Autochartist Review 2025

Autochartist is an automated technical analysis tool that provides free trading signals and alerts. The plugin is essentially designed to save time and support trading decisions. The software is offered by a growing list of forex and CFD brokers.

This review ranks the best Autochartist brokers in 2025 alongside subscription prices and demo trading. Our tutorial also unpacks the key features of Autochartist and explains how to download and get the most out of the software.

UK Brokers With Autochartist

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

-

BlackBull is a New Zealand-based CFD broker providing diverse trading opportunities on over 26,000 instruments. After undergoing a rebrand in 2023, it now sports a modern look and feel complete with professional-grade trading tools and ultra-fast execution speeds averaging 20ms.

-

GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

-

Established in 2007, Axi is a multi-regulated forex and CFD broker that has made strides to improve its trading experience over the years, from expanding its suite of stocks and upgrading the Axi Academy to launching its own copy trading app.

-

FXTrading.com is global broker offering highly leveraged CFDs on 10,000+ assets, including forex, stocks, indices, commodities and cryptocurrencies. Competitive prices with raw spreads and low to zero commissions are available. Traders can use the popular MetaTrader 4 platform and will have access to a suite of additional analytical tools and other resources. The multi-regulated brokerage is authorized by the ASIC and VFSC.

-

Founded in 2010, ThinkMarkets is a reputable CFD and forex broker with regulation from several top-tier bodies including the FCA and ASIC. The broker provides services to over 450,000 accounts from 11 global offices. Traders can use a bespoke platform, MT4 or MT5 to access a wide variety of assets including 3500+ stocks and ETFs, 46 forex pairs and over 20 cryptocurrencies.

-

IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

-

Global Prime is a multi-regulated trading broker offering 150+ markets. Traders can get started with a $200 minimum deposit and trade with leverage up to 1:100. The firm also has a high trust score and a good reputation with a license from the ASIC.

-

Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

-

Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

-

OANDA is an award-winning global broker, established in 1996. The hugely respected brand offers competitive trading accounts and serves clients from 196 countries. It remains a popular option with both beginners and experienced traders thanks to its user-friendly and sophisticated web platform, no minimum deposit and premium currency products and services. The company is also overseen by reputable regulators, including the FCA, ASIC and CIRO.

-

LegacyFX is a multi-asset broker offering an MT5 download & free signals.

What Is Autochartist?

Autochartist Limited (Ltd) is a financial data company that provides automated market analysis to aid trading decisions. The firm was established in 2004 by founder and CEO, Ilan Azbel and operates from headquarters in Nicosia, Cyprus.

Forex.com was the first online broker to offer Autochartist to its traders in 2006. Today, Autochartist is a widely available market scanning and analytical solution that offers insights into forex, stocks, indices, commodities, and cryptocurrencies. Its services support millions of traders in 100+ countries, including the UK.

The tool is mainly provided through a web interface and is available on platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) as a custom plugin.

Autochartist is compliant with regulatory rules set out by major financial agencies, including the UK’s Financial Conduct Authority (FCA).

How Does It Work?

Autochartist automatically analyses financial information relevant to your watchlist. Results are then published directly within a linked trading platform.

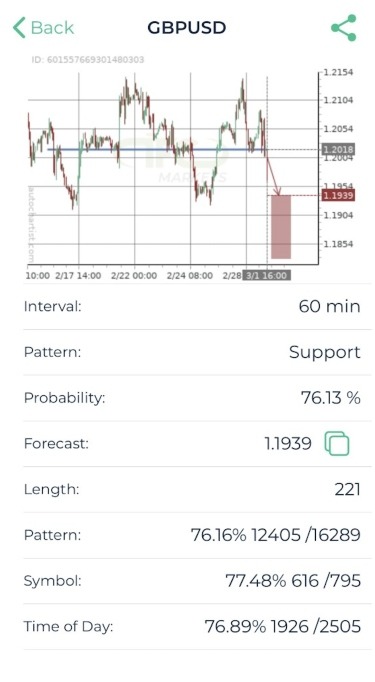

The software monitors the markets 24 hours a day, alerting users to trading opportunities in real time. It has been developed to identify openings based on support and resistance levels, breakouts, wedges, and triangles.

Key Features

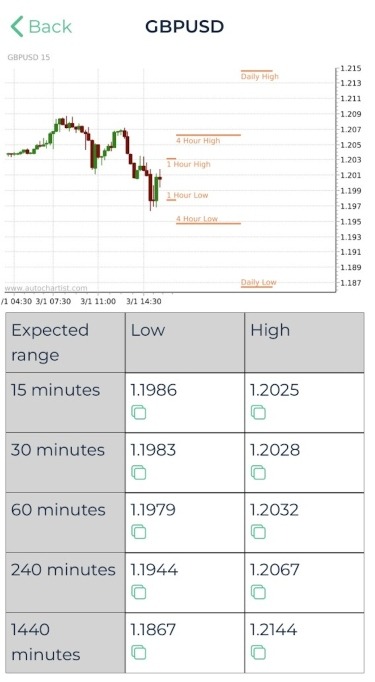

- Volatility Analysis – Detailed volatility evaluation on hourly, daily, and weekly timeframes. The software provides the statistical measure of the dispersion of data around an average over a pre-defined period. Data patterns can be used to set exit levels based on price deviation.

- Risk Calculator – Manage your risk and establish suitable position sizes to help maintain stable trading conditions. The calculator also gives suggested trade volumes to stay within a set risk tolerance.

- Social Sentiment – Community response metrics on major assets every minute. This includes Twitter volumes and conversation dispersion with proprietary Natural Language Processing (NLP). Data can be used as context for trade timing, new investment ideas, and market intelligence.

- Trade Setup Identifier – Chart analysis delivers direct results based on selected instruments. This includes macroeconomic forecasts, consecutive candles, Fibonacci patterns, support & resistance levels, and extreme movements.

- Economic Events – Major announcements and upcoming news can be assessed. The plugin provides an indication of potential price movements based on historic data alongside volatility warnings to protect against significant losses.

- PowerStats – Supports traders in setting stop loss and take profit levels with statistical information on the assets being traded. It can be helpful when creating new trading plans or refining existing strategies.

Installation Guide

Autochartist can be used as a desktop application, web terminal, or via a plugin for third-party platforms like MT4, MT5, and cTrader.

To download the software for a PC/Mac:

- Download or open the web version of your trading platform

- Log in to your trading account using your registered credentials

- Open the Autochartist installation file from your broker and select the setup language

- Review the welcome and disclaimer information and select Next

- Tick the box next to each file path to install the Autochartist plugin

- Click Install and then Finish

- Open your trading platform and drag the Autochartist plugin onto a chart

- Enter your email address to sign up for daily market forecasts and click Save

Once Autochartist has been successfully installed, you can restart your trading platform.

How To Use Autochartist On MetaTrader

To open the Autochartist tool, locate the brand name in the Navigation window under Expert Advisor (EA). Select an instrument from the Market Watch window, such as the EUR/GBP, and then drag the tool onto a chart. The programme will then load the relevant data and display it in an advanced chart.

The navigation menu will be visible in the bottom left of the chart with several features including a pattern probability display, filters, and timeframes. The view icon on the left of the features will automatically update the relevant chart. Select the tick box labelled Display all symbols if you want to view data based on the instruments listed in the Market Watch widget.

Historical price patterns will be available on the graph in a grey colour tone. This provides a visual representation of the direction that the instrument has taken in the past.

Once the close button of the main menu is selected, the programme will remove itself completely from the chart.

Mobile App

Autochartist offers a mobile-compatible app, available for free download on iOS and Android (APK) devices. Autochartist brokers including Pepperstone provide a QR code for the mobile application from their client dashboard area.

Autochartist offers a mobile-compatible app, available for free download on iOS and Android (APK) devices. Autochartist brokers including Pepperstone provide a QR code for the mobile application from their client dashboard area.

Unfortunately the mobile app is fairly basic, with limited customization options. Having said that, the search function enables users to filter by asset type and probability statistics. It is also useful for receiving push notifications whilst on the go.

To get started:

- Download the Autochartist mobile app from Google Play or the Apple App Store

- Log in to your broker’s client area and launch Autochartist

- Scan the QR code on your mobile device

- Search for an instrument in the bottom navigation bar or filter using the funnel symbol

Contact your broker directly for any download help or information as to why the app is not working.

Pricing

Brokers pay Autochartist a licensing fee, so there is not normally a fee for traders. With that said, some brokers may require traders to hold a minimum account balance or meet trading volume criteria. Membership levels also vary between Autochartist brokers, meaning the number of tools and content available may change.

If your broker does not provide access to any version of the tool, consider a subscription-based indicator download that can be integrated into your platform. ChartViper, for example, provides access to Autochartist for £29 per month or £145 for six months.

Pros Of Autochartist

- Alerts – Autochartist can provide email or dashboard alerts every 15 minutes. The tool creates audio and visual alerts for emerging opportunities as they happen in real-time. For example, a highly volatile instrument due to a macroeconomic announcement.

- Customisation – Users can filter search criteria based on specific instruments. This means unrequired data is left out, and information only relevant to your strategy is published. The advanced search filter uses either predefined or selected criteria to find trading opportunities.

- Time-Saving – The tool is a time saver, doing all the market analysis that could otherwise take hours to study manually. Autochartist can scan all instruments within the Market Watch window on MetaTrader, searching for actionable opportunities.

- Integration – Traders can easily drag and drop the Autochartist web application directly onto existing trading platforms. Information can be viewed within one interface, with no switching between screens or additional login required.

Cons Of Autochartist

- Profits Are Not Guaranteed – Returns are not guaranteed even when following trade suggestions. Your trading performance and success rates will still require insights and input. Spend time learning how to use the programme with the best settings, alongside learning the basics of investing.

- No Automated Trading – Although Autochartist is a popular automated market analysis tool, it cannot open and close positions on your behalf. It simply scans the markets for signals and sends alerts and trade suggestions. It is your responsibility to decide how to review and use the signals.

- Inadequate Education – Autochartist takes away from the traditional ‘learning by doing’ aspect of trading. For beginners, it is important to learn how to read market information and interpret financial data.

How To Compare Brokers With Autochartist

As well as checking the quality of the Autochartist package, also consider:

- Demo accounts – Brokers that offer Autochartist typically allow customers to test the programme. A practice account is ideal to get comfortable with the features including how to use the risk calculator download plus chart patterns and indicators. The tool is also available as a free 14-day trial before registration with a broker. Note, all demo accounts will be subject to information delays.

- Trading Platforms – The best Autochartist brokers offer industry-recognised platforms such as MetaTrader 4 and MetaTrader 5 with simple download integration. A stable terminal interface will ensure the Autochartist tool can operate effectively and provide appropriate signals for trading decisions. You should also consider access to mobile trading, which means you can keep up with investments whilst on the go.

- Customer Support – Autochartist does not offer support to retail traders directly. For any issues including MT4 download and integration, how to uninstall Autochartist, or the latest programme updates, you will need to contact your brokerage. It is important to find a broker with responsive customer service during trading hours. This may include via live chat, telephone, or email. IG for example provides 24-hour support, 5 days a week.

- Fees – Although Autochartist brokers do not typically pass costs on to retail investors, it is important to assess trading fees. Commission charges and spreads can eat away at profits. Non-trading fees to consider include inactivity charges, rollover fees, and payments to deposit or withdraw to live trading accounts.

Should You Use Autochartist?

Autochartist is a popular automated market analysis tool. It provides a wealth of trade setup ideas, alerts, and insights to aid decision-making. The software can also be easily integrated into brokers’ trading platforms, often with no fees. However, profits are not guaranteed and the tool will still need oversight and input to get the most out of it. To get started, use our list of the best Autochartist brokers.

FAQ

Is Autochartist Good?

Autochartist is an intuitive automated analysis tool that can be integrated into brokers’ platforms. It provides 24/7 market scanning which can save hours of manual analysis. The software also provides free trading signals, alerts every 15 minutes, and a risk calculator. It is usually available for free when you sign up with partnered brokers.

Does Autochartist Work With MT4?

Yes, Autochartist works with the MetaTrader 4 (MT4) desktop and mobile terminal. It can be downloaded as a free plugin and integrated into the platform interface. Our installation guide provides a step-by-step tutorial on how to get started with Autochartist brokers.

Does Autochartist Work?

Autochartist provides visual price analysis and trade setup suggestions. It considers a wealth of historical data and macroeconomic factors, though what you do with this information is up to you. Some suggest the success rate of Autochartist trade ideas is between 70-80%, but profits are never guaranteed.

What Are Best The Alternatives To Autochartist?

Autochartist provides similar services to Trading Central. Both link with partner brokers and are typically available free of charge. TradingView is also a good alternative that is widely available and offers automated trading bots.

Is Autochartist Suitable For Beginners?

Yes, Autochartist is a good option for beginners. Investors can simply wait for trading alerts from the dashboard. However, it is important to remember success is not guaranteed. Some market knowledge and understanding will help you assess the credibility of trade suggestions.