AETOS Review 2025

|

|

AETOS is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to AETOS |

| AETOS Facts & Figures |

|---|

Aetos is an international forex and CFD broker founded in 2007. Headquartered in Sydney, the broker is licensed by the ASIC, FCA and VFSC and has a global client base in over 100 countries. The firm offers the MetaTrader 4 platform and the minimum deposit to get started is $50. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, energies, precious metals, indices, share CFDs |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, ASIC, VFSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | CFDs are available to trade manually in the MT4 platform, or via the broker’s copy trading solution which allows you to automatically copy other strategies. I also appreciate that the broker offers a demo account with $10,000 in virtual funds so you can practice CFD trading strategies risk-free. |

| Leverage | 1:30 (UK), 1:400 (Global) |

| FTSE Spread | 25 |

| GBPUSD Spread | 2.35 |

| Oil Spread | 0.06 |

| Stocks Spread | Variable |

| Forex | My tests uncovered only 27 currency pairs at Aetos, which is below the industry average. Leverage is available up to 1:200 for Australian clients but I’m not overly impressed with the 1.8-pip average spreads for EUR/USD. Top competitors typically offer the same pair for around 1 pip in a standard-level account. |

| GBPUSD Spread | 2.35 |

| EURUSD Spread | 1.80 |

| GBPEUR Spread | 2.57 |

| Assets | 27 |

| Stocks | I was equally disappointed in the small range of 21 major US shares at Aetos, although commissions are low at 2.5 US cents per lot. I was pleased to see 18 cash and futures indices, which allows for a little more diversification, plus traders get access to the popular analysis tool, AutoChartist. |

AETOS is an FCA-regulated broker offering forex and CFDs on precious metals, energies and indices. Investors have access to the MetaTrader suite of platforms on the broker’s primary account. This review will detail the key markets available, plus fees, trading platforms, pros and cons, and whether AETOS is a good choice.

AETOS is regulated in the UK, however a narrow product list, high fees, and poor customer service mean it is not the best pick for British investors. See our list of better alternatives.

Market Access

AETOS offers a limited range of forex and CFD products across four main markets: currencies, energies, precious metals and indices. Compared to top-ranking CFD brokers such as Pepperstone, we would have liked to have seen a wider offering, plus additional trading vehicles such as stocks and ETFs.

- Forex – 27 major, minor and exotic forex pairs including GBP/USD and EUR/USD

- Energies – Brent Crude Oil Futures CFD

- Precious metals – Gold, silver and copper against the US Dollar

- Indices – 8 indices, including the FTSE 100 and DAX 40

AETOS Fees

Instead of commissions, the broker’s fees are reflected in floating spreads. When we used AETOS, we got typical spreads on EUR/USD and gold of 1.8 pips and 0.48 USD, respectively.

These are a little higher than competitors, with Pepperstone, for example, offering an average EUR/USD spread of 1.12 pips.

Additionally, AETOS charges swap fees on overnight CFD positions, depending on the asset traded and whether the position is long or short.

The broker has published a list of products on the website; however, details of the broker’s trading fees are limited and vague.

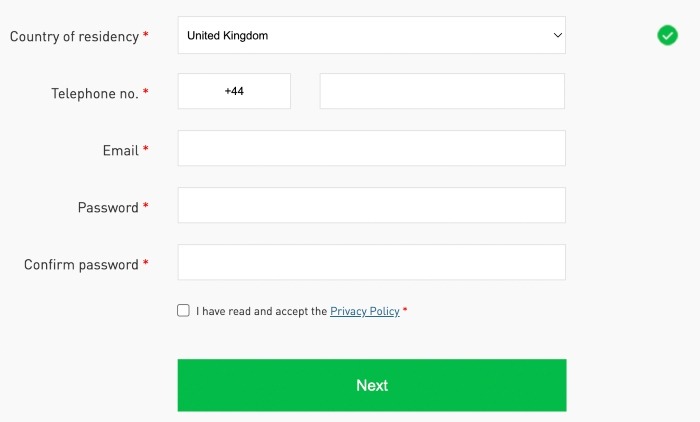

Accounts

For traders in the UK, there is only one account type which caters to retail traders and professional clients. Unfortunately, the conditions of the account and minimum funding requirements are lacking entirely from the website, which shows a lack of transparency.

Whilst AETOS does offer a demo account, it is only available through the global website rather than the UK-based website. Demo accounts allow clients to practice trading within the platform without risking any real money. Leading brokers will provide a large sum of virtual funds plus access to the demo solutions for several weeks or an unlimited period.

It was disappointing to see that AETOS only provides $10,000 of simulated funds with a limit of 14 days. Popular brokers, such as XTB, offer four weeks of demo trading with £100,000 of virtual funds.

Payment Methods

AETOS supports an average range of payment methods, including wire transfer, Visa and Mastercard, Skrill, ZotaPay, and PayTrust.

Deposits can be made in the member’s area once a live account has been opened.

Leverage

AETOS offers leverage up to 1:30 on forex pairs for UK clients, as per European regulations. Precious metals are available up to 1:20, whilst energy and index CFDs depend on the product.

For example, the margin requirement for the FTSE100 Futures CFD is USD 8,000.

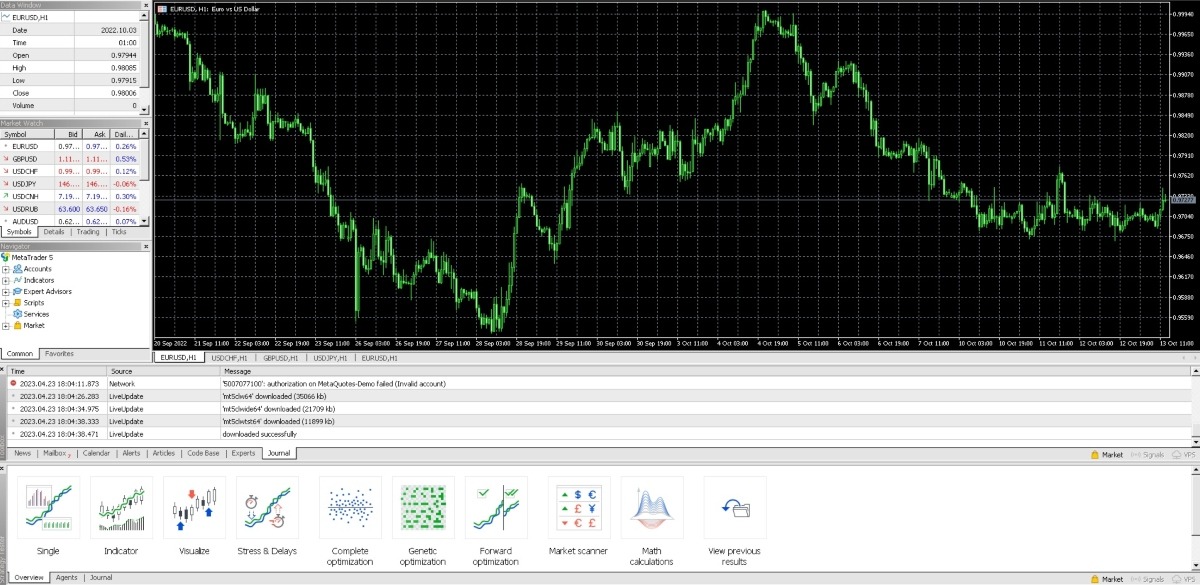

Trading Platforms

AETOS clients have a choice of two platforms: MetaTrader 4 or MetaTrader 5. Both are available for download on Windows and Mac computers as well as on Android and iOS mobile devices.

MetaTrader 4 (MT4) is a market-leading platform for traders of all experience levels, with its user-friendly interface and intuitive charting features. The platform comes with:

- 30 in-built technical indicators including Relative Strength Index and Moving Averages

- A pre-included marketplace for custom indicators and expert advisors

- 31 graphical objects such as lines, channels and Fibonacci tools

- 9 chart time frames suitable for short and long-term strategies

- 4 pending order types

MetaTrader 5 (MT5) is the next MetaQuotes iteration, launched five years after MT4. Notably, MT5 boasts greater charting capabilities, with 82 indicators and graphical objects, plus 12 chart timeframes. MT5 also comes with an embedded community chat to discuss strategies and asset picks as well as a multi-threaded strategy tester.

MetaTrader 5

Overall, the selection of platforms at AETOS is good, though not comparable to the likes of AvaTrade and Pepperstone. These top-ranking brokers offer the MetaTrader suite, plus proprietary platforms and automated trading software like Capitalise.ai.

How To Make A Trade

While using AETOS, it was easy to make a trade from within each platform upon login. After confirming the trade volume, execution type and order type, the MetaTrader platforms facilitate both buy and sell orders in just a few clicks.

With that said, our team were disappointed that AETOS makes it difficult to register and access the platforms. For a seamless registration and trading experience, we recommend looking elsewhere.

Education & Analysis

AETOS does offer access to Trading Central, although insights are vague and not updated regularly. There is also an economic calendar and a video commentary section, which again has not been updated at the time of writing.

For comprehensive insights, market analysis and a range of educational tools, we recommend considering other reputable brokers in the UK. Prime examples include AvaTrade or CMC Markets.

Customer Support

AETOS claims to offer 24/5 support, although the available methods for UK clients are limited compared to other brokers. There is a telephone number and postal address, yet no email or live chat feature until you enter the global site. Again, the broker’s website lacks general clarity on this.

- Telephone – +44 208 104 9400

- Address – Unit 401, Sky Gardens, 153 Wandsworth Road, London, SW8 2GB

Is AETOS Regulated?

AETOS holds a valid license with the UK’s Financial Conduct Authority (FCA) under registration number 592778. As such, AETOS offers a range of safety measures such as segregated client accounts and negative balance protection to UK-based retail traders.

Additionally, clients are entitled to claim up to £85,000 through the Financial Services Compensation Scheme (FSCS) if the broker becomes insolvent.

Company Background

AETOS Capital Group (UK) Limited is a subsidiary of AETOS Capital Group, an Australian broker headquartered in Sydney. Founded in 2007, the broker offers forex and CFD products across currencies, indices, energies and metals.

As well as its license from the Financial Conduct Authority (FCA) in the UK, our experts found that AETOS is regulated by the Australian Securities and Investments Commission (ASIC) in Australia. The broker has additional office locations in London and Vanuatu.

The broker claims to offer competitive pricing, a diverse product range and professional client service, However, the broker’s inadequate website and lack of useful information make it difficult to rank AETOS on many of these features.

Benefits

- FCA Regulation – The broker holds a license with the Financial Conduct Authority in the UK and therefore can provide high standards of regulatory protection

MetaTrader platforms – AETOS offers the popular MT4 and MT5 platforms which are suitable for both beginners and experienced traders

Drawbacks

- Limited markets – AETOS only offers trading on four markets

- Poor website usability – The UK website is difficult to navigate and is missing key information

- Demo account limitations – Demo accounts are limited to only 14 days and $10,000 of virtual funds

- Limited support options – AETOS only offers support through a telephone number and postal address

Trading Hours

AETOS offers forex trading from Sunday to Friday between 22:11 and 21:55 GMT.

Precious metals are open Sunday to Friday between 23:01 and 21:55 GMT. Trading days for indices and energies depend on the relevant exchange and a breakdown of times is available on the broker’s website.

Should You Trade With AETOS?

Overall, our experts were not impressed with AETOS. The broker’s fees, lack of customer service and range of assets are below the market standard compared to other contenders. The availability of MT4 and MT5 is a plus, however, the lack of information on accounts makes it difficult to rank this broker across several key areas.

For a wider range of assets, top-tier customer service and competitive pricing, consider one of our recommended brokers.

FAQ

Is AETOS Legit Or A Scam?

AETOS Capital Group is licensed by the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). The broker, therefore, adheres to strict guidelines to protect client funds, including negative balance protection and access to compensation schemes. Overall, we are comfortable that the trading firm is legitimate.

How Do I Contact The AETOS Support Desk?

Unfortunately, there are limited support options on the UK website. Clients can reach the support desk via the telephone number +44 208 104 9400. The broker’s postal address is Unit 401, Sky Gardens, 153 Wandsworth Road, London, SW8 2GB.

Should I Sign Up With AETOS?

AETOS provides a small range of assets and two well-respected platforms, MT4 and MT5. With that said, pricing is not very competitive, and the availability of additional research and education is lacking. Additionally, information on fees and accounts is missing which may force investors to look elsewhere.

Does AETOS Offer Any Bonus Schemes?

No, AETOS does not offer any bonus schemes such as a joining or ‘no deposit’ bonus for UK clients. FCA-regulated brokers are prohibited from offering such incentives to retail clients.

Does AETOS Provide Investment Management Services?

No, AETOS does not offer an investment management team. Investors manage their own accounts through MetaTrader 4 or MetaTrader 5. The platforms offer sophisticated technologies such as strategy testing, market news and a variety of charting options.

Article Sources

Top 3 AETOS Alternatives

These brokers are the most similar to AETOS:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- IronFX - IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

AETOS Feature Comparison

| AETOS | IG Index | IronFX | Swissquote | |

|---|---|---|---|---|

| Rating | 3.5 | 4.7 | 3.8 | 4 |

| Markets | Forex, energies, precious metals, indices, share CFDs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $50 | $0 | $100 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, ASIC, VFSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | CySEC, FCA, FSCA, BMA / Bermuda | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4 | MT4 | MT4, MT5 |

| Leverage | 1:30 (UK), 1:400 (Global) | 1:30 (Retail), 1:222 (Pro) | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | 1:30 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | AETOS Review |

IG Index Review |

IronFX Review |

Swissquote Review |

Trading Instruments Comparison

| AETOS | IG Index | IronFX | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

AETOS vs Other Brokers

Compare AETOS with any other broker by selecting the other broker below.

Popular AETOS comparisons: