Blackwell Global Review 2025

|

|

Blackwell Global is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Blackwell Global |

| Blackwell Global Facts & Figures |

|---|

Blackwell Global offers seamless online trading in forex, stocks & cryptos. |

| Awards |

|

|---|---|

| Instruments | Forex, CFDs, indices, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $250 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, CySEC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Flexible CFDs are available across markets. |

| Leverage | 1:30 |

| FTSE Spread | 1.4 |

| GBPUSD Spread | 1.2 |

| Oil Spread | 0.029 |

| Stocks Spread | N/A |

| Forex | Trade on the FX market with 1:30 leverage. |

| GBPUSD Spread | 1.2 |

| EURUSD Spread | 0.7 |

| GBPEUR Spread | 1.3 |

| Assets | 45+ |

| Stocks | Trade on 12 indices including the FTSE 100. |

| Cryptocurrency | Trade crypto CFDs from 1 unit. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Blackwell Global is a global brokerage that offers CFD trading in forex, crypto and commodities markets. The brand has a UK branch that is regulated by the FCA. In this Blackwell Global review, we examine the instruments its offers, account types, fees, how to trade on its platform and more.

Blackwell Global boasts low latency and raw spreads, thanks to its ECN execution model. UK regulatory oversight also gives it a good trust rating. On the downside, the broker offers little in terms of education and market research. Overall, there are better alternatives in the UK.

Market Access

Blackwell Global UK offers over 85 contracts for difference (CFDs) covering four markets: forex, indices, commodities and cryptocurrencies.

50 forex instruments are offered, including every major like GBP/USD, EUR/USD and USD/JPY, as well as all the minors and several exotics. The 10 index products include the FTSE 100, S&P 500 and DAX 40, while those with their sights on commodities can trade Brent Crude Oil (UK Oil) and West Texas Institute (WTI) Crude Oil (US Oil), as well as silver and gold against the US dollar (XAU/USD & XAG/USD).

More than 20 crypto CFDs are also available with Blackwell Global UK. Many of the major cryptocurrencies are accounted for, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP).

Overall, the firm’s offerings are not the most abundant when compared to some brokers. That being said, many of the most commonly traded assets in these categories are supported.

Accounts

Blackwell Global UK offers four different account types: Standard, ECN, Islamic (swap-free) and Professional. Unfortunately the minimum deposit requirements are fairly high, especially for beginners.

Standard

The standard account has three variations, depending on how much money is deposited into the account. All three have a margin call level of 80%, stop out level of 50%, can be ECN or spreads based, and support forex, index and commodity CFDs.

Midi

- £400 to £8,000

- Leverage 1:400

Max

- £8,000 to £80,000

- Leverage 1:200

- Trading Diary and Trading Central

Ultra

- £80,000

- Leverage: 1:100

- Trading Diary and Trading Central

ECN

ECN accounts grant tighter spreads (from 0.1 pips) but charge a commission for each position, though this varies on trade volume.

On the downside, Blackwell Global UK does not specify the exact commission fee but the global branch charges ~3.50 per lot per side, which is reasonable.

Islamic (Swap-Free)

Blackwell Global UK also offers an Islamic, swap-free account.

This account follows the basic prohibitions of Riba according to Sharia, providing interest-free investing by removing swap charges. This means that Muslim clients can hold positions overnight without any interest charges or credits. As such, these accounts are widely considered halal.

However, these accounts are limited to spot contracts for forex, gold, silver and oil products.

Professional

Professional accounts offer higher leverage, personal account managers, the best possible execution speeds and more sophisticated language in communication.

To open a professional trader account with Blackwell Global UK, two of the three following criteria must be met:

- At least ten significant positions in each of the last four quarters

- Financial services experience

- £500k+ in liquid assets

Importantly, professional investing accounts lose some protection from the FCA as they primarily regulate retail trading accounts. As such, benefits like negative balance protection become unavailable.

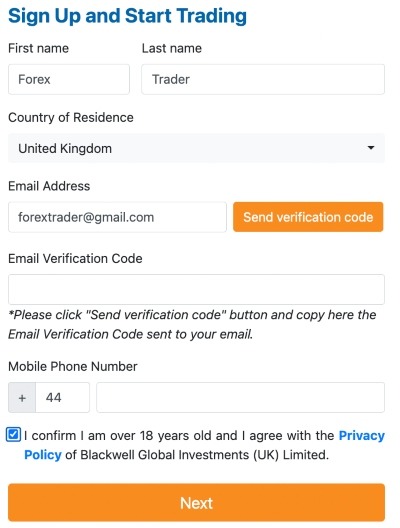

How To Open A Blackwell Global Account

To start trading with Blackwell Global UK, you will need to open an account. Doing so is straightforward; simply follow the guide below.

- Go to the Blackwell Global UK website

- Click the Start Trading button

- Input all of the information asked for, including your email address, country of residence and mobile phone number

- Fill in the next form, covering your employment information, financial details and investing experience

- You will be prompted to provide documentation as part of the KYC procedure. This will require some sort of official identification, such as a driver’s license

- Input your contact details and verify them as directed

- Deposit funds into your account to start investing

Fees

All the accounts with Blackwell Global UK charge spreads on their positions, though only the ECN accounts charge commission fees, albeit with much tighter spreads.

Spreads vary between assets. For example, EUR/GBP has an average spread of 0.00017 pips, while the UK 100 index has a spread of 3.2 points on the standard account.

Overall, fees are in line with competitors.

Deposits & Withdrawals

There are four main transfer methods available with Blackwell Global UK: Neteller, Skrill, payment card and bank wire transfer. While using Blackwell Global, we were pleased to see that GBP deposits are accepted for UK traders.

Neteller

- E-wallet service

- Instant processing

- USD, EUR and GBP transfers

- No deposit or withdrawal fees

- Minimum withdrawal is £0.01

- Transfer limits depend on the user

- Max withdrawal is your available balance

Skrill

- E-wallet

- Instant processing

- USD, EUR and GBP transfers

- No deposit or withdrawal fees

- Minimum withdrawal is £0.01

- Transfer limits depend on the user

- Max withdrawal is your available balance

Visa & Mastercard

- Instant processing

- Debit & credit payment cards

- USD, EUR and GBP transfers

- No deposit or withdrawal fees

- Minimum withdrawal is £0.01

- Transfer limits depend on the user

- Max withdrawal is your available balance

Bank Wire Transfer

- No transfer limit

- Minimum withdrawal is £80

- Fees are dependent on your bank

- USD, EUR, GBP and CHF transfers

- Max withdrawal is your available balance

- Local transfers are processed within three days

- International transfers are processed within five days

Trading Platforms

Blackwell Global UK only offers the MetaTrader 4 (MT4) platform, while the global branches also offer MetaTrader 5 (MT5).

The MetaTrader suites are some of the most popular online platforms available, offering advanced customisability, sophisticated technical analysis tools, built-in automated investing and copy trading.

MT4 is ultimately a good fit for new traders and experienced investors, though veteran traders in the UK may be disappointed that MT5, the latest iteration, isn’t available.

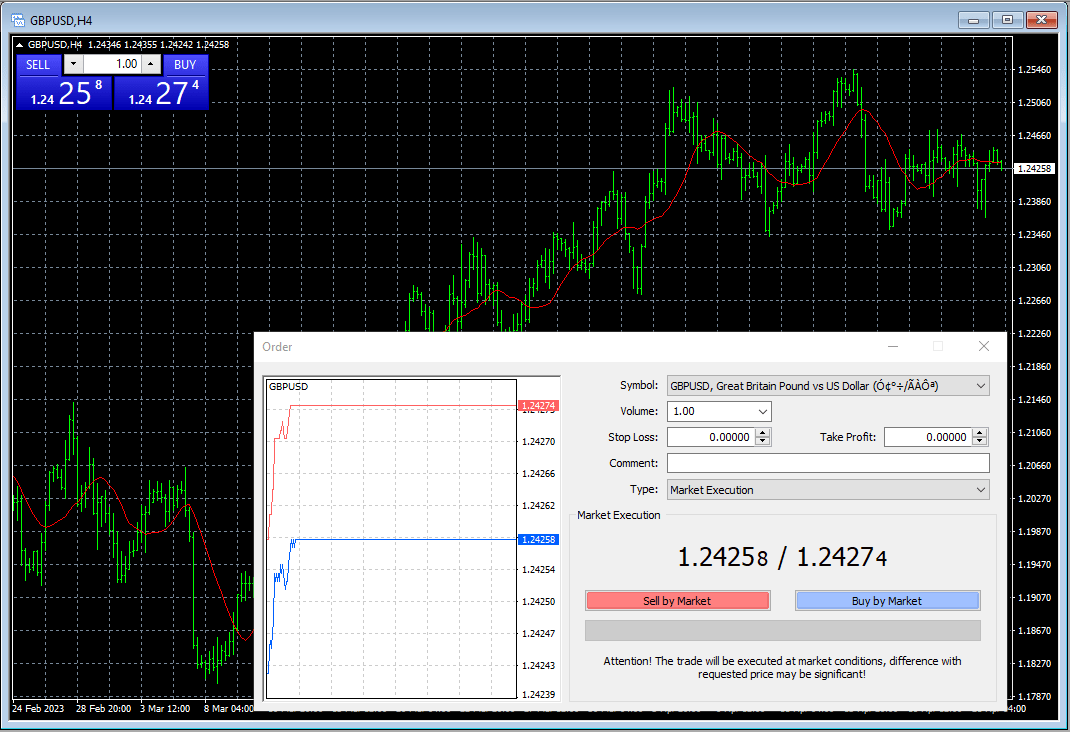

How To Place A Trade With MT4

- Download the MetaTrader 4 platform from Blackwell Global UK’s website download link

- Login to your Blackwell Global account within MT4

- Choose the asset you would like to trade from the left-hand side menu

- Click the New Order button in the hotbar at the top of the window

- Input the details of your trade, such as volume, stop loss and order type

- Select Sell by Market or Buy by Market to place the trade

MetaTrader 4 Order Screen

Is Blackwell Global Regulated?

Blackwell Global UK is regulated by the FCA of the United Kingdom, with registration number 687576. This means that the broker must follow strict financial fair play rules, including providing access to the Financial Services Compensation Scheme (FSCS) and ensuring the segregation of company and client funds.

- The FSCS allows UK traders to claim up to £85,000 in compensation if Blackwell Global is unable to commit to its financial obligations due to bankruptcy, for instance

- Separation of funds ensures that should the broker become insolvent, investors can be returned their funds

- Negative balance protection ensures that your account can never go into the negative, meaning you will not lose more than you have invested in the account

Customer Service

Blackwell Global UK can be contacted in several ways. Support for general questions is available in its support and FAQ section, found on the website’s Contact Us page. However, this is very limited, only covering six basic questions.

A live chat channel is also available on the contact page for instant help and callbacks can be requested on this page by filling out the provided form.

Alternatively, clients can get in touch with the firm via the telephone number and email address below:

- Phone Contact Number: +44 20 3769 9881

- Email Address: cs@blackwellglobal.com

Company Background

Blackwell Global Investments UK Ltd is an online CFD broker founded in 2010 in Cheapside, London. The name is also used by several international bodies run by the same corporate group, taking advantage of different regulatory conditions and markets.

These include Blackwell Global Investments (Cyprus) Limited, Blackwell Global Holdings in New Zealand and Blackwell Global Investments HK, as well as seven other office locations.

The firm focuses on low spreads, fast execution, high liquidity and trustworthiness. The Financial Conduct Authority has been regulating Blackwell Global’s UK branch since 2016, while the CySEC and the SCB regulate the global branch.

Opening Hours

Trading hours at Blackwell Global vary depending on the asset in question.

For example, cryptocurrencies are open 24/7, while indices have set hours depending on the market, such as the London Stock Exchange in the UK.

Should You Trade With Blackwell Global?

Overall, the most attractive features that Blackwell Global UK offers are its low spreads, even in the zero-commission accounts, and strong regulatory presence.

However, in terms of asset variety, trading platform choice and account offerings, the firm does not stand out. Top brokers offer more assets, plus a greater number of tools and extra features, such as educational resources and analyst insights.

FAQ

Is Blackwell Global UK Trustworthy?

Our experts found Blackwell Global’s UK branch to be regulated by the Financial Conduct Authority of the UK, one of the strictest financial regulators. As such, the broker has all of the essential features in place to protect traders from financial foul play, including negative balance protection, segregation of funds and FSCS access.

What Trading Platform Does Blackwell Global UK Offer?

Blackwell Global UK offers the MetaTrader 4 platform to clients. If you open an account with one of the international branches, you will have access to the MetaTrader 5 platform instead.

It is a little disappointing that this offer is not extended to UK clients, given the improved capabilities of MT5.

Does Blackwell Global Offer Halal Accounts?

Blackwell Global does offer Islamic accounts that follow the laws of Sharia. This means that these accounts do not have swap fees and do not charge any interest, allowing for halal trading.

However, these accounts do have a much more limited pool of assets, only being able to spot trade forex and commodities.

Is Blackwell Global A Good Broker?

While using Blackwell Global UK, our experts found the service to be competitive in some areas. While the range of assets may not be as extensive as some, clients can still access 85 CFD products across forex, crypto, indices and commodities with the choice of STP or ECN execution, high leverage rates and the MetaTrader 4 app.

Can You Make A Free Demo Account With Blackwell Global?

Blackwell Global UK offers free demo trading accounts through the MetaTrader 4 platform. You can make as many of these accounts as you wish, each with varying specifications. These accounts provide an opportunity to practise using the platform, come to understand the fee structure of the broker, and test new strategies.

Does Blackwell Global UK Offer Professional Trading Accounts?

You can open a professional trading account with Blackwell Global as long as you fit the FCA-mandated criteria. This includes having experience in relevant financial services jobs, having over £500,000 of liquidity (not including your place of residence) and having made at least ten significant trades in each of the last four quarters.

Article Sources

Blackwell Global Investments UK FCA Licence

Blackwell Global CySEC Licence

Top 3 Blackwell Global Alternatives

These brokers are the most similar to Blackwell Global:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Blackwell Global Feature Comparison

| Blackwell Global | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| Rating | - | 4 | 4.7 | 4.8 |

| Markets | Forex, CFDs, indices, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $250 | $1,000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySEC | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

||

| Review | Blackwell Global Review |

Swissquote Review |

IG Index Review |

Pepperstone Review |

Trading Instruments Comparison

| Blackwell Global | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Blackwell Global vs Other Brokers

Compare Blackwell Global with any other broker by selecting the other broker below.

Popular Blackwell Global comparisons: