ATC Brokers Review 2025

|

|

ATC Brokers is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to ATC Brokers |

| ATC Brokers Facts & Figures |

|---|

ATC Brokers is a London-based brokerage that was founded in 2012 and has since opened offices in California and the Cayman Islands. The firm benefits from rigorous FCA regulation for maximum client security, with leverage rates are capped at 1:30. The broker offers both self-directed investing as well as PAMM accounts, with access to the broker's MetaTrader 4 and MT Pro software. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, commodities |

| Demo Account | Yes |

| Min. Deposit | $5000 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, CIMA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | My tests only uncovered 51 CFD products spanning currencies, indices, energies, precious metals and cryptocurrencies - a very underwhelming line-up compared to most other brands. |

| Leverage | 1:30 |

| FTSE Spread | 0.6 |

| GBPUSD Spread | 0.6 |

| Oil Spread | 0.03 |

| Stocks Spread | Variable |

| Forex | ATC Brokers offers a poor range of 35 forex products through the MT Pro platform. That said, I was impressed with the very tight spreads and low latency speeds. |

| GBPUSD Spread | 0.6 |

| EURUSD Spread | 0.3 |

| GBPEUR Spread | 0.5 |

| Assets | 35+ |

| Stocks | Aside from the 7 stock indices including the Dow Jones and S&P 500, stock traders will be disappointed that there are no equities on offer at ATC Brokers. |

ATC Brokers is a UK-based, FCA-licensed brokerage that offers a high-quality trading experience through an ECN model on the popular MetaTrader 4 platform. This review will examine the markets on offer, spreads, account types, pros, cons and anything else a UK-based trader should know before signing up.

Our Verdict

ATC Brokers is suitable for experienced traders willing to deposit $5000 in return for tight spreads and low commissions. The ECN model and fast order executions also make the brand suitable for short-term trading strategies, such as forex scalping.

On the downside, the high minimum deposit will put ATC Brokers out of reach for most beginners. The education offering also falls short when compared to other leading brokers in the UK. Finally, our team were disappointed to find steep deposit and withdrawal fees.

Market Access

Retail clients of ATC Brokers can trade on just four markets, which we felt leaves this broker lagging behind the competition. Forex, the main offering, is limited to less than 40 pairs, while many rivals offer around 60 and some offer more than 70 assets. We also think the lack of stocks is a letdown and may put some traders off.

Supported assets include:

- 35+ forex pairs, seven of which include GBP

- CFDs on seven indices including the FTSE 100 and S&P 500

- Two energy CFDs on WTI crude oil and Brent crude oil

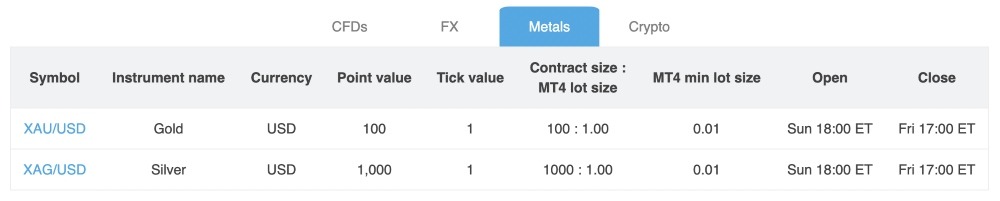

- Two metals gold and silver against USD

- Professional traders can also trade CFDs on five cryptocurrencies including Bitcoin and Ethereum

Fees

ATC Brokers uses a trading commission-based pricing model that we rate – particularly for short-term and high-frequency strategies that will benefit from the tight spreads.

Rather than charging through wider bid-ask spreads, ATC applies a fixed percentage fee to every trade. This amounts to a $0.6 round turn for 10,000-lot mini contracts or a $6 round turn for standard contracts of 100,000 lots. Note that these charges are in USD regardless of base account currency, for example GBP.

Our team appreciate the tight spreads that ATC Brokers can offer thanks to this model, which are better than some forex brokers. For example, the average spread for the EUR/USD pair is 0.3 pips, which is lower than the minimum spread with XTB.

The spreads are also fairly tight in other markets as well as forex. For example, the average spread for gold is 0.7 pips and for the FTSE 100, it is 0.6 pips.

You will, however, also need to consider the rollover fees which are swaps charged on a daily basis for positions held overnight. It is worth noting that on Wednesday night, the rate is trebled to account for Saturday and Sunday.

On the downside, ATC Brokers charges an inactivity fee of £50. We are sad to see that the inactivity period is only six months, which is less than other brokers such as eToro, which charges £10 after a year of inactivity. On the other hand, the penalty is only charged every six months. This means the penalty works out to around £8 per month, which is aligned with other brokers such as Plus500.

Account Types

When we used ATC Brokers, our experts found that there is only one account type for retail customers, but that is not necessarily a negative. We were pleased to see the simplified registration process without the need to compare different accounts, as all clients have access to the same features and services.

We were also reassured to see ATC Brokers supports three base currencies – GBP, USD and EUR – and this suits UK traders well, negating the need to pay a currency conversion charge when depositing funds.

All accounts with ATC Brokers adopt a straight-through processing model with an ECN market execution. Importantly, we found that trades are processed quickly while maintaining a high order quality.

We were also pleased to find the assets valued by high-tier banks with non-banking liquidity providers as counterparties to each trade.

How To Open An Account

- Navigate to the registration form

- Specify your country of residence and base currency, for example the UK and GBP

- On the next page, provide personal information such as your name and phone number, as well as a unique PIN used for placing orders over the phone

- Complete the KYC process by uploading proof of identity and residency

- Wait for the customer service team to approve your application

Payment Methods

Deposits

The available options to fund your account include bank transfer, Visa and Mastercard credit/debit cards and the e-wallet Skrill. UK clients can also use the ‘Faster Payment’ method in GBP. These will generally process instantly but sometimes take up to two hours. We did think the range of funding methods is light, and we would have liked to see additional e-wallet options.

Our team were pleased to see that bank transfers are free, but it is disappointing that debit, credit card or Skrill deposits incur a 2.9% fee.

Finally, we felt that the £2000 minimum deposit is high, especially given the even higher initial deposit requirement of $5000 or GBP equivalent. This will amount to a high barrier to entry that could prevent more casual traders from signing up.

How To Deposit Funds With ATC Brokers

- Navigate to the ‘My Account’ page on the ATC Brokers website and go to the ‘Deposit Funds’ section

- Scroll to the section providing details for your chosen payment method

- For bank transfers or Faster Payments, ATC Brokers has dedicated bank accounts that you deposit funds in. To send the funds, use your online banking portal to make a payment with your account name as the reference

- If you are using a debit or credit card, you must first send a scan of your card to ATC Brokers. Then, complete the Payment Form accessed via the website

- For Skrill, fill out the Payment Form and, once you are redirected to the Skrill website, sign into your account and complete the payment process

Withdrawals

With a £25 fee for UK users to make withdrawals via bank transfer, ATC Brokers withdrawals are expensive. Although debit and credit card withdrawals are free, the Faster Payment method is cheaper with only a £10 charge and Skrill withdrawals incur a 1% charge, this is still a relatively expensive broker, given that it also charges to make deposits using most funding methods.

On a more positive note, all withdrawals from ATC Brokers are processed within two business days.

Trading Platforms

ATC Brokers supports the world-leading MetaTrader 4 trading platform, which we rate highly and feel will satisfy clients of all experience levels. This is a reliable and quality platform that supports a wide range of trading styles.

With technical indicators such as the RSI, the Stochastic Oscillator and the MACD, in addition to thousands that can be downloaded via the marketplace and the industry-leading expert advisor trading robots, MT4 provides ample features for experienced traders.

However, we do think beginner traders might prefer the sleeker interfaces available on some newer platforms, even though MT4 is user-friendly enough for most to use without issue.

How To Place A Trade

Through MetaTrader 4, ATC Brokers clients can execute two types of trade:

Market Execution

- Sign into your account on the trading platform

- Click on ‘New Order’

- Select an asset from the drop-down list

- Specify the trade volume

- Input stop loss and take profit strike prices

- Click either ‘Sell’ or ‘Buy’

Pending Order

- Sign into your account on the trading platform

- Click on ‘New Order’

- Select an asset from the drop-down list

- Choose ‘Pending Order’ from the order type menu

- Select the type of pending order from ‘Buy Limit’, ‘Sell Limit’, ‘Buy Stop’ and ‘Sell Stop’

- Type in the strike price

- Specify an expiration for the pending order if desired

- Confirm the order

MT Pro

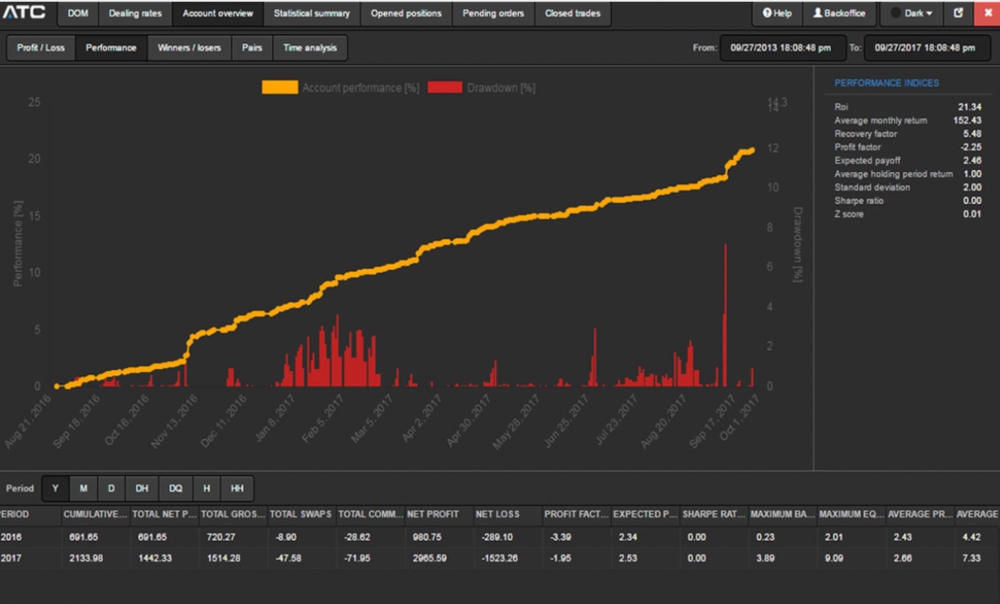

ATC clients also have the option of using a more advanced version of MT4 called MT Pro, which is exclusive to ATC Brokers and provides extra tools mainly designed to help track and analyse traders’ records.

For example, trading history reports showing profit and loss as well as portfolio performance detailing winners and losers. This is in addition to an enhanced one-click trading tab where you can see the available contracts at different price levels, current forex spreads and customisable strategy and bracket orders.

Unfortunately, the MT Pro platform is only available on Windows computers.

App Review

ATC Brokers clients can access their terminals on the go using the MT4 mobile app, which is compatible with both iOS and Android devices and can be downloaded from the Apple App Store or Google Play directly or via the ATC Brokers website.

These applications are ideal as they have the same functionality as the desktop app, allowing you to monitor your portfolio and execute trades while away from your computer.

Leverage

As ATC Brokers is authorised by the Financial Conduct Authority, the maximum leverage limits are mandated by the regulatory body, and are sufficient for most retail traders even though significantly lower than the margins on offer from offshore brokers.

Major forex pairs allow the highest leverage on offer at 1:30 (3.33%). Minor and exotic forex pairs’ leverage is capped at 1:20 (5%), as are gold and major indices, and silver, energies and other indices are limited to 1:10 (10%).

Note that these limits are for retail traders. If you are registered as a professional trader, the maximum leverage increases to 1:100.

Demo Account

We like that ATC Brokers offers a free demo account for all clients. Although the license only lasts for 60 days, clients with a live account can request an extension. As a result, investors have ample opportunities to develop different strategies with simulated funds before implementing them on their live accounts.

We were especially happy to find that the demo account mirrors live prices and support features such as expert advisors, making these useful tools to practise strategies as well as to test out ATC Brokers.

How To Open A Demo Account

- Click on the ‘Start Demo Trial’ button on the broker’s homepage

- Fill out the form with information such as your name, email address and country

- Submit the online request

- Wait for the support team to email you with the MT4 download link and the login details

UK Regulation

We are pleased to report that ATC Brokers holds a valid license with the Financial Conduct Authority under the name ATC Brokers Ltd and license number FRN 591361, and has been authorised by the FCA since 2013.

As a result, the London broker must implement certain protective measures for its clients. A key rule is that customer funds must be kept separate from the broker’s money so that they cannot be used for business operations. Because of this, if ATC Brokers were to enter insolvency, the funds could still be returned to clients. As a backup, clients are entitled to claim through the Financial Services Compensation Scheme if the broker were to default.

ATC Brokers also enables negative balance protection for its UK clients, meaning you cannot make losses in excess of the deposits held in your account. If a CFD has a sufficient losing margin equal to the deposited funds, then it will automatically be closed to prevent you from becoming indebted to the broker.

Bonuses

While using ATC Brokers, we weren’t surprised to find no promotional schemes such as deposit bonuses, since the broker holds a license with the FCA which restricts this type of scheme. Instead, the firm points users towards its competitive range of additional services.

Extra Tools & Features

Our experts were pleased with the wide range of tools that ATC Brokers, particularly its support for MetaTrader 4’s renowned expert advisors (EAs). These algorithmic trading robots execute a strategy on your behalf according to the given instructions. To add an expert advisor to MT4, follow these steps.

- Open the MQL4 folder and insert your EA files

- On the MT4 platform, navigate to the ‘Data’ folder

- Select the chosen EA that you want to upload and use

While we were sorry to see that ATC Brokers does not offer its own VPS service, you can contact customer support to receive a recommendation for a third-party provider. A VPS is an excellent tool to help improve latency, which is important for those who want to use EAs.

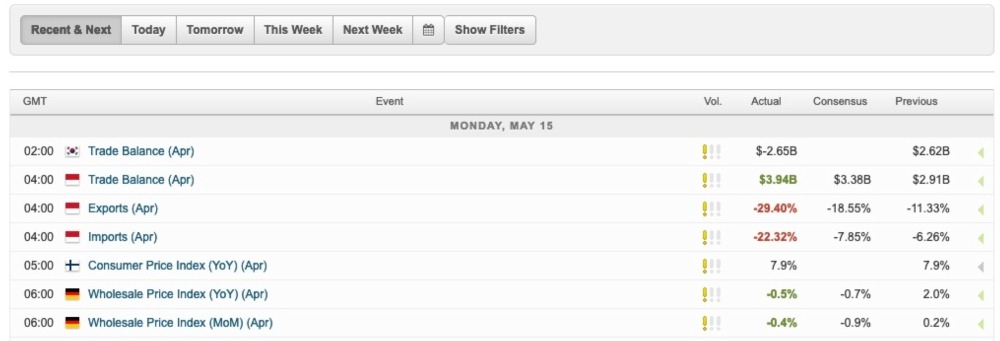

Another helpful tool provided by ATC Brokers is the free economic calendar for key upcoming financial news and global events, with a good range of countries included. Examples of events in the UK include the Bank of England’s policy meetings, house price indices and public sector net borrowing.

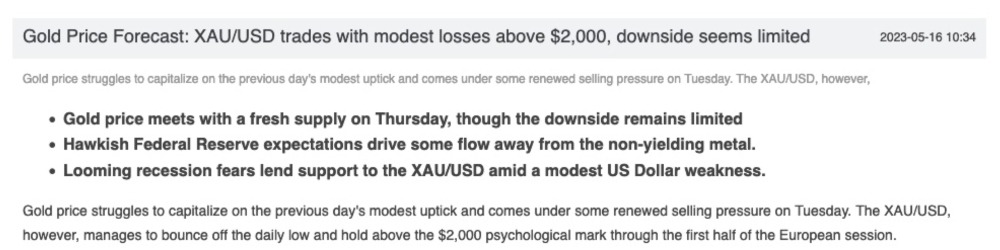

This is in addition to a regularly updated news page with important headlines. While testing ATC, we found this useful to start our day with a good range of relevant news and announcements since the previous market close.

We also like that ATC Brokers supports a percentage allocation money management (PAMM) for traders that want to invest in forex but do not have the time to trade or sufficient knowledge of markets to execute their own strategy. Through the PAMM and PAMM Plus services, you can put money into a pooled fund which is managed by an expert.

Customer Service

We were impressed by ATC Brokers’ responsive and easy-to-reach customer support team. The desk is open 24 hours a day during the midweek when markets are open and can be reached in the following ways:

- Call the hotline at +44 20 3318 1399

- Live chat on the website

- Email support@atcbrokers.com

It is worth noting that you need to have a live account to use the instant chat feature on ATC’s website, though responses are fast for all methods with responses to emails coming in just a couple of hours.

Company Background

ATC Brokers Limited was launched in 2012 and its headquarters are found on Ropemaker Street London, UK. The company also has a branch in the Cayman Islands and holds a license with this Cayman Islands Monetary Authority.

Another office is in California in the US, though this branch’s National Futures Association membership has lapsed.

Through ATC Brokers, clients can trade on margin with forex, indices, energies and precious metals.

Trading Hours

The ATC Brokers’ opening hours depend on the market that you are trading.

Forex trading hours are between 9:05 PM GMT on Sunday evening and 8:59 PM, Friday, while metals are traded from 10 PM Sunday GMT until the following Friday at 9 PM, with an hour break each day beginning at 9 PM.

Should You Trade With ATC Brokers?

Overall, we rated ATC Brokers and felt it has more than enough to keep many forex traders happy. It is FCA regulated, offers tight spreads through the ECN model, and supports MT4’s Expert Advisors, making strategies such as scalping viable, and will suit experienced forex traders who know how to make the most of its advantages.

On the downside, we found that the high minimum deposit limits and charges for deposits and withdrawals make ATC a tough sell for less experienced traders.

FAQ

Is ATC Brokers Trustworthy?

Yes, ATC Brokers Ltd holds licenses with two regulatory bodies. These include the Financial Conduct Authority in the UK and the Cayman Islands Monetary Authority. ATC Brokers was also previously a member of the National Futures Association in the US but this ended in 2022. These are all promising signs that the brand is reputable and trustworthy.

Does ATC Brokers Support Automated Trading?

Yes, ATC Brokers clients can use expert advisors (EAs) with the MetaTrader 4 platform. The platform comes packaged with two EAs and clients have the option to download additional algo traders. The broker also permits testing with a demo account to see how viable an EA is before using one with real money.

Does ATC Brokers Have A Demo Account?

Yes, ATC clients can register for a 60-day demo account free of charge, allowing you to practise executing any strategies as well as build experience with the MetaTrader 4 platform and its features. Customers with a live account can request to extend the license past the 60-day limit.

Does ATC Brokers Charge Deposit Fees?

ATC Brokers charges a fee equal to a percentage of the deposit depending on your chosen method. If you use a bank transfer, you will not need to pay any fees. If you use a debit or credit card or Skrill (the e-wallet service), you are charged a 2.9% fee, equating to a £29 charge per £1000 deposit. This is significantly higher than many alternatives which offer free deposits and withdrawals.

Does ATC Brokers Offer High Leverage?

For UK clients of ATC Brokers, the leverage limits are set by the Financial Conduct Authority. As a result, the maximum leverage for major forex pairs is 1:30. For minor and exotic forex pairs, gold and major indices, the leverage is 1:20. For silver, energies and non-major indices, the leverage is capped at 1:10.

Article Sources

Top 3 ATC Brokers Alternatives

These brokers are the most similar to ATC Brokers:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- INFINOX - Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

ATC Brokers Feature Comparison

| ATC Brokers | Swissquote | Interactive Brokers | INFINOX | |

|---|---|---|---|---|

| Rating | 2.8 | 4 | 4.3 | 3.4 |

| Markets | Forex, CFDs, indices, commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFDs, Indices, Shares, Commodities, Futures |

| Minimum Deposit | $5000 | $1,000 | $0 | £1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CIMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, SCB, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | - | MT4, MT5 | - | MT4, MT5 |

| Leverage | 1:30 | 1:30 | 1:50 | 1:30 (UK), 1:200 (Global) |

| Visit | ||||

| Review | ATC Brokers Review |

Swissquote Review |

Interactive Brokers Review |

INFINOX Review |

Trading Instruments Comparison

| ATC Brokers | Swissquote | Interactive Brokers | INFINOX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | Yes |

ATC Brokers vs Other Brokers

Compare ATC Brokers with any other broker by selecting the other broker below.

Popular ATC Brokers comparisons: