Amana Capital Review 2025

|

|

Amana Capital is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Amana Capital |

| Amana Capital Facts & Figures |

|---|

Amana Capital is a leading retail broker offering deposit bonuses and MT4 trading. |

| Instruments | Forex, CFDs, ETFs, indices, shares, energies, metals, futures |

|---|---|

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, DFSA, CySEC, CMA, LFSA, FSC, SC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Speculate on prices across financial markets. |

| Leverage | 1:30 (EU), 1:500 (Global) |

| FTSE Spread | 1.5 |

| GBPUSD Spread | 1.9 |

| Oil Spread | 5 |

| Stocks Spread | Variable |

| Forex | Trade online currencies with tight spreads. |

| GBPUSD Spread | 1.9 |

| EURUSD Spread | 1.4 |

| GBPEUR Spread | 2.1 |

| Assets | 50+ |

| Stocks | Trade on 280+ US stocks and shares. |

Amana Capital is an FCA-regulated forex and CFD broker that offers trading on six asset classes through the MetaTrader 4 and MetaTrader 5 platforms. This review will unpack typical fees, account types, deposit and withdrawal methods and our verdict on trading with Amana Capital.

Our Verdict

Amana Capital is best for seasoned traders who qualify for Active or Elite accounts, which offer ultra-tight spreads and access to useful extras like a VPS. We were also pleased to see that the broker is regulated by the FCA in the UK, a promising sign that the firm is trustworthy.

On the downside, fees on the entry account are higher than many alternatives. Beginners may also be deterred by the limited-time demo account and lack of copy trading or top-quality education resources.

Market Access

Forex traders, in particular, will be pleased with the selection of currency pairs. The choice of other markets is fairly average, with a more diverse range of products available from larger rivals, such as IG Index and CMC Markets.

However, with 550 stocks on offer as well as indices and commodities, this is not a bad suite of products.

Supported instruments include:

- 65+ forex pairs with 16 GBP pairs

- Seven indices including the FTSE 100 and Dow Jones

- Futures and spot trading on gold and silver

- Spot trade Brent and WTI oil and futures on Light Sweet crude oil, Brent crude oil and natural gas

- Seven soft commodities including sugar and coffee

- CFDs on shares for over 550 companies from the US, UK and Europe

Fees

Our experts were pleased with Amana’s pricing model as it suits different strategies, trading preferences and experience levels, with fees determined by account type.

More experienced traders who employ a high-frequency strategy such as scalping can benefit from ultra-tight spreads on the Active and Elite accounts.

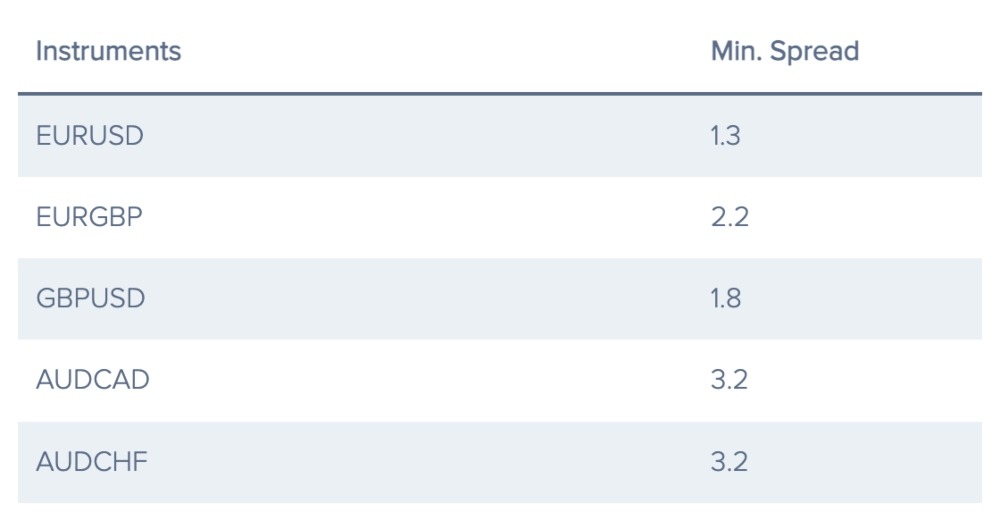

On the other hand, novice traders can access wider spreads with less or zero commission on the Classic account. However, we were disappointed to see that these spreads are wide compared with other forex and CFD brokers, with the minimum spread for the EUR/USD pair on Amana at 1.3 pips, compared to just 0.9 pips with AvaTrade.

Other trading fees to be aware of include overnight swaps, which are charged when investors hold positions past the end of the trading day. The exact amount that Amana charges depends on the asset you are trading and whether you are going long or short.

On the positive side, we were happy to see there are no inactivity fees, meaning you will not be charged if you do not open any trades or deposit funds for an extended period. This will appeal to casual investors.

Account Types

We like that Amana Capital offers four different account types, which helps to cater for traders with different styles and experience.

The Classic account is suitable for less experienced and low-frequency traders, with a low entry requirement of a $50 deposit. Amana’s Classic traders are free to trade without restrictions and can use both the MT4 and MT5 platforms, but we were disappointed at the breadth of the bid-ask spreads, which start at 1.4 pips. This will make it more difficult to turn a profit with Amana than with popular brands such as CMC Markets, whose spreads start at 0.7 pips.

It is good to see the Active and Elite accounts offering much tighter spreads starting from 0.1 pips, though we feel the high entry requirements of at least $25,000 in funds or $100 million monthly trading volume will put this out of reach for many traders, and the Elite account’s barrier to entry is even higher. Those who do qualify will be able to access excellent features including some of the best prices on the market and for Elite traders, a dedicated account manager.

Finally, we were glad to see Amana offers a halal Islamic account that will accommodate Muslim traders by replacing the interest charged in overnight swap fees with a competitive flat fee.

We have pulled out the key differences between the trading solutions:

Classic

Best for beginners and intermediate traders

- Spreads from 1.4 pips

- Minimum deposit of $50

- Leverage up to 1:30

- MetaTrader 4 and MetaTrader 5 available

- No commission charged on forex and cash CFDs. For futures, there is a $10 per lot charge and a $0.02 charge per share on share CFDs

- Base currencies include GBP, USD and EUR

- Minimum trade size of 1,000 lots

Active

Best for experienced traders

- Only available to clients with funds summing to $25,000 or more and trading $100 million in volume each calendar month

- API implementation available

- Fees are $30 per 1 million on forex

- No commission on cash CFDs

- $5 commission for each lot in future CFDs.

- Very tight spreads. For example, the minimum spread for the EUR/USD pair is 0.1 pips

Elite

Best for high-volume experienced traders

- To register an account, you must meet the minimum funding requirement of $250,000

- Certain fees are waived and there are tighter spreads with lower charges

- Users are given a dedicated account manager that offers one-to-one coaching

Shares

Best for stock traders

- An account for trading CFDs on shares specifically

- EUR and USD accepted as base currencies only

- Instant market execution only

- MetaTrader 5 platform only

- No minimum deposit

- Leverage up to 1:10

How To Open An Account

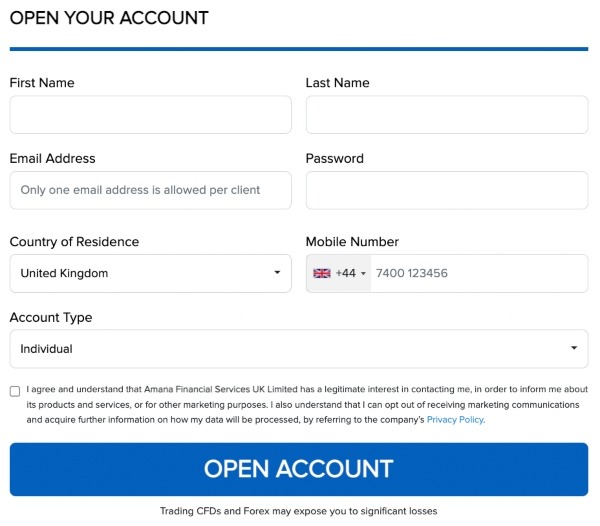

I found the sign-up process at Amana Capital quick and easy. To get started:

- Open the account registration form

- Input your name, address and other personal details

- Select the account type from individual, joint or corporate

- Upload identification documents to complete the joining process

Payment Methods

Deposits

We were pleased to find numerous deposit methods supported by Amana, including bank payments, Faster Bank Transfers, credit and debit cards and several e-wallets. Across all deposit methods, the minimum is also reasonable at $10 or the GBP equivalent.

However, we do think the quite substantial deposit fees and processing times for some funding methods are a disadvantage. Normal bank transfers take between three and five days to complete and incur a flat fee of £6. The Fast Bank Transfer service reduces this fee to €2, but it does not save that much time as deposits still take at least two business days.

For fast deposits, your best option is to use either debit or credit cards or an e-wallet such as Skrill or Neteller. These methods process transfers immediately, but we were sorry to see that they also charge percentage fees. For bank cards, this fee is 1.5%, whereas for Skrill and Neteller, the fee is 3.9% + $0.29.

How To Deposit Funds To Amana Capital

- Log into your account via the Amana website or app

- In the main member area, navigate to the ‘deposit’ section

- Select the deposit currency and the amount, e.g. £1000

- Choose your desired payment method

- For bank transfers, account details of the recipient account will be provided

- If you select any other method, the pop-up will ask you to fill out your payment details and confirm the request

Withdrawals

We rate that Amana permits withdrawals with all the available deposit methods, meaning you can withdraw your gains using bank transfer, the Fast Bank Transfer service for UK clients, debit/credit cards and e-wallets.

When we used Amana Capital, we found that withdrawals are processed in good time, generally taking three to five days.

We were also happy to see that withdrawals via credit and debit cards or the Fast Bank Transfer service are fee-free. For normal bank transfers, Amana does not charge you but the broker will not cover any fees from the bank’s side. On the downside, the use of Neteller comes with a 2% charge up to a maximum of $30, and Skrill withdrawals cost 1%.

Trading Platforms

Amana Capital offers both MetaTrader 4 and MetaTrader 5. This gives users a choice of two world-leading trading platforms to plan and execute their trades.

Both MT4 and MT5 are available to download on Windows and Mac computers. If you use Linux, you will need to use WebTrader, though this is only available on MetaTrader 4.

I would recommend MT4 for beginners and casual traders while MT5 is better for experienced traders with more analysis tools, order types and faster processing.

My favourite features on the MT4 platform include:

- 50+ objects, patterns and indicators for technical analysis

- Expert advisor support for automated trading strategies

- Nine timeframes ranging from a minute up to a month

- One-click trading

MetaTrader 5 is the newer platform and comes with the following useful features in addition to the MT4 tools such as one-click trading and EA support:

- 80+ objects, patterns and indicators for technical analysis

- MQL5 programming language for traders to develop and back-test their own EAs

- MQL5 community full of traders to discuss strategies and asset picks

- 21 timeframes

- Depth of market data

- Economic calendar

How To Place A Trade

You can open a trade in a couple of minutes on either MetaTrader platform:

- Sign into your account on the trading platform with your Amana Capital login details

- Click the ‘New Order’ button

- Select the asset from the drop-down symbol list

- Choose the trade type from market execution or pending order

- Input trade order volume

- Specify stop loss and take profit strike level

- If you are opening a pending order then choose the type from buy or sell limit or buy or sell stop. You can also set an expiration time

- Confirm the trade by placing your order

Apps

MetaTrader 4 and MetaTrader 5 also have mobile apps available on iOS or Android handheld devices and available from the Apple Store or Google Play.

You also have the option of trading through Amana’s dedicated mobile app. However, we felt this app is tailored more towards trade execution rather than analysis and we prefer using the MT4 or MT5 app to plan trades.

Leverage

If you are a retail trader based in the UK then the maximum leverage limits are predetermined by the Financial Conduct Authority. As Amana Capital holds a license with the FCA, the maximum caps on leverage for each market are as follows:

- 1:30 for major forex pairs

- 1:20 for non-major forex pairs, major indices and gold

- 1:10 for non-major indices, silver, energies and soft commodities

- 1:5 for share CFDs

Demo Account

While using Amana Capital, our team was pleased to see that new clients can register for a demo account to practise trading and develop strategies using the MetaTrader 4 and MetaTrader 5 platforms.

The demo account basically gives traders access to a simulated trading environment that closely mirrors that of a live trading account, though we are sad to see the broker only offers licences for 30 days.

How To Open A Demo Account

- Go to the broker’s website and click on the ‘open demo account’ button on the homepage

- Select the platform you wish to practise with

- Input personal information including your name and contact details

- You will be sent a download link and sign-in details via email

- Download the platform and begin practising

UK Regulations

Our experts were happy to see that Amana Capital is regulated by the Financial Conduct Authority under the name Amana Financial Services UK with license number 605070. Among the important benefits of this regulation is insurance of up to £85,000 per client if Amana were to become insolvent. As such, we are comfortable that the firm is legitimate and trustworthy.

The broker also holds licenses with several other regulatory bodies from around the world:

- Amana Capital Ltd is regulated by the Cyprus Securities and Exchanges Commission (CySEC) with license number 155/11

- AFS Global Limited is authorised by the Labuan Financial Services Authority (LFSA) in Malaysia with license number MB/18/0025

- ACG International Limited holds a license with the Financial Services Commission (FSC) in Mauritius with license number C118023192

- Amana Capital Group S.A.L Holding is authorised by the Capital Markets Authority (CMA) in Beirut, Lebanon with license number 26

- Amana Financial Services Limited is regulated by the Dubai Financial Services Authority (DFSA) and the Dubai International Finance Centre (DIFC) with registration number 2115

Bonuses

We were not surprised to find no promotional schemes available to UK clients, since these are not permitted under FCA rules. You would need to sign up with an offshore and often unlicensed firm for trading promotions which increases the risk of scams and foul play.

Extra Tools & Features

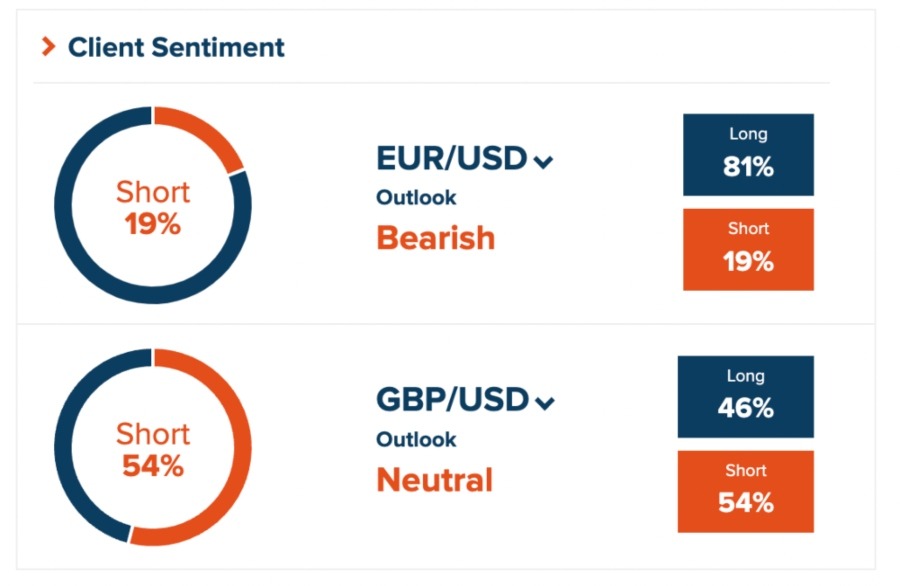

Our experts were content with the range of extra tools available through Amana Capital to support clients and their online trading. We found that the educational resources cover just enough topics to add value for traders of various experience levels, and the possibility to access a VPS server makes Amana a good option for active traders who use Expert Advisors. We also liked the client sentiment reports.

Yet while Amana’s offering is very good, we do feel it is missing features for up-to-date market analysis such as a news feed or blog. These would be welcome additions and help Amana Capital compete with top brokers.

Education

The learning centre offers resources such as webinars and seminars which are tailored to beginner, intermediate and advanced levels as well as guides breaking down key information for different markets.

For example, there are guides on the types of market analysis, types of charts and the different ways to trade forex, amongst other instruments.

Trading Signals

We particularly rated the trading signals through the third-party provider Autochartist. This is a useful notification service that offers live analytics and reviews markets in real-time to provide you with updates on important price action, and we think it makes a very attractive addition to Amana’s roster of features.

Account Analysis

Amana Capital has enlisted RiskPulse to help traders analyse their performance, and we were impressed by this free feature. RiskPulse gives Amana Capital clients access to charts showing gains and losses, trading history and an overall report of your performance.

Ultimately, this analysis tool is a great way for clients to reflect on their performance and our tests found it to work effectively in place of our usual trading journal.

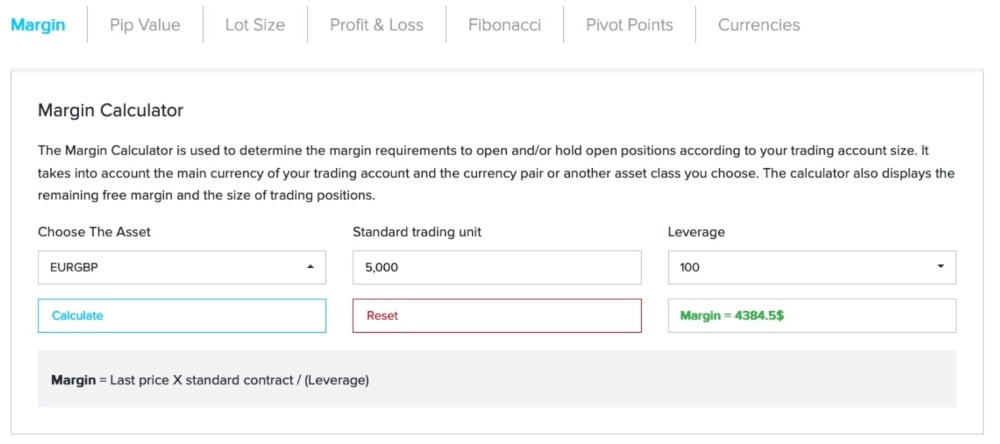

Calculators

A range of calculators are accessible for free on the Amana website including margin, profit and loss, pip value and lot size calculators amongst others. To find these, navigate to the Financial Calculators page under the tools section and choose your desired calculator. These can all help beginners plan out trades and costs.

VPS

One of the most important tools used to support Expert Advisors is a virtual private server (VPS), so we were glad to find this available from Amana Capital. A VPS allows you to reduce latency for your algo trading bot as well as have it run 24/7 so the EA can execute a strategy around the clock.

To begin using the Amana Capital VPS, contact the customer support team and request access.

Customer Service

I like that Amana offers support through a range of methods and can be contacted 24/5. However, our experts found that the contacts on the live chat were slow to respond and so, if you need immediate support, you should speak to the team over the phone.

To contact someone from the Amana Capital team:

- Request a callback

- Open the live chat on the website

- Use the message form on the website with a response by email

- Email support@amana.app

- Contact the Amana Capital social media accounts on Facebook, Twitter, LinkedIn and YouTube. Following these accounts is also a good way to keep up to date on company announcements

Company Details

Amana Financial Services UK is a branch of the larger Amana Capital Group, which operates in numerous countries around the world.

The group itself was launched in 2010 and first began accepting UK clients in 2014. The location of the UK office is Ludgate Hill in London.

The current Amana Capital CEO is Muhammad Rasoul, who was appointed in 2021. Other directors and owners include Mazen Yazbeck, Ziad Melhem and Athanasios Velianis.

Trading Hours

The Amana Capital trading hours relate to the market you are investing in. For clients with a UK login, the forex markets are open from 00:00 on Monday morning until 23:59 on Friday. Whereas for shares, the opening hours vary according to their exchange. US shares such as AT&T can be traded from 13:30 GMT until 20:00 each day from Monday to Friday.

For the full details on trading hours for each asset and market, see the spreads and commission portal on the broker’s website.

Should You Trade With Amana Capital?

Amana Capital is a good broker that aims to support investors of all experience levels through its range of account types and additional tools. We like that the broker offers both MetaTrader 4 and MetaTrader 5, giving clients a choice of two high-quality platforms.

Overall, though, we found the trading experience to be better for experienced investors rather than beginners. While there is a demo account, it is limited to 30 days only. Moreover, the forex spreads for the Classic account are not competitive when compared with other, similar brokers.

As a result, we think Amana Capital is best for more experienced traders who trade frequently with a decent amount of capital, as they will benefit from the tight spreads available on Amana’s Active or Elite accounts.

FAQ

Is Amana Capital A Real Broker?

Yes, Amana Capital is a legitimate broker. The UK branch, Amana Financial Services UK, holds a license with the Financial Conduct Authority. Several other subsidiaries of the Amana group also are authorised by regulators such as CySEC, DFSA and CMA. You can trust Amana Capital to be a genuine broker that will carry out your trades.

Does Amana Capital Offer Any Bonuses In The UK?

No, the UK branch of Amana Capital does not offer any promotional schemes, so UK traders cannot benefit from offers such as a no-deposit or welcome bonus. Instead, you can make use of the broker’s extra features, such as the VPS and Autochartist.

Does Amana Capital Offer An Islamic Account?

Yes, Amana Capital does offer an Islamic account. This account allows investors to trade overnight positions swap-free. Instead, there is a fixed fee applied in the place of interest.

How Can I Fund My Amana Capital Account?

Amana Capital supports numerous deposit methods for its UK clients. This includes wire transfers, bank cards issued by Visa, Mastercard and Maestro and e-wallets such as Neteller and Skrill. UK customers also have the option to use the Fast Bank Transfer service, which is less expensive than the normal bank transfer solutions.

Using credit/debit cards or e-wallets means your deposit is processed instantly whereas bank transfers, including the Fast Transfer service, can take anywhere from two to five days.

Does Amana Capital Offer A PAMM Account?

No, unfortunately, Amana Capital does not offer a percentage allocation management module account. The only account types available are Classic, Active, Elite and Shares, all of which require the account holder to control their own portfolio rather than a money manager.

Article Sources

Top 3 Amana Capital Alternatives

These brokers are the most similar to Amana Capital:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- GO Markets - GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

- IronFX - IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

Amana Capital Feature Comparison

| Amana Capital | Swissquote | GO Markets | IronFX | |

|---|---|---|---|---|

| Rating | - | 4 | 3.9 | 3.8 |

| Markets | Forex, CFDs, ETFs, indices, shares, energies, metals, futures | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, forex, indices, shares, energies, metals, cryptocurrencies | Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) |

| Minimum Deposit | $50 | $1,000 | $200 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, DFSA, CySEC, CMA, LFSA, FSC, SC | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSC of Mauritius | CySEC, FCA, FSCA, BMA / Bermuda |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4 |

| Leverage | 1:30 (EU), 1:500 (Global) | 1:30 | 1:500 | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) |

| Visit | ||||

| Review | Amana Capital Review |

Swissquote Review |

GO Markets Review |

IronFX Review |

Trading Instruments Comparison

| Amana Capital | Swissquote | GO Markets | IronFX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | No |

Amana Capital vs Other Brokers

Compare Amana Capital with any other broker by selecting the other broker below.

Popular Amana Capital comparisons: