Bithoven Review 2025

|

|

Bithoven is #79 in our rankings of crypto brokers. |

| Top 3 alternatives to Bithoven |

| Bithoven Facts & Figures |

|---|

Bithoven is a MT5-powered online broker offering leveraged cryptocurrency trading. |

| Awards |

|

|---|---|

| Instruments | Cryptocurrency |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | Yes |

| Min. Trade | 0.01 Lots |

| Regulated By | FSA |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | No |

| Cryptocurrency | Trade with 1:20 leverage on dozens of popular cryptocurrency coins. |

| Coins |

|

| Spreads | Floating from zero |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Bithoven is a very basic brokerage, with no standout services. The brand is registered offshore by the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). Our experts were not pleased with the lack of transparency and subpar features, as well as the limited tools for beginners. In this review, our team unpack the services available and see how Bithoven compares to alternatives.

Our Take

- Bithoven offers a decent third-party platform, a demo account and free deposits

- The broker’s limited range of assets and weak educational resources are disappointing

- There is no transparency around fees or company background, which is a major red flag

- The lack of FCA regulatory oversight and reliable security features makes it hard to recommend this broker

Market Access

Bithoven’s product list is limited to just forex and commodities, which you can trade via CFDs. You will struggle to create a diverse portfolio with no stock, index, or cryptocurrency investment opportunities. Instead, we recommend considering a broker like XTB, which offers thousands of instruments spanning popular asset classes.

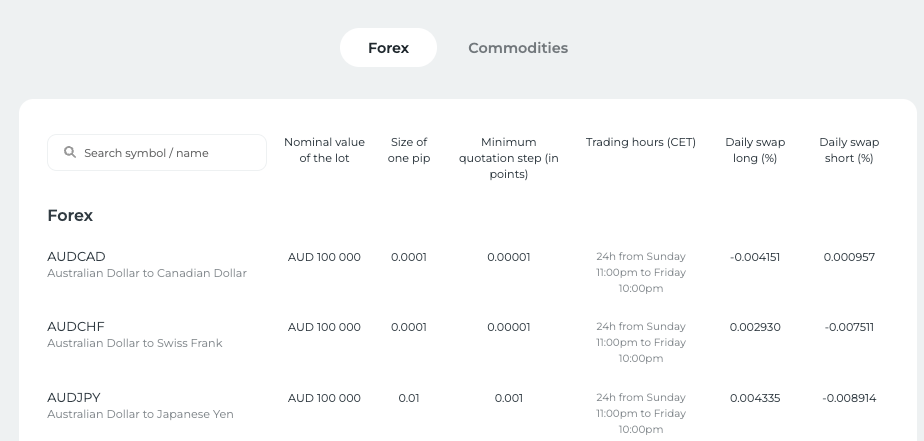

CFDs available at Bithoven include:

- Commodities: Brent crude oil, gold, silver and platinum

- Forex: 50+ major, minor, and exotic currency pairs such as EUR/GBP, GBP/JPY, USD/CAD, and AUD/NZD

Fees & Costs

Bithoven is not transparent with its trading and non-trading fees.

When we tested the broker, we struggled to judge average spreads by instrument, though the broker’s website suggests these start from 1.1 pips. This is not competitive compared with the accessible raw spreads offered by top brands like Pepperstone and IC Markets.

Swap fees apply for positions held overnight which is industry standard. Deposits are free, and some withdrawal charges do apply, which we outline in the ‘Funding Methods’ section below.

Overall, the lack of pricing transparency makes it difficult for us to recommend the brand.

Accounts

All retail investors using the Bithoven platform can trade on the Standard account. We were disappointed that the account is available with a USD base currency only, with no GBP support. High-volume investors will also not receive any perks.

Key features of the account:

- Commission-free

- Maximum trade size of 100 lots

- Minimum trade size of 0.01 lots

- Unlimited number of open orders at any time

How To Open A Bithoven Account

On a lighter note, we found the account registration process quick. There is an option to also sign up using an existing Facebook or Google account.

- Select the ‘Register’ icon from the top right of the broker’s website

- Add your email address and create a password

- Review and agree to the client agreement and privacy policy by selecting the tickbox

- Choose ‘Sign Up’

Funding Methods

We were pleasantly surprised with the number of accepted payment methods offered by Bithoven, including a choice of fiat or cryptocurrency transactions. It was also good to see the broker does not charge any deposit fees.

However, our experts found none of the payment options could be completed in GBP, meaning you may be liable for currency conversion charges.

We would recommend VISA and Mastercard credit/debit cards as the most appropriate deposit method for UK investors, though payments in USD only are accepted.

- Advcash: USD only

- Perfect Money: USD only

- Credit/Debit Card: USD only

- Cryptocurrency: Bitcoin, Tether, Ethereum and more

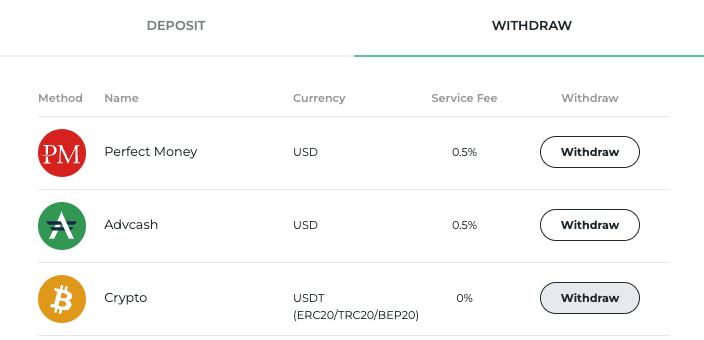

Withdrawal terms are disappointing at Bithoven. There is no option for credit/debit card transactions, meaning you will need to select an alternative method to remove your profits.

The brand does not provide any information on withdrawal times, but cryptocurrency will be dependent on blockchain confirmation speeds. We were also dissatisfied to see that all payment methods, except for cryptocurrency, are liable for a withdrawal charge:

- Advcash: 0.5% fee

- Cryptocurrency: No fee

- Perfect Money: 0.5% fee

Trading Platform

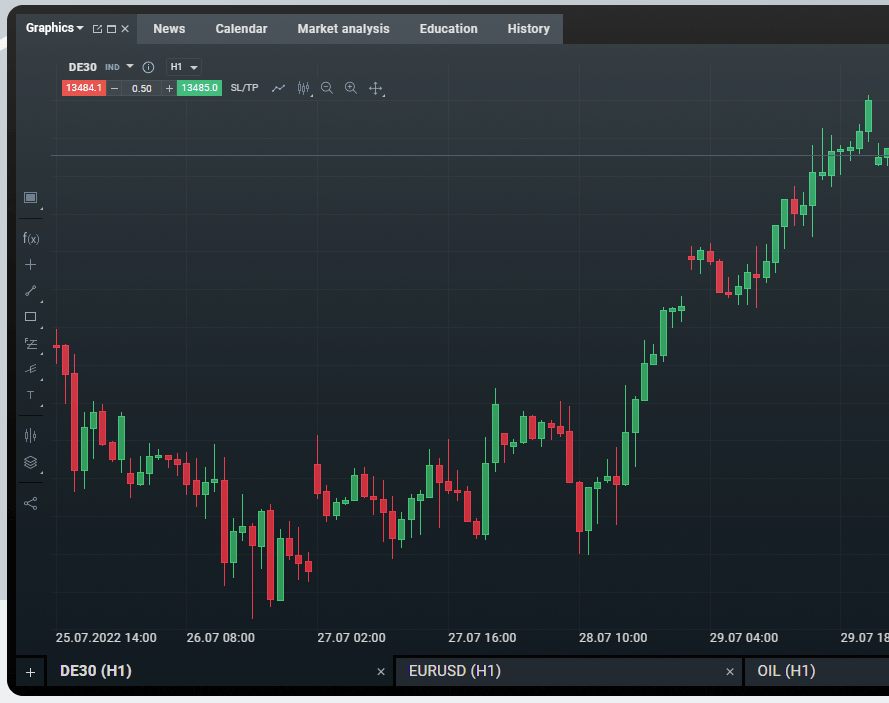

Bithoven offers a third-party trading platform: XOH Trader.

The platform is available as a web terminal, compatible with Chrome, Firefox, Safari, and Opera. Alternatively, the platform can be downloaded to desktop devices with Windows and Mac compatibility or can be used as an iOS or Android mobile app. All versions offer global market access with all the powerful tools and charting functions.

While using Bithoven, our team found the white label terminal complex, with many advanced features that may not be suitable for beginners. Having said that, the interface is customisable, so you could consider moving windows and collapsing some features that are not needed for your strategy.

We liked that there are integrated tools such as an economic calendar, financial news stream, and a view of the biggest asset movers so you don’t have to switch away from the platform. Other features that we rated include:

- Hots: Visualise the biggest product gainers and losers in the financial market

- Heatmap Visuals: Colour-coded CFD data demonstrating price changes by percentage to aid with investment decisions and trend pattern formations

- Market Sentiment: View peer retail traders’ open positions (long vs short) and instruments of high interest to help determine market entry and exit points

- Advanced Charting: Personalised chart views such as price, sessions, and grid. You can save custom templates, drag technical indicators and view several time periods

Interestingly, we found the XOH mobile app easier to use then the desktop software. You can access full account management features, charts with small screen views, and all the trading tools needed for market analysis.

It is great for keeping up to date with price charges and influences whilst you’re away from a computer device.

XOH Platform

Leverage

Bithoven offers very high leverage, much more than you would be able to access if you invested with an FCA-regulated brand. You can access a maximum leverage of 1:1000, meaning for every £1 you deposit, you can borrow £1000 from the brokerage.

Whilst this can boost your position sizes significantly, it can also cause severe losses.

The brand has a tight margin call at 50% and a stop-out level of 5%.

Demo Account

We were satisfied to see Bithoven offers a demo account, ideal for beginners. Even more so, the practice profile offers unlimited access and real market conditions, so you can get a feel for trading before investing your own money.

You can choose flexible leverage and a virtual balance.

UK Regulation

Bithoven is registered under the trading name Fortis Ltd and is regulated by Saint Vincent and the Grenadines Financial Services Authority (SVGFSA), license number 25256. The brand is not overseen by the UK’s Financial Conduct Authority (FCA).

The SVGFSA is not a particularly respected financial body, with relaxed measures in place for registered firms.

We did not find any evidence of negative balance protection or segregated funds from business money, which is a major red flag. You also won’t be covered by FSCS protection, in the case of business insolvency.

Having said this, the brand does comply with KYC requirements at sign-up, though this does not make up for the lack of financial protection for its customers.

Bithoven does offer two-factor authentication (2FA) for additional account security. We would recommend enabling this for peace of mind, particularly as financial safeguarding measures are limited.

Bonus Deals

When we used Bithoven, we found that frequent traders get bonus rewards, as well as prizes for new customers. The brand has flexibility with financial incentives, as it is not registered under any strict regulatory authorisations.

At the time of writing, the brand had a trading competition with product prizes and a 100% deposit bonus promo. We were not offered a no-deposit bonus.

On the negative side, we reviewed the threshold requirements for the ‘trading battle’ and found these quite unrealistic for the majority of retail investors. The minimum trading requirement was a 100-lot turnover for the lowest prize tier.

The 100% deposit bonus was available to new and existing customers, with a maximum bonus match reward of $10,000. Profits made using the bonus can be withdrawn, though we recommend checking the terms and conditions before signing up.

Extra Tools & Features

We were disappointed when it comes to additional tools offered by Bithoven. The brand does not provide any advanced services such as VPS hosting, automated trading, or crypto exchange functions, so we wouldn’t rank the brand highly for experienced retail traders.

For beginners, there is also no educational content or online learning academy, so you really are on your own. There is however a ‘Top Movers’ and ‘Market Watch’ feature available alongside the economic calendar. This is hosted by XOH, the third-party trading platform provider. Even so, the information is quite basic, with no option to expand the data or delve further for additional insights.

For some excellent examples of brokers offering full-fledged educational resources and trading tools, we recommend market leaders such as IG Index or XM.

Customer Service

Our experts were disappointed with Bithoven’s customer support. There is no live chat function or telephone number available, which often provides the fastest response times.

Prospective clients are required to complete an online contact form or use a generic email address (customercare@bithoven.com). We tested the online contact form and did not receive a response within 24 hours, which is unsatisfactory.

There is also an FAQ section, where we did find some useful information, though this does not compensate for the lack of human interaction.

Company Details & History

Bithoven.com was established in 2019 and is regulated by the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. The company is also headquartered here, though there is no UK office.

There is very little published company information, though the brand has been recognised with some industry awards including the Best Crypto Start Of The Year at the IAFT Awards 2018 and the Fastest Growing Cryptocurrency Trading Platform at the Global Brands Magazine Awards 2019.

Trading Hours

Trading hours vary by instrument:

- Forex: Sunday 11:00 pm to Friday 10:00 pm (CET, GMT -1)

- Oil: Monday 2:05 am to Thursday 11:00 pm and Friday 2:05 am to Friday 10:00 pm (CET, GMT -1)

- Precious Metals: Monday 12:00 am to Thursday 11:00 pm and Friday 12:00 am to Friday 10:00 pm (CET, GMT -1)

We were pleased to see an economic calendar available on the broker’s website, which publishes major economic events that may impact your positions, as well as public holiday dates.

Should You Trade With Bithoven?

Bithoven is not upfront about key information, including trading fees. This, along with no additional tools, loose regulation and lack of customer support options mean we don’t recommend trading with this brand. The product list is also very limited.

Instead, consider trading with one of the best UK brokers.

FAQ

Is Bithoven A Good Or Bad Broker?

We would not classify Bithoven as a good broker. The brand is not transparent with its services or fees and is not regulated by a reputable financial authority like the FCA. We were unsatisfied with the customer support, lack of educational content or trading tools, and withdrawal fees apply.

On the plus side, margin trading is available, with high leverage of up to 1:1000. You can also invest in demo mode and trade on a powerful third-party terminal.

Is Bithoven A Safe And Trustworthy Broker?

Our experts are not convinced that Bithoven is a safe brand. The brokerage is registered offshore with the SVGFSA, which is renowned for its relaxed membership requirements. We found limited evidence of financial safeguarding initiatives or negative balance protection in place for retail traders.

Does Bithoven Offer Good Market Access?

No, Bithoven has a very limited product lineup, with forex and commodity CFDs available only. There are no stocks, indices or cryptos like Ripple available to traders.

Is It Easy For UK Traders To Fund A Bithoven Account?

Bithoven offers a choice of fiat and crypto payment methods, though GBP is not accepted as a base currency. The brand does not charge any deposit fees, which is a plus. You can add funds to your live account via credit/debit card, cryptocurrency including Bitcoin and Ethereum, plus Perfect Money, AdvCash, and more.

Does Bithoven Have A Mobile App?

The Bithoven trading platform, XOH Trader, is available with iOS and Android mobile app compatibility. You can access all the features of the desktop software including charts, analysis tools, and account management. We actually found the app easier to use than the desktop platform.

Article Sources

Top 3 Bithoven Alternatives

These brokers are the most similar to Bithoven:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Bithoven Feature Comparison

| Bithoven | Swissquote | FP Markets | IC Markets | |

|---|---|---|---|---|

| Rating | - | 4 | 4 | 4.8 |

| Markets | Cryptocurrency | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $0 | $1,000 | $40 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | - | 1:30 | 1:30 (UK), 1:500 (Global) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | ||||

| Review | Bithoven Review |

Swissquote Review |

FP Markets Review |

IC Markets Review |

Trading Instruments Comparison

| Bithoven | Swissquote | FP Markets | IC Markets | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Bithoven vs Other Brokers

Compare Bithoven with any other broker by selecting the other broker below.

Popular Bithoven comparisons: