Blueberry Markets Review 2025

|

|

Blueberry Markets is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to Blueberry Markets |

| Blueberry Markets Facts & Figures |

|---|

Blueberry Markets is an Australian-based CFD and forex broker offering 300+ instruments on the MT4 and MT5 platforms. Account holders also get access to DupliTrade, a low-latency VPS and educational materials. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Cryptos, Commodities |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Andriod |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, VFSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Blueberry Markets offers access to 300+ CFD products, spanning commodities, stocks, indices and currencies. These products are available with leverage rates up to 1:500, with competitive STP and ECN pricing models. |

| Leverage | 1:30 (ASIC), 1:500 (VFSC) |

| FTSE Spread | From 0.0 pips |

| GBPUSD Spread | From 0.0 pips |

| Oil Spread | From 0.0 pips |

| Stocks Spread | From 0.0 pips |

| Forex | Blueberry Markets clients can speculate on more than 40 forex pairs, encompassing all major and minor crosses, plus some exotic pairings. We found that all orders are executed at market price, with commission-based or spread markup pricing options. |

| GBPUSD Spread | From 0.0 pips |

| EURUSD Spread | From 0.0 pips |

| GBPEUR Spread | From 0.0 pips |

| Assets | 40+ |

| Stocks | Blueberry Markets users are spoiled for choice when it comes to stock market access, with the firm boasting more than 30 global indices, on top of 200 of the largest stocks, including US technology shares. |

| Cryptocurrency | Invest in a modest selection of popular digital currencies including Bitcoin with no hidden fees. However, we have seen many other firms provide access to hundreds of different tokens, so it isn't best for serious crypto investors. |

| Coins |

|

| Spreads | From 0.0 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Blueberry Markets is a forex and CFD broker that offers UK traders access to 300+ trading instruments. The company offers excellent customer service and two different account types with plenty of learning resources to educate traders. This review will provide you with key information about fees, available instruments, trading platforms and more. Our UK team also reveal their verdict after using Blueberry Markets.

Our Take

- Blueberry Markets is a good pick for experienced traders looking for competitive conditions and advanced platforms

- The broker’s high-quality customer service, range of payment methods and GBP account compete with top brands

- The lack of FCA regulation and negative balance protection are notable drawbacks for UK traders

- Some features are not accessible for lower-budget traders, including the DupliTrade platform and VPS

Market Access

Blueberry Markets offers a very respectable 300+ forex and CFD instruments across five asset classes. However, we were a little disappointed to see no ETFs, options, futures or bonds, which could be a drawback for traders looking to invest more broadly.

Available instruments include:

- 60+ major and cross-currency pairs including EUR/USD, GBP/USD and AUD/USD

- 300+ share CFDs including Facebook, Tesla and Netflix

- Crypto assets such as Bitcoin, Ethereum and Litecoin

- 30+ index CFDs including the FTSE and NASDAQ

- Commodities including gold, platinum and oil

Accounts

Our team were pleased to see two competitive account types at Blueberry Markets: the Standard Account where costs are built into the spread; and the Direct Account with raw spreads and a $7 commission per trade.

Both account types have a reasonable minimum deposit of $100, a minimum trade size of 0.01 and maximum leverage of up to 1:500. We also appreciated that you can access all instruments on every platform.

For high-volume traders, we would recommend the competitive professional account which offers fast execution, advanced market insights, priority withdrawals and dedicated 24/7 support. To qualify, you must exceed the volume threshold of $10 million per month in forex, commodities and/or share CFDs.

Sadly, for lower-budget traders, there are no additional tools on offer to make the accounts stand out, which we thought was a shame.

How To Open An Account

I was able to set up an account in about 5 minutes. Document verification should take around 3 minutes though it will take longer if there is a problem processing your documents.

- Click on ‘Start Trading’ and enter your email and chosen password

- Enter details such as your name, the type of account you would like, and the currency you want to use

- Verify your identity with a valid passport or government photo ID and a document showing a legal residential address

Blueberry Markets Fees

The only difference between the accounts is the pricing structure. The Standard account has no commission fees and spreads from 1.0 pips, whilst the Direct account has a $7 commission per round-turn trade and benefits from tight spreads from 0.0 pips.

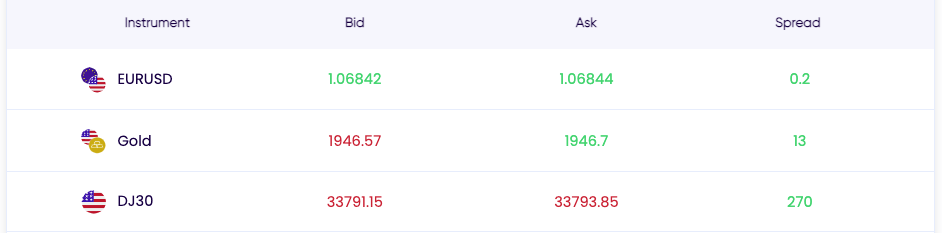

When I tested the platform, I was offered a spread of 0.1 pips on EUR/USD and 0.3 pips on GBP/USD. This is competitive and aligns with top brokers including Pepperstone and IC Markets.

Commissions are also competitive in the Direct account, with a rate of $3.50 per side on forex. Spreads and commission rates for all asset classes are:

- AU shares – Spreads from 0.1 pips, $0.05 commission per side

- US shares – Spreads from 0.1 pips, $2 commission per side

- Forex – Spreads from 0.0 pips, $3.5 commission per side

- Commodities – Spreads from 0.0 pips, $0 commission

- Indices – Spreads from 0.5 pips, $0 commission

- Crypto – Spreads from 1.0 pips, $0 commission

Note that the broker charges a monthly fee of AUD 28 to access ASX200 stocks on MT5 on top of a 0.1% commission of the traded value (this does not apply if your commission exceeds $28).

Non-Trading Fees

Our team were impressed that Blueberry Markets charges no inactivity fees. However, traders should be aware that accounts with a balance of less than 50 units of currency will be archived if inactive for over a month.

Swap rates also apply to trades that are held past the overnight platform server time (23:58-00:02).

Funding Methods

We appreciated the wide variety of supported payment methods available while using Blueberry Markets, including bank wire, credit cards, cryptocurrency and e-wallets.

However, UK traders looking for e-wallet payments are limited to Perfect Money and STICPAY only, with no PayPal support.

Deposits

Supported currencies include GBP, EUR, USD, AUD, CAD, NZD, and SGD, meaning UK traders can manage their accounts in British pounds. The minimum deposit for all methods is also accessible at $100 (or equivalent currency).

We were pleased to see that there are no deposit fees for any of the payment methods but they do have maximum deposit amounts that vary with the method chosen.

Processing times also depend on the method chosen and varies from less than 24 hours for e-wallets to 3-7 business days for bank wire, which is in line with competitors.

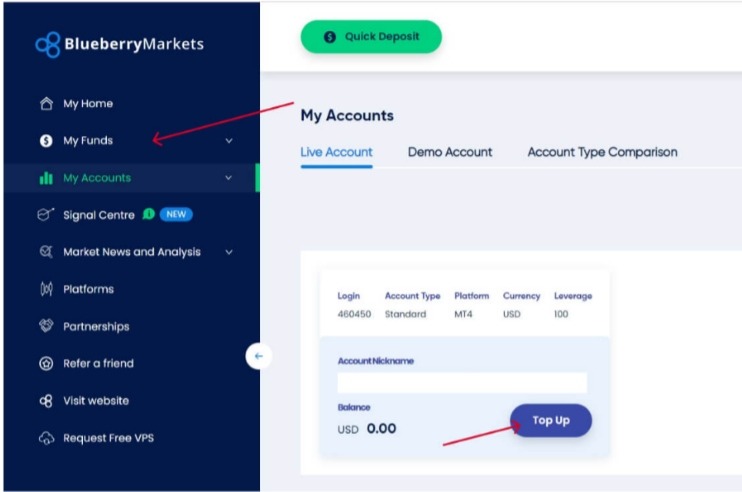

How To Make A Deposit

- Login to your trading account portal

- Click the Top Up icon on your trading account dashboard or click the My Funds icon on the left side panel

- Chose the deposit method

- Select the amount you wish to deposit, the currency and the account you want to fund

Withdrawals

Withdrawals at Blueberry Markets can be done via the same methods as deposits. When withdrawing funds there is a minimum requirement of $50 and a maximum amount that varies with the method chosen.

I was happy to see that withdrawal fees are not charged by Blueberry Markets but there may be fees depending on the receiving bank, such as a $25 intermediary fee for bank transfer.

Unfortunately, withdrawal processing times are up to 7 days for all methods, except for Bitcoin withdrawals which depend on the receiving exchange. This is longer than alternatives with some brokers even offering same-day withdrawals.

How To Make A Withdrawal

- Head to the client portal login and sign in

- Click on the My Funds icon on the left side panel and select Withdrawal

- Select the withdrawal method you prefer and the trading account you are withdrawing from

- Enter the amount you want to withdraw

- Select your payment profile and submit

Trading Platforms

Blueberry Markets offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, comparable with many leading brokers like Eightcap.

The MT4 and MT5 platforms are highly reliable with a vast range of customisable tools for investors. Both platforms are available to download as a desktop program, a mobile app, or can be accessed directly via the webtrader.

We were a little disappointed to find that Blueberry Markets doesn’t offer a proprietary trading platform, which would have made the broker stand out vs alternatives like OANDA.

The MT4 terminal is more focused on forex trading and offers four types of pending orders: buy limit, buy stop, sell limit and sell stop. This platform offers 30 technical indicators and 9 time frames, plus in-depth pricing history and real-time quotes. I like that you can access thousands more custom tools through the online marketplace. Algo traders can also build their own Expert Advisors (EAs) or import them directly.

I found that MT5 is more advanced, with a broader range of orders, 21 time frames, 38 technical indicators and advanced analytical tools. There is also the addition of an integrated economic calendar and copy trading operations via the platform’s signals.

Overall, I would recommend MT4 for beginners and MT5 for more experienced traders, although both platforms are highly popular among all experience levels.

Blueberry Markets Leverage

Leverage varies depending on the instrument you chose to trade in. A maximum leverage of 1:500 is available to traders for CFDs. This is significantly higher than the 1:30 cap imposed by UK and EU regulators.

On crypto CFDs, the maximum leverage is 1:2. whilst on share CFDs, there is a limit of 1:5. Traders using high leverage should consider using stop loss and take profit orders to mitigate against serious losses.

UK Regulation

Blueberry Markets is regulated by the Vanuatu Financial Services Commission (VFSC), with license number 012868.

Traders should be aware that the VFSC is an offshore regulator and does not offer the same protective measures as top-tier authorities, such as the UK’s Financial Conduct Authority. As such, we cannot give the broker a high trust and safety score.

With that said, we were pleased to see that the broker takes client protection seriously, with segregated client accounts in use.

Demo Account

Demo accounts are available for both MT4 and MT5, which we were happy to see. These simulation accounts are a fantastic way for beginners to learn more about trading and gain experience without financial risk. They are also a great way for investors to decide whether or not a broker is a good pick for them.

Blueberry Markets offers a competitive amount of $100,000 in free virtual funds to practice trading with and allows access to the broker’s learning courses and trading insights.

How To Open A Demo Account

- Hover over the Trade With Us icon on the top bar of the broker’s website and click the Try Demo Account icon on the left

- Enter your name, email and phone number

- Read how to set up a demo account for MT4 or MT5 on your chosen device type (e.g. Apple or Android) and follow the specific instructions

Bonus Deals

Blueberry Markets offers a refer-a-friend bonus to its traders. The bonus is a $200 cash deposit into the referrer’s account if they refer a friend who trades a minimum of 1 standard lot and deposits a minimum of $500 into their account within 60 days of referral.

Bonuses like this are common among offshore brokers, but traders should be cautious about any trading incentive they sign up for and always check the bonus terms and conditions. In particular, look for volume requirements that need to be satisfied before you can make a withdrawal.

Extra Tools

Our experts were impressed with the range of additional tools on offer, giving investors ample opportunities to enhance their trading strategies.

For example, a forex VPS service is available for experienced investors who trade a minimum of 15 lots every round turn, per month. The VPS offers improved connectivity and 24-hour access to the market, and trade execution in 1 to 3 milliseconds.

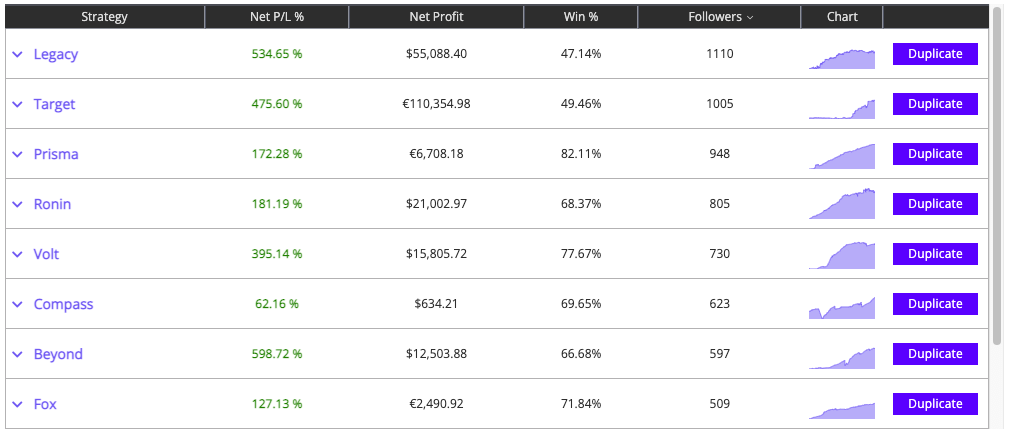

I was also initially thrilled to see that Blueberry Markets offers DupliTrade, a leading copy-trading platform which should be ideal for beginners. The program allows investors to automate their trades using signals from more experienced traders.

However, disappointingly, you are required to make a minimum deposit of $2,000 to gain access to the platform, which will exclude some newer traders.

If you are a beginner looking for access to a free copy-trading service, we would recommend top social trading brokers such as eToro or AvaTrade.

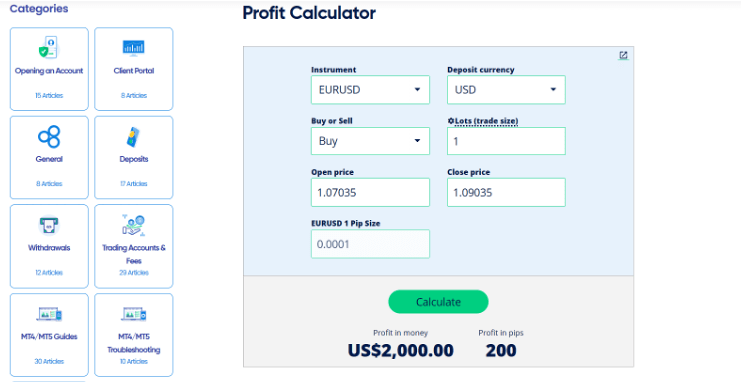

Nonetheless, we were happy to see some useful forex and profit calculators available on the Blueberry Markets website to help you determine pip sizes and trade margins.

DupliTrade Leaderboard

Education & Analysis

One of our favourite features of Blueberry Markets was the learning resources on offer. There are weekly newsletters as well as an economic outlook calendar and video tutorials.

I was particularly impressed with how comprehensive the market analysis section is, with trading strategies, news trends and guides all updated frequently.

Additionally, there is a trading program available at beginner, intermediate and advanced levels where traders can learn more about investing to match their experience.

Overall, I found the selection very competitive and comparable to top brands such as City Index.

Company Details

Blueberry Markets, a trading name of ACY Capital Pty Ltd, was set up in 2016 by Australian owner and managing director Dean Hyde. Hyde had nearly six years of experience as a trader and broker with AxiTrader before launching the company.

The firm’s headquarters are in Australia, with an office located on the island of Vanuatu. On the downside, the brand does not have a physical location in the UK.

The broker focuses on providing low spreads and excellent customer service and was an Australian finalist in the Finder customer service awards in 2020 and 2021.

Blueberry Markets also boasts strong ratings from other customers with 4.5 stars on Trustpilot and 4.8 stars on Google. The brokerage has over 30,000 clients from across the world.

Customer Service

Blueberry Markets prides itself on good customer service (with over 2,750 five-star reviews) and our experts found the service they offer to be worthy of that pride.

The customer contact team is available 24/7 via email at global@blueberrymarkets.com or by phone at +61 279083946 or +61 280397480. A useful help centre on the broker’s website also comprehensively answers common queries.

You can also message the customer service team via their website using the live chat icon on the bottom right side of the webpage. When I tested this feature, I received a human response immediately, which is impressive.

The office address is Govant Building, 1279 Port-Vila, Vanuatu.

Help is available in five languages including English, French and Mandarin.

Security

We were pleased to see that this broker segregates client funds in a trust account allowing traders better security on their money. However, Blueberry Markets does not provide negative balance protection, meaning that traders must manage their money carefully.

That said, I am confident that MT4 and MT5 both have strong security with data encryption and two-factor authentication available when logging in via Blueberry Markets.

Trading Hours

Trading hours vary depending on the instrument you want to trade. For example, commodities opening hours are generally 12:02 am – 11:58 pm on Monday and 12:04 am – 11:58 pm Tuesday to Friday (GMT+3).

The broker’s website also houses a calendar of market hours and events.

Should You Trade With Blueberry Markets?

Blueberry Markets has a good variety of instruments with high leverage and low fees. The MT4 and MT5 platforms are reliable and easy to use and a large variety of payment methods are supported. Our team especially liked the range of educational resources and the attentive customer service. However, the lack of FCA regulation and negative balance protection should be considered by UK investors.

FAQ

Is Blueberry Markets Safe And Legit?

Blueberry Markets has regulatory oversight from the VFSC. This is not a top-tier regulator like the FCA and does raise some safety concerns. However, the broker does take customer money protection seriously, with the use of segregated client accounts. The broker is also well-reviewed, with no recent reports of scams or malpractice.

Is Blueberry Markets Good For Beginners?

Blueberry Markets could be a suitable choice for beginners, with a relatively low minimum deposit and fees, plus a free demo account. In addition, there are lots of educational resources, including a beginner’s trading program and YouTube video tutorials. On the negative side, the copy trading platform requires a hefty $2,000 deposit.

Does Blueberry Markets Have A Low Minimum Deposit?

The minimum deposit for both the Standard and Direct accounts is $100 which is relatively low compared to other brokers in the market. It also means newer traders can access the brokerage.

Is Blueberry Markets A Halal Broker?

No, Blueberry Markets does not offer an Islamic trading account which is a disadvantage when compared to halal brokers.

Is Blueberry Markets A Good Broker For UK Investors?

Blueberry Markets offers UK traders a reasonably wide variety of products along with low fees, multiple payment methods and a GBP trading account. However, the broker is not regulated by the UK’s FCA which is a drawback for those looking for extra security.

Is Blueberry Markets An ECN Broker?

Yes, Blueberry Markets uses an Electronic Communications Network (ECN) which automatically matches the best buy and sell orders, giving traders direct access to the market. As such, the broker can offer competitive raw spreads, from 0.0 pips.

Article Sources

Blueberry Markets VFSC License

Top 3 Blueberry Markets Alternatives

These brokers are the most similar to Blueberry Markets:

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Blueberry Markets Feature Comparison

| Blueberry Markets | IC Markets | Fusion Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 3 | 4.8 | 4.5 | 4.8 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $100 | $200 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, VFSC | ASIC, CySEC, FSA, CMA | ASIC, VFSC, FSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | Yes | Yes | No | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:30 (ASIC), 1:500 (VFSC) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:500 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Blueberry Markets Review |

IC Markets Review |

Fusion Markets Review |

Pepperstone Review |

Trading Instruments Comparison

| Blueberry Markets | IC Markets | Fusion Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Blueberry Markets vs Other Brokers

Compare Blueberry Markets with any other broker by selecting the other broker below.

Popular Blueberry Markets comparisons: