs, the broker cannot provide cryptocurrency derivatives to UK traders due to FCA regulations.

Forex

Clients can access over 40 currency pairs through the MetaTrader 4 (MT4) platform and several additional forex markets using a FIX API. This fairly solid selection of assets includes major, minor and exotic pairs.

Spreads on major pairs start from 1.4 pips on the Standard ECN account, 0.0 pips through the Prime ECN account and 0.6 pips on a Pro STP account.

Indices

Fourteen major global indices are available through BP Prime, including the UK FTSE 100, US S&P 500 and Australian AUS 200. Unfortunately, no futures or exotic indices are supported, such as the VIX 70 or US Dollar Index.

Indices are subject to a minimum trade size of 0.1 lots and spreads are competitive.

Commodities

Commodities investors will be disappointed to discover that BP Prime only offers four commodities assets: UK (Brent) Oil, US (WTI) Oil, gold and silver. Minimum lot sizes stand at 0.01 lots.

Leverage

Due to the FCA regulation of BP Prime, the leverage available to retail clients is far more limited than many offshore CFD brokerages. Professional clients can access margins of up to 1:200, while retail clients are only offered the following:

- 1:30 – major forex

- 1:20 – minor & exotic forex, major indices & gold

- 1:10 – minor indices & other commodities

To protect retail clients from significant losses, FCA regulated brokers must also close out client positions at a 50% margin call rate.

Account Types

Customers can opt for STP and ECN execution-style accounts to suit their investing needs, with the option of zero commission or tight spreads.

The first account option is the BP Prime standard account, which requires a £100 minimum deposit. With no commission and fast STP execution, this account is ideal for beginner or low stakes traders. All speculation styles are supported, including scalping and hedging, and trade sizes start from 0.01 lots. However, standard account clients must face fairly uncompetitive spreads starting from 1.4 pips.

The BP Prime Pro account requires a £1,000 initial deposit but rewards clients with lower STP spreads from 0.6 pips. In addition, pro account users can access the FIX API for additional markets and ultra-fast trade execution.

Traders who favour the ultra-low spread ECN execution style can open a Prime account, with spreads starting from 0.0 pips. The broker levies competitive commissions of £3 per lot per side but requires a 0.1 lot minimum trade size and a hefty £10,000 initial deposit.

Unfortunately, BP Prime does not offer a swap-free Islamic account to investors who cannot pay interest due to their religious beliefs.

Demo Account

Many broker reviews highlight the importance of a demo account and for good reason. Demo accounts allow clients to preview the trading conditions of a broker before committing to a live account or refine trading strategies with no risk.

BP Prime offers access to a free demo account for its MT4 platform, providing prospective clients with a login to its dedicated paper trading server.

Trading Platforms

BP Prime clients are only offered one trading platform: MetaTrader 4. Popular amongst forex traders the world over, MT4 has proved a capable and reliable platform since its release in 2005.

As well as the nine standard timeframes and thirty technical indicators, MT4 excels in user customisability. Clients can download thousands of custom indicators and expert advisors from the MQL4 marketplace or create their own trading tools from scratch.

MetaTrader 4

MetaTrader 4 is available to download for Windows, Mac and Linux systems and has the advantage of running on even the most modest machines due to its low system requirements.

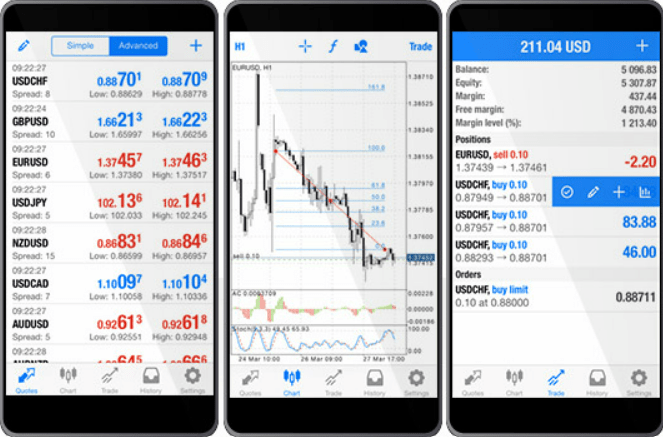

Mobile Apps

An increasing number of traders are using mobile apps to monitor and edit their positions on the go. BP Prime users can take advantage of the MT4 mobile app, available on Apple (iOS) and Android (APK) devices, to invest wherever they are. However, as the MT4 platform does not support deposits and withdrawals, funding must be done via the broker’s desktop or mobile site.

MT4 Mobile

Payment Methods

There is very little on the BP Prime site concerning accepted payment methods for deposits and withdrawals, which may make some potential clients question this lack of transparency.

However, this review can confirm that the broker accepts various payment options, including bank wire transfers, credit and debit cards, Skrill, Neteller and Union Pay. Transactions are available in GBP, EUR and USD, catering to the firm’s global client base.

The minimum initial deposit required to open a new account ranges from £100 to £10,000. However, there is no information regarding minimum deposit or withdrawal amounts for subsequent transactions.

Deposit & Withdrawal Fees

UK account holders are free from deposit or withdrawal fees on any supported payment method, with BP Prime covering Skrill and Neteller transaction fees. However, bank wire transfers may be subject to third-party bank processing fees of up to $25.

Trading Fees

Many investors view trading fees and commissions as one of the most important factors when picking a new broker. BP Prime is highly competitive here and rewards clients with spreads as low as 0.6 pips on the zero commission Pro account and commissions of only £3 per side per lot on the raw spread ECN Prime account.

Swap fees for holding positions overnight vary depending on the market and type of position. Traders can find overnight rates on the MT4 trading page for each instrument. The broker charges no inactivity or other fees on its trading accounts.

Security & Regulation

Many fraudulent companies exist to try and scam traders out of their funds in the forex and CFD industry. Thankfully, BP Prime clients have the assurance of a tier-1 regulator, the FCA, to protect them from broker insolvency or wrongdoing. Client funds are held in segregated bank accounts and protected by the Financial Services Compensation Scheme (FSCS), covering capital up to £85,000.

Two-factor authentication (2FA) provides enhanced account security to traders, requiring a one-time code to verify a client login. While some reports claim that the firm offers this feature, this broker review could not verify this.

Customer Support

A significant advantage of the BP Prime brokerage is access to 24/6, UK-based customer support. Clients can contact the team by phone, email, live chat or even by writing to the UK head office in London to submit a query, complaint or request for a free call back.

- Phone Number: +44 (0)20 3745 7101

- Email Address: support@bpprime.com

While many online brokers provide an FAQ and help section, this firm’s website lacks either section. This means that clients must either contact support or search online for an answer to their query.

Educational Content

BP Prime provides clients with a significant amount of education and analysis via its website, in addition to a section on staying safe while trading. However, the provided articles lack a cohesive structure to help new investors not be overwhelmed, as well as format diversity, not offering the likes of video or podcasts.

Nevertheless, there are several articles on forex trading strategy, understanding indicators, general market overviews and the dangers of unregulated brokers for investors to read.

Advantages Of BP Prime

- MT4 access

- FCA regulated

- FSCS compensation

- STP & ECN execution

- Competitive pricing structure

- Free deposits and withdrawals

- 24/6, UK-based customer support

Disadvantages Of BP Prime

- Low leverage limits

- No stocks or cryptos

- No promotions or bonuses

- Limited information on website

- Large initial deposit requirements

Promotions

The online forex and CFD broker space is highly competitive. Many providers use promotions and bonuses to tempt new traders to their platforms. However, due to FCA regulation, BP Prime offers no such promotions or trading rewards to either new or existing clients.

Additional Features

Most competitive brokerages enhance their clients’ trading experiences through additional features that give users the best chance of success in the markets. These often include economic calendars with key upcoming events, free VPS servers for frequent traders and calculators to preview potential positions.

Unfortunately, BP Prime offers none of these helpful add-ons, with its only notable additional feature being FIX API access for professional traders.

Trading Hours

The BP Prime trading hours run 24/5 alongside the forex market, though availability for indices follows local exchange hours. The client login portal is available 24/7 and investors can view account statistics or make deposits and withdrawals at any time.

BP Prime Verdict

BP Prime is a reliable broker that provides FCA regulated CFD speculation to UK-based clients. With a local help team that is available 24/6, MT4 trading platform support and the choice between a zero-commission STP and low spread ECN account, this broker should fulfil the needs of most investors. However, high minimum deposit requirements and the lack of share, crypto and soft commodity CFD s may mean some traders have to look elsewhere.

FAQ

Is BP Prime Regulated?

BP Prime is regulated in the UK by the Financial Conduct Authority (FCA). Furthermore, client funds are protected by the Financial Services Compensation Scheme (FSCS) for up to £85,000.

Does BP Prime Have A Mobile App?

BP Prime customers can trade on the go through the MetaTrader 4 (MT4) mobile app, available on iOS and Android devices. However, investors must carry out account management tasks such as deposits and withdrawals through the broker’s desktop or mobile site.

Is BP Prime A Good Broker?

As a reputable and regulated firm, BP Prime is judged positively in most review categories. However, high minimum initial deposits and limited assets may give some prospective clients pause.

Does BP Prime Offer Promotions Or Rewards?

Due to FCA restrictions, BP Prime does not offer clients any financial rewards, such as a welcome bonus or high volume commission rebates.

How Many Forex Markets Does BP Prime Offer?

Over 40 currency pairs are available to retail clients using the BP Prime MT4 platform, consisting of a solid range of major, minor and exotic forex instruments.

Top 3 BP Prime Alternatives

These brokers are the most similar to BP Prime:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

BP Prime Feature Comparison

| BP Prime | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| Rating | - | 4 | 4.7 | 4.8 |

| Markets | Forex, CFDs, indices, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $5000 | $1,000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

||

| Review | BP Prime Review |

Swissquote Review |

IG Index Review |

Pepperstone Review |

Trading Instruments Comparison

| BP Prime | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

BP Prime vs Other Brokers

Compare BP Prime with any other broker by selecting the other broker below.

Popular BP Prime comparisons: