Binary Options Arbitrage

Binary options arbitrage is a niche strategy which can reap high rewards if traders capitalise on rare market inefficiencies. This guide explains how binary options arbitrage works, explaining how to get started and listing the key advantages and disadvantages traders should consider. We have also ranked the best binary options brokers and platforms that support arbitrage trading strategies.

Binary Options Arbitrage Brokers UK

Safety Comparison

Compare how safe the Binary Options Arbitrage are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|

Payments Comparison

Compare which popular payment methods the Binary Options Arbitrage support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|

Mobile Trading Comparison

How good are the Binary Options Arbitrage at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|

Beginners Comparison

Are the Binary Options Arbitrage good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|

Advanced Trading Comparison

Do the Binary Options Arbitrage offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Binary Options Arbitrage.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|

Binary Options Arbitrage Explained

Before we cover how to execute a binary options arbitrage strategy, it’s important to understand how binary options and arbitrage systems work individually:

Binaries

Binary options are fixed with a yes or no outcome; there is no grey area. The conditions of each binary options contract are agreed with the broker before the contract starts. Conditions include expiry time, payouts and strike price. This means that the exact amounts a trader stands to gain or lose are set before the contract begins, and will stay the same regardless of how much the price moves.

Binary options can be traded on most asset classes such as stocks, commodities, indices, cryptocurrencies and forex pairs. Traders can take a long or short position depending on whether they believe the price will increase or fall. In both these scenarios, the trader is betting that an asset’s price will move in a certain direction.

If the trader’s bet comes in, they will receive a payout from the broker. This payout varies between brokers, with some offering 95% or higher. This means that while an unsuccessful trade will mean losing 100% of the stake, a successful trader will still usually need to pay a premium to the broker from a successful trade.

Arbitrage

The concept of arbitrage is when an asset is listed on two different exchanges at different prices and a trader can buy and sell on the respective exchanges, capitalising on the difference. This can be explained with a straightforward example…

BP is listed on the London Stock Exchange (LSE) at £45 per share and listed on the New York Stock Exchange (NYSE) at $50. Once both currencies are converted into dollars, the LSE BP Share is valued at $51.20, therefore the trader buys on the NYSE and sells on the LSE making a profit of $1.20 per share (less any commissions).

Although profits are small in the example above, in high volumes, returns can be significant. But importantly, financial markets are assumed to be efficient and therefore arbitrage opportunities can be hard to come by.

Binary Options Arbitrage Strategies

Hopefully the simplified arbitrage example above has explained the key components of the concept, now let’s look at possible strategies in the binary options space.

Buying & Selling Binaries Simultaneously

One method of arbitrage involves simultaneously entering both a call and put agreement on the same asset with different brokers on different platforms. It is unlikely that any broker would allow you to take out opposing positions on the same asset, and even less likely that this would be profitable if you could.

It is important to ensure that the payout is sufficiently high, otherwise the cost of the premiums on both the call and put sides will outweigh any expected profit. It is also critical for the contracts to have the same expiry time and date. The objective is to ensure that one of your two binary options contracts is in the money, so the net gain is a profit.

Note, due to the pricing structures of binary options contracts and efficient global markets, opportunities for this type of arbitrage are usually very limited.

Timing Arbitrage

Information about assets on certain exchanges can come out while the exchanges themselves are closed. For example, after 4:30 pm GMT traders can still speculate on LSE market information they receive even though the price of most assets will remain at the price they were at when the market closed.

An example of this would be if BP closed at £50 per share on Tuesday afternoon but a news leak came out on Tuesday evening regarding an earnings report which is expected to increase the share price of BP to around £60. Traders can buy binary options which are aligned with that news (expiry price of £60 and expiring the next morning), then when the market opens on Wednesday morning and the price increases to £60, the trader will be in the money having capitalised on the timing arbitrage.

Arbitrage On Correlated Assets

Some financial assets are linked in the way that they move in the market. When this is the case, binary options traders can capitalise on expected price movements before they happen. A good example of this is commodities like oil and gold which are invertedly priced against the dollar, so when the dollar increases in value the commodities normally decrease.

But although linked, their prices do not immediately respond to changes in the other’s price, so binary options traders looking to capitalise on an arbitrage can get in before price movements are reflected in the market.

How To Start Binary Options Arbitrage Trading

Choose A Broker

Traders may already be signed up with a broker that offers binary options. If not, there are many brokerages and platforms that could support binary options arbitrage. Depending on your arbitrage strategy you may need to be signed up with more than one broker.

When comparing accounts, consider the following factors:

Payouts & Premiums

The payout rate and the premium on a binary options contract are two of the most important factors. This is particularly the case when trading on arbitrage. To maximise returns on trades, you will need to secure high payout rates. The best firms offer payouts of 95%+.

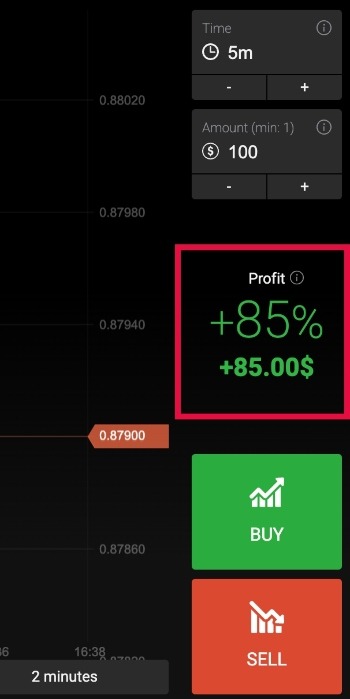

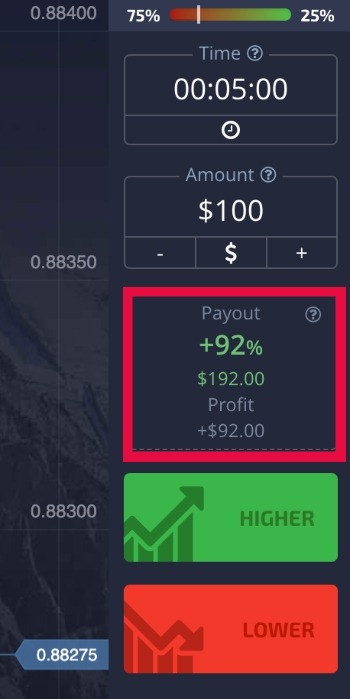

Example Payout

Example Payout

Deposit & Withdrawal Methods

Most binary options brokers, such as Pocket Option and IQCent, offer a range of payment methods where traders can deposit and withdraw quickly at low cost. As well as debit and credit cards, an increasing number of binary options brands are accepting crypto payments, including Bitcoin.

Leading binary options brokers will be transparent about their fee structure and their processing times before asking customers to sign up or pay a deposit. For any missing information, users can utilise the FAQs or contact customer service via live chat, phone or email.

Security & Reputation

Ensuring that your funds are safe when investing is important for any trader, regardless of their experience level. Although the FCA has restricted binary options, UK traders can still find a reliable, offshore broker through careful research. We have ranked the most trustworthy binary options brokers.

Extra Tools

There are many other additional features that investors should consider when trying a binary options arbitrage strategy. These include advanced platforms, educational resources, sign-up promotions, demo accounts, and trading signals, among others.

Binary options brokers that support arbitrage trading should advertise any additional features on their websites, so be sure to review these before signing up.

Add Funds To Your Account

Once you have chosen your binary options brokers and platforms, you need to fund your accounts. Some binary options arbitrage strategies are time sensitive, so ensuring your account has sufficient capital in it to make your move in the market is critical.

Check processing times when depositing and account for any currency conversions if trading an asset that is not denominated in GBP.

Enter The Market

After you have chosen your binary options arbitrage strategy and have deposited capital into your account, you are ready to enter the market. It is a good idea to test strategies in a binary options broker’s demo account so you can get a feel for the platform and market without risking any real money.

Each binary options arbitrage strategy should be supported with in-depth research and analysis. Since binary options are derived from an underlying asset, there should be a significant amount of market information available when plotting your next move. It is also important to employ a strong risk management strategy.

Advantages Of Binary Options Arbitrage

There are several benefits to trading binary options arbitrage:

- Out Of Market Trading – Many binary options are available to trade outside of typical market hours, and this can present arbitrage opportunities.

- Capped Losses – Losses with binary options are limited to the price of the contract. This is different to other asset classes where traders are exposed to the risk of the asset’s price falling in tandem with their losses. Furthermore, some arbitrage trades aim to negate that risk entirely – if successful the trader should make a profit regardless of the price movement.

Disadvantages Of Binary Options Arbitrage

There are also some downsides to binary options arbitrage trading:

- Limited Opportunities – Arbitrage strategies are born from the markets being inefficient and opportunities to find differences in the price of the same asset are limited.

- Multi-Broker Access – The most common way to execute a binary options arbitrage strategy is by signing up with multiple brokers to take advantage of differences in prices and payouts. However, managing multiple accounts can mean more effort and admin.

- High Payout Required – To maximise arbitrage opportunities, high payouts are required to cover the cost of premiums on both a call and put contract. Significant capital may also be needed to trade in high volumes.

Last Thoughts On Binary Options Arbitrage

Binary options arbitrage offers traders a dynamic way to generate profits by capitalising on market inefficiencies. Investors can make money from pricing differences, timing differences and opposing assets reacting to other assets’ changes in value. However, arbitrage opportunities are limited due to most markets being relatively efficient, so a binary options trader will often need to trade in high volumes to generate significant returns.

FAQs

What Is Binary Options Arbitrage?

Binary options arbitrage is using binaries to capitalise on market imperfections relating to pricing differences, timing differences and changes in the value of assets if they are influenced by price movements of other assets.

Is It Possible To Trade Binary Options Arbitrage?

Yes, it is. Although the opportunities can be limited, there are chances for traders to make money in the financial markets using this strategy. Note, you will also need to check that your binary options broker doesn’t prohibit arbitrage trading systems.

Are Binary Options Arbitrage Strategies Legal?

Binary options arbitrage is legal, but be aware that binary options have been restricted in many key trading jurisdictions, including the UK. Similar alternative products such as digital contracts are available, and UK traders can still sign up with reputable binary options brokers, though the FCA will not regulate them.

Is Binary Options Arbitrage Trading Safe?

This trading strategy is relatively safe if used and tested adequately. However, reports show some binary options traders have been scammed out of their deposits by fake brokers with false platforms. Traders should look for brokers who are well-reviewed and trusted. We have compiled a list of the top binary options brokers.

Does Anyone Make Money With Binary Options Arbitrage?

There is the opportunity to make money using this trading strategy, though market imperfections are limited and payouts can be low. You will need to shop around to find the right combination of broker, asset, payout and premium.