Bitlocus Review 2025

|

|

Bitlocus is #83 in our rankings of crypto brokers. |

| Top 3 alternatives to Bitlocus |

| Bitlocus Facts & Figures |

|---|

Bitlocus is an innovative crypto exchange supporting 16 major tokens and providing a crypto payment gateway for businesses. |

| Instruments | Cryptos |

|---|---|

| Demo Account | No |

| Min. Deposit | $0 |

| Mobile Apps | No |

| Payments | |

| Min. Trade | $10 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Cryptocurrency | Bitlocus offers spot cryptocurrency trading on over 16 tokens with EUR as the base currency. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Bitlocus is a fiat-to-crypto exchange that offers low fees, staking and insured crypto holdings. The DeFi investment platform provides an interesting way for traders to gain exposure to the digital currency world, but can its staking solution and other services make up for a token roster that falls behind the competition? In this Bitlocus review, we will find out by covering platform functionality, trading fees, security ratings, and everything else prospective users should know.

We liked that new customers can get started with a €10 minimum investment. Our team also appreciated the transparent pricing structure. On the downside, the list of crypto tokens is limited vs competitors. Bitlocus also lacks the industry presence and reputation of more established crypto platforms.

Crypto Tokens

We were not impressed by the selection of tokens at Bitlocus which includes 20 crypto and Euro pairs. This is far behind many of the brand’s competitors, though you can find popular digital currencies including Bitcoin, Ethereum, Tether, and the brand’s proprietary token BTL. Other less frequently traded coins available include PureFi (UFI) and Aidos Kuneen (ADK).

Our biggest complaint with this is that, while Bitlocus is a firm that only deals in cryptocurrencies, even its non-specialist alternatives like XTB provide a wider range of tokens.

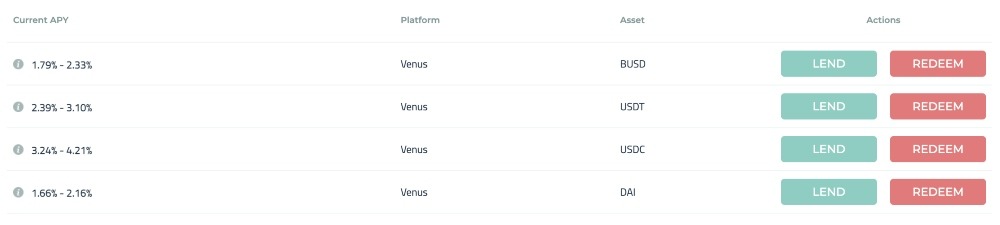

Lending Tokens

Fees

We rated the Bitlocus fees as competitive and were pleased to see a transparent and straightforward pricing structure.

Trading fees vary depending on the method; market maker or market taker. Simply explained, you will be a market maker if you create an order for execution or a market taker if you seek liquidity to execute the position.

- Taker Fees – 0.20%

- Maker Fees – 0.10%

With Kraken maker fees starting from 0.16% and taker charges from 0.26%, Bitlocus’s price structure is competitive, so we were impressed to find another advantage of 30 days of free trading available for new customers who meet tier-two verification requirements.

Note, Bitlocus has a minimum order value of €10 or equivalent in cryptocurrency.

Other Charges

There are some additional fees we came across for DeFi marketplace activities including staking, lending, and farming. Again, we thought these charges were relatively competitive:

- Lending – 0.5%

- Farming – 0.6%

- Staking – €0.50 order fee

How To Open A Bitlocus Account

We found the Bitlocus account registration process straightforward, though the identity verification process is lengthy. Since there are more steps to these identity checks than usual, we were glad to see the step-by-step video tutorial for additional guidance.

- Complete the online application form (email address and full name) and select ‘Register’

- Verify your registration via email confirmation

- Create a password and choose ‘Login’

- Confirm your identity via ‘Settings’ and then ‘Identification’ by inputting your country of residence and uploading identification documents

Although the initial identity verification takes about 10 minutes, users will need to provide more verification documents to access higher deposit values:

- Tier One – No trading or deposits permitted until tier two is reached

- Tier Two – Adhered to KYC requirements. Trading and deposits are permitted with a daily €2000 maximum fiat limit and no limits for crypto

- Tier Three – Provided proof of address and income details. Trading and increased deposits available with a daily €10,000 maximum fiat limit and no limits for crypto

- Tier Four – Provided additional documents. Trading and increased deposits available plus access to a business profile and custom trading fees with a daily €100,000 maximum fiat limit and no limits for crypto

Funding Options

Deposits

One of our favourite perks of the Bitlocus platform is that deposits can be made in either fiat currency or cryptocurrencies. We were, however, only offered bank wire transfers for fiat deposits which is limiting vs alternative brokers who often support credit/debit card and e-wallet payments.

Accepted crypto deposits include Bitcoin, Ethereum, Tether, PAX Gold, and more.

We were pleased to see that most payment methods come free of deposit fees, although the bad news for traders who use SWIFT transfers is that these are expensive at €30.

You won’t need to comply with a minimum deposit requirement for wire transfer deposits, however, 12 confirmations are required for all cryptocurrencies except for Bitcoin. This means you may have a moderate waiting period for most crypto deposits, since ‘confirmations’ refers to the number of ‘blocks’ added to the blockchain after your transaction was processed.

We have provided a few examples to illustrate the deposit structure:

- Ethereum – No minimum deposit, 12 confirmations required

- SWIFT Transfers – No minimum deposit, €30 fee for deposits less than €30,000

- Bitcoin – BTC 0.00001000 minimum deposit, no fees, one confirmation required

How To Make A Deposit

We outline the process for bank wire transfers below:

- Log in to the Bitlocus platform

- Select ‘Balances’

- Choose the funding method/currency (fiat or crypto) by selecting the ‘Deposit’ icon next to the payment method

- Select ‘SEPA’ or ‘SWIFT’ transfer and check the associated fees

- Review and agree to the T&Cs

- Follow the on-screen instructions to make a payment to your Bitlocus account

- Select ‘Confirm’

Withdrawals

When we used Bitlocus, we were pleased to find that the firm processes requests instantly with no minimum withdrawal amounts. However, we did feel the €50 fees for SWIFT withdrawals under €25,000 are expensive.

Minimum withdrawal amounts also apply for cryptocurrency, including BTC 0.00050000 and ETH 0.00500000.

Regulation & Security

Bitlocus LT is registered with the Financial Investigation Unit (FNTT) of the Republic of Lithuania, which isn’t a reputable authority for British investors. With that said, the Financial Conduct Authority (FCA) does not typically authorise platforms for crypto trading in the UK.

On a lighter note, we were happy to see some high-security standards practised by Bitlocus, which includes insurance protection for customers’ crypto holdings, provided by the Fireblocks platform, as well as EU-compliant data protection measures.

Despite these reassuring signs, we would always recommend you apply account security features including 2FA and keep an eye out for any security alerts such as unauthorised IP address activity.

Trading Platform

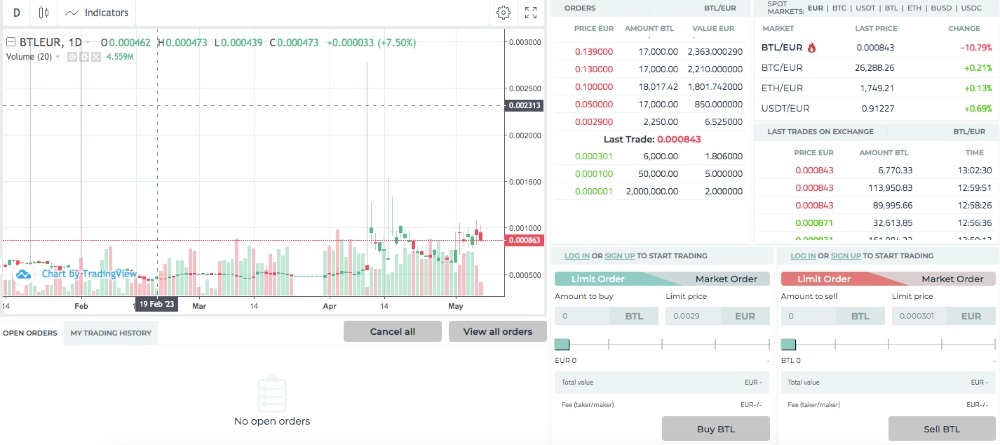

We felt the Bitlocus platform was simple but effective for customers who are satisfied with the crypto activities it supports: buying, selling, staking, lending and farming.

The platform was easy to navigate, though customisation features are limited; for example, we were unable to move or minimise widgets as required.

Fortunately, you can be assured of a top-tier charting package, with graphics hosted by TradingView. This means you can access all the features offered by the third-party function including seven chart types, 50+ technical indicators, and six timeframe views.

We are also pleased to report that the platform updates market data in real-time, with the latest crypto trades placed by retail investors available to view including the time placed and the amount traded.

However, we were disappointed to find that Bitlocus has no mobile app, which is a disadvantage vs competitors like Coinbase.

We also feel that some traders will find the platform and products available limiting – there are no derivatives of the type offered by crypto brokers, and customers of firms like eToro will find thousands of additional products in varied asset classes, while Bitlocus customers are limited to just 16 crypto tokens.

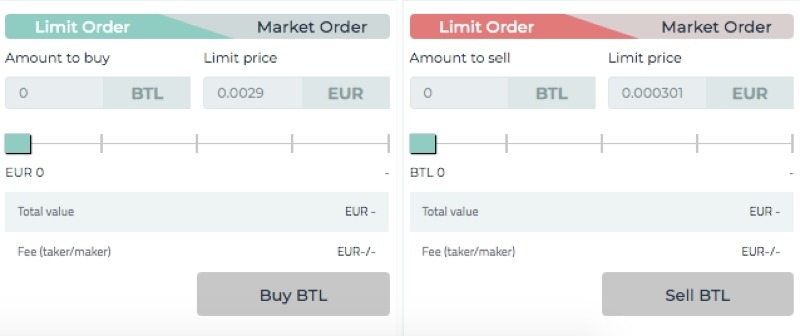

Bitlocus Orders & DeFi

Bitlocus processes two order types; market orders and limit orders. Market orders are processed immediately at the latest market price. Limit orders guarantee a specified price, but orders will be executed at the time this price is met.

To open a position, use the two windows at the bottom of the platform interface depending on whether you want to buy or sell crypto. Add the amount of digital currency to purchase and add a limit price (optional). Review the total value and the maker/taker fee. Select ‘Buy’ or ‘Sell’.

Importantly, lending, farming, and staking activity must be completed via the DeFi marketplace. To access, choose ‘Products’ from the top menu and then ‘DeFi Marketplace’. Then simply use the tabs to find an action and use the red and green icons to confirm.

Extra Features

Bitlocus Token

Bitlocus’ proprietary token, BTL, can be used to access unique rewards and benefits in a similar way to Binance’s BNB token. One of the advantages of holding BTL is access to improved interest rates of up to 30%.

On the downside, the token is only available to purchase on the Bitlocus exchange, via Gate.io or PankcakeSwap.

Loyalty Programme

An exclusive loyalty programme is available to all BTL holders. Interest rate rewards are available based on the percentage of BTL held in your cryptocurrency portfolio.

- Base (0-5% BTL in your portfolio) – Base interest rates

- Silver (5-10% BTL in your portfolio) – 15% interest rates

- Gold (10-15% BTL in your portfolio) – 20% interest rates

- Platinum (+15% BTL in your portfolio) – 30% interest rates

Customer Support

We were not impressed with the Bitlocus customer support, which lacks the live, instant options such as a hotline or chatbot that we consider the industry standard.

Instead, customers will have to submit their enquiries via a ticket or contact the company via their email or business address:

- Email – info@bitlocus.com

- HQ Address – Žalgirio 114, LT-09300 Vilnius, Lithuania

Company Details

We are pleased to report that Bitlocus’ company details were simple to track down and transparent. The firm was established in 2018, is headquartered in Vilnius, Lithuania, and has a three-person management team including CEO and co-founder Andrius Normantas.

Bitlocus has also partnered with several leading brands in the crypto space, including BlockInfinity, iDenfy, and Ginger Fund.

Bitlocus is registered with the Financial Investigation Unit (FNTT).

Opening Hours

One of our favourite aspects of cryptocurrency is that markets are open 24/7, a major advantage over instruments such as stocks.

This means you can trade any time you feel like it on Bitlocus, though it is worth noting that crypto liquidity levels will vary throughout the day, with the most active periods usually during the US working day.

Should You Trade With Bitlocus?

We found the Bitlocus platform to be easy to use and suitable for both beginners and experienced investors. We liked that deposits can be made in both fiat and cryptocurrencies, providing flexibility to get involved with the digital currency market. However, we were disappointed by the company’s short asset list and the lack of customer support options.

Ultimately, we feel that Bitlocus could be a good solution for anyone who simply wants to stake and earn from a few cryptocurrencies, but more active traders will probably want to look elsewhere.

FAQ

Is Bitlocus Regulated?

Bitlocus is registered with the Financial Investigation Unit (FNTT) of the Republic of Lithuania. Although the broker is not regulated by the Financial Conduct Authority (FCA), we have some confidence in this firm’s security measures, which include insurance for clients’ crypto deposits.

Are Bitlocus Trading Fees Competitive?

Yes, fees at Bitlocus are competitive. Fees vary by order type. Market maker fees are 0.10% and taker fees are 0.20%. There is a minimum order value of €10 or equivalent in cryptocurrency.

Does Bitlocus Have Good Customer Support?

We are disappointed to report Bitlocus’ customer service options are limited to an email contact; info@bitlocus.com. No telephone number or live chat function was available. This is a notable disadvantage vs competitors.

Is Bitlocus Good?

Our experts found that Bitlocus is a reasonably decent crypto exchange, offering access to simple crypto trading and digital currency activities. The product lineup is however limited to around 20 coins. Additional features such as educational content, tools, and customer service are also limited.

Is The Bitlocus Minimum Deposit Requirement Low?

There are no minimum deposit requirements for payments made via bank wire transfer. However, some cryptocurrencies do have a minimum limit, including a minimum BTC of 0.00001000. There is a minimum order value of €10 or equivalent in cryptocurrency. This puts the crypto platform in line with most of the industry.

Article Sources

Top 3 Bitlocus Alternatives

These brokers are the most similar to Bitlocus:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Bitlocus Feature Comparison

| Bitlocus | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| Rating | 2 | 4 | 4.3 | 4.7 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $0 | $1,000 | $0 | $0 |

| Minimum Trade | $10 | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | - | 1:30 | 1:50 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Bitlocus Review |

Swissquote Review |

Interactive Brokers Review |

IG Index Review |

Trading Instruments Comparison

| Bitlocus | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Bitlocus vs Other Brokers

Compare Bitlocus with any other broker by selecting the other broker below.

Popular Bitlocus comparisons: