ActTrader

ActTrader is a multi-asset platform with advanced charting, multiple order types, risk management, and automated trading capabilities. This user review will break down the features available, download options, and compare the platform to popular alternatives like MT4 and MT5. Our team have also listed the best ActTrader brokers in the UK with expert ratings.

UK Brokers With ActTrader

-

Founded in 2008, Capital Street FX is a forex and CFD broker offering 1000+ instruments on the ActTrader platform. The broker offers 4 STP/ECN account types starting from $100 with fixed or variable spreads. Capital Street FX is an offshore broker registered with the Mauritius FSC.

-

Founded in 2014, FxPlayer is a forex and CFD broker registered offshore in the Marshall Islands. This brokerage offers a very small selection of forex, commodities and indices on a range of accounts starting from $50. As an NDD broker, clients are promised tight ECN pricing, tier 1 liquidity and fast execution.

-

Hirose is a regulated and dedicated forex and binary options trading broker.

-

GCI offers online trading in 300+ tradable assets with up to 1:400 leverage.

What Is ActTrader?

ActTrader is a trading platform developed in 2002 by ActForex, a US-based technology company that specialises in developing software solutions for the financial industry. ActTrader is one of ActForex’s flagship products and is used by investors around the world to trade a range of instruments, including forex, commodities, stocks, and indices.

The platform is highly configurable, which means that traders can tailor it to their specific investing needs and strategies. This makes it popular among both retail traders and institutional clients who require a high degree of customisation in their trading software. The powerful solution essentially provides users with the tools and features to execute trades and manage risk effectively.

ActTrader is used by 1.85 million retail traders, 100+ institutional clients, and has processed $400 trillion in trading volume. The trading software is available in 15 languages and is operated from 5 global offices.

How ActTrader Works

The platform receives real-time market data from various sources, such as exchanges, liquidity providers, and data vendors. This data includes prices, volumes, and other market information that investors can use to make trading decisions.

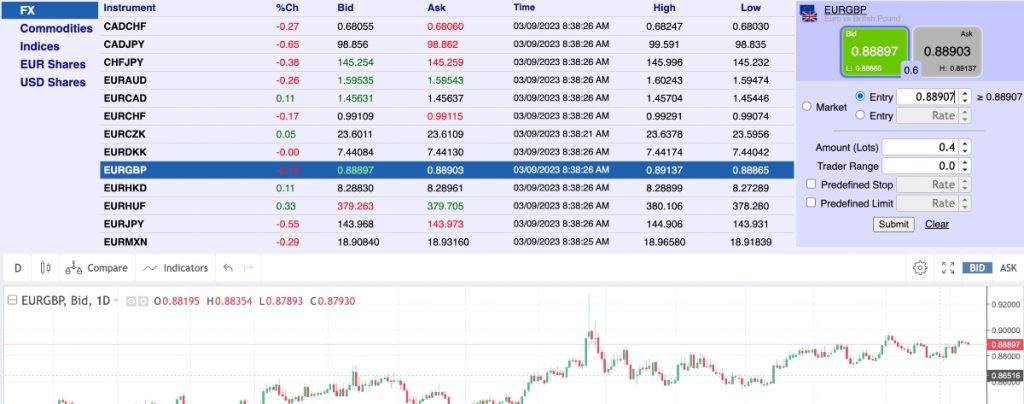

The ActTrader interface allows users to view real-time prices, monitor their positions, and execute trades. The terminal offers interactive charts, order entry screens, and account management tools.

Traders can enter various types of orders, including market orders, limit orders, stop orders, and trailing stop orders. These orders are sent to the relevant exchanges or liquidity providers for execution. ActTrader also offers risk management tools, including stop loss orders and take profit orders.

Traders can view their account balances, equity, margin, calculators, and other account-related information on the platform. There are also deposit and withdrawal methods for adding and removing funding from brokerage accounts.

ActTrader – Fxview

Features

ActTrader offers multiple features which means it rivals competitors like MetaTrader 4 and MetaTrader 5, including one-click trading directly from charts, a breadth of technical indicators, and automated trading.

Key features and functionality:

- Advanced Charting – The platform offers 30+ built-in indicators, as well as the ability to create your own indicators. Traders can also trade directly from charts and save multiple layouts for easy access. Available chart types include line, bar and candlestick with a range of drawing tools like trendlines, Fibonacci, retracements plus support and resistance levels.

- Customisable Interface – The customisable workspace allows traders to arrange their screens and tools in a way that suits their investing style. This includes personalised graphs, trading widgets, risk management features, and customisable scripts.

- Automated Trading – ActTrader supports automated trading through the use of Expert Advisors (EAs), which are algorithmic trading systems that can be configured using the platform’s proprietary programming language, ACTFX.

- Multiple Order Types – The platform supports multiple order types, including market, limit, stop, and trailing stop orders. Traders can also choose from multiple order execution modes, such as Instant Execution, Market Execution, and Request Execution.

- Risk Management – ActTrader is equipped with various risk management tools, including the ability to set stop loss and take profit levels. Traders can monitor their margin usage and open positions in real time.

- Backtesting Engine – The platform includes a sophisticated backtesting engine that allows traders to optimize their trading strategies using historical data.

- Educational Resources – In addition to the trading platform, ActTrader provides a range of educational resources, including trading guides, tutorials, and webinars.

Fees

ActTrader brokers usually offer the trading platform for free. The software company charges a licensing fee to the hosting brokerage which is not normally passed onto the trader. With that said, some brokers may have a minimum balance or volume requirement.

Fxplayer and GCI, for example, offer the ActTrader platform free of charge.

Pros Of ActTrader

- Highly customisable

- The interface is easy to use, even for beginners

- Available as desktop software, web terminal, plus iOS and Android app

- ActTrader offers backtesting and automated trading via Expert Advisors

- Large range of charting options with different time frames to suit short-term and long-term trading strategies

- Variety of tradable assets including stock, bonds, ETFs, commodities, indices and currency pairs

Cons Of ActTrader

- Fewer technical indicators and analysis tools compared to MT4 and MT5

- Relatively limited list of ActTrader brokers – MT4 and MT5 are more widely available

- Less suitable for seasoned traders

Guide To Using ActTrader

- Start with a demo account: If you are new to ActTrader, start with a demo account. This will allow you to familiarise yourself with the platform’s features and tools before risking real money.

- Customise your workspace: ActTrader allows you to customise your workspace, so take the time to arrange your screens and tools in a way that works best for you. This can help to improve your workflow and efficiency.

- Use advanced charting tools: ActTrader offers advanced charting tools, including over 30 built-in indicators. Experiment with different indicators and customise your own to find the ones that work best for your trading strategy.

- Set up automated trading: If you have a well-defined strategy, consider setting up automated trading. This can help to improve consistency in your trading and save time.

- Test your strategies: Use the backtesting engine to test and optimise your trading strategies using historical data. This can help you to identify the most effective trading setups and improve your long-term performance.

How To Compare ActTrader Brokers

- Regulation: Check whether the broker is regulated by a reputable financial regulator, such as the UK Financial Conduct Authority (FCA). This will help to ensure that the broker operates fairly and transparently with investor compensation schemes, negative balance protection, and segregated accounts.

- Instruments: Check that ActTrader brokers offer access to the markets you want to speculate on, whether that’s major forex pairs, FTSE-listed stocks, or metals like gold and silver. A range of instruments will give you more opportunities to diversify your portfolio and hedge open positions.

- Fees: The best ActTrader brokers offer tight spreads and/or low commissions. Also consider overnight holding fees, deposit and withdrawal charges, plus inactivity penalties.

- Customer Support: For beginners, in particular, consider the level of customer support provided by the broker, including availability and responsiveness. The top brokers with ActTrader offer 24/5 assistance via live chat, social media, forums and a telephone helpdesk to support with platform queries and technical issues.

- Reputation: Check the broker’s reputation by reading reviews and ratings from other traders. Alternatively, use our expert list of the best ActTrader brokers.

ActTrader vs MetaTrader 4:

ActTrader and MetaTrader 4 (MT4) are both popular platforms used by traders in the UK, but there are some key differences between the two.

For one, they are different in terms of the asset classes that they offer. While ActTrader offers trading in multiple markets, including currency pairs, stocks, indices, commodities, and binary options, MT4 primarily focuses on forex.

Both platforms offer customisation but in different ways. ActTrader provides traders with a customisable workspace, allowing them to tailor the platform to their specific needs and strategies. MT4 also offers some customisation options, but they are more limited. Customisation is the biggest advantage that ActTrader has over MT4.

ActTrader offers advanced charting tools, including multiple chart types and indicators, however MT4 offers over 50 indicators vs the 30 available on ActTrader. The MetaTrader marketplace is also home to thousands of custom indicators and trading tools, available for free or for a small fee.

Both platforms support automated trading, but here MT4 benefits from its widespread usage, with a larger community of EAs. With that said, ActTrader allows investors to use automated trading directly from charts. ActTrader also offers more advanced tools for backtesting and optimising EAs.

Overall, MT4 is the more popular platform, giving traders a wider choice of supporting brokers. And while the MT4 interface is less intuitive and modern than ActTrader, it will be familiar to many traders removing the learning curve for investors new to ActTrader.

Support

The level of support provided by ActTrader can vary depending on the broker or financial institution that provides the platform. However, ActForex provides technical support and assistance to brokers who offer ActTrader.

The ActForex website offers a support portal where brokers and traders can view technical documentation, FAQs, and user guides. They also provide phone and email support for technical issues or questions related to the platform. In addition, ActForex offers custom development services for brokers who require specialised features or customisation of the platform.

Brokers who offer the ActTrader platform will also provide their own customer support services, including via phone, email, or live chat.

Bottom Line On ActTrader

ActTrader is a versatile platform that offers a range of features and tools for traders and institutional clients. The platform is easy to use and customise, and it provides access to real-time market data and advanced charting tools.

With that said, using ActTrader effectively requires a combination of technical skill, trading strategy, and risk management. It is also important to sign up with one of the best brokers that offer ActTrader.

FAQ

What Is ActTrader?

ActTrader is a trading platform developed by ActForex, which allows users to access multiple asset classes, including forex, stocks, indices, and commodities. The platform provides real-time market data, advanced charting tools, automated trading and a backtesting engine. It’s available on desktop devices and Android and iOS mobile apps.

How Do I Use ActTrader?

To use ActTrader, you will need to open an account with a broker that offers the platform. Once you have an account, you can download the platform, customise your workspace, and start trading. You can use the platform to place orders, analyse market data, and monitor your trades. Use our ranking of the top ActTrader brokers to get started.

What Are The Best Features Of ActTrader?

Key features of ActTrader include real-time market data, advanced charting tools, multi-asset trading, automated investing, customisable workspaces, and risk management. It is a beginner-friendly platform with a modern look and feel, available as downloadable desktop software, a mobile app, or through web browsers.

What Costs Are Associated With ActTrader?

The best ActTrader brokers do not charge a fee to traders. Instead, the software company charges a licensing fee that the brokerage covers. With that said, traders may need to deposit a minimum amount or trade a certain volume of lots each month to retain access to the software.

Is ActTrader Good For Beginners?

ActTrader is a good platform for beginners with a user-friendly interface, customisable workspace, and a range of features and tools to help traders develop their skills. A catalogue of training guides and video tutorials also makes it easy to get started with the software. However, beginners need to have a solid understanding of trading principles and risk management before using the platform to avoid potential losses.