Bitfinex Review 2025

|

|

Bitfinex is #39 in our rankings of crypto brokers. |

| Top 3 alternatives to Bitfinex |

| Bitfinex Facts & Figures |

|---|

Established in 2012, Hong Kong-based Bitfinex is a formidable player in the crypto industry. It boasts a powerful proprietary platform, 180 cryptocurrencies and more than 430 market pairs available for spot or perpetual swaps derivatives trading. With new payment methods, lower entry barriers and fresh products like crypto futures, Bitfinex is attracting a wider range of active crypto traders. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Trading App |

Bitfinex provides a mobile application that mirrors the full functionality of its web platform, facilitating seamless crypto trading on the move. The app also includes a Lite Mode for a simplified trading experience, presenting a more user-friendly interface for trading, staking, and lending cryptos, requiring just a few taps. The app is downloadable from both Apple’s App Store and Google’s Play Store, though app store ratings demonstrate a superior user experience on iOS devices. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | $10 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | No |

| Cryptocurrency | Bitfinex provides access to an exceptional variety of crypto assets, encompassing over 180 tokens. In addition to spot trading, the platform supports perpetual swaps trading, enabling traders to engage in margin trading on crypto assets with leverage up to 1:10. With digital tokens frequently listed and delisted, Bitfinex provides diverse opportunities to participate in the dynamic cryptocurrency market. |

| Coins |

|

| Spreads | Taker (0.2% to 0.055%) and maker (0.1% to 0.0%) |

| Crypto Lending | Yes |

| Crypto Mining | No |

| Crypto Staking | Yes |

| Auto Market Maker | No |

Bitfinex is a popular crypto exchange and P2P financing platform giving customers around the world, including the UK the opportunity to trade and invest in digital assets. This 2025 broker review will explore Bitfinex’s trading app, fees, leverage, demo account, funding rates and minimum order size.

Company History & Overview

Founded in 2012, Bitfinex is focused on giving its customers the ultimate cryptocurrency trading experience. Its founders are Raphael Nicolle and Giancarlo Devasini. The company’s owner is iFinex Inc and its CEO is JL van der Velde.

With a 30-day trading volume of over $19bn, the firm is now one of the largest digital asset trading platforms in the world. Although the global crypto market has taken a hit in 2022, its market cap still stands at around $859bn.

In addition to trading, Bitfinex provides peer-to-peer (P2P) financing. It is unregulated but registered offshore within the jurisdiction of the British Virgin Islands.

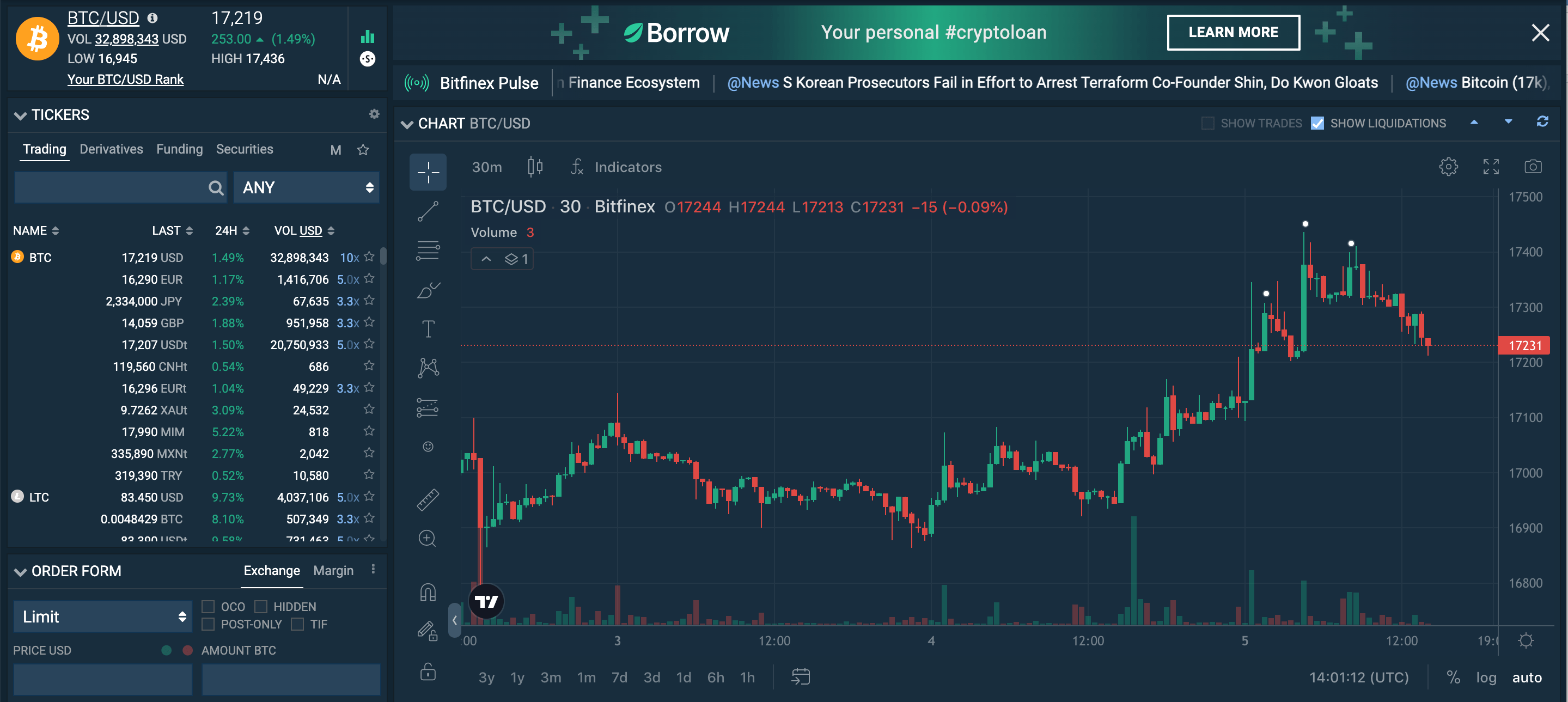

Trading Platform

Bitfinex uses a web-based trading platform that combines convenience with the tools needed to undertake technical analysis. With a simple layout and a range of technical indicators, chart types and drawing tools, the platform suits the needs of beginners and seasoned traders alike. Note that MetaTrader 4 and 5 are not available. While using the platform, we found the following features:

- Drawing tools

- Order book data

- Rolling news bar

- High liquidity for minimal slippage

- 12 timeframes from one minute to one month

- Multiple chart types including line and candlesticks

- Indicators including a moving average and a stochastic oscillator

- Multiple order types including limit, stop and trailing stop orders

Bitfinex Trading Platform

Markets & Assets

The majority of assets available on Bitfinex are digital currency trading pairs, with multiple quote currencies, including USD, EUR, GBP, JPY, and some cryptos. Traders can access all the main crypto pairs like BTC/USD, ETH/USD and XRP/USD, as well as more obscure tokens like 1INCH and Quantfury.

In addition to currency pairs, users can trade crypto, forex and commodities perpetual swaps – a type of derivative contract. Bitfinex is developing further derivative products, so we may see crypto futures and options appear at some point. There are also three securities for investors: BMN/USD, EXO/USD and BMN/BTC.

The exchange does not offer traditional stocks or indices. Also, note that some tokens, such as QASH, have been delisted from the platform.

Fees

When we used Bitfinex, we found the fee structure to be fairly complicated as it depends on multiple factors, including your 30-day trading volume and the number of UNUS SED LEO tokens (the platform’s own token) that you hold. Fortunately, there is a fee calculator available to assist. The general rule is that, for crypto-to-crypto, crypto-to-stablecoin and crypto-to-fiat transactions, the maker fee is 0.1% and the taker fee is 0.2%. For derivatives, the maker fee is 0.02% and the taker fee is 0.065%. These fees are in place of the standard commission at a traditional broker.

Those holding UNUS SED LEO tokens may be eligible for a discount on fees. This depends on the quantity of the token held and the type of transaction. If holding more than one token but no more than 5,000 (further discounts apply for amounts higher than this), there is a 15% discount on taker fees for crypto-to-crypto and crypto-to-stablecoin transactions. Discounts also apply if a trader has executed investments worth $500,000 or more in the last 30 days.

Those borrowing funds on Bitfinex will pay a maker fee twice – once to take out the loan and another when returning the funds. The interest/lending rates charged in addition to this to compensate the investor funding the loan depend on the asset/coin.

Leverage

Investors can get up to 1:10 leverage when margin trading. Those wanting higher leverage of 1:100 or more should look at other exchanges. Traders can either borrow funds themselves or simply open a position and Bitfinex will take funding out at the best available rate. Those with uninvested funds may want to lend crypto or fiat out themselves and earn interest.

Traders can claim a leveraged position, which means using profit or funds in their margin wallet to settle part of or an entire position.

Mobile Trading

Bitfinex has a popular mobile app that can be downloaded from the App Store and Google Play. Like the web platform, the app is easy to use and offers a similar investing experience, with users able to exchange crypto and fiat currencies, as well as borrow funds.

Bitfinex Mobile App

Payment Methods

Deposits

There are three ways to buy crypto on Bitfinex:

- Credit/debit card (Mastercard, Visa and UnionPay)

- Exchange another currency for crypto on the exchange

- On-ramp services in Euros (processed by happyCOINS but accommodates instant payment methods like iDeal and Giropay)

Using a bank card or an on-ramp service is generally instant. Purchasing crypto using a debit/credit card is processed through OWNR, Mercuryo or Simplex. The cryptos available to purchase and the required identity verification level depend on the provider in question. Fees and minimum/maximum deposits also vary, although Bitfinex does not charge its own fees for crypto deposits. The minimum purchase through the on-ramp provider, happyCOINS, is EUR 50.

Those depositing crypto directly from a third-party wallet will be subject to blockchain capacity and traffic in terms of processing times. That being said, Lightning Network is available for faster BTC deposits (and withdrawals if BTC is converted to LN-BTC first). Check to ensure wallet addresses are accurate.

There is also the option to deposit fiat money (USD, EUR, GBP, JPY and CNH) into your Bitfinex account via a bank wire transfer. The fee for this is 0.1% with a minimum of £60. The maximum fiat deposit is £10,000. Five business days is a common processing time for international wire transfers.

Deposits can be made into three different types of wallets on Bitfinex:

- Margin wallet – for trading on the margin

- Funding wallet – for lending to other traders

- Exchange wallet – for trading cryptocurrencies

There is also the Derivatives Trading wallet and the Capital Raise wallet (for Bitfinex Securities).

Withdrawals

Unlike some other cryptos exchanges, withdrawals can be made in both crypto and fiat money. Crypto withdrawals are subject to transaction fees (also referred to as gas fees) to incentivise miners to add the transaction to the blockchain. The fee is automatically updated depending on current blockchain traffic and the currency being withdrawn, for example, USDt (ETH). There are no maximum withdrawal limits.

The minimum withdrawal for crypto is the equivalent of $5. It can take up to 12 hours for Bitfinex to process withdrawals, although the process can be automated if users meet certain security requirements. The transaction then needs to be added to the blockchain.

There is a minimum withdrawal requirement of £10,000 for fiat withdrawals by wire transfer. Express wire transfers are available that ensure fiat withdrawals are sent out within one business day. Although this is significantly quicker than the usual withdrawal time of 5-10 business days, the processing fee is 1% (£60 minimum) compared to 0.1%.

Demo Account

Bitfinex released a paper trading account in June 2020 to enable traders to test strategies without risking their own funds. Demo accounts are regularly used by beginners to familiarise themselves with investing before using their own capital.

There are no time limits imposed on the account.

Bonuses & Promotions

Our experts found no details of any sign-up or welcome bonuses on Bitfinex. Although there was a zero investing fee promotion on the Tether/US Dollar pair, this was only available to those with a trailing 30-day trading volume of more than $15m, which, effectively, restricts it to high-net-worth individuals.

Regulation

Bitfinex is registered in the British Virgin Islands and is unregulated. This means there is limited supervision of the exchange and minimal protection for customers. That said, it is not uncommon for legitimate crypto brokers and exchanges to be unregulated.

Account Types

Although there are not different account types on Bitfinex, there are various verification levels based on KYC, AML and CTF laws and regulations, which may limit the amount of activity you can undertake on the platform. The verification levels are Basic Access, Basic Plus, Intermediate and Full. Basic Access is a view-only account. The other three levels are detailed below. Note that the processing time for Intermediate and Full verification is generally within 2-3 working days.

Basic Plus

- Exchange and OTC trading only

- Crypto transfers and Tether token withdrawals

- Credit/debit cards, crypto transfers and Tether token deposits

Intermediate

- All types of investing, lending and borrowing

- All deposit methods except for international bank transfers

- All withdrawal methods except for international bank transfers

Full

- All deposit and withdrawal methods

- All types of trading, lending and borrowing

How To Trade On Bitfinex

1) Register For An Account

Signing up on Bitfinex only takes a few minutes. Simply enter a username, email, password and your country of residence on the sign-up page. Traders will then need to configure two-factor authentication (2FA), which uses Google Authenticator, and verify their email addresses. Setting up 2FA will require you to scan a QR code with the Google Authenticator app. Note that 2FA is mandatory for security reasons. If you have lost your phone, bought a new phone or have lost access to Google Authenticator itself, you can reset your 2FA online.

2) Deposit Funds Or Purchase Cryptocurrency

Traders can deposit crypto or fiat currency into their accounts. Crypto can also be purchased using common payment methods like debit/credit cards. The platform is therefore accessible to many types of investors, although the high minimum deposit amount for fiat money may put some beginners off.

3) Open A Position

The crypto market can be extremely volatile. We recommend that clients first engage in paper trading before risking their own funds. When ready to open a real position, investors should use the technical analysis tools on the platform to identify any trends or ranges for a particular asset. The advanced order types enable more accurate investing and help to manage risk. More experienced traders may wish to use Bitfinex Honey for algorithmic trading.

Benefits Of Bitfinex

- Low trading fees

- API Python 3 key

- Quandl data available online

- Fiat and crypto deposits and withdrawals

- No crypto deposit fees imposed by Bitfinex

- Intuitive trading platform with technical analysis tools

- Potential fee discounts for those holding UNUS SED LEO tokens

- Earn on spare funds through lending and staking (including ETH)

Drawbacks Of Bitfinex

- No sign-up bonuses

- Limited crypto derivatives

- Previous security breakdowns

- Unregulated and registered offshore

- High minimum deposit fee for bank wire deposits

- High minimum deposit and withdrawal amounts for fiat money

Additional Features

Bitfinex Honey allows traders to execute hundreds of algorithmic investing orders at once from their browsers. It is a convenient and accessible way of automating the trading process. Linked to this is the Bitfinex Terminal, which enables investors to backtest strategies using historical market data. Using an API (note that there is a rate limit), clients can also integrate with other sites like 3Commas and QuantConnect to run bots.

Those seeking insight into the crypto market should look at Bitfinex Pulse, which is a social trading platform that feeds news and analysis direct to your device. It includes content ranging from the latest NFT game to a price prediction for XRP. Bitfinex Alpha also contains articles with market analysis and insight.

The blog includes educational articles, to expand your knowledge base, and media releases. Some tutorial videos and articles can be found that teach investors how to use the platform, as well as services linked to the platform.

In addition to traders being able to lend out uninvested funds, some assets are eligible for staking rewards, which are paid weekly at an annual rate of up to 10%.

Bitfinex has a leaderboard on its website that shows the most profitable traders.

Trading Hours

Whether investing in Bitcoin or Dogecoin, the crypto trading market is open 24/7, meaning you can invest overnight and at weekends.

Customer Support

Bitfinex provides a live chat and an online contact form to assist customers with problems like if 2fa is not working, the trading platform is down or you have an invalid token error. There is a wide range of FAQs in the Help Center, which also contains useful articles on subjects like the order book, leverage and volatility that have explained various terms for beginners.

The company has numerous social media accounts, including on Facebook, Twitter, LinkedIn, YouTube and Discord.

Security

Around 99.5% of user funds are held in cold wallet storage to protect them from malicious attacks. Cold storage is safer as it keeps funds offline. This is in addition to various other security measures designed to shield the platform, such as DDoS protection, automatic logouts and an IP address whitelist. Personal account security is enhanced by mandatory 2FA for logins and withdrawals, with a verification code being sent via Google Authenticator. Customers can also have their accounts frozen.

Despite these measures, Bitfinex has been at the centre of multiple security incidents, including a 2016 hack in which around $72m of Bitcoin was stolen. The exchange and its sister company, Tether, have previously faced investigations and lawsuits.

Final Word On Bitfinex

This global digital asset trading platform is now one of the largest in the world. The success of Bitfinex can be attributed to its low trading fees, wide range of assets and well-equipped trading platform. Clients that are aware of crypto’s security and volatility risks but want to explore further may find joining Bitfinex to be a profitable idea.

FAQ

Is Bitfinex A Wallet?

Bitfinex is an exchange and P2P financing platform, although it does provide different types of wallets for users to store their funds within.

Is Bitfinex A Good Exchange?

Bitfinex is one of the largest crypto exchanges in the world with low trading fees and a good trading platform. On the other hand, it is unregulated and registered offshore.

Is It Safe To Trade On Bitfinex?

There are always risks when trading crypto, mainly because of the lack of regulatory oversight. That said, Bitfinex is a reputable exchange with a large trading volume.

How Do You Trade On Bitfinex?

Investors can invest through the Bitfinex web platform or mobile app. To place a trade, simply complete the order form. Those choosing a limit order will need to enter a price and order size.

How Do You Buy Crypto On Bitfinex?

Traders that want to buy crypto can do so directly using a credit/debit card or an on-ramp service. Alternatively, investors can deposit fiat currency and then swap this for crypto on the exchange.

Can I See My Bitfinex Transaction History?

Investors can access their trading history by navigating to Trades within the Reports section of the website. This data can also be exported to your email address.

Top 3 Bitfinex Alternatives

These brokers are the most similar to Bitfinex:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Bitfinex Feature Comparison

| Bitfinex | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| Rating | 3.9 | 4 | 4.3 | 4.7 |

| Markets | Cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $0 | $1,000 | $0 | $0 |

| Minimum Trade | $10 | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | - | 1:30 | 1:50 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Bitfinex Review |

Swissquote Review |

Interactive Brokers Review |

IG Index Review |

Trading Instruments Comparison

| Bitfinex | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Bitfinex vs Other Brokers

Compare Bitfinex with any other broker by selecting the other broker below.

Popular Bitfinex comparisons: