BitMEX Review 2025

|

|

BitMEX is #5 in our rankings of crypto brokers. |

| Top 3 alternatives to BitMEX |

| BitMEX Facts & Figures |

|---|

BitMEX is a crypto exchange and derivatives trading platform, launched in 2014. The firm offers a fiat–crypto onramp, spot trading, and crypto derivatives including perpetual contracts, traditional futures and quanto futures. BitMEX offers amongst the largest market liquidity of any cryptocurrency exchange. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Crypto |

| Demo Account | Yes |

| Min. Deposit | $0.01 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Min. Trade | Variable |

| Regulated By | Republic of Seychelles |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | BitMEX Market Maker, BotVS, and via API |

| Islamic Account | No |

| Cryptocurrency | BitMEX continues to offer a highly competitive crypto trading environment, with cheap $1 contracts and leverage up to 1:100. The broker’s proprietary platform offers cutting-edge trading features, including a customizable order book, a depth chart and dozens of technical indicators. |

| Coins |

|

| Spreads | -0.01% maker, 0.075% taker |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | Yes |

| Auto Market Maker | Yes |

BitMEX is at the forefront of crypto trading exchanges, offering a gateway for investors to access futures and perpetual swaps on a range of major cryptocurrencies, including Bitcoin. In 2016, the crypto broker launched XBT/USD perpetual leveraged swap contracts, paving the way towards becoming a top-tier liquidity cryptocurrency derivatives investing environment. This 2025 review explores perpetual swaps, leverage rates, fees, assets and more. Read on to find out whether you should create an account with BitMEX today.

BitMEX Company Details

BitMEX, short for Bitcoin Mercantile Exchange, was founded in 2014 by former CEO Arthur Hayes and co-founders Benjamin Delo and Sam Reed and is now owned by HDR Global Trading Limited. Since it set its headquarters (HQ) in Seychelles, it has established itself as one of the leading global crypto brokers.

The original logo BitMEX represented the put-call parity relationship of crypto derivatives. In 2019, this design was updated, abstracting the literal interpretation of the formula and creating a more visually appealing identity for the platform.

Trading Platform

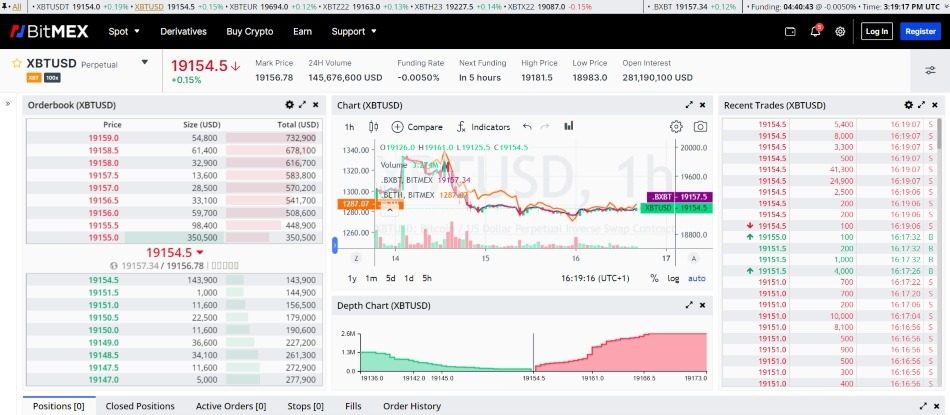

BitMEX offers an integrated browser-based derivatives platform within its website, which means there is no software download requirement. The platform supports all futures and perpetual swaps offered by the firm. The interface combines trading charts, the order book, recent positions, market depth analysis and order management into one convenient space.

Our review and testing found the charting system to be provided by TradingView and boast 16 timeframes, seven chart types, 104 built-in indicators, 82 graphical tools, eight widgets and comparison overlays. Each widget can be added, removed and moved around to build a custom interface for each client. Moreover, the widgets can be expanded into a full-screen view in a separate tab for increased functionality.

BitMEX Derivatives Platform

API Support

BitMEX boasts an impressive peer-to-peer (P2P) crypto trading platform and application programming interface (API) system. The exchange offers its customers a choice of two advanced APIs: Representational state transfer (REST) and WebSocket.

A REST API supports numerous useful data formats. This flexible API is a favourite amongst developers wishing to have a high level of freedom when trading, managing accounts and accessing market data.

Unlike a REST API, which is HTTP based, a WebSocket API allows for higher levels of efficiency and real-time communication. BitMEX also offers a reference implementation of the WebSocket API, python, enticing python users to engage in the crypto derivates exchange.

By offering a variety of APIs to its customers and access to an interactive API explorer, BitMEX proves to be an attractive platform for many different types of traders.

Historical Data

Access to historical data is imperative when developing an understanding of the market’s dynamics. BitMEX offers the following historical data:

- Funding rate

- Insurance fund

- Settlement history

- A Leaderboard of the top 25 traders by notional

The firm features an order book to ensure that its users make well-informed decisions when trading.

Assets & Markets

Our review team has found that BitMEX users can buy, sell and trade some of the largest cryptocurrencies in the market, such as Bitcoin (XBT or BTC), Ethereum (ETH) and Dogecoin (DOGE). In May 2022, BitMEX launched its brand-new spot exchange and announced its entry into a new crypto market, India.

The following trading pairs are available on its spot exchange:

- APE/USDT

- UNI/USDT

- ETH/USDT

- XBT/USDT

- AXS/USDT

- LINK/USDT

- MATIC/USDT

The value of these cryptocurrencies is calculated using a composite index system that draws pricing information from19 major crypto exchanges. These token prices are weighted and averaged to form the firm’s own pricing levels. The price levels are recalculated and updated every five seconds, while the exchange ranking-based weightings and constituents are reviewed quarterly.

The firm also offers futures and quanto perpetual contracts, which use a fixed bitcoin multiplier, allowing traders to go long or short without owning the underlying coin or USDT. There are no crypto options contracts or stock products offered by BitMEX.

Trading Fees

BitMEX imposes standard maker-taker fees across all spot products and taker fees on derivatives products, given their nature. All fees are applied automatically upon opening a trade.

Those looking to trade a significant volume of assets can take advantage of the firm’s two-fold discount fee structure. These discounts are available in a tiered structure, based on 30-day average daily volume (ADV) and staking quantity.

For spot products, the ADV-based fee levels are as follows:

- Tier B: Less than USD 100,000 30-day ADV, 0.10% maker fees, 0.10% taker fees

- Tier I: More than USD 100,000 30-day ADV, 0.09% maker fees, 0.05% taker fees

- Tier T: More than USD 500,000 30-day ADV, 0.08% maker fees, 0.03% taker fees

- Tier M: More than USD 1,000,000 30-day ADV, 0.07% maker fees, 0.02% taker fees

- Tier E: More than USD 10,000,000 30-day ADV, 0.05% maker fees, 0.00% taker fees

- Tier X: More than USD 25,000,000 30-day ADV, 0.03% maker fees, 0.00% taker fees

These fee levels are combined with an additional staking discount, based on the size of each position’s stake amount. Staking discounts are only applied to taker fees, as follows:

- BMEX 0: 0% additional taker discount

- BMEX 25: 1% additional taker discount

- BMEX 200: 2% additional taker discount

- BMEX 1,000: 4% additional taker discount

- BMEX 10,000: 6% additional taker discount

- BMEX 50,000: 8% additional taker discount

- BMEX 500,000: 10% additional taker discount

- BMEX 1,000,000: 12% additional taker discount

- BMEX 3,500,000: 15% additional taker discount

Derivatives trading does not take advantage of the ADV tier structure, though taker fee discounts are applied based on the stake amount as above.

BitMEX Margin Trading

BitMEX offers competitive leveraged contracts, bought and sold in cryptocurrency, at rates up to 1:100 leverage to customers trading on its XBT/USD perpetual contract. The initial and maintenance margin levels determine the amount of leverage available on each contract and can be found in the table on the website’s Risk Limits page.

Clients are required to keep a maintenance margin percentage to hold their positions open. If this requirement is not fulfilled, you will be liquidated and lose your maintenance margin. Navigate to the Open Positions tab to view your liquidation price per position.

Mobile Apps

When our experts used the new BitMEX mobile app, they found it to be intuitive and display detailed real-time data and charts. The application also allows you to track trends in the market and manage your portfolio. In addition, customers can buy over 30 currencies straightforwardly via the app through its fiat On-Ramp service.

The mobile app is compatible with Apple (iOS) 14.0 or later and Android (APK) devices.

Payment Methods

BitMEX clients can fund and empty their accounts directly using the following cryptocurrencies:

- APE (ERC20)

- Bitcoin (XBT)

- ETH (ERC20)

- Tether (ERC20)

- MATIC (ERC20)

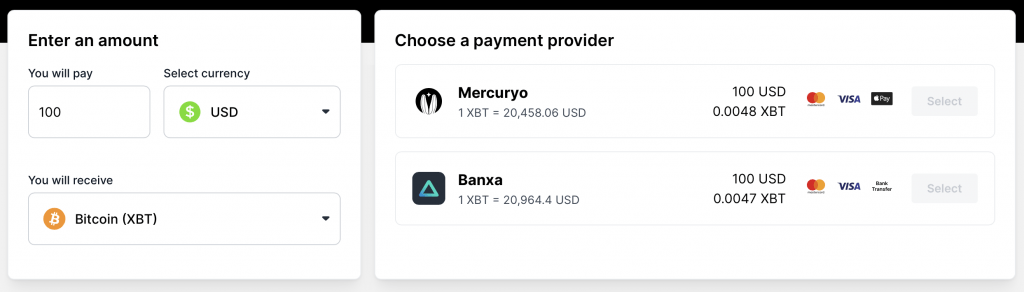

For those that do not currently have any spare crypto or their own wallet, the firm does offer an on-ramp service. This system routes a fiat deposit through partners Mercuryo or Banxa to automatically convert funds to crypto and deposit them into BitMEX. Mercuryo supports Visa and Mastercard payment cards plus Apple Pay, while Banxa swaps Apple Pay for bank wire transfers. The interface includes up-to-date conversion rates, as below.

BitMEX On-Ramp

Currently, the minimum deposit required to open an account with the exchange is BTC 0.0001.

The minimum withdrawal amount for Tron Network (USDT TRC-20) is USDT 11.

Deposit & Withdrawal Fees

The broker does not charge any fees for deposits. However, charges do apply to withdrawals of Bitcoin, Ethereum, Tether and other ERC-20 coins. BitMEX enforces a cut-off on Bitcoin withdrawals after 13:00 UTC, whereas Tether Coin (ERC20) withdrawals are processed in real-time.

Demo Account

BitMEX Testnet is the crypto broker’s proprietary paper trading account, which is open to all prospective investors who would like to become more familiar with this environment and test their strategies before entering the live market. There are no capital or time limits on this account.

How To Trade On BitMEX

Below is a brief guide on how to begin trading with BitMEX.

1. Create An Account

To open an account, simply navigate to the banner at the top of the home webpage and click on ‘Register’. When prompted, enter your email address and create a password and then you will be presented with the platform’s default page. Before you can make a deposit and properly get started, you need to go through the know-your-customer (KYC) process. This requires you to input personal details, upload a photo ID, confirm your location and submit your experience and employment details. The company will then review this information before verifying your account.

2. Make A Deposit

Once your account has been successfully verified, you can login and fund it by following four simple steps.

- Click on the wallet icon located in the banner at the top right-hand corner of the trading page.

- Select ‘Deposit’, which can be found in the ‘Total Balance’ tab.

- Once you have landed on the deposit page, copy the deposit address. This can be done one of two ways, either scan the QR code or select ‘Copy to Clipboard’.

- Paste the address into the withdrawal field in the platform where your bitcoin is currently being stored, ensuring the correct network is selected. BitMEX accepts both Bitcoin and ERC20 currency deposits.

After network confirmation, the deposit will be credited to your account and you will receive a deposit pending email, which will need to be verified. his can take 20 minutes or longer. Once you have confirmed your pending deposit, you will receive a confirmation email.

3. Open A Trade

Log into your BitMEX account to begin trading. Firstly, select the contract you would like to speculate with by navigating to the top right-hand side of the screen, where a contract is currently showing. When selected, a drop-down list will appear, giving you the option of choosing perpetuals, futures and, most recently, FX contracts.

Once you have chosen the contract type, input how much you want to speculate within the box entitled “Size”. You can also set either a limit or market price type. Decide whether you are going to go long or short and click on the appropriate box. Once this is selected, the platform will automatically open the position.

4. Close Your Position

You can close your position at any time by clicking on the ‘Positions’ tab, found at the bottom of the trading page. Here you can see the PNL and choose whether to close your position as either a limit or market order. Alternatively, you can set stop-loss and take-profits when opening the position to automatically close the order when desired.

Deals & Promotions

BitMEX is currently advertising the following deals with rewards to both existing and prospective customers:

- Welcome Offer: New traders can earn up to 45 BMEX tokens, split into a series of tasks. Signing up and verifying your identity will net you 5 BMEX and buying USD 250+ within 10 days of verification will earn you another 10 tokens. Purchasing another USD 1,000+ through BitMEX will net a further 30-token bonus.

- Crypto Convert Offer: Customers receive 2.5 BMEX for every $100 worth of crypto converted, up to a maximum of 250 BMEX.

BitMEX regularly advertises new and exciting deals to allow existing customers to continue to earn free BMEX and entice new customers to join the leading crypto broker. As BitMEX is not FCA-regulated, this advertisement is permitted in the UK.

Regulations & Licensing

BitMEX, like many other crypto exchanges and decentralised finance (DeFi) companies, is not licensed or regulated by any financial watchdog. That being said, the firm does request identity verification and implements many anti-money laundering (AML) and countering the financing of terrorism (CFT) practices. Moreover, the firm has several global offices, established on-chain transaction monitoring and carefully surveilles the markets for questionable practices that could impact its clients.

That being said, the company does have an open lawsuit against the three founders, leading to restricted services in countries like the USA.

Additional Features

- An open interest chart that clearly illustrates all of the open BTC/USD positions.

- BitMEX Research is an extensive library of reports and published articles on financial markets and, more specifically, Bitcoin and cryptocurrency.

- BitMEX Academy is a multi-media learning platform that provides its subscribers with extensive information on how to trade Bitcoin via podcasts, interactive courses, distinguished lectures and more.

- The website contains a useful calculator with which you can calculate your profit/loss, liquidation price and return on equity (ROE).

Account Types

BitMEX offers only one account type, which provides access to all its services.

Benefits Of BitMEX

- Crypto staking

- Crypto on-ramp

- BitMEX Academy

- Very low trading fees

- 1:100 crypto leverage

- TradingView charting

- Liquidation calculator

- BMEX rewards system

- Crypto perpetual swaps

Drawbacks Of BitMEX

- No fiat currency pairs

- Some security lawsuits

- No live customer support

Trading Hours

Trades can be placed, executed and calculated 24/7, Monday through Sunday by all exchange users.

Customer Support

BitMEX provides help and support in the form of a ticket enquiry system, which will require you to input your email address and the subject of your query. The firm does not offer live chat support, which is common amongst its competitors, though it does provide access to an extensive selection of resources and information across a range of social media platforms, such as Twitter and YouTube. Users can also get up-to-date news and articles from former CEO Arthur Hayes on the firm’s in-house blog site.

In addition, the company has a fantastic knowledge base, which our experts found incredibly helpful in teaching how best to use the platform. This knowledge base covers many aspects, including a getting started series, APIs, calculations, staking and spot trading.

Safety & Security

BitMEX employs industry-leading multi-party computational security. A multi-signature deposit and withdrawal scheme is implemented in the platform, keeping your wallet secure and funds and investments protected. In the event of a hack, the trading engine completely shuts down. Zero cryptocurrency tokens have so far been lost through a hacking breach with the firm.

Any security issues or concerns over crypto scams can be reported through the company’s HackerOne program or by contacting the security team.

Our experts found that the exchange boasts one of the largest insurance funds in the industry. The fund is there to avoid auto-deleverage liquidations (ADLs) and protect the user base.

BitMEX Verdict

Whilst BitMEX’s reputation may have stumbled over the past couple of years, it has remained popular with many investors and traders. It is an innovative exchange and derivatives broker, boasting competitive fees, adaptable API connections, an advanced trading blog and a useful crypto on-ramp system. BitMEX continues to grow, with respectable valuation and revenue, attracting new users with deals, updates, new products and entry into new and exciting markets.

FAQ

Who Founded BitMEX?

BitMEX was founded in 2014 by former CEO Arthur Hayes and co-founders Benjamin Delo and Samuel Reed. The founder, Arthur Hayes, moved to Hong Kong in 2008, where he set up an office and worked for Deutsche Bank and Citigroup for several years before founding the exchange alongside Delo and Reed.

Is BitMEX Legit?

In October 2020, the Commodity Futures Trading Commission (CFTC) opened a lawsuit against BitMEX. The case identified that the owner-operators, Arthur Hayes, Benjamin Delo and Samuel Reed had failed to establish an anti-money laundering (AML) or KYC program, violating the US Bank Secrecy Act (BSA). This case closed in May 2022.

Since the lawsuit, BitMEX has remained a leading and highly-rated crypto derivates exchange, continuously growing and developing. In 2020, the broker introduced identity verification, restricted its services in certain jurisdictions and implemented an extensive AML/CFT policy.

How Do I Delete My Account With BitMEX?

You must contact BitMEX customer services directly to delete your account.

What Is The BitMEX Trollbox?

The Trollbox found in the bottom right-hand corner of the BitMEX platform page is a live internal chat service. The Trollbox allows users to share their positions, providing an overview of the long and short positions posted over 24 hours.

Does BitMEX Have A Partnership with AC Milan?

In the summer of 2021, BitMEX announced its multi-year partnership with AC Milan, the football club’s first-ever Official Sleeve Partner. To increase peoples’ awareness of crypto and, in particular, the derivatives exchange, it launched the Born to Lead NFT Collection in May 2022, inspiring football fans to adopt crypto and join the growing, innovative platform.

Top 3 BitMEX Alternatives

These brokers are the most similar to BitMEX:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

BitMEX Feature Comparison

| BitMEX | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| Rating | 3.2 | 4.3 | 4 | 4.7 |

| Markets | Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $0.01 | $0 | $1,000 | $0 |

| Minimum Trade | Variable | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | Republic of Seychelles | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | - | - | MT4, MT5 | MT4 |

| Leverage | - | 1:50 | 1:30 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | BitMEX Review |

Interactive Brokers Review |

Swissquote Review |

IG Index Review |

Trading Instruments Comparison

| BitMEX | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | Yes | Yes |

BitMEX vs Other Brokers

Compare BitMEX with any other broker by selecting the other broker below.

Popular BitMEX comparisons: