AGEA Review 2025

|

|

AGEA is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to AGEA |

| AGEA Facts & Figures |

|---|

AGEA is a regulated forex & CFD broker offering multiple trading platforms and account types. |

| Instruments | Forex, indices, commodities, cryptocurrencies |

|---|---|

| Demo Account | Yes |

| Min. Deposit | $1 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | Commission for Capital Markets |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | No |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade CFDs on forex, indices, & commodities |

| Leverage | 1:100 |

| FTSE Spread | 0.7 |

| GBPUSD Spread | 0.2 |

| Oil Spread | 0.3 |

| Stocks Spread | N/A |

| Forex | Trade majors, minors, & exotic currency pairs |

| GBPUSD Spread | 0.2 pips |

| EURUSD Spread | 0.6 pips |

| GBPEUR Spread | 0.2 pips |

| Assets | 17 |

| Stocks | Trade CFDs on major US, European, & other stock indexes |

| Cryptocurrency | Trade with leverage on popular crypto coins |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

AGEA is a multi-asset online broker offering trading opportunities in forex, commodity CFDs, indices and cryptos. This broker review will cover how to sign up and open an account, login requirements, account types, regulator details, and more. Find out whether AGEA is right for you.

About AGEA

The broker was founded in 2005, operating from Montenegro. AGEA is regulated as an exchange-listed company by the Commission for Capital Markets under the trading name AGEA International AD. The brokerage is also publicly listed on the Montenegro Stock Exchange. Unfortunately it is not regulated by the UK’s Financial Conduct Authority (FCA).

Trading Platforms

AGEA offers two online trading platform options for clients; Streamster and MetaTrader 4. Both platforms are suitable for new and experienced traders. The broker highlights their proprietary platform as the recommended choice for clients. Both platforms are available for free download to desktop devices or through major web browsers. Available trading assets vary by platform.

Streamster

Available assets to trade on this platform; cryptocurrency, forex, indices and commodity CFDs. Features include:

- Trade size 1+

- Up to 100 open positions

- API for algorithmic trading

- Real-time live chat support

- Trading limits – minimum 3 points

- Automatic execution (1 second processing)

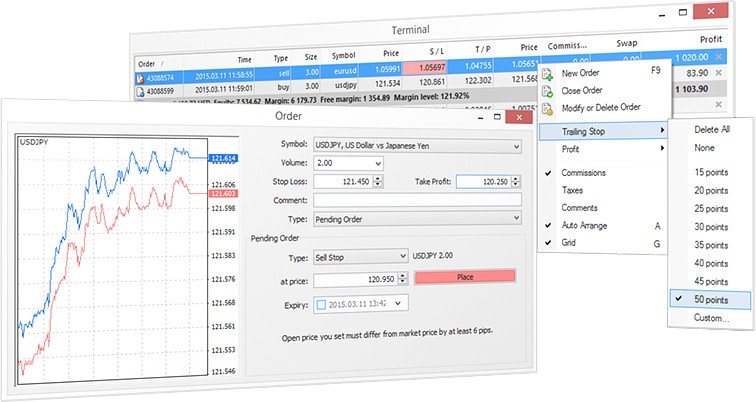

MetaTrader 4

Available assets to trade on this platform; forex, indices and commodity CFDs. Features include:

- Secure login

- Dozens of drawing tools

- Access to Expert Advisors

- Multiple time-frame charts

- Instant & pending order types

- Bespoke programming language MQL4

- Hundreds of built-in & customisable indicators

MetaTrader 4

AGEA.Trade

AGEA also supports a web trader platform, AGEA.Trade. This can be accessed directly through major web browsers, without the need for installation or download. The platform is available in over 100 languages and provides simple navigation, straightforward account management and intuitive charting.

AGEA.Trade

Markets

AGEA offers clients trading opportunities in the following markets:

- Forex – 15+ currency pairs

- Commodities – Including gold and oil

- Cryptocurrencies – Including Bitcoin and Ethereum

- Index CFDs – Including the FTSE 100, Dow Jones and Nasdaq

- Funds – Access to global markets including the US, Russia and Japan

Market access does vary by platform. Visit the instrument page on the broker’s website for trading conditions.

Trading Fees

AGEA does not charge a trading commission on transactions. Spreads fluctuate with the market and between trading platforms. Streamster provides the tightest spreads for forex trading with major forex pairs such as EUR/USD at 0.6 pips (vs 0.7 on MT4) and EUR/GBP at 0.8 pips (vs 0.9 on MT4). UK100 CFD spreads are offered at 0.7 pips on both platforms. Visit the broker’s website for live market spreads today.

An inactivity fee is charged after 12 months. For UK traders this is charged at £14.50 per year. The broker charges an overnight swap fee on positions held overnight.

Leverage Review

Leverage is offered up to 1:100 across both accounts. AGEA is not affiliated with the FCA or other EU regulation, therefore it is not required to follow ESMA’s 1:30 retail leverage cap. As a result, it’s important to utilise risk management strategies to limit potential losses.

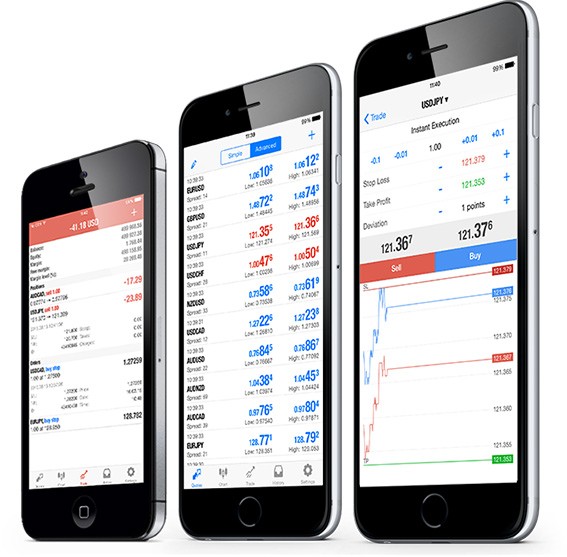

Mobile Trading

The broker offers a mobile version of their proprietary AGEA.Trade platform. This is available for free download and is compatible with iOS and Android devices. Similarly, MT4 is also available on mobile. Both apps allow for complete trading management, price analysis, and transactions while on the go from a mobile or tablet device.

AGEA MT4 app

Streamster is not currently available on mobiles.

Deposits

AGEA minimum deposit requirements vary by account type; £6 for the Cent Account and £100 for the Standard Account. Deposit methods vary by currency. Accepted GBP payment methods include:

- Skrill – Instant processing

- Neteller – Instant processing

- Bank wire transfer – Typically 1 – 2 working days

AGEA does not charge a fee for deposits.

Withdrawals

Withdrawals can be completed via any of the deposit methods. Fees are charged for some payment methods; bank wire transfers at £7 per transaction and a one-off e-wallet charge of £5 applies. Typical withdrawal processing times range from 6 to 24 hours.

Demo Account

The broker offers a demo account with £10,000 in virtual funds to practise trading within simulated market conditions. There are no expiry limits for these accounts so it is a good way to test trading strategies or techniques risk-free. You can then upgrade to an AGEA live account when you’re ready.

AGEA Bonus

AGEA offers a £5 no deposit bonus with all new client registrations. Funds are automatically added to trading accounts. Keep an eye on the broker’s platform for any new promotions.

Regulation Review

AGEA International AD is licensed under the Commission for Capital Markets (formerly Securities and Exchange Commission of Montenegro). The license is based on the legal framework of the MiFID. Although there is no FCA regulation, it is good to see some licensing aligned with local and international laws. Obligations of this regulation include the segregation of client funds.

Additional Features

The broker’s website offers basic trading support resources. This includes educational information on topics such as introductions to the financial markets, calculating profit, and trading techniques. The website also integrates a terminology glossary plus extensive trading and company FAQ pages.

Trading Accounts

AGEA offers two different account types; the Standard Account and the Cent Account. Both offer zero commissions, leverage between 1:1 and 1:100, and trade sizes ranging from 0.01 to 10.0 lots. A key difference between accounts is the minimum deposit requirements and funding limits:

- Standard Account – Minimum £100 balance, no maximum limit

- Cent Account – Minimum £6 balance, £5,000 maximum limit

Account opening takes around 5 minutes. Clients are required to complete an online registration form with supporting identity documents and proof of residence.

Benefits

- 1:100 leverage

- Reliable live chat function

- Demo account with virtual funds

- Low minimum deposit requirements

- Proprietary trading software plus industry-leading MT4

Drawbacks

- Withdrawal fees

- No stocks and shares

- No MetaTrader 5 platform

Trading Hours

AGEA follows standard office hours, 08:00 to 16:00, Monday to Friday. Trading is available from Sunday 22:15 to Friday 21:00 GMT on all trading platforms. Note, during periods of low trading activity spreads may widen and costs can increase.

Contact Details

The AGEA group offers a range of customer support options, available 24/5:

- Email contact form – Contact us page

- Live chat – The bottom right of the broker’s website

- Telephone contact number – +382 (20) 664-320 (for corporate issues rather than trader support)

- Address – AGEA International AD, Business City, Arsenija Boljevića 2A, Podgorica, 81000, Montenegro

Our review found reliable and fast response times with the live chat function, in particular.

Client Safety

Account access is fully password protected. Personal information is protected by SSL encryption on both PC and mobile applications. AGEA’s trading platforms assure secure login features and industry-standard data privacy.

AGEA Verdict

AGEA offers opportunities for clients of all abilities to invest in multiple asset classes. Low minimum deposit requirements, demo accounts and mobile apps, alongside transparent trading conditions, are real benefits. The only major downside for UK traders is the lack of FCA regulation. Still, AGEA is a solid all-round broker.

FAQ

Does AGEA Offer A Demo Account?

Yes, AGEA offers a demo account with access to virtual funds and simulated market conditions. Practise trading with access to current prices and software found on the live accounts.

Is AGEA A Regulated Broker?

AGEA International AD is licensed by the Commission for Capital Markets (formerly Securities and Exchange Commission of Montenegro). This follows the trustworthy EU MiFID regulator directive. Note, AGEA is not regulated by the UK’s FCA.

What Trading Platforms Does AGEA Offer?

AGEA offers two platform options; the broker’s proprietary platform Streamster and the industry-recognised MetaTrader 4. Both solutions offer a range of technical features including chart indicators and graphs. The AGEA.Trade web platform is also available.

What Is The Minimum Deposit For An AGEA Trading Account?

Minimum initial deposits vary by account type; £6 for the Cent Account and £100 for the Standard Account. These are low requirements making the broker a good option for beginners.

What Are AGEA’s UK Trading Hours?

Trading is available from Sunday 22:15 to Friday 21:00 GMT on MT4 and Streamster. This is in line with market opening times and means users can trade forex, indices and commodities.

Top 3 AGEA Alternatives

These brokers are the most similar to AGEA:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

AGEA Feature Comparison

| AGEA | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 2 | 4.8 | 4.8 | 4.7 |

| Markets | Forex, indices, commodities, cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $1 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | Commission for Capital Markets | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:100 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | AGEA Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| AGEA | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

AGEA vs Other Brokers

Compare AGEA with any other broker by selecting the other broker below.

Popular AGEA comparisons: