Annuities

Annuities are insurance policies that provide you with a stable and guaranteed income during retirement. This guide will explain what annuity policies are, how they work, the different types available, and assess their advantages and disadvantages.

Quick Introduction

- Annuities pay out a pre-determined regular income either for a set period or for the life of the policyholder.

- Annuities are becoming increasingly popular as rising life expectancies prompt people to seek a guaranteed income for their entire retirement.

- Demand has also picked up as higher interest rates have fed through to better annuity rates.

- You can choose from various policy types, as well as the level of income you’ll receive and when payouts commence.

Interactive Investor is a terrific option for British investors interested in self-invested personal pensions (SIPPs). Regulated by the FCA, they offer a smooth joining process, excellent pricing and you can fill out a ‘SIPP Transfer Out’ form to move some or all of your SIPP balance to a chosen annuity provider.

Visit Interactive InvestorWhat Are Annuities?

Like any insurance product, annuities exist to protect the individual from financial hardship should the worst happen. We all want to live as long as possible, but many people unfortunately outlive their savings, leaving them unable to pay their daily expenses or fulfil their retirement plans.

Annuities mitigate this risk by guaranteeing a regular, pre-agreed income for the rest of the customer’s life or a pre-agreed duration, regardless of the length of their eventual retirement period.

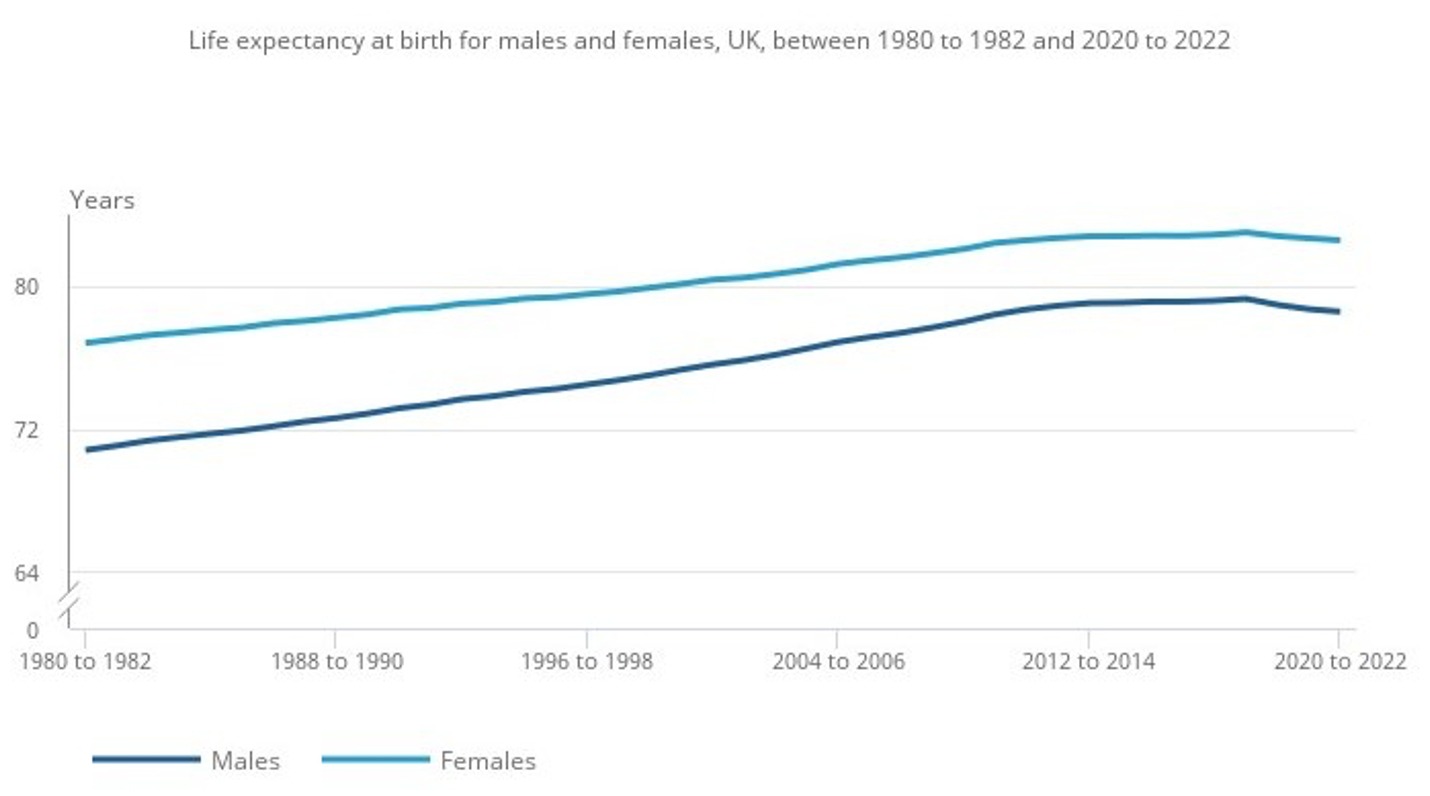

Demand for annuities is steadily growing, as peoples’ life expectancies steadily increase and people take steps to ensure they have enough money to last until their final days.

While they’ve dipped following the COVID-19 crisis, life expectancies remain on a long-term uptrend thanks to improvements in working and living conditions and advancing healthcare.

Source: Office for National Statistics

This demographic change – combined with a steady rise in interest rates – drove annuity sales 34% higher in 2023, to 72,200, according to the Association of British Insurers.

Drawdowns vs Annuities

Individuals who have built up a pension pot often choose to withdraw a certain percentage each year to fund their retirement. The ‘4% drawdown rule’ is one popular model that retirees use to fund their post-work lifestyles.

This concept involves an individual withdrawing 4% of their retirement pot in the first year, and then over time adjusting this figure annually for inflation. The idea is that this model should provide an income for 30 years before the well runs dry.

The problem is that – as the chart above shows – people are living longer, and therefore retirement periods have also become more elongated since financial advisor William Bergen came up with the rule in the 1990s.

An annuity policy can eliminate the threat of a retiree running out of cash. An individual can use some, or all, of their pension pot to buy one of these products through a lump-sum payment, which in turn will provide a fixed and regular amount.

The payouts on some policies increase according to inflation, while others climb at a pre-set rate. Such mechanisms can protect my standard of living over time from rising prices.

Types of Annuities

There are many kinds of annuity policies available today, each best fitted according to the holder’s financial goals and personal circumstances. These include:

- The Lifetime Annuity – The most popular form of policy, this format provides a regular income for as long as the holder is living.

- The Enhanced Annuity – These are available for people who, due to a medical condition or lifestyle factor, believe they will have a lower-than-average life expectancy. For this reason, these policies offer a higher annuity rate than a standard annuity.

- The Fixed-Term Annuity – Such policies provide an income stream for a fixed period, such as five, 10, or 25 years. Annuities will cease at the end of the term regardless of whether the holder is still alive.

- The Guaranteed Annuity – These policies guarantee that if the annuitant passes away within a pre-determined period after the start of the policy, payments will continue to be made to the designated beneficiary (or beneficiaries) for a guaranteed period.

Within these annuities, individuals can select from a variety of other options that best suit their needs. They can decide, for instance, on a ‘level’ policy – whether the annuity rate remains the same over time – or one where the rate increases in line with inflation.

Policyholders can also choose an annuity that is paid monthly, quarterly, half-yearly or yearly. Furthermore, they can buy a policy that defers annuity payments for a number of months or years, or choose one that delivers income straight away.

“The ideal policy for many economists is a deferred, inflation-linked annuity, which protects the individual against the twin financial risks of a very lengthy retirement and cumulative inflation.” – Taken from “Guide to Investment Strategy” by Peter Stanyer and Stephen Satchell

What Is The Annuity Rate?

The annuity rate determines how much income you’ll receive from the policy. It’s expressed as a percentage and will be affected by the lump sum you deposit, as well as the type of policy and other options you’ve selected.

Source: Pension Expert

Like a health insurance policy, the annuity rate will also depend on how long you’ll be expected to live for. So other things the provider will consider include your:

- Age

- Sex

- Health

- Lifestyle

- Family medical history

The chief influence for annuity rates, however, is the level of interest rates when the policy is taken out. When interest rates rise, annuity rates follow suit, and vice versa. This is because insurance companies invest the premiums they receive in fixed-income securities like government bonds.

The annuity industry is becoming more competitive, so take the time to find the most cost-effective policy for your needs before signing up.

Rises in annuity sales in recent years reflect the boost that higher interest rates in the UK have given annuity rates. Data from Hargreaves Lansdown shows that a £100,000 pension pot could have bought an annuity of £6,225 in July 2022. At this point, the Bank of England benchmark rate stood at 1.25%.

Fast forward 12 months and interest rates were at 5%. At this level, a £100k lump sum would have bought an annuity of £7,358.

When Should I Take Out An Annuity?

In the UK, there is no upper age limit as to when someone can take out an annuity policy. As a result, some pensioners who intend to eventually buy one of these products delay doing so until later in their retirement.

This could be for numerous reasons, including expectations that annuity rates will improve later on, and a person’s assumption that their spending levels will change during the retirement period (in other words, will reduce over time).

Delaying the purchase of an annuity to the ‘second’ phase of retirement can help individuals manage the cash flow provided by a pension pot.

A later purchase ensures that the pension lasts for as long as it is needed, while also providing greater spending flexibility during the initial years of retirement.

Pros and Cons Of Annuities

Pros

- Guaranteed income: Annuities offer a reliable income stream over a set period or for the remainder of an individual’s lifetime.

- Defence against market volatility: The annuity rate remains the same regardless of how financial markets are performing.

- Highly customisable: Policies can be tailored according to an individual’s personal needs and objectives, with options available on when payouts begin, the level of income, and the frequency of payments.

- Inflation proof: Except for ‘level’ policies, the payouts on annuities rise in line with inflation, which in turn protects the long-term purchasing power of the policyholder.

Cons

- Extra cost: As with any insurance policy, the peace of mind that annuities provide results comes at a cost to the purchaser.

- No refunds: Once an annuity has been purchased, the holder is locked in following a 30-day cooling-off period. An annuity cannot be sold and the cash then reinvested, as with some other retirement products.

- Not inheritable: Unlike investment-based products, whose remaining value can usually be passed down when the owner passes away, an annuity policy cannot be inherited.

Bottom Line

Whether it’s through a pension, an annuity, or any other financial product, ensuring that you’ll have enough money for retirement is becoming ever-more important given the uncertain future of the State Pension in the UK.

Annuity policies can be an effective and stress-free way for people to fund their retirement. There are also lots of options for individuals to choose from when deciding on a policy.

But this product category is highly complex, and you should think carefully about your personal circumstances and financial goals before making a purchase. Talking to a qualified financial advisor before buying an annuity is a great idea.

Article Sources

2023 sets new post-pension freedoms record for annuity sales – Association of British Insurers

Is it time to retire the 4% rule? – Legal & General Investment Management

The impact of interest rates on pension annuity rates – Hargreaves Lansdown