Compare Bond Trading Accounts and Brokers

Bonds have been around for a long time but it is only more recently that they began to be more widely accessible to and popular with private investors in a greater variety of forms. Older generations of investors may have bought government bonds, or gilts, as an alternative to putting cash into a savings account but likely have been largely unaware of corporate bonds, let alone inclined, or able, to invest in them. Gilts are a low-risk (at least those issued by countries with a strong credit rating and stable political environment like the UK), relatively low return investment. But there are now a wide variety of different kinds of bonds offer different risk and return levels.

Bond Trading Brokers

-

CMC Markets offers an excellent selection of 50+ government bonds and interest rates with spreads as low as 1 point. Traders can take advantage of the broker’s exclusive market insights and pattern recognition scanner to level up their bond trading strategy. Plus, high-volume traders can earn spread discounts of up to 21% on treasuries in the CMC Price+ scheme.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

IC Markets offer trading on 9 bonds with deep liquidity and excellent pricing. The broker also stands out by offering very high leverage up to 1:200, alongside access to leading charting platforms MT4 and MT5

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, FSA, CMA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

IG maintains a top 5 position in our ranking for its flexible and diverse bond offering. Traders can invest in global bond futures and ETFs via CFDs, share dealing or spread betting, with competitive spreads from 1 point. Serious traders can also explore correlated interest rate products and enjoy additional investment benefits such as dividend coupons.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

IC Trading offers 9 bonds with long/short opportunities through CFDs with leverage up to 1:200. Government bonds are available in major countries, including United States, Japan and Europe.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures FSC MT4, MT5, cTrader, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:500 -

You can trade bonds at eToro by investing in ETFs and its YieldGrowth Smart Portfolio. Simple to navigate, they offer the advantages of fixed-income products with one-click access.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Trade Nation offers a handful of popular bond futures on their proprietary TN Trader terminal. The 1:5 leverage, low fixed spreads and $0 minimum deposit make Trade Nation ideal for beginners looking to start trading bonds easily. There are also some decent analysis tools available, including a signal centre to help uncover bond market opportunities.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Available on both MT4 and MT5, Vantage’s bond products cover a range of government and corporate markets. You can speculate on rising and falling prices with as little as 1 lot. There’s also an excellent range of educational materials and market analysis tools for those looking to elevate their short-term strategies.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

City Index remains a top choice for bond CFD traders, thanks to its commission-free pricing model and competitive spreads from 0.02 points. There’s a wealth of bond market news and analysis to utilize, including the Trading Central dashboard. Beginners can also get started easily with no minimum deposit, or experience the bond market risk free in the 12-week demo.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting FCA, ASIC, CySEC, MAS Web Trader, MT4, TradingView, TradingCentral Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Spreadex offers spread betting and CFDs on 19+ global bonds and interest rates, including the Japanese Government Bond and Euribor futures. Spreads start from 2 and leverage is available up to 1:30. Beginners and seasoned traders can elevate their bond trading strategies using best-in-class platform features, including integrated macro data and advanced order types.

Instruments Regulator Platforms Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting FCA Spreadex Platform, TradingView Min. Deposit Min. Trade Leverage £0 £0.01 1:30 -

VT Markets remains a popular choice for bond traders looking for zero commissions and low spreads. You can trade popular products like the Bund and UK Long Gilt futures CFDs with quotes as low as 0.4 pips, plus competitive leverage up to 1:100. The broker has also partnered with Trading Central to deliver the market-leading ProTrader tools - perfect for serious bond market analysts.

Instruments Regulator Platforms CFDs, Forex, Commodities, Stocks, Indices ASIC, FSCA, FSC VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral Min. Deposit Min. Trade Leverage 50 - 500 USD 0.01 Lots 1:500

What is a Bond?

Bonds are essentially debt-issuances offered by governments, companies and other organisations. They are often compared to IOUs. When a company wishes to raise finance it can do so either by selling equity in the company, issuing shares, or by selling debt, issuing bonds. Governments and other organisations which can’t offer ownership stakes are restricted to bonds. Generally speaking, bonds have a very simple structure. You have the bond’s issuer, which is borrowing money. The bond’s coupon is the interest on the loan that the borrower agrees to pay and the maturity or redemption date is when the borrower returns the loan. Interest payments are made either annually, bi-annually or quarterly depending on the conditions of the bond.

Most bonds have fixed maturity dates and coupons but there are bond varieties where the coupon is linked to inflation or the maturity date is within a range and the issuer can choose at which point within the starting and closing date of that range to redeem the bond’s face value.

Many, though not all, bonds can also be traded on bond aftermarkets. Here, like in the case with equities, their face, or par, value, can rise or fall depending upon market conditions and the supply and demand for the bond type. A bond initially issued with a par value of £100 might change hands on the aftermarket for £110 or £90. At the bond’s maturity date whoever is currently the holder will receive the original par value, which could result in a profit or loss if the bond was purchased on an aftermarket at a different price.

Kinds of Bonds

Gilts/Government Bonds

These are issued by governments to fund public spending. When you hear about a country’s ‘national debt’ this is in large part made up of the unredeemed bonds it has in circulation; held by banks, financial institutions, other countries and private investors. Government bonds can be traded on exchanges with their value fluctuating up and down with interest rates and the country’s credit rating as assigned by the major ratings agencies. Interest rates offered on gilts are higher or lower depending on the perceived stability of the country’s finances. Countries such as the UK, the USA and Germany will offer relatively low interest rates on gilts issued as the risk of default is considered to be minimal. Countries experiencing economic troubles, Greece being a recent example, will have to offer far higher returns to entice investors to lend to them through buying their bonds.

Government bonds can offer fixed interest rates or variable rates linked to a defined index (such as the UK Retail Prices Index). They can also be fixed term meaning that the value of the bond is returned to the bond holder at a pre-defined date or within a range between two dates. Undated bonds, referred to as perpetuity bonds, also exist. In the case of these bonds the government may or may not buy the debt back at a time of their choosing. The latter variety is now rare and most retail investors will anyway stick to bonds with a fixed or ranged maturity date.

Retail Bonds

Retail bonds are offered by companies and are intended for retail investors. They can generally be bought in relatively small increments, of £1000, or less in some cases. These bonds are listed on an exchange, the London Stock Exchange’s Order Book for Retail Bonds (ORB) in the UK, and can be freely bought or sold before their maturity date. While the buy-back price will be the same as that of the initial purchase price, exchange-traded values will fluctuate to some extent based on interest rate expectations and the perceived risk of the issuer defaulting.

Mini Bonds/Corporate Bonds

Like retail bonds, corporate or mini bonds as they are now often referred to are also issued by companies. The primary difference to retail bonds is that these bonds are not listed on an exchange and so their value cannot be redeemed before their redemption date, though they do sometimes provide the option of earlier redemption at set junctures throughout their lifetime. There is often some level of penalty, commonly between 5% and 10%, if the holder chooses to redeem the bond earlier in its intended lifetime.

Conditions attached to the issuance of mini bonds can vary greatly. Mini bonds are becoming an increasingly popular way for SMEs to raise finance. As with all bonds, the risk to the investor is in the issuer of the bond defaulting due to insolvency or being able to meet interest payments as a result of cash flow difficulties.

As corporate bonds are issued by such a wide variety of companies, investors must carefully assess the chances of the issuer being unable to meet the bond’s terms. As such this kind of bond is only open to sophisticated and high net worth investors who are presumed to be able to make a calculated risk assessment.

Asset-backed Securities

These are bonds whose values are tied to a private pool of assets that are not readily convertible to cash. Under this category of bonds, a trust that takes ownership of the assets is established and the bond owners are assigned stakes in this trust through which they can monetise any interest payments on the bond. Various types of assets (e.g. mortgages on real estate) can be used to back up the bonds. Some of these are real estate.

Convertible Bonds

Convertible bonds are debt securities which, as the name of this bond implies, can be exchanged for ownership of stock.

Retractable/Extendable Bonds

These are bonds which traditionally pay a lower rate on the bond, but which do not have a fixed maturity. As the name implies, bond holders have the option of extending the maturity of a short term bond (extendable), or reducing the maturity of a long-term bond. This flexible maturity option is what makes this category of bonds attractive to investors.

Foreign Currency Bonds

These are usually foreign bonds that are issued in a different currency other than the currency of the bond buyer. These bonds are peculiar in that their valuation is subject to the vagaries of currency exchange rate fluctuations.

High Yielding Bonds and Junk Bonds

What used to be known as “junk bonds” are high yield bonds issued by entities with a higher risk of default. Under the ratings regime of the credit ratings agencies, these bonds are below investment grade. Presently, the bonds of some European companies located in some of the sovereign debt trouble spots are very close to being rated junk bonds. As a rule, the higher the risk of default, the higher the yield (or interest payable) on that bond.

Bonds as Part of an Investment Portfolio

Numerous studies have demonstrated that diversified investment portfolios that have exposure to different asset classes perform better over the long term than less diversified equivalents. Diluting exposure between asset classes, such being part equities and part bonds and possibly also holding some cash and possibly gold allows a portfolio to generate comparable returns at lower risk or better returns at the same risk level. It’s also important to have good diversification with an asset class, so funds should be spread between a good selection of different equities, bonds or other alternative investments.

Equities are generally considered as a higher risk allocation in an investment portfolio, though there can be a significant risk range within equities, from fairly low to high. Their role is to provide growth and income through dividends.

Bonds, though a range of risk profiles is also available and higher risk bonds could potentially be considered riskier than some very low risk equities, are generally considered to be a stabiliser in an investment portfolio. They, minus the risk factor of default, offer a guaranteed level of return, from the coupon, and guaranteed redemption price.

Equities vs. Bonds

The strength of equities and the downside to equities, in almost equal measure, is that it is close to impossible to accurately predict the returns the investment will yield. Yes, you can pick a winner and make 20% almost overnight but you can equally as easily pick a dud that plummets in value. Big blue-chips tend to be less volatile and can offer income from dividends but these companies also regularly gain and lose big chunks of value over the course of months and years. Professional and private investors alike combat this volatility by building diversified portfolios. However, as a result, gains tend to be a modest average of somewhere around 5% for well-balanced portfolios with a very small number of equity investors, professional or otherwise, consistently beating the market. It’s certainly possible to outperform the return on investment offered by most bonds through equities but all historical evidence points to this being hard to achieve for most. A strength of equities over bonds, however, is that holders can realise both income from dividends as well as capital gains if the value of the equities rises.

Bonds typically offer fixed interest returns, meaning that the investor knows exactly what return on investment they will realise from the investment. This tends to sit within a range of 3% to 9% for corporate depending on the market’s perception of the level of risk of default. Government-issued bonds, because of the low risk level, offer lower coupons.

Exchange-listed bonds can also increase and decrease in value depending on demand, though the typical extremes of fluctuation are generally far tighter than is the case for equities. This is because the returned value at the point of maturity does not change from the original purchase price.

Bond Funds

Potential risk involved in bonds can be offset by investment in an ETF or investment fund that diversifies risk between a range of bonds. These might hold bonds from the same or similar categories but with a range of maturity dates or diversify between corporate bonds with different risk categories like an equities fund that mixes holdings between large, mid and small-caps.

The Role of Fixed Income Bonds in a Diversified Portfolio

The primary challenge of putting together a balanced portfolio is that there are many options, not only equities, that offer the possibility of income (dividends in the case of equities) and potentially strong capital gains. However, they also come with the price of increased downside risk when things go wrong.

Equity investment strategies that target beating the market will also usually lead to underperforming the market when it hits a downturn. This leads to returns being worst right at the point when the market is weakest.

High quality corporate and government bonds on the other hand benefit from safe-haven status and a ‘flight to quality’ influx of capital when market conditions are poor. For example, when the great financial crisis hit Wall Street in 2008, equities lost an average 36% across the board. US 10 Year Treasuries (the US equivalent of gilts) rose by 20%. In the UK that year, where equities lost 28.3%, gilts, while not surging like US Treasuries, held and didn’t see returns move into negative territory.

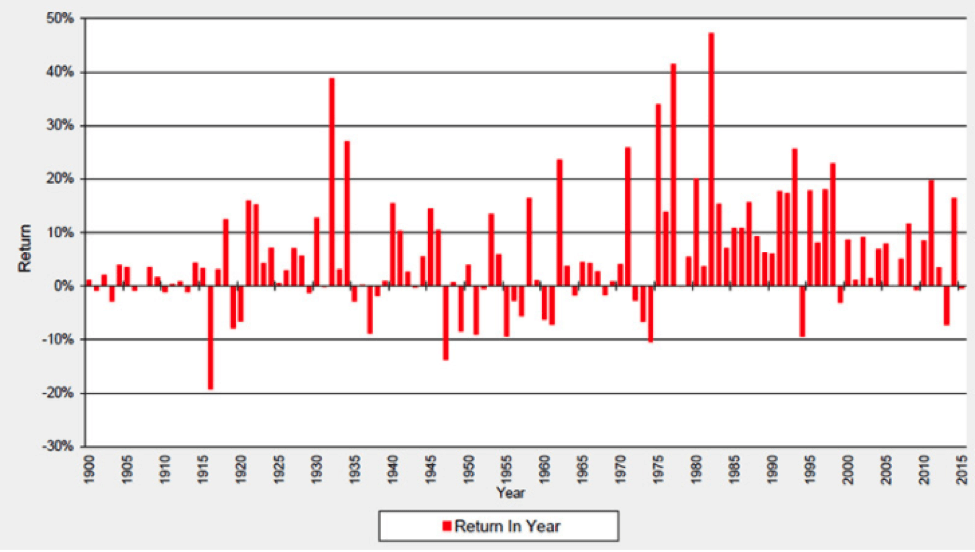

UK Gilt Nominal Returns Since 1990

Source: Barclays/COURTIERS

Bonds do normally rise when equities are going through a rough patch and generally show far lower volatility than equities. This helps level portfolio returns and helps investors maintain their course and reach long term investment prospects.

The stabilising effect of bonds is particularly valuable for investment portfolios with shorter time horizons. In this case the investor may not be able to afford the luxury of waiting out a downturn or crash in equities markets. For this reason, pension fund managers tend to defensively rebalance investment portfolios towards an increasingly greater weighting of bonds the closer to retirement the pension holder gets.

Even for investment portfolios with a longer time horizon the stabilising impact of bonds is also important and it has been repeatedly shown how a foundation holding of bonds reduces risk and helps a portfolio perform better over its lifetime.

Reasons to Invest in Bonds

Many people underestimate the power of bond investments and think it is for lazy investors who are not ready to take risk. But the truth is that bond investments are heavily misunderstood, and here we will give out 7 reasons why those with some money to spare should consider investing in bonds.

Safety and Security

Except for Greece, Spain and a few other countries teetering on the edge of bankruptcy, government bonds provide the safest and surest form of investment. Most of the world’s governments are fully solvent and so a trader can decide to purchase a government bond knowing fully well that he will get the returns on his investment paid in a timely manner. Even if the trader has lost the proof of his bond purchase (i.e. his bond certificate), it is still possible to trace the bond purchase and pay the trader his full entitlements as far as the bond investment is concerned.

Good Returns

If you are thinking of investing in a country like the US or Japan where interest rates are slightly above zero, this is simply not going to work in terms of returns. But if you live in a country with inflationary pressure and the central bank of that country maintains high interest rates, then investing in bonds will give you wonderful returns on investment. Take a country like Nigeria for instance, which offers an interest yield of 13% on its 30 day bond and 13.68% on the 364 day tenor. If you invested $5,000 on the 364 day bond, that would yield an interest of $6,840. This bond market easily outperforms any stock market in the US. Best of all, you can actually purchase this bond on the JP Morgan Index where it was recently listed. There are other countries with high interest rates such as Ghana (15%), Belarus (30%), Venezuela (16%), Mongolia (13.25%) and Kenya (13%).

Predictability of Earnings

Bonds are one form of investment where there is predictability in the timing of payments as well as the amount to be earned in interest. As long as the credit rating of the bond issuer is ok and is a true reflection of the financial status of the issuer, the predictability of the earnings from bond investments will not be in doubt.

Ease of Investment

It is easy to get started investing in bonds. There are no charts to analyze, no news reports to trade and no complicated methods of executing trades. To buy a bond, all you need to do is to get in touch with your bankers and they will handle all the complicated paperwork and processes for you. Bond investments can be done by the average Joe on the street.

Retirement Investment

Bonds represent an investment which has a safety profile that is suitable for those close to retirement. As people get older and closer to retirement, the window of opportunity for a recovery after a bad investment narrows, so the level of risk that they can safely assume is dramatically and irreversibly reduced. As such, they will need safer and more guaranteed investment vehicles to put whatever money that they have been able to save over the years. This is where a fixed and guaranteed income investment like bonds come in.

Invest in your Country and Government

The UK government may decide to float bonds in order to raise money to balance the budget. So by investing in your country’s bonds, you are indirectly contributing to the betterment of your own future. This may not seem so obvious, until you look at it in the context of this example:

The government is looking at ways of expanding the housing market, and part of the plan is to build rail lines through which cement and other building materials can be transported from the point of production to the point of sale at a much cheaper price than by road transport. Your government decides to float a bond to finance this project. When you and several thousands or millions of citizens purchase this bond, your government will have the funds for the project, and you or other citizens will have access to cheaper housing.

How to Choose a Broker or Investment Professional

This is the starting point of your bond investing career. Unlike forex trading or other trading types, bond investing is not an endeavour that you should get into alone. It is best to use a financial advisor who clearly understands the issues pertaining to bond investment. You will need to choose a broker. There are two types of brokers that are available for bond trading. The full service brokers are better suited for institutional and high net-worth investors, as their services come at a premium which may not be available for individual investors. Full service brokers provide ‘full services’ ranging from investment advice to active portfolio management and personalised services. Individual investors can use the discount brokerage firms that do not provide most of the services that full-service brokers offer. There is also the option of using an online brokerage firm.

In choosing a broker, you need to choose one whose interests will not compete with yours. You need to know if you can get access to the kind of bonds you want through your broker. You need to know how much you are paying in fees. Above all, you also need to make sure that the broker you are using is licensed to deal in the bonds market. Beware of third-party brokers. They are basically marketers and going through them will increase your fees as you will bear the cost of their compensation.

When choosing a financial advisor to work with, such a person must be licensed as such and must be able to show you a track record of performance with other clients.

Bond Buying Considerations

When you have got a suitable broker, the next step is deciding how to invest in the bond market. This is where you answer the following questions:

a) What kind of bonds should I buy for my risk profile? Those who want to take some bigger risk can decide to invest in higher-yielding bonds, or bonds that are assembled as a mixed portfolio.

b) How much money do I have to invest? This point will determine where to piut your money as many bonds have minimum investment amounts attached.

c) How long can I afford the bond investment? Can I afford to keep my money in a 10 –year bond, or would I need to use some money in 5 years? Generally, those who have plenty of free cash or are looking for a safer way to keep away money for the long term can decide to buy bonds with longer maturity dates.

d) A very important consideration would be to consider your age and how many years of working life you have left. Those closer to retirement should not trade bonds with higher risk.

In essence, the answers to these questions would determine your investment goals, and this would serve as a guide for your bond investments.

When investing in bonds, you can buy the following forms of bonds:

a) Individual bonds

b) Bond unit trusts: These are trusts in which a mixed portfolio of different types of bonds are assembled into a single investment vehicle.

c) Money market bonds which are actually investments in short term securities that have been pooled together into individual bond investment portfolios. Maturities are much shorter (about three months) and the bonds are highly liquid, allowing traders to cash out easily.

Strategies for Bond Trading

For most bond investors who move into bonds because of the relative safety of this investment vehicle, the essence of bond trading is first to preserve capital, and then to get interest payments. To achieve this, the bond would have to be held to maturity. The maturity period chosen will depend on the investor’s goals. Buying and holding a bond until maturity is a strategy that must be deployed carefully. For instance, if the bond investor has invested in several bonds, it is better to create a portfolio where each bond has a different maturity. Such “laddered” portfolios should consist of a bond maturity for the long term (10 years) and probably one or two short term and medium term maturities (one year or five years). That way, the principal becomes available for re-investment. If at the time of the re-investment, the government has raised interest rates to combat inflation, then any bond investment done at this time will bring in higher interest yields. This style of investing in bond with short, medium and long term maturities is known as a ladder investment. Another type of a buy and hold bond investment strategy involves using only long term and short term maturities. This is known as the barbell strategy.

For investors who are not interested in the buy and hold strategy, there are certain bonds which are “callable”, i.e. which can be sold before maturity. However, interest yields on the bond are typically lower.

Bond Investing Considerations

When investing in bonds, the following special considerations must be brought to play to protect the investment as much as possible.

a) Diversify bond investments. A diversified bond investment spreads out the risk. You can choose a bond from different issuers, or bonds in different asset classes, or use a ladder/barbell investment model.

b) Always investigate the credit-worthiness of the issuer to avoid risk of default.

c) Take note of the yield-to-maturity and yield-to-call rates.

Bond investing will work for you if you stick to what has been discussed in this piece.

Premium Bonds

A premium bond is a loan note to the British government. When you buy a premium bond, you are lending the government £1, which it promises to repay you upon demand. In other words, you are guaranteed to get your capital back.

A premium bond is a loan note to the British government. When you buy a premium bond, you are lending the government £1, which it promises to repay you upon demand. In other words, you are guaranteed to get your capital back.

Premium bonds don’t pay an interest rate, but rather they pay out prize money to the holders of bond numbers selected in a monthly draw. The top prize is £1 million and the lowest value prize is £25.

Each month all premium bonds that have been held for at least one full calendar month are entered into the draw, and winning numbers are picked out by a machine called the electronic random number indicator equipment, or ERNIE for short.

The amount that is paid out in winnings depends upon the prevailing interest rate: when interest rates are low, then the premium bond prize fund falls. If this pay-out didn’t fall, then the government would be paying a higher rate on these borrowings than if it issued government bonds in the open market.

In 2012, the amount paid out from the prize fund equated to 1%. However, the average pay-out is a lot less than 1%. With a top prize of £1 million, and thousands of prizes of £25, the average interest rate paid out is skewed upwards.

There is no tax on winnings from premium bonds. This makes it a tax efficient form of saving. However, if you die, the value of the premium bonds are added to your estate for inheritance tax purposes. They cannot be transferred in life or after death.

Prize winners are notified in writing each month. But on the NS & I website, you can also check the winning numbers from previous draws. Over time, people change addresses, get married, and die. There are tens of thousands of unclaimed premium bond prizes and these can be checked online.

Read more about Premium Bonds on the NS&I website

How to Buy Premium Bonds

Firstly, you must be at least 16 years old to buy premium bonds (although accounts can be opened in a child’s name by parents or grandparents). Application for premium bonds can be made either online, or by post, or by telephone. The process is straightforward, and application forms can either be downloaded from the NS&I website, or collected from the Post Office.

Payment for the bonds must be made either by cheque (postal application) or by bank debit card. They cannot be bought using a credit card.

Investments can be made either by lump sums or as regular savings paid by standing order from your bank account.

The maximum amount that you can invest is £30,000. The bonds have a par value of £1, and so for a maximum investment you receive 30,000 entries into each month’s draw.

If you are investing a lump sum, then the minimum you can invest is £100, but if you are saving via a standing order each month, this minimum falls to £50.

How Winnings are Paid

If you are lucky enough to win, then you will normally receive a warrant (like a cheque) through the post. However, it is more common for premium bond holders to elect to receive any winnings direct to their bank account. If choosing the latter payment method, then winners are sent an email confirming the win and payment.

For any prize higher than £5,000, you will be sent a claim form to fill in and claim your prize. If you are lucky enough to win the big prize, then a personal visit will be made to you to inform you of your win.

You may also elect to reinvest any winnings, buying more premium bonds until the maximum holding is reached.

The Odds of Winning

If you have bought the maximum £30,000, and keep your bonds for 5 years then with average luck you should receive £1500 in winnings.

The odds of winning one of the £25 prizes are 1 in 24,000. The odds of winning the £1 million prize are 1 in over 43 billion per premium bond held! If you hold the maximum £30,000, the odds of winning the big prize are still 1 in 110,000!

Are Premium Bonds a Good Investment?

An investment in premium bonds gives you certainty of capital with the chance to win some big money. It is sometimes called the ‘working man’s lottery’. However, when compared to the National Lottery, the top prize is smaller and the odds of winning far larger (your chances of winning the jackpot on the National Lottery are only 14 million to 1!).

With a prize fund of 1.5% of the total funds held, premium bonds pay out a lower rate of interest overall than most high interest rate accounts. On top of this, because of the way that winnings are divided, the equivalent actual rate of interest received by most premium bond holders is even less (at around 1%).

But, winnings are tax free. For a higher rate taxpayer who wants security of investment, premium bonds offer a safe haven for short term lump sums.

If you too want the chance to win big money, whilst knowing your capital is safe, then premium bonds might be for you. However, as with all investments there is an investment risk. The risk with premium bonds is that your winnings will not keep up with inflation, and the purchasing power of your money will decrease over time.

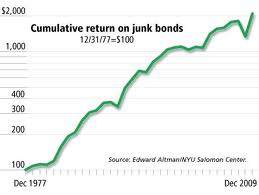

High Yield Junk Bonds

Junk bonds refer to fixed-income security debt instruments issued by entities whose credit ratings are below the BB credit rating or below investment grade. Junk bonds are also known as high-yield bonds, speculative bonds, or speculative grade bonds.

Junk bonds refer to fixed-income security debt instruments issued by entities whose credit ratings are below the BB credit rating or below investment grade. Junk bonds are also known as high-yield bonds, speculative bonds, or speculative grade bonds.

In order to understand why junk bonds are given their below investment grade ratings, we need to talk a little bit about credit ratings and how the credit rating agencies of Fitch, Moody and Standard & Poor’s come up with their rating system.

Ratings agencies look at the credit-worthiness of a debt issuer and assess their cash flow, accountability and compliance to good business or governance practices to determine their ability to settle their debt obligations. It is on the basis of these parameters that debt instruments issued by these entities are graded on an investment scale. A table that shows the classification of bonds according to investment status is given further down this article.

The classification of a bond as a junk bond is therefore assigned when a company is having serious issues with cash flow, or when a government is not making enough revenue to take care of its debt obligations. If a country has mounting debt and seems unable to curtail it by paying off some of the debt or by eliminating the conditions that cause its debts to mount, it risks a situation where its credit rating could be cut down several notches in a progressive fashion. If the problem is severe enough, this could mean being assigned a junk bond status.

How Do I know If It’s a Junk Bond?

Junk bonds have been identified as low grade investment bonds. The ratings that identify a junk bond are given by credit rating agencies. There are three credit rating agencies: Fitch, Moody’s and Standard and Poor’s. While the nomenclature assigned to their various credit ratings are different, the connotations are generally the same and are understood as such by the financial markets.

|

Fitch |

Moody’s |

Standard & Poor’s |

Grade |

|

AAA |

Aaa |

AAA |

Investment |

|

AA |

Aa |

AA |

“ |

|

A |

A |

A |

“ |

|

BBB |

Baa |

BBB |

“ |

|

BB |

Ba |

BB |

Junk |

|

B |

B |

B |

Junk |

|

CCC |

Caa |

CCC |

Junk |

|

– |

Ca |

CC |

Junk |

|

– |

C |

Junk |

|

|

DDD, DD, D |

C |

D |

Junk |

Why Do Junk Bonds Have High Yields?

Why do junk bonds carry such high interest rates? It is really a question of being able to attract investments. Corporations and governments that have been classified as being below investment grade essentially have very limited options when it comes to increasing their revenues. Even when programs have been arranged to get these entities to cut expenditure as a way of balancing their budgets, there is a limit to what kind of spending can be cut. A government must always pay salaries to its workers. Even when salary cuts and pension cuts are made, payments must still be made and there is a limit to the cuts. A company facing financial trouble cannot lay off all its workers; essential staff must be kept and paid.

So really, there is only one way of attracting more money to assist in bolstering the company’s fortunes or enabling a government to function, and this is by taking loans from investors in the form of bonds. Due to the high risk of default, most investors would not ordinarily look at these bonds. So the bond issuers are forced to offer the increased interest rates as an incentive for investors to take up these instruments and somehow hope that the money realised from the bond sales can be used by the bond issuers to engineer a turnaround that would eventually put them in a position to repay this debt.

If Junk Bonds are Bad, Why Do People Buy Them?

Junk bonds were popularised in the 1980s by businessman and cancer-survivor, Michael Milken. He believed that the rewards to be earned from the high interest yields outweighed the risks of default on junk bonds, and he used a tactic of using funds obtained from the junk bond sales to finance hostile takeovers of companies, and then use the assets of the acquired company to pay off the interests and principals on the junk bonds, thus making money from the “bounce-backs” of these companies as well as the interest on these bonds. However, a conviction on securities fraud and insider trading, as well as the bankruptcy of the investment bank where Milken worked effectively put paid to the junk bond market. However during the hey days of the junk bond market, many investors including Michael Milken made a fortune trading these junk bonds.

The Future of High Yielding Junk Bonds

Junk bonds seem to have been awakened from their 20 year slumber by the rash of sovereign debt issues in several Eurozone countries. Greece and Spain have had trouble with paying off their sovereign debt and Greece has had to apply for bailout funds to settle its obligations. Presently, the status of its bonds has been cut to junk by all three rating agencies, and the yield spreads are about the highest in the Eurozone. Spain is teetering on the edge as its credit rating has been cut several notched by the ratings agencies. The recent announcement by the European Central Bank that it would participate in buying Eurobonds as a way of stabilising the financial structure of the Eurozone, has buoyed confidence in the bond market.

So should a trader be trading junk bonds at this time? It will depend on the investor’s risk appetite as well as the outlook of the company or government that has been assigned the junk status. For instance, if a company has the outlook of being rescued, it may be prudent to purchase amounts of the bond that the investor’s risk appetite would allow, and wait for the process of recovery to be initiated. There are countries which have recovered from junk status and have moved to the point of paying off their debt obligations. Argentina is one such country. So considerations about the future of the bond issuer and the investor’s risk appetite are two factors that would need to be considered before a junk bond investment is made.

Investment Bonds

In many ways the term investment bond is a misnomer of what is, essentially, a form of life insurance. It is this standing as a life insurance product that gives the bond certain tax advantages over other investments, though it is important to understand that investment bonds are not the tax free investments some financial advisors might have you believe.

An investment bond is opened with a lump sum, and a sum assured is assigned to the bond at this time.

Investments within the bond can be made into a variety funds and for differing attitudes to risk. Once invested funds can be switched, though different companies will have different rules regarding how often this can be done and the costs of doing so.

Withdrawals from the bond can be made, and if the withdrawal is less than 5% of the initial sum invested then there will be no tax to pay. Many investors use investment bonds to augment income, even though what they are really receiving is a repayment of capital.

At the end of the policy term, or upon full encashment if sooner, the total profit on the bond is calculated to assess tax liability.

Investment bonds can be “unit linked” or “with profits”.

The Difference Between “Unit Linked” and “With Profits”

The values of unit linked funds fluctuate on a daily basis with investment prices. As stock markets and other investments rise, so, too, do the values of unit linked funds. As stock prices fall, so, too, do the values of unit linked funds. The value of a unit linked policy depends upon the value of the units at any given time.

A with profits policy, on the other hand, has what is known as reversionary bonuses added to it, usually on an annual basis. Once added, these bonuses cannot be taken away. However, the bonuses paid are subject to an operation called smoothing, whereby a proportion of profits earned during good years is held back to be paid out during poor years. Often a large part of the profit made on a with-profits bond is by way of the terminal bonus, which is usually only paid upon maturity.

How Investment Bonds are Taxed

The first thing to remember is that taxes paid by the life company on income and capital gains cannot be reclaimed by the individual investor. These are taxed at the basic rate, and so non-taxpayers, in particular, will be hit by this inescapable charge.

When the bond is cashed in or it matures, the final gain is added to all withdrawals made during the lifetime of the bond. This total gain is added to the investor’s income for the year in which the bond matures/ is cashed in, and if the investor’s total income under this calculation takes the investor into the higher rate or additional tax bracket, then there will be extra tax to pay (at the difference between basic rate and the investor’s marginal rate).

However, this calculation could be considered to be unfair and rather draconian. After all, the total profit has been made during the lifetime of the bond, and not solely in the year of its maturity/ cashing in. To get over this problem, the investor is allowed to make a calculation called ‘top slicing’ when assessing tax liability on the gains from an investment bond.

How Top Slicing Works

The total gains made during the life of the bond, including all withdrawals, are added together. This sum is divided by the number of full years that the bond has been held. This calculated figure is added to the investor’s income in the year of maturity/ cashing in. If the resulting amount is below the higher rate tax threshold, then there will be no further tax liability. But, if this amount falls in the higher rate threshold or above, then extra tax will be liable on the whole gain made.

Older Investors Beware

People over the age of 65 have a higher personal tax allowance than the under 65’s, and at 75 this allowance increases still further.

Once income reaches a certain level, this allowance is reduced at the rate of £1 for every £2 received, until the allowance falls to the basic (under 65) level.

While ‘income’ taken from the bond (withdrawals of 5% or less) is not added to annual income for this calculation, the gain made upon maturity/ cashing in of an investment bond is. Older investors should bear this in mind when cashing in an investment bond.

Charges Levied on Investment Bond Investors

Life companies, and financial advisors, make a good deal of money from investment bond business.

Financial advisors are paid a commission by the life company for selling its products. Initial commission paid out by the life company on investment bond business falls in the region of 3% to 6% of the sum invested. Then there is the trail commission – payment from the life company to the financial advisor – which is often around 0.5% for every year the bond remains in force.

The life company may also impose early exit charges upon those investors who cash in their investment bond early (typically within the first five years), or in the case of a with-profits bond, a market value reduction (MVR) may be charged. The MVR is a reducer which allows the life company to properly reflect the value of fund units at the time a bond is cashed in.

There may also be charges levied for fund switches, and of course for investment management.

The Cost of Withdrawals

Although withdrawals of up to 5% can be made ‘tax free’ each year, and rolled over to a second year should they not be taken one year, the investor should remember that such withdrawals will decrease the funds available on which gains may be made. If the investor withdraws 5% each year that he holds the bond, and growth within the bond is only 3% each year, then the final sum available upon maturity will be less than the sum originally invested.

So Who are Investment Bonds Best For?

Investment bonds allow for investments across all attitudes to risk, and for differing attitudes during the life of an investment. Whilst this allows certain flexibility, the imposition of early exit penalties means an investment bond should not be considered by an investor who has an investment term of less than five years in mind.

For those investors who want to know a certain amount will be paid out upon the death of the life assured, then an investment bond achieves this aim.

Investors who want to augment income – maybe to pay school fees, or other regular expenses – or may wish to take withdrawals from an investment in the future; investment bonds provide a mechanism to release one-off or regular payments. This is particularly useful for higher rate taxpayers.

For a higher rate tax payer who may become a basic rate taxpayer in the future, particularly when the bond matures (maybe moving into retirement, for example, and losing a sizeable portion of earnings), then an investment bond may provide a good deal of tax efficiency.

Investment bonds are reasonably easy to understand, provide a way to release cash from an investment without additional tax charges, and provides for investment flexibility. However, advice should always be sought before making such an investment, particularly with regard to on-going or later tax implications.

Bond ETFs

ETFs are supposed to be liquid enough to be traded on the stock markets on a daily basis. Bonds are fixed-income instruments and are therefore not subject to the wild daily speculative activity that is seen on the stock, currency or commodity markets. This poses a problem as ETFs are supposed to be liquid enough to trade daily, with reasonable volatility to be able to create money-making opportunities for traders. In order to overcome the inherent obstacle that the constituent basket of securities poses for bond ETFs, a system has been devised to create bond ETFs out of the most liquid and the most likely to be traded on the markets. With this in view, traders can therefore trade the following bond ETFs in the US markets:

- iShares Barclays Treasury Inflation Protected Securities Fund

- Vanguard Total Bond Market ETF

- iShares iBoxx $ High Yield Corporate Bond Fund

- iShares Core Total U.S. Bond Market ETF

- SPDR Barclays Capital High Yield Bond ETF

- iShares Barclays 1-3 Year Credit Bond Fund

- Vanguard Short-Term Bond ETF

- iShares Barclays 1-3 Year Treasury Bond Fund

- iShares Barclays MBS Fixed-Rate Bond Fund

- iShares JPMorgan USD Emerging Markets Bond Fund

- iShares Barclays Intermediate Credit Bond Fund

- iShares Barclays 7-10 Year Treasury Bond Fund

- Vanguard Short-Term Corporate Bond ETF

- Vanguard Intermediate-Term Bond Index Fund

- PIMCO Total Return ETF

- iShares S&P National Municipal Bond Fund

- Vanguard Intermediate-Term Corporate Bond Index Fund

- iShares Barclays 3-7 Year Treasury Bond Fund

- iShares Barclays 20 Year Treasury Bond Fund

- ProShares UltraShort 20 Year Treasury

- PowerShares Emerging Markets Sovereign Debt Portfolio

- iShares Barclays Short Treasury Bond Fund

- PIMCO Enhanced Short Maturity Exchange-Traded Fund

- SPDR Barclays Capital International Treasury Bond ETF

Classification of Bond ETFs

There are several ways to classify bond ETFs.

Classification According to Type of Underlying Bond

Bonds can be issued by federal governments, state governments, municipal authorities (local government councils) or by companies/corporations. Therefore, a bond ETF can be classified according to whether the issuing agency is a federal government, state government of corporation. Using this classification, we can have the following types of bond ETFs:

- Treasury Bond ETFs (federal government bond ETFs such as the US Treasury Bond ETF). Another example of a sovereign bond ETF is the PowerShares Emerging Markets Sovereign Debt Portfolio (PCY).

- Corporate bond ETFs. A good example of a corporate bond ETF from our list above is the iShares iBoxx $ Investment Grade Corporate Bond Fund (LQD).

- Municipal Bond ETFs. An example is the iShares S&P National Municipal Bond Fund (MUB).

Classification According to Country of Origin (Local/Foreign)

A bond ETF can also be classified according to whether the component bond basket is of local origin or an international bond. An example of an international bond ETF would be any of the bond ETFs that track emerging market economies such as CEMB – iShares Emerging Markets Corporate Bond ETF, EMB – iShares JP Morgan USD Emerging Markets Bond ETF and SPDR Barclays Capital International Treasury Bond ETF (BWX).

Classification According to Maturity of Constituent Bond

Using this classification, a bond ETF can also be classified on the basis of the maturity of the constituent bonds. A bond ETF can therefore be classified according to whether the bonds that make up its basket of securities are short-term, intermediate-term or long term bonds. Our list of bond ETFs will easily show a few bonds which have a one to three-year maturity (short term bond ETFs such as iShares Barclays 1-3 Year Credit Bond Fund-CSJ), intermediate-term bonds (3 – 7 years such as the iShares Barclays 3-7 Treasury ETF) and long term bonds (20 to 30 years such as ProShares UltraShort 20 Year Treasury – TBT).

Bond ETF Trading Strategy

Traditionally, bond investors like to hold bonds until maturity and we really do not see many of them coming to sell on the market. However, there has been some change in the global outlook concerning safety of bond investments, with many countries (especially those in the Eurozone) on the brink of not being able to service their bond commitments by paying periodic interests. Again, we see interest rates being changed periodically as governments struggle to find a balance between stimulating growth of their economies and at the same time, performing fiscal tightening to control inflation.

So you need to put the following factors into consideration when trading bond ETFs:

- Do you want to trade local bond ETFs or do you want to go international? International bond ETFs may only be suitable for those who thoroughly understand the investing terrain in the countries whose bonds they want to trade as ETFs.

- Long term bonds pay more interest than short term bonds, but are more sensitive to interest rate fluctuations. You need to understand this relationship and determine if you want to trade the shorter term or long term bond ETFs.

- What is the solvency status of the bond issuer? This is a pertinent question for those who are trading bond ETF based on the type of issuer. The global financial crisis showed how dependence on credit ratings alone could ruin trades for those who relied on this information.

Mistakes to Avoid

Investing is a complex issue. It is not just a matter of throwing in money and pulling on a lever to churn out multiplicities of it. If the markets worked that way, there would be no losers and there would be no market. But because there will always be more losers than winners, the markets flourish and reward the few who are careful. In this article, we will look at the common mistakes that many investors make when buying bonds, and how to avoid them so you end up on the winning side.

Taking Excessive Risks

This has to come top on the list because it is simply a no-brainer. The golden rule of investment in any financial market (and bonds are certainly not exempt) is never to take too much risk. But what happens a lot of times is investors assuming risk that is way beyond the capacity of their accounts to handle, and beyond their risk appetite. There are certain factors that individuals must consider before assuming a type of investment.

This has to come top on the list because it is simply a no-brainer. The golden rule of investment in any financial market (and bonds are certainly not exempt) is never to take too much risk. But what happens a lot of times is investors assuming risk that is way beyond the capacity of their accounts to handle, and beyond their risk appetite. There are certain factors that individuals must consider before assuming a type of investment.

For example, those who are nearing retirement and who suddenly discover that they have probably not invested or saved as much over the years, get tempted to assume more risk than is necessary in an attempt to make up for the lost years. They turn to bonds as the saviour, being the fixed-income and probably “safest” investment that there is, and decide to fling all risk considerations out of the window. Now because they are out to max out all their investments in the bond market, they jump into high-yield bonds or bonds of untested markets. Some investors even decide to jump in just because of the name brand of the bond issuer. Many investors probably do not know that the higher the yield of the bond, the more likely it is that the bond will never get repaid. Eventually, many of these investors lose their money, and the more they lose, the more desperate they get and the cycle repeats itself all over again. The lesson here is never to take more risk than you should. Consider your circumstances, your finances and capacity to absorb losses before jumping into a bond investment.

Buying Purely on Yield Information

Higher yielding bonds are more risky because of the high probability of default. The safest bonds are the ones with the lowest yield. Indeed for most average Joe investors in the bond market, there is simply no reason to be buying high-yield, high-risk bonds. If such investors are seeking higher returns, then in all honesty, they should not be in the bond market. They are better off in higher-yielding markets like the spot forex and options markets. Buying bonds based on which ones will give the largest returns is a common mistake that bond buyers should avoid making.

Improper Diversification

Many average bond buyers have a warped idea of diversification. They probably think that diversification means maintaining different bonds in different accounts. Consider a case where an investor has bond brokerage accounts with three different brokers, and probably has bought bonds of an investment bank in one account, a commercial bank in the second account and a mortgage bank in the third account. Is such an account diversified? The answer is no. Even though the accounts hold three different bonds, they are bonds of companies in one sector of the economy. If a systemic problem crops up that causes the entire sector to collapse (the way the subprime mortgage crisis hit Bear Stearns and Lehman Brothers and eventually the financial services sector in 2008), all the investments in the three accounts will collapse. Notice how the subprime mortgage crisis (affected mortgage banks), eventually spread to the commercial and investment banks who were exposed to that sector in the form of loans, guarantees and direct investments, and the entire financial services sector eventually got hit all over the world. A truly diversified investment would purchase bonds in several unrelated sectors, probably include some foreign bonds, and with varying maturity dates. The investor may even decide to buy some callable bonds which can be sold ahead of their maturities, and mix them up with date-to-maturity bonds. Having such a mix in one account provides a better diversification of bond investments than holding several accounts that are used to purchase bonds from a single sector, or bonds with common characteristics. So non-diversification of bond purchases is just as bad as improper diversification of bond purchases. Traders should therefore get proper investment advice on how to diversify their bond investments.

Wrong Assumptions About Investment Payouts

Many traders enter bond investments with the wrong assumption that they will always get paid on maturity. Fact is, nothing is assured 100% when it comes to investments. That is why it is always important to purchase bonds after thorough analysis. It is possible for a company to delve into an unfamiliar business that is different from its core competency and problems with the new venture could create a big problem with the entire group. There are loads of examples of companies who have seen their financials badly undermined by non-performing new ventures/products. Similarly, political unrest in a country can negatively impact its credit ratings. This is why traders should also include date-to-call bonds in their portfolios, so that they can easily jump ship when the tide turns for the worse.

Adopting a Do-it-Yourself Approach

Professionals are there for a reason: they know what the layman does not know and try as hard as you can, you can never be more of a leopard than a leopard. They are there to guide you and use their professional insight and knowledge to help you. Trying to save money on professional fees by going it alone is a bad gamble. Eventually, you could stumble into an investment issue that will prove too much for your level of expertise, and you may rack up in losses, much more than you would have had to pay a professional bond investment advisor for sound advice. The world operates on a principle of giving and receiving. If you hoard giving money to investment advisors (they need to make a living too), you will eventually hit a bad losing streak.