Amega Review 2025

|

|

Amega is #41 in our rankings of CFD brokers. |

| Top 3 alternatives to Amega |

| Amega Facts & Figures |

|---|

Amega is an offshore STP broker offering CFD trading fon forex, stocks, indices and commodities with very high leverage up to 1:1000 and a zero-commission pricing structure. Traders access markets through the MT5 platform and can test the broker's services through a demo account. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Shares, Indices, Commodities, Cryptos |

| Demo Account | No |

| Min. Deposit | $20 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MT5 |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade CFDs on 100+ instruments from popular asset classes. Leverage up to 1:200 is available on precious metals, while stocks, indices and energies can access 1:20 max leverage and 1:10 for commodities. On the negative side, the depth of assets is limited vs other CFD brokers. |

| Leverage | 1:1000 |

| FTSE Spread | From 0.8 pips |

| GBPUSD Spread | From 0.8 pips |

| Oil Spread | From 0.8 pips |

| Stocks Spread | From 0.8 pips |

| Forex | Amega offers an unusually large selection of currency pairs for an unregulated broker with 70+ forex CFDs, alongside up to 1:1000 leverage, zero commissions and competitive spreads from 0.8 pips. FX traders also have access to MT5 – the faster, more advanced version of MT4. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.8 |

| GBPEUR Spread | 0.8 |

| Assets | 70+ |

| Stocks | Trade 25+ global stocks with CFDs commission-free with fast execution and STP pricing. This is a narrow selection vs competitors, focussed on US markets. Eight indices are also available to speculate on the movements of US, European, UK and Australian markets. |

| Cryptocurrency | Trade popular digital tokens against fiat currencies. Go long or short on Bitcoin and get 24/7 instant cashback when you trade in high volumes. However, traders looking for low-cap tokens should look at alternative brokers. |

| Coins |

|

| Spreads | From 0.8 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Amega Finance is an offshore broker offering leveraged CFDs on popular global markets. While the only trading platform is the industry-leading MetaTrader 5 (MT5), this is an effective tool for learning to invest and analysing complex technical patterns. This 2025 broker review will delve into the financial services offered by Amega Finance, alongside its fees, security and more.

Amega Finance offers low-cost, high-leverage CFDs encompassing forex, indices, cryptocurrencies, stocks and commodities. With MT5 platform access, a 150% deposit bonus and negative balance protection, Amega boasts a competitive trading service. On the downside, the company is not regulated by the UK’s FCA.

Company History & Overview

Amega Finance is an online broker that was founded in 2018. The broker is split into two main entities: Amega Global Ltd and Amega Markets LLC. The former is the regulated arm of the broker’s business, although its license is with the Financial Services Commission in Mauritius, which is not a well-regarded agency. Amega Markets LLC is registered in St. Vincent and the Grenadines and is unregulated. Both branches can be accessed and used by UK traders.

The broker uses an STP no-dealing desk (NDD) model. This means it is not a market maker and thus is not a counterparty to any trades, reducing any potential conflicts of interest. Instead, the broker acts as an intermediary between investors and liquidity providers. In short, it provides direct access to liquidity providers in return for a markup on spreads.

Markets & Instruments

Amega Finance boasts derivative products in a range of markets, including:

- Seven precious metal CFDs, including gold & silver

- 70+ major, minor and exotic forex CFDs

- 10 major indices including the FTSE 100 & S&P 500

- 9 soft commodity CFDs from corn to wheat & cocoa

- 25+ global stocks, including US blue chips like Apple, Amazon and Tesla

- 2 energy futures and three spot energies, covering Brent Crude Oil and natural gas

Cryptocurrencies are available but only when investing under the unregulated Amega Markets LLC body.

Trading Platform

The only trading platform offered by Amega Finance is MetaTrader 5.

Whilst MT5 is widely recognised as one of the best off-the-shelf products, this broker is uncommon in that it does not give its traders a choice of other platforms. Many competitors provide MetaTrader 4 and a proprietary trading platform, too. Nonetheless, while using Amega Finance’s MT5, our experts found the following features:

- One-click trading

- Economic calendar

- Trading signals from professional traders

- Automated trading using expert advisors (EAs)

- 80+ built-in technical indicators and analytical tools

- Web terminal to avoid downloading the desktop client

- Market-depth information that allows liquidity assessments

- Multiple order types, including stop-loss and trailing-stop orders

- Available on Windows, MacOS and Linux, as well as Android and iOS phones and tablets (although it is not currently available on iOS due to App Store restrictions)

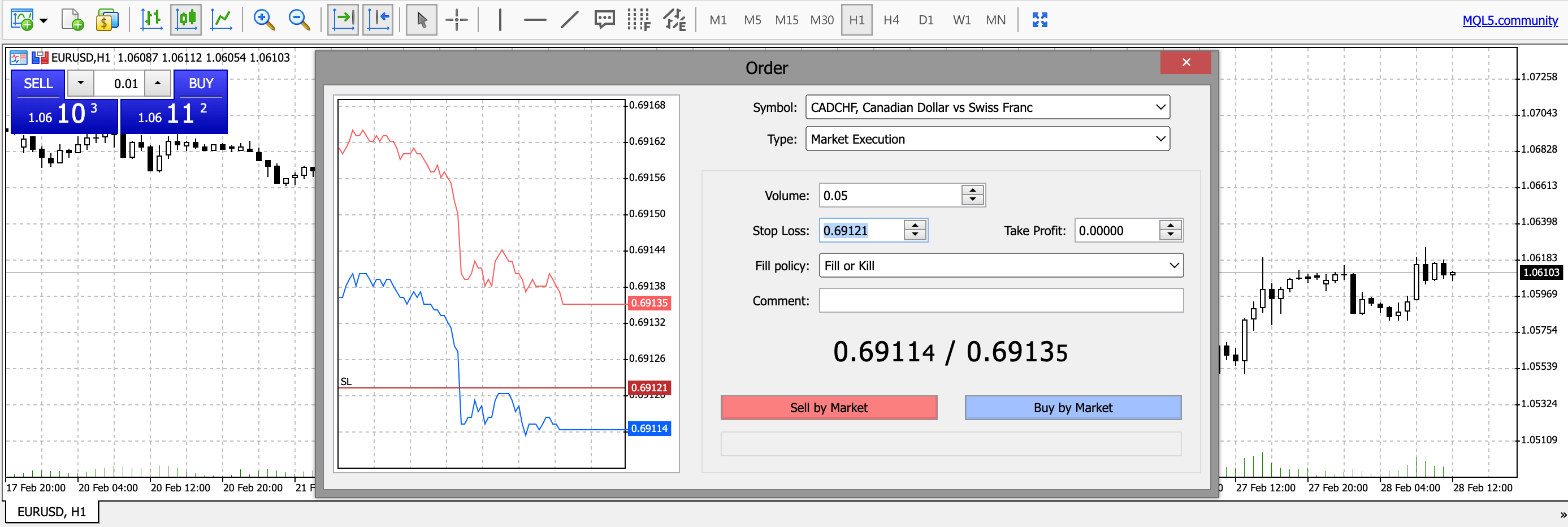

How To Place A Market Order On MT5

- Open the MT5 platform and log in

- Right-click on your chart, hover over Trading and then click New Order from the drop-down menu

- On the Market Watch window, click on the Symbol drop-down list and then click on the asset you wish to trade

- Enter the desired volume in lots

- Enter a stop-loss and take-profit, if required

- Click on the Sell by Market or Buy by Market button

Note, one-click trading is also available directly from the chart window.

MT5 Market Order Window

Fees & Charges

Amega Finance is a zero-commission broker, although this does not mean that clients are immune from fees. Spreads typically start from 0.8 pips, which is lower than most commission-free alternatives.

However, less liquid forex pairs usually have higher spreads. When we used Amega Finance, we found spreads of around 1.6 pips for EUR/GBP and 2.0 pips for GBP/USD and 1.8 points for the FTSE 100.

In addition to spreads, swaps are paid or credited (apart from on Islamic accounts) to maintain derivative positions held overnight.

Another charge to be aware of is inactivity fees. Amega Finance charges an initial fee of £5 for any Live account left inactive for 180 days. A further £5 is charged every 30 days beyond this.

Mobile App

Although Amega Finance does not have its own mobile app, the MT5 app can be used by most traders to analyse charts, manage accounts and place orders. However, given that the app is currently not available on the App Store, iOS users are left without a reliable mobile or tablet solution.

Our experts found that the MT5 mobile app has all the major functions that the desktop and WebTrader versions offer – investors can deposit funds, review charts and make trades all on an intuitive platform that accommodates traders of varying abilities. The main difference is that all this can be done without needing a desktop or laptop.

Payment Methods

Deposits

When we used Amega Finance, we found that the minimum deposit is only £20, which is one of the lowest in the industry and makes this broker accessible to beginners with limited funds. Furthermore, we were pleased to see there are no deposit fees.

The deposit options depend on whether an investor holds an account with Amega Global Ltd or Amega Markets LLC.

The deposit methods for Amega Global Ltd are:

- Skrill

- Neteller

- DusuPay

- STICPAY

The deposit methods under Amega Markets LLC are:

- DusuPay

- STICPAY

- Help2Pay

- B2BinPay

- PayTrust 88

- Online Naira

- Perfect Money

Some payment methods on Amega Finance may not be available to UK traders. Eligible cryptos can also be used as a deposit method under the Live MAX account.

How To Deposit On Amega Finance

- Login to your account

- From the Client area menu, click on Funds

- From the dropdown menu, click on Deposit Funds

- Select the live account you want to deposit to

- Select your preferred payment method

- Click Continue

- Enter the amount

- Click Continue to complete the deposit

Withdrawals

Unlike deposits, there are fees on all methods when withdrawing from Amega Finance. The cheapest withdrawal methods are Skrill and Neteller, which both have a 1% fee. The withdrawal fee for Perfect Money is 1.5%.

Fortunately, withdrawals are usually executed within minutes during working hours.

How To Withdraw From Amega Finance

- Log in to your account

- From the Client area menu, click on Funds

- From the dropdown menu, click on Withdraw Funds

- Select the correct Live account

- Select the withdrawal method (must be the same as that used for the deposit)

- Click Continue

- Enter the amount

- Click Continue to complete the withdrawal request

Account Types

Amega Finance has a regulated Live account, which is available under the Amega Global Ltd entity. Unregulated Live MAX and Live Bonus MAX accounts are available under Amega Markets LLC. All live account types have halal Islamic account (swap-free) alternatives.

Live Account (Amega Global Ltd)

This is a regulated account that includes hundreds of CFDs spanning forex, stocks, indices, precious metals, oils, natural gas and agricultural commodities. No crypto investing is available.

Live MAX Account (Amega Markets LLC)

This unregulated account allows investors to trade all assets on the Live account but with the addition of crypto CFDs. Deposits and withdrawals can also be made using crypto.

Live Bonus MAX Account (Amega Markets LLC)

This is a second unregulated account that provides a deposit bonus of up to 150%, in addition to the ability to trade CFDs and cryptos.

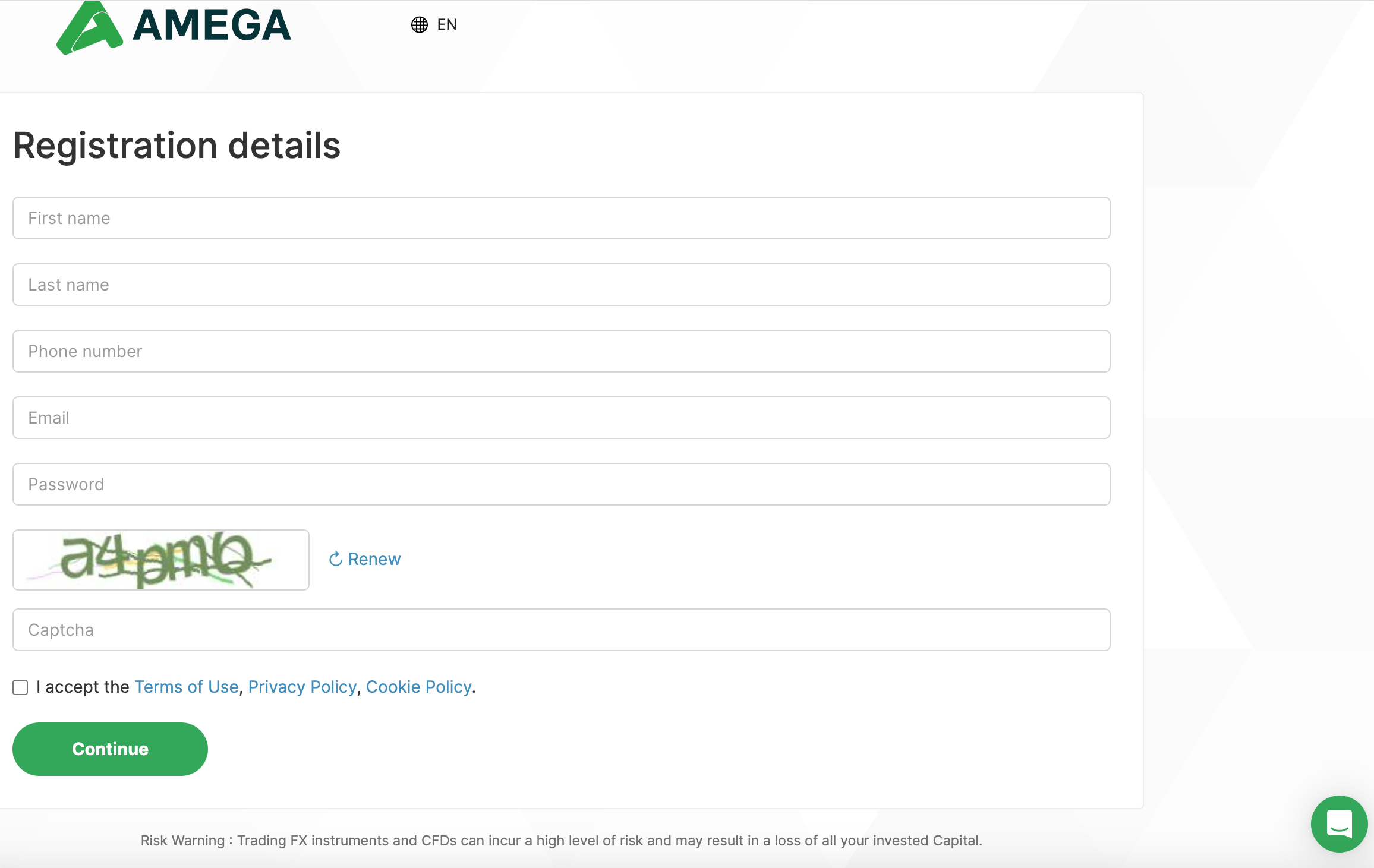

How To Register For A Real Account On Amega Finance

- Complete the Amega Finance registration form

- Review and accept the terms and conditions

- Complete the captcha check

- Click on Continue

- Verify your email address

Amega Account Registration Form

You have now created an account. However, to begin investing, the following steps must also be completed:

- Verify your phone number, identity and address

- When logged in, on the side menu click on Accounts

- Click on Open Live Account from the dropdown menu or the Dashboard

- Choose between Netting (can only have one position open on a particular asset at one time) or Hedging (can open separate positions at the same time on a single asset)

- Select your preferred leverage limit and click Continue

- Confirm your selections by clicking Continue

Demo Account

Amega Finance has a free demo account that can be loaded with virtual funds of up to £1 million. Although demo accounts are fairly standard with most brokers, we were pleased to see that this broker has one that runs on the MT5 platform and does not have a time limit. This allows beginners to learn more about the tools and features of the investing platform and also allows more experienced users to test new strategies and markets.

How To Open A Demo Account On Amega Finance

- Once you have registered with the broker, sign in and then, on the side menu, click on Accounts and then on Open Demo Account from the dropdown menu or the Dashboard

- Select either Netting or Hedging

- Select your preferred leverage limit

- Choose an initial virtual balance

- Click Continue

- Review your selections and confirm them by pressing Continue

Bonuses & Promotions

The Live Bonus MAX account and the equivalent Islamic account offer users a deposit bonus of up to 150%. As this account is unregulated, this gives Amega Finance more freedom to offer promotions that attract new customers. There is also a Loyalty Program that gives £1 cashback for each traded lot, with no maximum amount.

As with all promotions, it is important to check the terms and conditions to ensure you are not signing up for something you do not understand the implications of, such as restrictions on withdrawing any bonus credit.

Amega Finance Regulation

Amega Finance has two main entities with one (Amega Global Ltd) regulated by the Financial Services Commission in Mauritius and the other (Amega Markets LLC) unregulated and registered offshore in St. Vincent and the Grenadines.

Investing with an unregulated broker carries increased risk as it usually means less stringent monitoring and transparency requirements. However, investors should also approach the regulated entity of Amega Finance with caution; offshore regulators like the Financial Services Commission in Mauritius do not carry the same reputation as more robust authorities like the UK’s FCA, which generally scrutinise brokers more closely.

Leverage Review

As an offshore broker, Amega Finance has more freedom to offer higher leverage rates. However, our experts recommend caution with high limits due to the increased associated risks. Leverage is available up to 1:1000, although this is dependent on the market:

- Shares – 1:20 fixed

- Energy – 1:20 fixed

- Indices – 1:20 fixed

- Metals – 1:200 fixed

- Forex – up to 1:1000

- Commodities – 1:10 fixed

Extra Tools & Features

A helpful tool for traders using fundamental analysis is an economic calendar. While MT5 has one built into its interface, Amega Finance also has one on its website, covering information on upcoming publications and announcements for major economies.

The broker’s strongest educational resource is its technical analysis and blog section. This contains up-to-date investing information and analysis, as well as recommendations on when to open and close positions for particular markets. There are also educational articles on strategies like Fibonacci Retracements and SMA divergence. This certainly goes further than many other brokers, although we were disappointed to see that some sections were more outdated and lacked frequent publications.

In addition, we found news articles on Amega Finance containing a mix of internal broker news and market news, such as what the Fed has said in its latest meeting about potential interest rate hikes. Market forecasts are also available.

Trading Hours

Investing hours depend on the market in question. The forex market is open 24 hours a day from Sunday 21:00 GMT to Friday 21:00 GMT. US stocks, on the other hand, are open on weekdays from 13:30 GMT to 20:00 GMT.

Customer Service

Amega Finance has a live chat option during its office hours, which are 07:00 to 14:00 GMT on weekdays only. Although we were pleased to see the live chat option, other brokers have broader hours for their live chats.

An alternative contact option is the broker’s email address, although there is no phone number on offer. The website’s Help Centre also contains various articles and FAQs, with more FAQs included within the live chat portal.

- Email Address: support@amegafx.com

Amega Finance has social media accounts including on Twitter (@amegafinance) and Instagram (@amegafx).

Client Safety

Two-factor authentication (2FA) can be enabled on Amega Finance using Google Authenticator to bolster account security. Despite being offshore, the broker does also hold a string of verification checks, including identity and proof of address.

The MT5 tool is a reputable platform and all transactions and data are encrypted to ensure a high standard of security. Moreover, negative balance protection is imposed by the broker to limit losses to the capital within the account.

How To Enable 2FA With Amega Finance

- Download the Google Authenticator app on Android or iOS

- Sign in to your brokerage account

- Click on Profile on the side menu and select Two-factor authentication from the drop-down menu

- Click on Enable two-factor authentication by Google Authenticator

- Scan the QR Code with Google Authenticator or enter the provided code in the relevant field

- Click on Enable

Should You Trade With Amega Finance?

Amega Finance is an offshore broker with regulated and unregulated arms. Investors should be wary of the risks involved with unregulated brokerage firms, including a lack of investor compensation support and no access to a financial ombudsman. However, some reputable brokers are unregulated and still operate in a fair, secure manner, simply taking advantage of legal freedom to expand the range of services offered to their clients. For example, Amega Finance users can access leverage rates of up to 1:1,000 on forex products and a 150% deposit bonus.

FAQ

Is Amega Finance A Safe Broker?

The fact that Amega Finance has an unregulated side of the business and is an offshore broker does mean it carries more risk compared to a broker regulated by the UK’s Financial Conduct Authority. That being said, the firm does carry out verification checks on its clients before allowing them to begin investing. Moreover, there is the option to improve account security with two-factor authentication. Negative balance protection is also provided.

Is Amega Finance A Good Broker?

Amega Finance offers investing in a range of markets, including stocks, indices, commodities and forex at zero commission and with reasonable spreads on the most liquid markets like GBP/USD. However, spreads on other markets are usually higher and other costs such as withdrawal fees, swap charges and inactivity levies may deter traders.

Does Amega Finance Offer Crypto Trading?

Only the unregulated Live MAX accounts (and their Islamic account equivalents) offer crypto. The regulated Live account does not support cryptocurrency investing.

What Are Swap Fees On Amega Finance?

CFD brokers like Amega Finance generally impose swap rates for overnight positions, which are either debited or credited from your account. The broker is transparent about overnight fees when clients open an account.

Does Amega Finance Provide Negative Balance Protection?

Yes. This broker offers negative balance protection, which means a trader cannot owe money to the broker if they lose out on a high-leverage position – they can only lose what is in their account.

Top 3 Amega Alternatives

These brokers are the most similar to Amega:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Amega Feature Comparison

| Amega | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| Rating | 3.2 | 4 | 4.8 | 4 |

| Markets | CFDs, Forex, Shares, Indices, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $20 | $1,000 | $0 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Amega Review |

Swissquote Review |

Pepperstone Review |

FP Markets Review |

Trading Instruments Comparison

| Amega | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Amega vs Other Brokers

Compare Amega with any other broker by selecting the other broker below.

Popular Amega comparisons: