Turbo Binary Options

Turbo binary options are ideal for traders looking to make multiple short-term trades throughout the day. Expiry times can be as short as 5 seconds and payouts can exceed 100%. Turbos also often have a knock-out level designed to limit potential losses. This guide to trading turbo binary options explains how they work, shares strategy tips and lists the best brokers in 2026.

Binary Options Brokers

Safety Comparison

Compare how safe the Turbo Binary Options are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|

Payments Comparison

Compare which popular payment methods the Turbo Binary Options support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|

Mobile Trading Comparison

How good are the Turbo Binary Options at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|

Beginners Comparison

Are the Turbo Binary Options good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|

Advanced Trading Comparison

Do the Turbo Binary Options offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Turbo Binary Options.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|

What Are Turbo Binary Options?

Turbos are derivative products that track the price of an underlying asset, such as the GBP/USD forex pair. Traders then make a bet as to whether the price of the asset will rise or fall by the expiry time, for example, 30 seconds.

If the prediction is correct, the position ends ‘in-the-money’ and the initial stake is returned to the trader plus a fixed payout. The payout is normally a predetermined percentage of the initial investment, usually between 60% to 90%, however, this varies between brokers and assets. Pocket Option, for example, offers payouts of up to 218%. If the prediction is incorrect, the contract ends ‘out-of-the-money’ and the trader loses their initial investment.

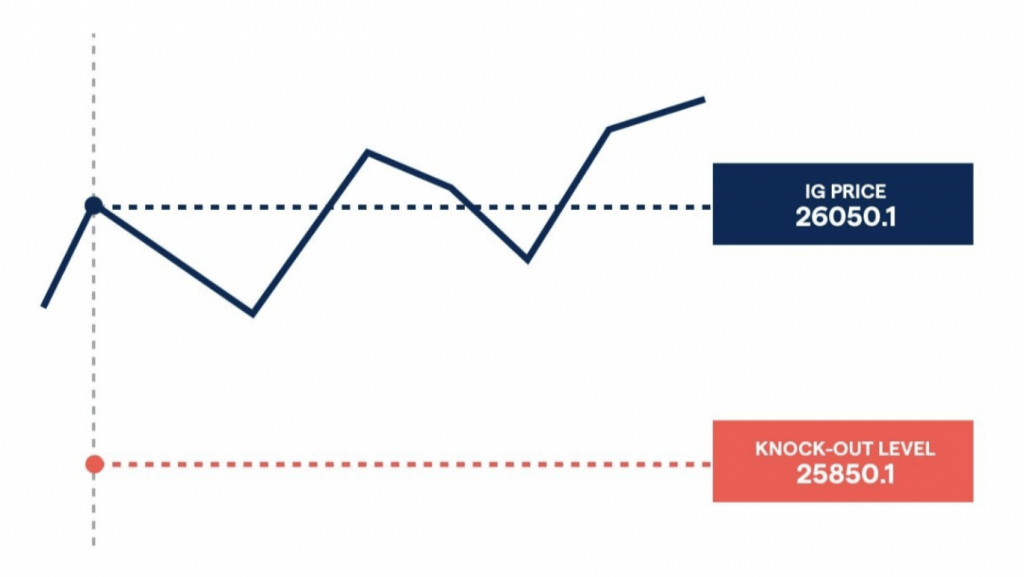

Importantly, turbos are usually ultra-fast trades that allow investors to speculate on short-term price fluctuations, sometimes just a matter of seconds. With that said, some brands, including IG, offer turbos with longer expiries of up to 24 hours. The IG Group also offers leveraged trading on its turbo contracts with built-in knock-out levels. This means clients can increase their purchasing power for a small capital outlay and can identify a price point at which the position is automatically closed, limiting potential losses.

Knock Out Levels On IG Turbos

How a Trade Works

Let’s look at an example of a turbo binary options trade…

Stock A is currently trading at £50. However, the company has just announced that its CEO is stepping down and you expect the share price to drop in the wake of the news. Your broker offers a turbo with an expiry time of 30 seconds and a payout of 60% if the share price drops to £49.50. You stake £200.

30 seconds later, the share price is £49.48 so your trade finishes in the money. As a result, your account is credited with £320 (£200 stake + £120 profit).

If the price had been £49.52 after 30 seconds, you would have lost your £200 stake.

Variations

Importantly, online brokers offer different payouts and expiries on their turbos. Some brokerages’ turbo products also have different characteristics. For example, IG offers leveraged trading opportunities, knock-out levels and longer expiries. With standard binary options brokers though, the following contract types are usually available:

- High/Low: The most common and straightforward type of turbo option. This contract is a question of ‘will the underlying asset be greater than or less than the strike price at expiry?’

- Ladder: A contract formed of several staggered strike prices at equal distance with increasing payouts. It works akin to having a series of high/low contracts.

- Boundary: Two strike prices are used to create upper and lower price levels for a contract. You predict if the underlying asset’s price will be between or outside of the price boundaries at expiration. Some brokers also call these range or in/out binaries.

- Touch/No-Touch: You predict if the asset’s value will reach a certain price before the expiration. Different from other binary options, it is not the price at expiry that matters. Rather, the asset only needs to ‘touch’ the price before expiring.

Trading Tips

Comparing Indicators

To build a successful strategy for turbo binary options trading, some investors turn to charts and indicators. Because turbo contracts often expire so quickly, you cannot always rely on fundamental analysis. Keep in mind that you don’t need to rely on a single indicator – your strategy can involve several.

Moving Average

A moving average (MA) indicator is used to identify trend momentum from previous periods. There are several different types of MA indicators, such as exponential and linear weighted, but the example below uses a simple moving average.

Typically, you set up a chart with a series of MA indicators, each with different time periods. In the example below, the blue line uses data from the past five days, the black line uses information from the past 10 days and the red line uses the past 20 days. Specific time frames can be changed for greater or less sensitivity. As turbo binary options are short-term, you may want to use shorter time frames.

When a shorter-term MA line increases past a longer-term MA line, you can assume a positive price movement will follow. This is called a bullish crossover. The opposite is called a bearish crossover and predicts a negative price movement. Examples of both can be seen in the chart for the GBP/JPY forex pair below.

GBP/JPY Moving Average Chart

Relative Strength Index

The relative strength index (RSI) is used to indicate when an asset is overbought or oversold using a 0-100 scale. The RSI is particularly useful for turbo binary options trading as it helps to tell investors when a trend reversal is likely so they can capitalise on short-term swings.

An example of how the RSI indicates price movement can be seen below. In this image, an RSI of 70 or higher indicates an asset is overbought and an RSI of 30 or lower indicates overselling. Just before 10:12, National Express stock is overbought and the RSI stays above 70 for several minutes, after which there is a large downtrend. At 10:36, the RSI drops below 30 for a short period of time, which precedes a small stock price uptrend.

National Express Relative Strength Index Chart

Bollinger Bands

Bollinger Bands are indicators of volatility. This is helpful for day traders executing turbo binary options as highly volatile assets are likely to see larger and more frequent price swings. The bands are created by finding the simple moving average and then calculating two standard deviations away in both positive and negative directions. The result is a bubble-like shape that expands and contracts to indicate higher and lower volatility.

An example can be seen below using the natural gas price history chart. As you can see, when the distance between the two bands is smaller, the fluctuations are not as large. When the boundaries are further apart, the price fluctuations are greater.

Natural Gas Bollinger Bands Chart

Comparing Brokers

Finding the right turbo binary options broker is not an easy task. With that in mind, consider the factors listed below.

Payouts & Expiries

How competitive are the payouts offered on turbo binary options contracts? Some brands offer over 100%. Also look at contract expiries. Do they start from 5 seconds, 15 seconds, 30 seconds or 1 minute? Finally, look at the underlying assets that turbo options are available on. Can you speculate on stocks, forex, commodities and cryptocurrencies?

Fee Structure

Look out for transaction fees, account subscription costs and any deposit or withdrawal charges. Check that the broker is clear about all trading and non-trading fees. If the broker tries to hide information about fees or a price schedule is not available, steer clear.

Reliability

In 2019, the Financial Conduct Authority introduced a ban that said FCA-licensed brokers are prohibited from offering binary options contracts to retail traders. Because of this, you will need to open an account with an offshore or unregulated brokerage.

This makes it particularly important to sign up with a trusted and reputable trading platform. Check user reviews and ratings on social trading forums. Alternatively, choose from our list of recommended brands.

Customer Support

If there are any problems with your account, it is important to have access to prompt support. The best turbo binary options brokers have multilingual and accessible support teams that are contactable 24/7 or 24/5 via live chat, phone hotline or social media.

Demo Account

Free demo accounts are a great place to test turbos and develop strategies in a risk-free environment. They are also a good way to try other binary options contracts and to get comfortable with a new online broker’s tools and products.

Trading Platform

Is there a high-quality trading platform available such as MetaTrader 4 or MetaTrader 5? If the broker offers a proprietary platform (as many binary options brokers do), check the range of indicators and drawing tools to accommodate technical analysis. Also find out if the broker provides additional support like mobile alerts, real-time signals and trading robots.

Deposit & Withdrawal Rules

You should avoid turbo binary options brokers with excessively high minimum deposit limits and withdrawal thresholds, such as £1,000+. This, in addition to only permitting deposits via crypto, are indicators of a potentially shady trading platform. The best brokers will offer low, beginner-friendly deposit limits and hassle-free withdrawals.

Pros of Turbos

- Simple instrument to understand

- Potential for high rewards with large payouts

- Multiple trading opportunities available throughout the day

- Avoids risk associated with longer-term trends and trading positions

Cons of Turbos

- High-risk investments

- Losses can quickly rack up

- Traders must use offshore brokers

Bottom Line on Trading Binary Options

Turbo binary options are high risk and trading such a product demands discipline and preparation if you want to boost your chances of success. It is also important that you understand how turbos work before getting started with a live account, so make the most of any demo trading environment offered by your broker. Check out our list of recommended brands to get started.

FAQs

Are Turbo Binary Options Legal In The UK?

Licensed brokers in the UK cannot offer any kind of binary options product to retail traders. That does not mean, however, that traders cannot access them. To trade turbo binaries, you will need to sign up with either offshore or unregulated brokerages.

How Short Are Turbo Binary Options?

Turbo binary options often expire after just 30 seconds. With that said, some platforms offer products that expire after 15 seconds or even 5 seconds. IG, on the other hand, offers 24-hour turbos.

When Can I Trade Turbo Binary Options?

This is dependent on the underlying asset you want to trade. For example, if you want to trade stocks on the London Stock Exchange, you are limited to trading between 8:00 AM and 4:30 PM GMT. However, if you are interested in cryptocurrency, you can trade turbo binary options 24/7.

Can Beginners Trade Turbo Binary Options?

Yes, novices can trade turbo binary options. If you are a day trader interested in executing short-term trades, then turbos could suit your needs. See our list of top brokers to get started.

Can Trading Turbo Binary Options Be Profitable?

Yes, turbo binary options trading can be profitable, however, no investment is without risk. A careful approach to risk and money management is required. It is also worth pointing out that most retail binary options traders lose money in the long run.