Absolute Markets Review 2025

Absolute Markets is an award-winning CFD broker that offers competitive trading conditions to UK investors. Facilitating highly leveraged trading opportunities alongside a £50 minimum deposit, the brokerage is a good fit for beginner traders. This 2025 review of Absolute Markets unpacks the firm’s list of trading instruments, demo account details, pros, cons and more. Find out whether to open an account with Absolute Markets.

About Absolute Markets

Absolute Markets is an online trading broker that offers 500+ assets spanning five popular financial markets, including forex, stocks and cryptocurrencies. The company is based in Saint Vincent and the Grenadines where it is regulated by the Financial Services Authority (SVGFSA).

Founded in 2021, Absolute Markets has quickly amassed a global presence, accepting clients from over 170 countries including the UK. In recognition of its high-quality trading services, Absolute Markets has won both the Fastest Growing Forex Broker and Best Trading Experience awards at the World Finance Awards.

Instruments

UK clients can trade CFDs on the following markets with leverage up to 1:1000:

- Indices: 12 global stock indices including the FTSE100

- Commodities: 10 commodities including gold and Brent crude oil

- Cryptocurrency: 61 cryptos including Bitcoin, Ethereum and Litecoin

- Stocks & Shares: 76 company stocks listed on NYSE, LSE and other EU stock exchanges

- Forex: 50+ major and minor currency pairs, 11 of which include GBP as either the base or quote currency

Trading Platforms

Our experts found that Absolute Markets provides clients with two trading platforms:

WebTrader

The online WebTrader is a proprietary trading platform that clients can access directly through their internet browser. New traders are given a login and a password that can be used to sign in to the platform following account registration.

When we used Absolute Markets, our experts were pleased with the various indicators available to overlay onto charts. Examples include Keltner Channels, MACD and Relative Strength Indexes.

To accommodate individual trading preferences, charts can be customised with time frames ranging from 1 minute up to 1 month. Alternative charting styles also available include Japanese candlesticks, bars, lines and area charts.

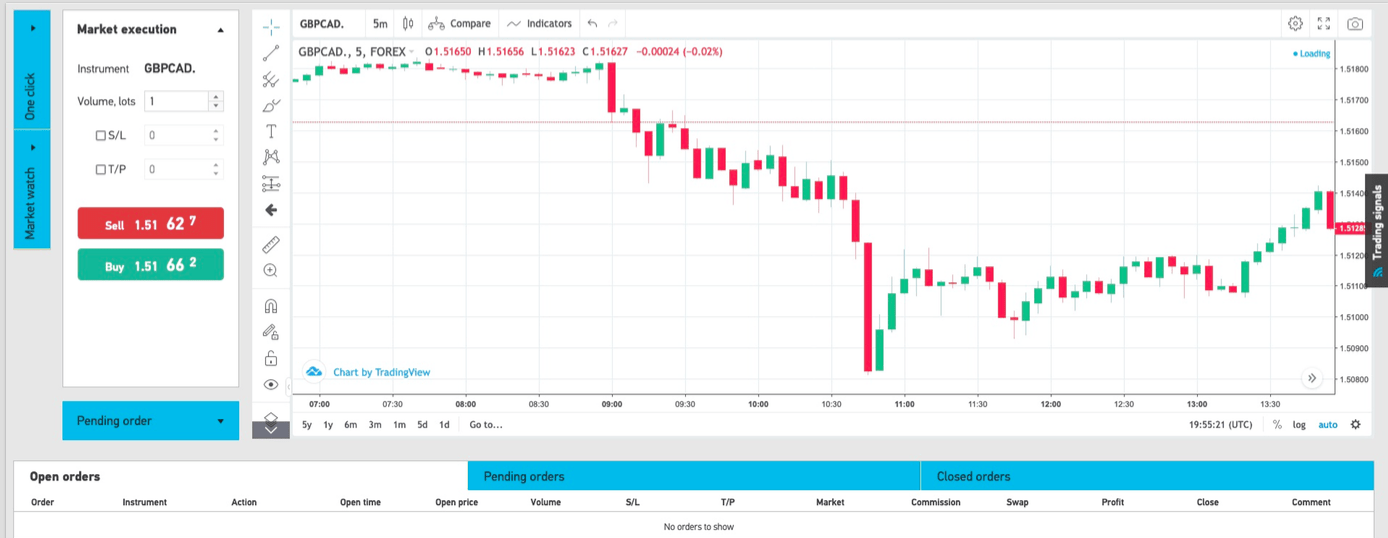

WebTrader

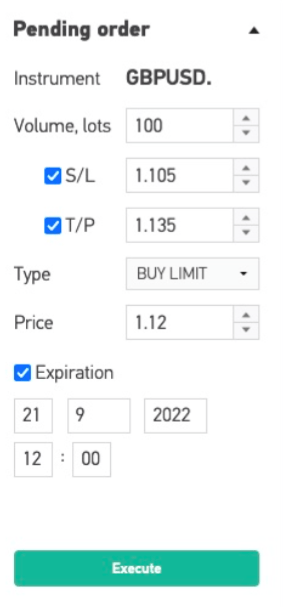

How To Place A Trade

- Select an asset from the drop-down list or type in the ticker (e.g. for Unilever PLC on the LSE, type in ‘ULVR’)

- Choose whether you want to place a market execution or pending order trade. Market execution is placed as soon as you click either buy or sell. A pending order will only enter the trade if certain conditions are met before the expiration time

- Input the volume in terms of lots

- Set stop loss and take profit orders as needed

- Click either ‘Buy’ or ‘Sell’ depending on how you predict the asset will move

- Once the order is placed, you can view your position under the ‘open orders’ tab below the price history chart

Placing A Trade

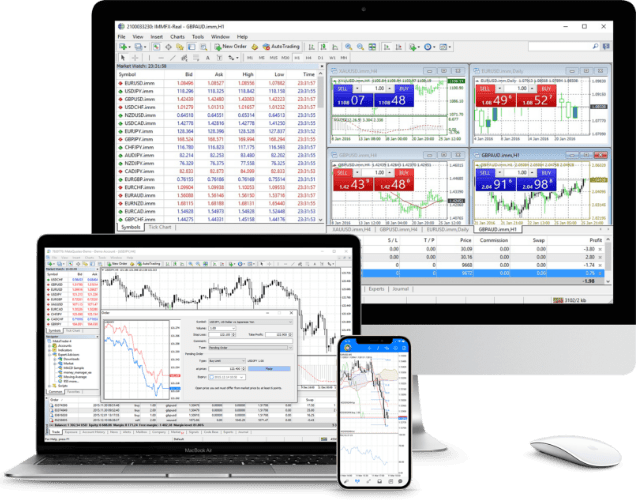

MetaTrader 4

MetaTrader 4 (MT4) is a world-leading trading platform created by MetaQuotes. Clients have access to 50+ in-built indicators, which are ideal for planning out trades and finding new opportunities. Investors can trade forex, spot metals, shares and spot indices.

Additionally, customers have the option of introducing Expert Advisors (EAs). EAs can automatically execute trades according to a given strategy.

MetaTrader 4

Account Types

There are four live trading accounts available to UK clients. When you register for a new profile, you can select a maximum leverage ratio, ranging from 1:25 to 1:1000 and set the base currency to GBP, EUR or USD.

Micro

- Spreads from 1.4 pips

- No commission on trades

- Minimum deposit is £50

- No promotional schemes or bonuses

Variable (Classic)

- Spreads from 1.2 pips

- No commission on trades

- Minimum deposit is £100

- Access to bonuses and promotions

ECN

- Spreads from 0.1 pips

- Cannot trade energies

- Minimum deposit is £500

- Commission of £10 per round lot

- Access to bonuses and promotions

- Trade on electronic communication networks

ECN VIP

- Priority support

- Spreads from 0.0 pips

- Cannot trade on energies

- Minimum deposit is £5,000

- Commission of £10 per round lot

- Access to bonuses and promotions

- Trade on electronic communication networks

Demo Account

Absolute Markets offers two different demo account profiles; Classic and ECN.

Both accounts duplicate the functions of the live profiles, however, clients have access to virtual funds rather than investing real money. When we used Absolute Markets, both accounts were helpful in learning how to use the WebTrader platform, develop new strategies and test leveraged trading opportunities.

Deposits & Withdrawals

Deposits

Absolute Markets offers a number of methods for making payments to your live trading account. No fees apply unless you deposit less than the minimum requirement for the selected payment option. The minimum deposit also varies by account type, starting from £50.

- Deposits made via Visa/Mastercard debit and credit cards are processed instantly

- E-wallets such as PayRedeem and Perfect Money are accepted. Payments are processed instantly

- Bitcoin, Ethereum and Tether crypto coins are all accepted and can take between 15 minutes to an hour to be available

- To use bank transfer, UK-based investors must cover any third-party fees. Average fund clearance is between one and five working days. The minimum deposit for this type of payment is £200

Withdrawals

Below is a list of the supported withdrawal methods, along with any payment limits and fees.

- PayRedeem withdrawals incur a 6% fee. The minimum withdrawal limit is £25

- For bank transfers, third-party charges may apply. The minimum withdrawal limit is £100

- All crypto withdrawals must be at least £25 in value. Charges vary by token; Bitcoin is 0.5%, Tether is 1.99% and Ethereum is 1% + 0.006 ETH

- Perfect Money is available at no cost. The minimum withdrawal is advertised as £1, however, while using Absolute Markets, we found that the limit was set to £100

Allow at least 24 hours for fund processing unless using a bank wire transfer, which can take up to five working days.

How Do I Process A Withdrawal?

To request a withdrawal from Absolute Markets, follow these steps:

- Log in to your Absolute Markets trading account

- On the main account zone, click ‘Withdraw’ under the ‘Finances’ section

- Select a payment method

- Input the account or wallet you are withdrawing to and the amount

- Confirm and wait for funds to arrive in your payment account

Note that clients must first complete an account verification process before they can request a withdrawal.

Account Verification

Absolute Markets mandates that each client must verify their account before requesting a withdrawal.

To do this, you must submit information such as your annual income, employment status and source of funds, in addition to proof of address and identity documents.

Fees

The fee structure at Absolute Markets is transparent. All clients are either exposed to wider bid-ask spreads or tight spreads with commission charges. Those trading with micro or variable accounts will incur spreads of at least 1.2 pips and 1.4 pips, respectively. Clients with ECN accounts must pay a £10 commission per round lot with spreads from 0.0 pips. A round lot is the typical base unit for securities traded.

There is also an inactivity fee of £5 that is charged on a monthly basis if there is no trading activity over a six-month period.

Regulation

Absolute Markets LLC holds a licence with the Financial Services Authority of St. Vincent and the Grenadines. The registration number is 1904-01-16.

We are confident that the broker abides by anti-money laundering and ‘Know your customer’ policies. Nonetheless, the broker does operate offshore. There is no reputable oversight from top-tier authorisations such as the Financial Conduct Authority (FCA).

Customer Support

Absolute Markets promotes 7/7 customer support and our experts found that the team is contactable 24/7. Options for contacting the customer service team include:

- One-to-one live chat

- Request a phone call

- Email at info@absolutemarkets.com

- Social media accounts on Facebook, Instagram, Telegram and YouTube where you can keep up to date with news and announcements

Apps & Accessibility

There is no mobile app for the Absolute Markets proprietary platform. If you want to use their trading platform, you can access it via your phone, tablet, laptop or computer through a web browser.

The MetaTrader 4 app, on the other hand, is available on both mobile and desktop. Access all features and functionality across devices including full account management, plus customisable charting and analysis tools.

Windows desktop app download links are available on the broker’s website. The mobile app can also be downloaded directly via the Apple and Android app stores.

Promotional Deals

Absolute Markets offers a 30% joining bonus for clients with Variable, ECN and ECN VIP accounts. To receive the bonus, you must claim within five days of registration and deposit at least £200 (minimum bonus of £60).

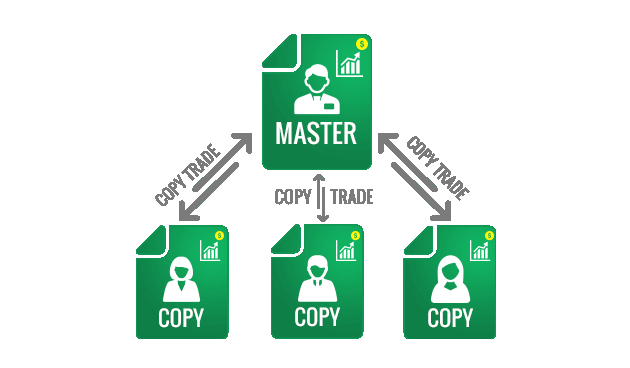

The online broker also offers a copy trading solution. New traders can follow experienced investors while successful traders can market their strategies and earn a percentage from followers.

Benefits

When we used Absolute Markets, we found several compelling reasons to open an account:

- Take profit and stop loss orders available

- 1:1000 leverage (1:100 on cryptos)

- Multiple payment options

- MetaTrader 4 platform

- Copy trading solution

- 0.01 minimum lot

- Joining bonus

Drawbacks

Our experts also found downsides to registering with Absolute Markets:

- Withdrawal fees

- Bonus is unavailable with micro accounts

- Wide spreads for Micro and Variable accounts

- The company is not licensed by the UK Financial Conduct Authority (FCA)

- High minimum deposit requirements for accounts with competitive spreads

Should You Trade With Absolute Markets?

Absolute Markets is a viable option for aspiring UK investors. While it is not regulated by the FCA, it is one of the few brokers that offer leverage up to 1:1000 with welcome deposit bonuses. There is also a decent selection of UK-listed stocks and forex pairs with the GBP.

Follow the sign-up link below to get started with Absolute Markets today.

FAQ

Is Absolute Markets A Legit Or Scam Broker?

Absolute Markets holds a license with a regulatory authority so we are comfortable that it is not a scam broker. With that said, the company is not regulated by the Financial Conduct Authority in the UK so British traders will have limited legal protections should the broker behave inappropriately or go bankrupt.

What UK Markets Can I Trade On Absolute Markets?

Clients interested in trading UK assets have a number of options. There are 11 forex pairs where the Pound Sterling is used, 6 stocks listed on the London Stock Exchange, plus the FTSE 100 index.

What Deposit Methods Are Available At Absolute Markets?

UK traders can deposit funds to an Absolute Markets trading account via crypto payments, bank wire transfers, Mastercard and Visa debit and credit cards, plus e-wallets such as Perfect Money and PayRedeem. Deposits are free with the exception of bank transfers, or if transferring less than £200.

Does Absolute Markets Offer Halal Trading Accounts?

All Absolute Markets clients have the option of opening a swap-free, halal trading account that complies with Sharia law. Speak to the broker’s customer support team for more details and sign-up instructions.

Top 3 Absolute Markets Alternatives

These brokers are the most similar to Absolute Markets:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Absolute Markets Feature Comparison

| Absolute Markets | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 1.3 | 4.8 | 4.8 | 4.7 |

| Markets | CFDs on forex, indices, shares, commodities, cryptocurrencies, futures | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $50 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SVGFSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:1000 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | Absolute Markets Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Absolute Markets | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | Yes | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Absolute Markets vs Other Brokers

Compare Absolute Markets with any other broker by selecting the other broker below.

Popular Absolute Markets comparisons:

|

|

Absolute Markets is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Absolute Markets |

| Awards |

|

|---|---|

| Instruments | CFDs on forex, indices, shares, commodities, cryptocurrencies, futures |

| Demo Account | Yes |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Regulated By | SVGFSA |

| Trading Platforms | MT4 |

| Leverage | 1:1000 |

| Mobile Apps | iOS & Android |

| Payment Methods | Credit Cards, Debit Card, Mastercard, PayRedeem, Perfect Money, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | TradingView |

| Islamic Account | Yes |

| Commodities | Copper, Gasoline, Gold, Oil, Palladium, Platinum, Silver |

| CFD FTSE Spread | From 1.2 pips |

| CFD GBPUSD Spread | From 1.2 pips |

| CFD Oil Spread | From 1.2 pips |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | From 1.2 pips |

| EURUSD Spread | From 1.2 pips |

| GBPEUR Spread | From 1.2 pips |

| Assets | 200+ |

| Coins | ADA, ALG, ATM, AVA, AXS, BAT, BAT, BCH, BNB, BTC, CRV, DASH, DOG, DOT, EOS, ETC, ETH, FIL, INC, IOT, LNK, LRC, LTC, MRK, MTC, NEO, NER, OMG, ONE, SAN, SHB, SOL, SUS, TER, TRX, UNI, VEC, XLM, XMR, XRP, XTZ, ZEC |

| Crypto Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |