Balancer Review 2025

|

|

Balancer is #82 in our rankings of crypto brokers. |

| Top 3 alternatives to Balancer |

| Balancer Facts & Figures |

|---|

Balancer is a decentralised crypto exchange with a focus on liquidity provision and smart contract pools. |

| Instruments | Cryptos |

|---|---|

| Demo Account | No |

| Min. Deposit | $1 |

| Mobile Apps | No |

| Min. Trade | $1 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Cryptocurrency | Balancer supports crypto investment and trading in a range of tokens on the exchange's sleek online platform. |

| Coins |

|

| Spreads | N/A |

| Crypto Lending | Yes |

| Crypto Mining | Yes |

| Crypto Staking | No |

| Auto Market Maker | Yes |

Balancer is a decentralised, automated market maker (AMM) crypto exchange, operating on the Ethereum network. The brand offers over a good selection of 175 crypto tokens, including Bitcoin. Liquidity Providers (LPs) also can earn yield through several formats such as adding liquidity to pools from an existing crypto wallet.

Our review will outline the potential rewards available, typical fees, wallet connection protocols, and more. We also highlight any safety concerns.

Our Take

- Balancer offers a strong choice of ERC-20 tokens to swap on the app, or via alternative aggregators such as 1inch or Paraswap

- Gas fees are lower than many alternatives, which will appeal to active crypto traders

- We found the platform easy to navigate, with a clear and stable interface

- The hacking incident in 2020 and the lack of a regulatory license raises security concerns

- Education falls short compared to established crypto brokers who can better serve newer investors

How Does It Work?

Balancer enables investors the opportunity to swap crypto coins or add liquidity without the need for a centralised intermediary. Liquidity providers (LPs) are rewarded with an income if swaps are completed in pools where liquidity is provided. This liquidity can then be used by crypto swappers, aggregators, and arbitrageurs.

The prices of tokens listed on an AMM network will fluctuate depending on demand. As customers remove or add liquidity to a pool by conducting trades, the total ratio will change and therefore influence the price of an asset. Balancer will complete trades through the liquidity pools that provide the best prices for customers.

We were pleased to see that the brand offers a native token, Balancer token (BAL), which can be either earnt or used to participate in governance activities such as voting rights.

The coin reached an all-time high of $74.77 in May 2021. The maximum supply of BAL tokens is capped at 100 million.

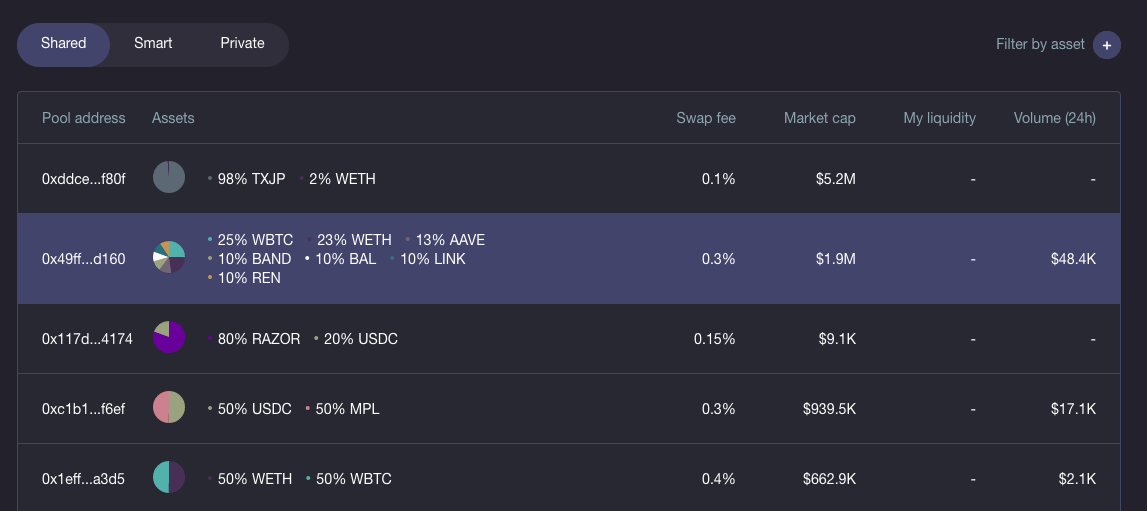

Pools

We found Balancer allows its customers to invest or create different types of pools (private, shared, or smart) and attracts different types of users including liquidity providers, traders sourcing liquidity for tokens, and arbitrageurs looking to benefit from differing spreads between platforms. We liked the accessibility of the brand, with anyone with two or more ERC20 tokens able to become a liquidity provider.

Investing your equity in several different liquidity pools decreases the likelihood of impermanent loss and as they are multi-asset, you may find pools with two or more tokens of interest in one.

- Smart Pools: Pool creators can continually adjust the parameters of their pools after launch

- Public Pools: Enables all users to add tokens to the pool to create liquidity. Pool owners can pre-define parameters before launching

- Private Pools: Enables the creator to add or remove assets from the pool only. This includes the ability to adjust parameters, asset weightings, and fees

We liked that Balancer does not restrict users by pool type, with extended options and full customisation available. This includes weighted pools, liquidity bootstrapping, plus linear and managed pools. Pools consist of smart contracts that use the Balancer Protocol to provide enhanced liquidity for exchanges.

The brand gives freedom and flexibility for pool developers to control the number of coin types and ratios between tokens such as 80/20 or 70/30, which we think is competitive vs Curve.

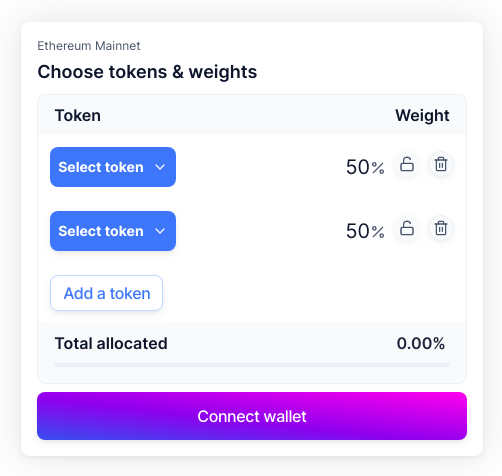

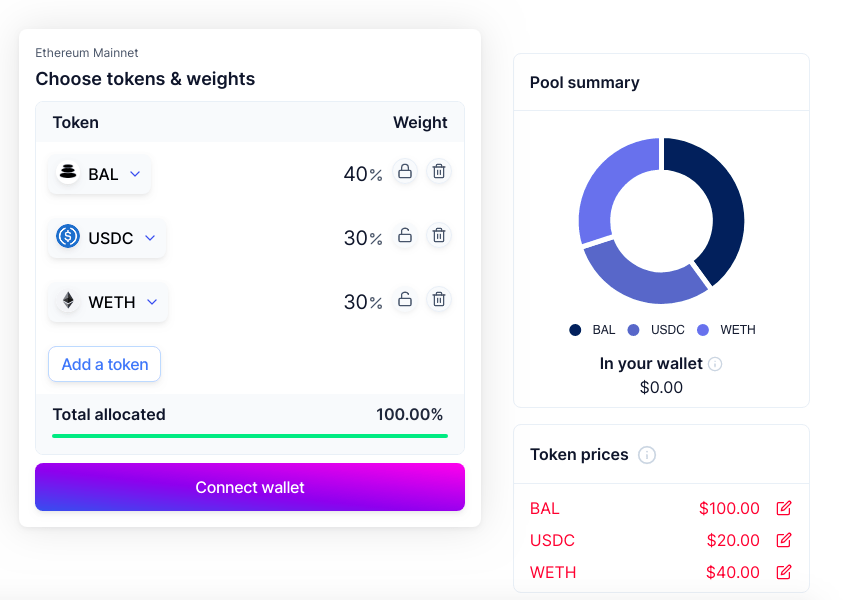

How To Create A Pool

I found the process to create a pool fairly easy and only took me a couple minutes. To do so:

- Select ‘Pool’ from the top menu of the exchange website and then choose the ‘Create A Pool’ logo from the top right

- Choose tokens from the dropdown menu

- Overtype the weighting ratios and choose the ‘Lock’ symbols to confirm

- Overtype the token prices in the bottom right section

- Choose ‘Connect Wallet’ to proceed. Follow the onscreen instructions/scan the QR code to initiate the connection

- Set pool fees and initial liquidity

- Review pool details and confirm the pool creation

Vault

The Balancer vault is the smart contract that holds and manages tokens in the pool and where operations including swaps take place. It uses a dynamic rebalancing model to maintain trading efficiency and flexibility.

We found the two main benefits of the brand’s vault are low gas costs and flexibility. You can use either single swaps (swapping two tokens against a single pool) or batch swaps (multiples).

Crypto Tokens

Balancer offers an impressive selection of 175+ cryptocurrency tokens. This puts in line with leading crypto firms.

When we created a pool, we were offered 175 tokens on the Balancer Listed option or were given the option of 241 tokens on the Uniswap Labs list or 85 tokens on the Gemini Token list. This includes:

- Nexo (NEXO)

- UniSwap (UNI)

- Balancer (BAL)

- ChainLink (LINK)

- USD Coin (USDC)

- Dai Stablecoin (DAI)

- Xend Finance (XEND)

- Wrapped Ether (WETH)

- Wrapped Bitcoin (WBTC)

Fees

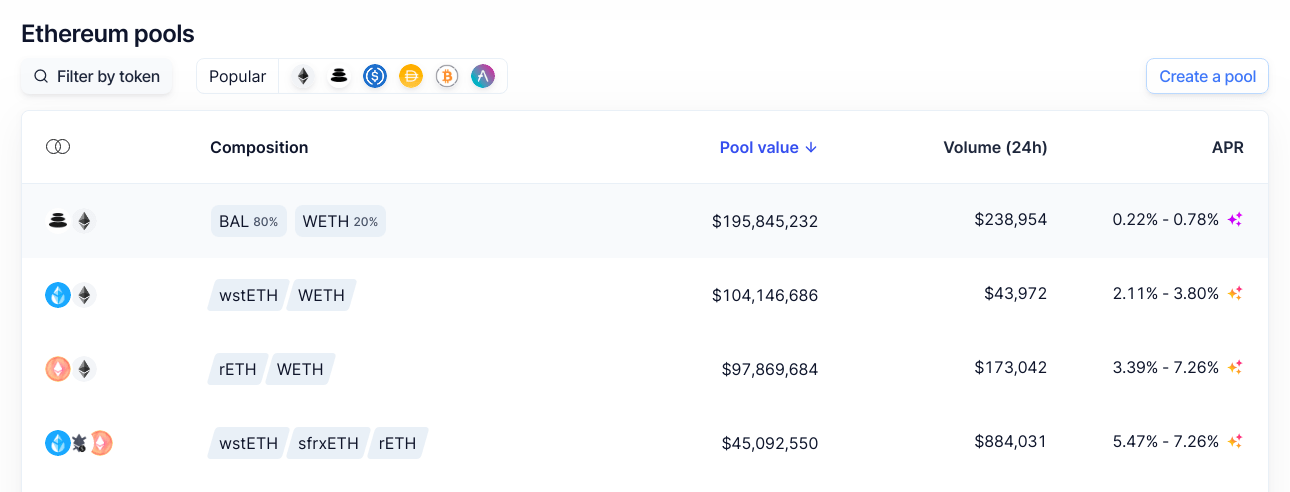

Traders are liable for token swap fees, which are shared between those providing liquidity to the pool. We found charges can vary significantly between pools and are based on a percentage of the traded volume, with full control given to the pool creator rather than by Balancer.

Charges can range between 0.0001% and 10% vs a flat 0.30% fee when trading on the Uniswap exchange. Fortunately, you can easily check the fees of the liquidity pool before requesting a coin swap.

Some liquidity pools offer very generous APR of up to 80%. Our experts were also pleased to see that Balancer v2, introduced in 2021, administers all pool activity from a single protocol vault, which offers reduced Ethereum gas fees for users.

Trading Platforms

We found the platform very easy to use, with a clear layout and order simplicity when exchanging tokens. There are no complex pricing graphs, or analytical views so we feel assured it will appeal to beginners, however, it would be good to see some crypto price predictions based on peer user activities.

To use the Balancer exchange you need to have a compatible cryptocurrency wallet to connect to your account. Accepted brands include MetaMask, WalletConnect, and Coinbase. We liked that there are no additional sign-up requirements needed to begin trading.

On the downside, we were disappointed to find that Balancer does not offer a mobile app version of the exchange, available on iOS or Android devices. The terminal is only available as a web trader via all major browsers.

How To Make A Trade

Balancer doesn’t use traditional order books to settle customer trades. The liquidity pools, of up to eight crypto tokens, provide this instead to host the environment needed by traders. Each time a trade is initiated, the pool is automatically rebalanced to the ratios set by the pool host.

The brand uses Smart Order Routing (SOR) and pool creators can set the costs for traders to pay when using liquidity, which can range from as little as 0.0001% to 10%.

I found the process of making a trade seamless once you enter the website:

- Select ‘Pool’ from the top menu and filter by token (you can also filter by APR, pool value, and volume)

- Choose a pool and review the composition by token and applicable fees

- Select the token you wish to trade

- Input the amount of new token you wish to receive

- Exchange rates and fees will be displayed on the screen

- Once happy with the order details, select ‘Connect Wallet’

- Choose the wallet you wish to initiate the transaction and confirm the connection with Balancer

- Review the pricing and click ‘Swap’

Regulation

As we expected, Balancer is not regulated by any financial watchdog. This is common for DeFi organisations as they are difficult for the government to control.

Instead, the brand uses its community of users as voting participants using the BAL token. We do feel reassured to some degree that the brand uses third-party security and regular audits, plus an active bug bounty programme with up to 1000 ETH rewards.

Having said this, our experts found the brand was a victim of substantial hacking in 2020. Over $500,000 value of Ether, Wrapped Bitcoin (WBTC), Chainlink (LINK), and Synthetix (SNX) tokens were stolen from two liquidity pools. This raises serious security concerns.

Despite this, the brand continues to improve its security stance, with reports in early 2023 of an emergency mitigation plan to protect against a new security threat. In any case, traders should be careful when trading with unregulated crypto exchanges.

Customer Service

Balancer does offer some customer support options, though this is quite limited vs established crypto brokers.

The exchange indicates social media channels as their main information source, including Twitter, Discord, and LinkedIn. Alternatively, users can email contact@balancer.finance.

We were impressed with the ‘Balancer Docs’ section, which contains a catalogue of useful details and explanations of the tools and services offered by the brand. However, we would like to have seen more guides with imagery and video content, especially as some of the information is quite complex.

Company Details & History

Balancer was initially launched in 2018 with its bronze release, with a full launch in 2020. A funding round in March 2020 saw the brand raise $3 million.

The exchange provides an open and accessible exchange for traders to invest in Ethereum or ERC20 tokens. Since its establishment, the brand has become one of the largest DEX platforms in the world by trading volume.

The protocol was developed by Balancer Labs, a tech firm led by founders Mike McDonald and Fernando Martinelli.

Today, Balancer hosts over 25,000 liquidity providers, with $3+ billion in locked liquidity.

Should You Trade Crypto With Balancer?

Balancer is an easy-to-use, flexible decentralised crypto exchange suitable for beginner-level and experienced traders. The brand offers token swaps, liquidity pool staking, and more, on a simple web browser-based terminal. Shared, private and public pools support up to eight cryptocurrency coins, with adaptable ratios available.

On the negative side, the lack of regulation and the hacking incident in 2020 are key drawbacks for us. We urge traders to be cautious if considering this exchange. Alternatively, consider our recommended cryptocurrency brokers which have a good track record of serving aspiring traders.

FAQ

What Is Balancer?

Simply explained, Balancer is a decentralised finance (DeFi) network operating on a predominant Ethereum exchange. It is one of the world’s largest automated market marker (AMM) networks in the cryptocurrency landscape, allowing clients to swap tokens and create liquidity pools.

Does Balancer Offer A Mobile App?

No, Balancer can be used as a web-based exchange only. There is no iOS or Android mobile app compatibility, which we consider a drawback compared to OKX.

Is The Balancer Crypto Exchange Easy To Use?

Our experts found the Balancer exchange fairly straightforward to use. We were able to swap tokens on the platform in a matter of minutes, with all fees and transaction details clearly displayed before confirmation.

However, advanced traders looking for more complex analysis may be disappointed with the lack of graphs and price prediction information provided in the terminal.

Is Balancer Compatible With A Good Choice Of Crypto Wallets?

Balancer users can connect a few popular cryptocurrency wallets to their account including Metamask and Coinbase. We liked that there were no additional registration requirements, making the process quick and seamless.

Are Balancer Trading Fees Low?

Balancer trading fees vary by token and liquidity pool, but are competitive. LP creators have full flexibility to set trading fees, which can range up to 10%. Importantly, the brand offers full fee transparency for users, meaning you will be aware of all applicable costs before completing a transaction.

Article Sources

Top 3 Balancer Alternatives

These brokers are the most similar to Balancer:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Balancer Feature Comparison

| Balancer | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| Rating | - | 4 | 4.3 | 4.7 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $1 | $1,000 | $0 | $0 |

| Minimum Trade | $1 | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | - | 1:30 | 1:50 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Balancer Review |

Swissquote Review |

Interactive Brokers Review |

IG Index Review |

Trading Instruments Comparison

| Balancer | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Balancer vs Other Brokers

Compare Balancer with any other broker by selecting the other broker below.

Popular Balancer comparisons: