ACY Securities Review 2025

|

|

ACY Securities is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to ACY Securities |

| ACY Securities Facts & Figures |

|---|

ACY Securities is a reputable CFD broker offering over 2200 instruments across forex, indices, commodities, shares and more. Regulated by ASIC, ACY Securities is a trusted broker with a strong reputation since 2011 and numerous industry awards. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, ETFs, Commodities |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, SVGFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | I appreciate the wide range of over 2,000 CFDs at ACY Securities, encompassing global stocks, ETFs, forex, indices and commodities. New traders can get started with just $50, but I found that the best CFD prices are available for those who can deposit at least $200. |

| Leverage | 1:500 |

| FTSE Spread | 1.3 |

| GBPUSD Spread | 0.8 |

| Oil Spread | 0.04 |

| Stocks Spread | Variable |

| Forex | I was glad to see over 60+ major, minor and exotic currency pairs available to trade on the industry favourites, MT4 and MT5. Traders can leverage up to 1:500 and access liquidity from 16 tier-one global banks. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.4 |

| GBPEUR Spread | 0.5 |

| Assets | 63 |

| Stocks | My tests uncovered a good selection of 2,200+ US and Australian shares on the powerful MetaTrader 5 platform. I found commissions were also competitive, coming in at $0.02 per share for US stocks and 0.08% on ASX-lised stocks. |

ACY Securities is an award-winning broker offering CFD trading in forex, shares, ETFs, commodities, indices and cryptocurrencies. Clients can analyse markets and execute trades using the popular MetaTrader 4 and MetaTrader 5 platforms through a demo or a live account. This UK review will evaluate the trading platforms, account types, fees, FCA oversight and more.

Our Take

- Reliable and established broker with ASIC regulation

- Excellent range of tradeable assets with high leverage up to 1:500

- Very competitive spreads from 0 pips on two account types aimed at active traders

- UK traders will be disappointed that they must sign up with the unregulated offshore branch

Market Access

Our experts were impressed with the variety of markets you can trade with ACY Securities, which are varied enough to accommodate different strategies and trading preferences. The breadth of stocks and ETFs is particularly strong and UK investors will appreciate access to British equities.

- Forex: More than 40 major, minor and exotic currency pairs

- Commodities: 17 metals and energies including gold against GBP

- Crypto: Nine cryptocurrency CFDs such as Bitcoin and Ethereum, paired with USD

- Indices: 21 indices covering global markets, including the FTSE 100 and Russell 2000

- ETFs: 180 exchange-traded funds such as the Proshares UltraPro Dow30 and the SPDR S&P500 ETF Trust

- Shares: Over 2,200 stocks listed on the London Stock Exchange, NASDAQ, New York Stock Exchange and Australian Stock Exchange, including AstraZeneca, BAE Systems and HSBC

Fees

ACY Securities scores well for its low fees and transparent pricing structure.

For a Standard account, you are charged through the bid-ask spread, which is the difference between the current best bid and best ask orders. The minimum spread for the EUR/USD pair is 1 pip, which is competitive, and matches the minimum for Pepperstone’s Standard account, although a little more expensive than CMC Markets’ 0.7-pip minimum for the same pair.

Similarly, ACY Securities has a minimum spread of 1.6 pips for the GBP/USD pair, which is comparable to the 1.7 pip minimum of XTB, though higher than the 1-pip minimum from Pepperstone on this pair.

However, the ProZero or Bespoke accounts’ spreads come directly from the liquidity providers and are far tighter as a result – sometimes as low as 0 pips. Instead, the broker makes its money from commissions here, which vary according to the market and the account type.

For forex and metals trading in GBP, there is a $5 commission round turn for clients with a ProZero account or $4 for Bespoke account holders. There is no commission charged on either indices or crypto trades.

For shares trading, the commission relates to the exchange. Stocks on the ASX exchange charge a 0.08% commission across both account types, whereas all other exchanges come with a fee of $0.02 per share.

Accounts

Our experts were pleased with the flexible account types offered by ACY Securities, which will suit traders with different levels of experience and starting capital. Clients can choose a Standard, ProZero or Bespoke live account, each with a different initial minimum deposit limit and pricing model.

The ProZero and Bespoke accounts have a minimum initial deposit limit that raises the barrier to entry, but the commission-based pricing model and ultra-tight spreads from zero will suit more experienced traders.

We were also reassured to see that ACY Securities supports GBP as a base currency, alongside six others including USD and EUR. This means UK clients will not have to pay a currency conversion fee to start trading.

The main features of the three account types are:

Standard

- Wider spreads compared with ProZero and Bespoke accounts

- Minimum deposit of $50

- Islamic-account support

- Zero commission

ProZero

- Tighter spreads

- Minimum deposit of $200

- All subsequent deposits have a minimum of $50

- Commission charged across all markets

Bespoke

- Tighter spreads

- Minimum deposit of $10,000

- All subsequent deposits have a minimum of $50

- Commission charged across all markets but less than the ProZero account

How To Open An ACY Securities Account

Overall, I found the registration process fairly straightforward, though it was a little lengthier than some alternatives:

- Click the ‘Open an Account’ button on ACY.com

- Complete the initial registration form with your email address and password

- Select whether you are opening a personal or corporate account

- Complete the onboarding process either via webcam or by manually filling out forms

- Submit information on your trading experience, employment and source of funds

- Select the base currency, leverage and trading platform you wish to use

- Send documentation such as proof of identification

- The customer team will review your application and, once accepted, you can start trading

Funding Methods

Deposits

ACY makes it easy and affordable for clients to deposit funds with many methods available and no extra fees.

The initial minimum deposit relates to the account type, then a $50 minimum applies to all later deposits. This is affordable for most traders, though higher than other brokers such as FXCC and Axi.

For UK clients, the following payment methods are supported:

- Bank wire transfer

- Debit/credit card

- PerfectMoney

- FasaPay

- Neteller

- Skrill

Our experts could not determine how long the deposits for all methods take but generally, bank wire transfers take between three and five working days, while debit/credit cards and e-wallets are typically processed instantly.

How To Deposit Funds To ACY Securities

I was pleased that I was able to fund my account relatively quickly through the client dashboard:

- Sign in to your account via the broker’s website

- On the cloud client portal, click ‘Deposit’ under the ‘Cash Management’ tab on the menu

- Choose your desired deposit method

- Specify the amount of funds you want to transfer

- Fill out the deposit method details. For example, the 16-digit card number, expiry date, name and three-digit code for debit/credit cards

Withdrawals

The same methods for deposits are available for withdrawals from ACY Securities. However, we were disappointed to see that if you use a credit or debit card, you can only withdraw the amount you deposited initially. To withdraw any profits, you will need to use an alternative method such as a bank wire transfer or e-wallet. In other words, if you make a $50 profit from an initial $100 deposit, you will not be able to withdraw the full $150 via a credit or debit card.

We also found it frustrating that card withdrawal requests must be submitted within 20 days of the deposit. If you wait longer than this period, you cannot use a card to process a withdrawal.

Regardless of the method, ACY Securities says it will process withdrawal requests on the same day if submitted before 6:00 am GMT. If you send a request after this time, disappointingly, you will need to wait until the start of the next working day in Australia, which is at 11:00 pm GMT.

Regulation

Our team was disappointed to see that ACY Securities is not licensed by the Financial Conduct Authority (FCA). As a result, UK clients cannot expect to receive protection from the Financial Services Compensation Scheme. It ultimately reduces the safety and security score of the firm for British traders.

The ACY Securities branch that accepts UK clients is licensed by the Vanuatu Financial Services Commission (VFSC) with registration number 303403. This can be found on the regulator’s register under the name ACY Capital Australia Limited.

We were also pleased to see that the broker holds an ASIC license, which considerably boosts the brand’s credibility. However, only Australian-based clients can register with this subsidiary.

Trading Platforms

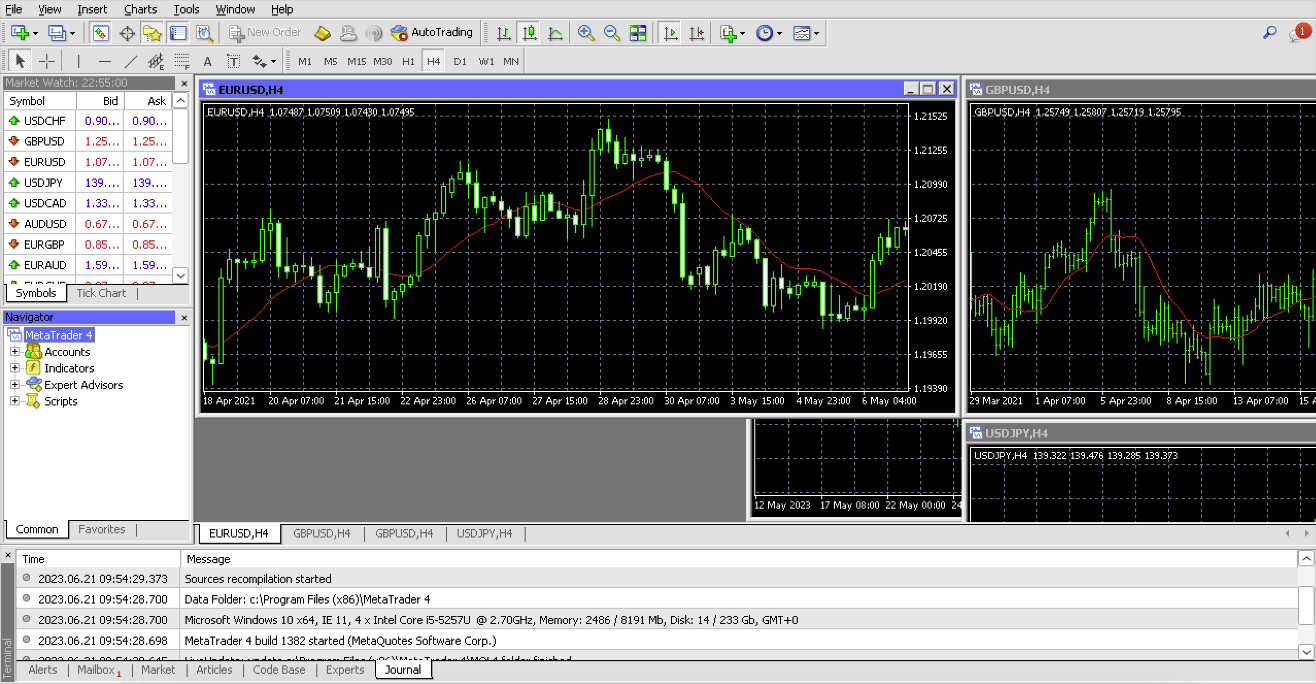

I rated the trading platforms at ACY Securities very highly, with both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) supported. These world-leading platforms are ideal for developing a strategy and executing trades and are renowned for their support of automated trading through their Expert Advisor robots.

The main highlights of the platform are:

MetaTrader 4

- Easy-to-use interface

- 9 in-built time frames

- Expert Advisor support

- Windows and macOS app support

- Used for trading forex, commodities and crypto

- 30 technical indicators and 20+ analytical objects

- Multiple order types with market execution and four pending orders

- Access to a marketplace with 2,000+ indicators available for download

MetaTrader 4

MetaTrader 5

In addition to many of the MT4 features such as access to a community marketplace, EA support and a simple user interface, MetaTrader 5 comes with the following benefits:

- 21 total time frames

- 8 additional indicators

- 2 extra pending order types

- Used for trading shares, ETFs and indices

- Downloadable app for both macOS and Windows computers

- MQL5 programming language for EA development and back-testing using historical data

MetaTrader 5

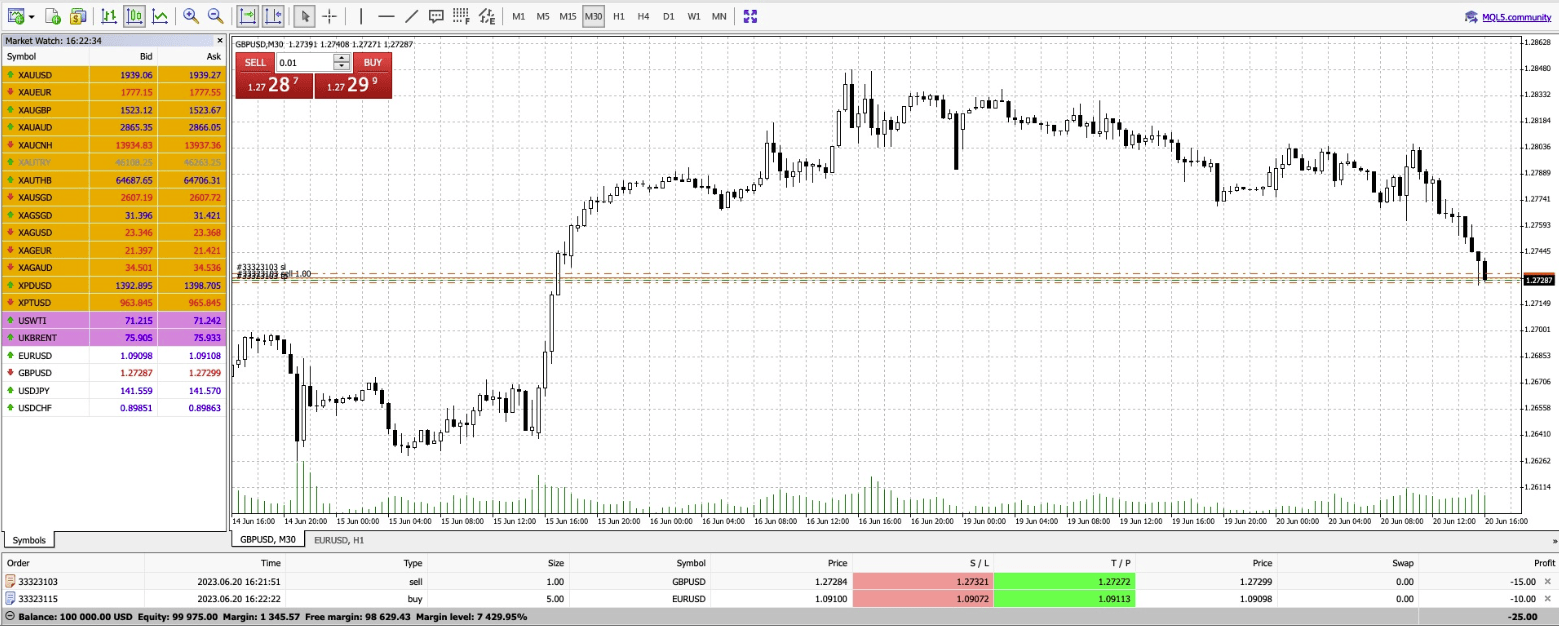

How To Place A Trade

Placing a trade in the MetaTrader platforms is easy:

- Click the ‘New Order’ button on the menu bar

- Select the asset you want to trade from the drop-down symbols list

- Fill in trade information such as trade volume and any stop loss or take profit strike prices

- Choose the order type from market execution, buy limit, sell limit, buy stop or sell stop

- If a pending order, input the strike price and expiry time, if necessary

- Confirm the order and wait for it to fill

Mobile App

Our experts were let down by the lack of a broker-specific mobile app, which means you will need to sign in using the web browser on your mobile device to manage your account.

However, both MetaTrader 4 and MetaTrader 5 have powerful mobile apps, meaning you can conveniently execute trades and monitor your portfolio while on the move.

You can find download links for MT4 and MT5 mobile versions on Android and iOS phones via the ACY Securities website.

ACY Securities Leverage

ACY Securities offers high leverage up to a maximum of 1:500, providing an attractive alternative for UK clients since the broker is not restricted by the maximum 1:30 limit imposed by FCA. Clients can open a trade with an exposure of $1,000 using a stake of just $2.

With ACY Securities, you will experience a margin call if your margin level drops to 100%. If the margin level continues to drop, then at 50% the broker will automatically liquidate some of your positions until your margin level reaches 100% again. This can be avoided by depositing funds to increase your account balance.

While we are fans of the flexibility and additional trading power that high leverage can provide, margin trading also magnifies losses, and is not to be taken lightly.

Demo Account

I liked the ACY Securities demo account model, as it provides the useful benefits of a trade simulator with no expiry. This means you can practise using the $100,000 of virtual funds for as long as you like.

If the demo account remains inactive for six months, then the broker will freeze the account, but there is no restriction to opening a new account later.

How To Open A Demo Account

In line with other competitors, the process to open a demo was fast, requiring some basic personal details and setting up my account preferences:

- On the ACY Securities website, click the ‘WebTrader’ button on the menu bar at the top of the screen

- On the pop-up tab, click ‘Demo’

- Enter personal information such as your name and email address

- Specify the desired account type, simulated funds balance and leverage

- Click ‘Next’ and receive login details

- Use these to sign in to your demo account

- Begin practising

Bonus Deals

ACY Securities’ promo schemes provide a way for clients to kick-start their trading. A deposit bonus adds an extra 10% if your deposit is greater than $1,000. Additionally, you will be given a chance to spin a roulette wheel where you can win a $2000 boost to your deposit.

There is also a trading competition that is run through TradingCup. Over an open period of several weeks, the top 10 most successful traders according to an MMR ranking algorithm will share a prize pool of $75,000. This algorithm accounts for total gain, PnL, maximum drawdown, win rate and deposit size, as well as several technical measures to evaluate aspects such as risk-adjusted returns and stability.

But whilst these are enticing offers, we don’t recommend choosing a broker based on their bonus deals. First and foremost consider the security, tools, market and fees.

Extra Tools & Features

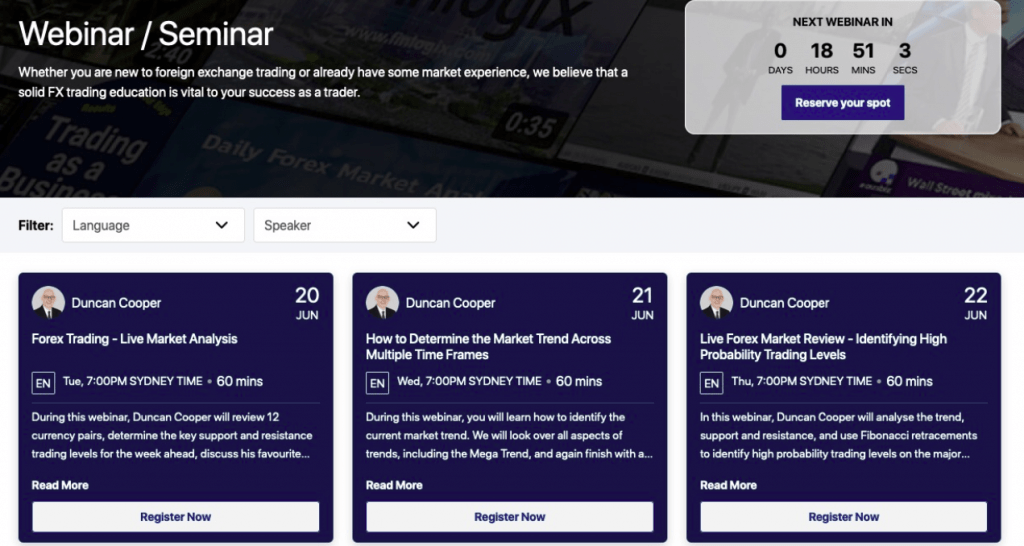

The additional tools ACY Securities provides to clients are of a high standard, with numerous resources to educate traders on investing and regular insights and updates on market news.

Training & Education

Guides and tutorials detailing foundational information on forex and CFD trading are available on the ACY Securities website, and we think these will be useful for newer traders.

One of the main resources is a video trading course taught by Duncan Cooper, an expert trader with more than a decade of full-time trading experience. This course is free to sign up for and provides helpful information on a range of topics, including a primer on news-based strategies and a breakdown of using Fibonacci indicators.

Finally, you can download a free trading e-book that covers topics such as risk management and technical and fundamental analysis. This is an alternative resource that you can read in your own time and at your own pace.

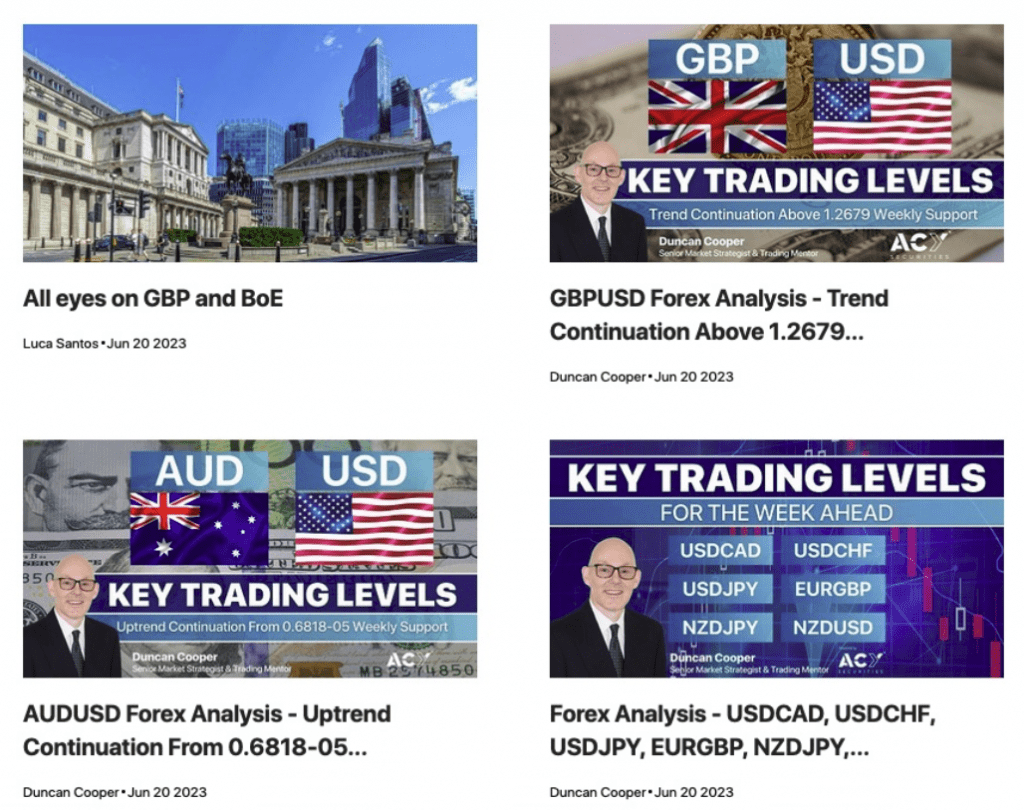

Market News & Analysis

ACY Securities also provides a range of market insights and a news feed that we found to be useful as they highlight events that could impact portfolios or provide investing opportunities.

They include analysis from in-house experts through webinars, seminars and a news board. These are a great way to learn about key recent headlines, insights from experts and upcoming events to be aware of.

There is also an ACY Securities-related board showing recent assets of note. These are spread reviews detailing the assets with the tightest bid-ask price ranges covering forex, indices, shares and commodities mostly.

Customer Service

I found the ACY Securities customer support team to be satisfactory, and I was pleased to see that the customer desk is open 24/5, meaning clients can seek help anytime during the week.

On the downside, the response times for live chat varied from just a few minutes to almost an hour, so clients might need to call the dedicated hotline to receive a faster response.

Clients can access support through the following methods:

- Email: support@acy.com

- Contact form: Available from the broker’s website

- International telephone hotline: +61 29188 2999

- Social media: Facebook and LinkedIn with regular news and announcements

- Live chat: You will initially communicate with a chatbot before being connected with an agent if your query cannot be resolved

We also found a useful FAQ section, as well as PDS and FSG documents on the terms and conditions page on the ACY Securities website

Company Details & History

Launched in 2011 by founder and current CEO Jimmy Ye, ACY Securities is a forex and CFD broker that is part of the wider ACY Group. Through the group’s subsidiaries, ACY engages in other industries such as corporate advisory services.

ACY Securities is based in Australia with its headquarters in Chatswood, Sydney and an additional office in Melbourne. There are also global offices in Vietnam, Japan, Taiwan, Egypt, Malaysia and Saudi Arabia.

ACY Securities has won several awards including Best Multi-Asset Broker in Australia at the Technology Era Awards in 2020.

The broker uses a straight-through processing order model with 16 liquidity providers to offer fast trade execution while keeping quality high.

Trading Hours

The ACY Securities trading hours relate to the market you are interested in. For example, you can trade forex from Sunday at 10:00 pm until Friday at 10:00 pm with no daily breaks. For the majority of commodities, the trading hours are 11:00 pm on Sunday until 10:00 pm Friday with an hour break each day starting at 10:00 pm.

The open hours for shares trading relate to the exchange. You can trade stocks on the LSE from 8:00 am until 4:30 pm Monday to Friday but the hours are different for stocks on the ASX, NASDAQ and NYSE and correspond to the exchanges’ native countries.

Should You Trade With ACY Securities?

ACY Securities is a good, cost-effective broker that provides a high-leverage alternative to UK-based CFD brokers. Some of the main benefits for beginners include the range of educational resources and the zero-commission trading account. Experienced traders will enjoy the ProZero and Bespoke accounts, which are great for employing scalping and hedging strategies. Finally, the availability of both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) allows clients to utilise high-quality and reliable trading tools.

However, bear in mind that ACY Securities is not FCA-regulated and so you should take care if you plan on registering a live account. This is the major drawback of signing up as the level of security and safety for British traders will be limited.

FAQ

Which Account Should I Choose At ACY Securities?

ACY Securities’ Standard account would work best for beginners, with an initial deposit requirement of $50 and no commission. The ProZero and Bespoke accounts have the tightest ECN spreads plus commission fees and would be ideal for scalpers or more experienced traders.

Does ACY Securities Offer An Islamic Account?

Yes, there is an option to register for a swap-free solution at ACY Securities. However, this is limited to the Standard account only. You cannot open an Islamic version of the ProZero or Bespoke accounts.

Does ACY Securities Provide Reliable Trading Software?

In line with other top brands, ACY Securities offers both MetaTrader 4 and MetaTrader 5 platforms. These are powerful third-party platforms with many customisation options to suit diverse trading preferences and needs. With that said, beginners may prefer the MT4 platform, whilst multi-asset or technical traders will rate MT5.

You can access both through the Web Trader or download a desktop or mobile app.

Does ACY Securities Offer A Free Demo Account?

Yes, ACY Securities offers a beginner-friendly demo account for free. This is a paper trading account where you can practise trading before you sign up for a live account. With a generous $100,000 in simulated funds and your choice of leverage, you can use the paper trading account for as long as you like. But, after six months of inactivity, ACY Securities will freeze the demo.

Does ACY Securities Offer Fast Deposits?

UK clients have fast and convenient deposit options at ACY Securities. Bank transfers can take between 3 and 5 working days, so we recommend opting for credit/debit cards or e-wallets such as FasaPay, Skrill, Neteller and PerfectMoney, which are processed instantly.

Article Sources

Top 3 ACY Securities Alternatives

These brokers are the most similar to ACY Securities:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

ACY Securities Feature Comparison

| ACY Securities | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| Rating | 4 | 4 | 4.8 | 4 |

| Markets | CFDs, Forex, Stocks, ETFs, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $50 | $1,000 | $0 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, SVGFSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | ACY Securities Review |

Swissquote Review |

Pepperstone Review |

FP Markets Review |

Trading Instruments Comparison

| ACY Securities | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

ACY Securities vs Other Brokers

Compare ACY Securities with any other broker by selecting the other broker below.

Popular ACY Securities comparisons: