AAATrade Review 2025

|

|

AAATrade is #94 in our rankings of CFD brokers. |

| Top 3 alternatives to AAATrade |

| AAATrade Facts & Figures |

|---|

AAATrade is a forex and CFD broker established in 2013 and regulated by CySEC. The STP broker offers tens of thousands of Stocks, ETFs, CFDs, securities and cryptocurrency products on the proprietary and MetaTrader platforms. Traders can benefit from standard retail accounts as well as portfolio management and advisory services. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | Yes (iOS & Android) |

| Payments | |

| Min. Trade | $0 |

| Regulated By | CySEC |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | No |

| CFDs | During my tests, I found thousands of leveraged CFD products across forex, indices, commodities, stocks and cryptocurrencies. Commissions are competitive and I particularly enjoyed using all the free CFD trading resources available in the demo account. |

| Leverage | 1:200 |

| FTSE Spread | 0.5 |

| GBPUSD Spread | 0.00002 |

| Oil Spread | 0.10 |

| Stocks Spread | Floating |

| Forex | AAATrade offers 80+ forex pairs, including majors and minors, which is a competitive range and more than most brokers I have reviewed. I was also able to take advantage of the broker's daily technical insights with chart analysis, as well as the live economic calendar. |

| GBPUSD Spread | 0.00002 |

| EURUSD Spread | 0.00002 |

| GBPEUR Spread | 0.00002 |

| Assets | 10000+ |

| Stocks | I'm impressed with the broker's vast range of global stocks across the US, Canadian, European, Asian and UAE markets, as well as popular ETFs. There's also 20+ stock indices tradable via CFDs or futures. Novice accounts are commission-free, whilst Experienced accounts can expect low commissions from 0.125% for most exchanges. |

| Cryptocurrency | I was impressed with AAATrade's range of 50 cryptocurrencies, including Bitcoin and Ethereum, which is more than most brokers I review. I was particularly glad to see a good mix of crypto-crypto pairs, as well as some crypto-fiat pairs against USD and EUR. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | Yes |

AAATrade is a CySEC-regulated online CFD and securities broker that offers thousands of assets from over 50 different exchanges. The brokerage boasts strong educational resources, a bespoke trading platform, multiple account types and promotions.

In this AAATrade review we will cover the markets it offers, its fee structure, available trading platforms, how to open an account and more.

Our Take

- The firm boasts more than 16,000 CFD & equity instruments, which is great for investors looking for a diverse portfolio all in one place

- AAATrade’s bespoke trading platform integrates seamlessly with the client portal and additional features, providing a one-stop shop for clients, though the technical analysis is limited

- Our team is disappointed by the broker’s account and fee structure, which is complex and includes excessive deposit and withdrawal charges

- AAATrade is not regulated by the FCA in the UK, sitting under the scrutiny of the Cyprus Securities and Exchange Commission

Market Access

AAATrade offers more than 16,000 tradable assets. Our team was impressed by this large list, giving strong diversification opportunities. Investors can trade CFDs, futures or stocks in a wide range of different markets. This grants a huge amount of flexibility to traders.

The instruments on offer include:

- Stocks – Thousands of stocks from a wide range of countries, including Toyota, Adidas, Barclays, Apple and BNP Paribas

- Indices – 24 different indices, including the FTSE 100, Dow Jones, CAC 40, DAX 40 and HK 50

- ETFs – A huge range of ETFs from five different countries, including the NASDAQ 100 index, TexDAX index, Bloomberg Silver subindex and Stoxx Europe indices

- Futures – Futures contracts on several UK and US commodity products, including London wheat, N.Y. cocoa, Brent crude oil, orange juice and sugar

- Metals – Several popular metal assets, including gold, silver, nickel and aluminium, all against the USD

- Bonds – German, EU and UK bonds

- Forex – A wide range of forex pairs, including all majors and a huge selection of minor and exotic pairs

- Cryptocurrency – Many crypto pairs, including Bitcoin/USD (BTC/USD), Eos/Ethereum (EOS/ETH) and Cardano/Euro (ADA/EUR)

Fees

Our team cannot agree whether AAATrade’s fee structure is just needlessly complex or intentionally challenging. The firm couples volatile trading fees with high transaction costs and investigation fees.

The overall fee structure provided by AAATrade is determined by the account type opened. The Novice account features commission-free trading at the cost of slightly higher spreads. On the other hand, the Experienced account charges commissions in exchange for tighter spreads.

Spreads vary between assets and classes. For example, the average spread on the Experienced account for EUR/GBP is 0.0003 pips while the average spread for Aviva Plc is 10.695 pips. Commission rates likewise vary, with a 0.85% rate on LSE assets for the Experience account, while forex majors are fixed at £3.20.

Dividends are always paid, while financing and swap rates are charged for overnight holding and are debited at 22:00 (GMT) every night.

Disappointingly, the below transfer fees also apply to all deposits and withdrawals.

- Wire Transfer – £8.50

- Credit/Debit Cards – 1.5%

- Alternative Payments – 5%

- Cryptocurrency – 0.2%

- Commercial MT1xx (Charging Option OUR) – £21.40

- Commercial MT1xx (Charging Option BEN) – £8.50

Furthermore, there is a foreign exchange fee of 0.5% and payment investigations also charge a fee:

- General – £42.80

- Amendment – £64.25

- Cancellation – £64.25

- Return of Funds – £12.80

Overall, this broker comes with a complicated and extensive fee structure that seems well-placed to catch out unaware and newer clients. Spreads are a mixed bag, with some relatively low (like some forex pairs), while others are rather high (like many equities).

Moreover, transaction charges are always a sad sight and the cost of going through a payment investigation is a serious downside.

AAATrade Accounts

We found that AAATrade offers two main account types, the Novice account and the Experienced account, though these really only refer to STP (Novice) and ECN (Experienced) execution.

Each of these can be opened with Basic Services, Advanced Services or Premier Services, depending on the minimum deposit amount. Both accounts offer access to the full suite of tradable assets, platforms and the AAATrade Education Center.

The differences between these accounts are primarily in the fee structure. The Novice account is commission-free on all stock, forex and CFDs, while the Experienced account is only commission-free on stocks and ETF investments. However, the Novice account has higher spreads than the Experienced account.

The above are the Basic Services offered by each account, which are provided with no minimum deposit. Advanced Services can be accessed by having an account level of at least £25,000, which grants a 5% commission rebate on every trade, one-on-one training with certified technical analysts and a 0.25% positive interest rate.

Premier Services are unlocked at an account level of £100,000. Premier traders will receive a 10% commission rebate on every trade, a dedicated account manager and concierge services.

Our team was pleased to see that the broker offers swap-free, Sharia-compliant Islamic accounts to traders that can demonstrate their religious beliefs. However, not much information is given about these halal accounts, which is drawback.

Overall, we think the account types offered are adequate for most traders, even if their structure could be a lot clearer. Furthermore, the broker allows you to open up to five accounts at once, meaning you can trial any account type, assuming you can reach the capital limits.

How To Open An Account

- Click the Sign Up button at the top of the page

- Input the required details (name, email address, password)

- Verify your account through the link sent to your email

- Log into the AAATrade online client portal

- Verify your identity through a short KYC check

- To deposit funds, you will need to complete a long KYC check and fully verify your identity (through an ID card or passport)

- In the portal, click on your account name on the top right and click the arrow next to the Account heading

- From here, you can add live or demo accounts

- Choose your base currency then click Open Account

- Deposit funds and begin investing

Funding Options

Our experts found that AAATrade offers a range of deposit and withdrawal methods, though these notably and disappointingly incur significant costs, as outlined above. Many alternative firms like Avatrade and XM offer a range of options at no extra cost.

Supported methods include:

- Credit/Debit card transfers

- FasaPayPayments

- Bank Transfers

- Crypto Wallets

- Neteller

- QIWI

- Skrill

Each deposit method allows for different base currency deposits but AAATrade only supports GBP, USD and EUR. This is particularly useful for UK investors as the 0.5% currency conversion fee is circumvented.

Alternative payment options, like Skrill, Neteller or crypto transfers, are usually processed instantly, though bank transfers can take up to two business days.

UK Regulation

AAATrade is not regulated in the UK but is a registered and regulated firm with the Cypres Securities and Exchange Commission (CySEC) under license number 244/14 and company registration number HE 322745.

As such, the broker is under the strict EU regulation presented in the European Markets in Financial Instruments Directive II (MiFID II).

This ensures that the broker is under supervision by the regulator and should meet all of the safety and requirements imposed on them.

The broker must have client security protocols in place, including anti-money laundering (AML) services and identity safeguarding. Furthermore, the company must be transparent and fair, providing untampered trading platforms, ensuring no price manipulation and not withholding client money. Financial reports must also be provided to the regulator frequently.

Trading Platforms

AAATrade offers two main trading platforms, AAATrader and MetaTrader 5.

MetaTrader 5 is one of the most popular online trading platforms, offering a huge host of built-in features and tools that benefit both new and experienced investors. AAATrader is AAATrade’s bespoke trading platform, boasting a sleek, modern design, intuitive UI and full integration with the client portal.

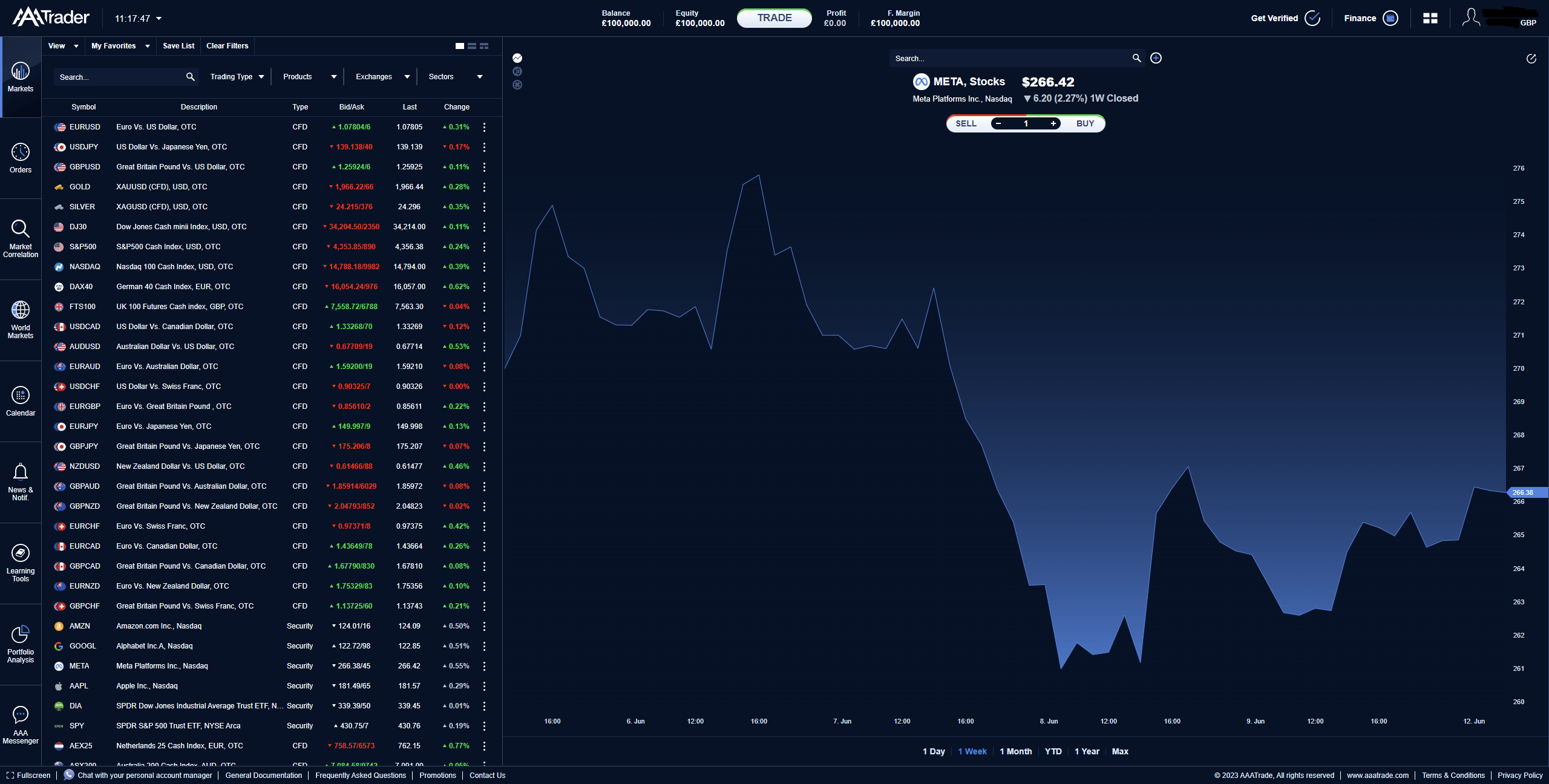

AAATrader

The bespoke AAATrader platform is accessible through the broker’s website or on both iOS and Android (APK) mobile devices. The platform is seamlessly integrated with the client portal, allowing you to access all of your important account features, such as deposits and withdrawals, accounts and an economic calendar.

The platform is great for new investors looking to implement fundamental analysis using the resources provided by the broker. However, the statistical and graphical tools are somewhat limited, making technical analysis to any level of sophistication difficult.

AAATrader Platform

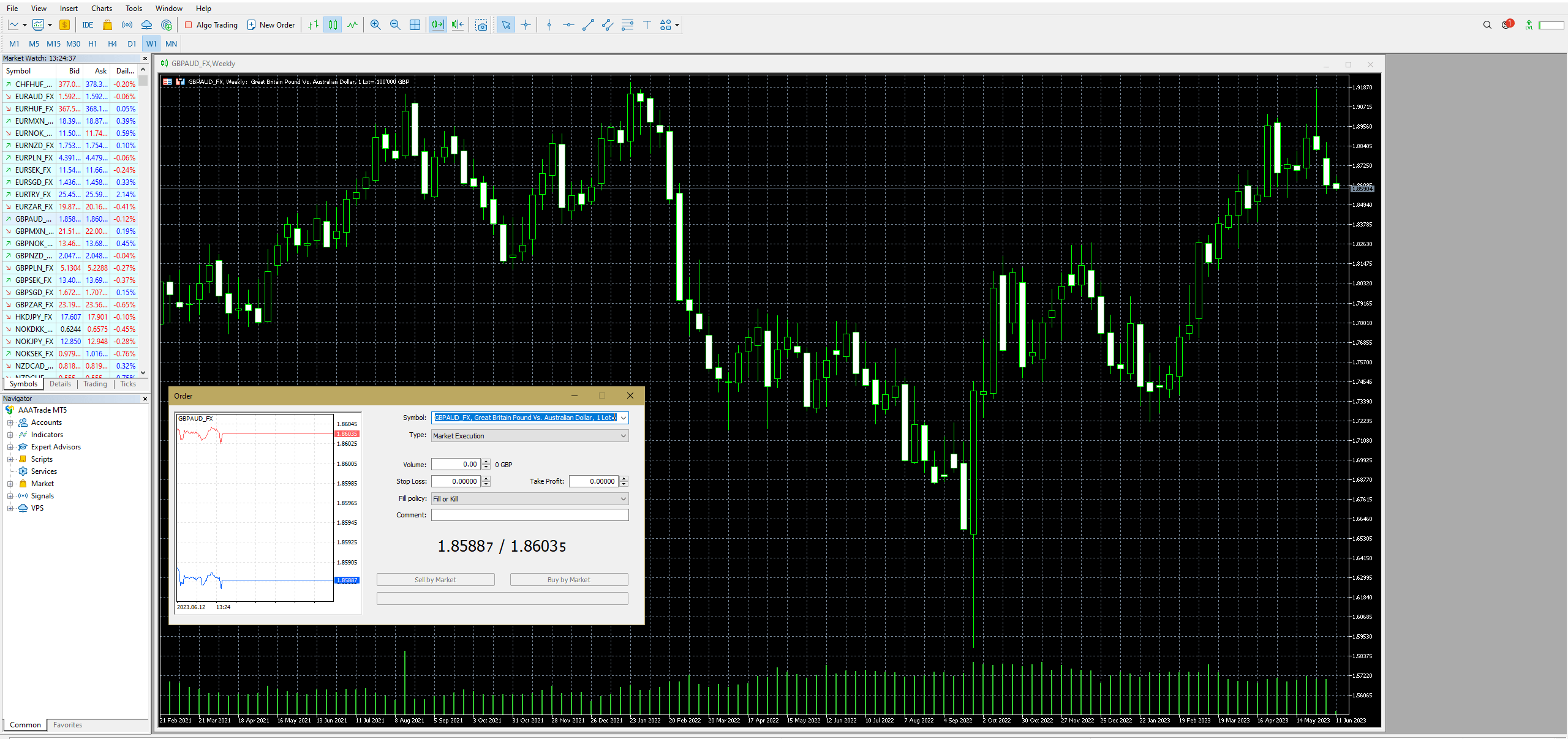

MetaTrader 5

MetaTrader 5 (MT5) is a more powerful and technical platform that was designed to help investors implement sophisticated trading strategies and algorithms.

The platform comes with a huge range of built-in tools and is easily programmable, allowing more features to be plugged in and developed by users. The platform boasts a suite of tools, including:

- 21 timeframes

- Strategy tester

- 44 graphical objects

- 38 technical indicators

- Six pending order types

- Compatible with plug-ins

- Mobile trading app available

- Automated trading through Expert Advisors

- Programmable through the MQL5 programming language

Our experts recommend the MetaTrader 5 platform as more suitable for most retail investors. Its range of functionality and technical analysis features is much more advanced, plus there is a widespread online community regularly using the platform and developing additional plug-ins and tools.

MetaTrader 5

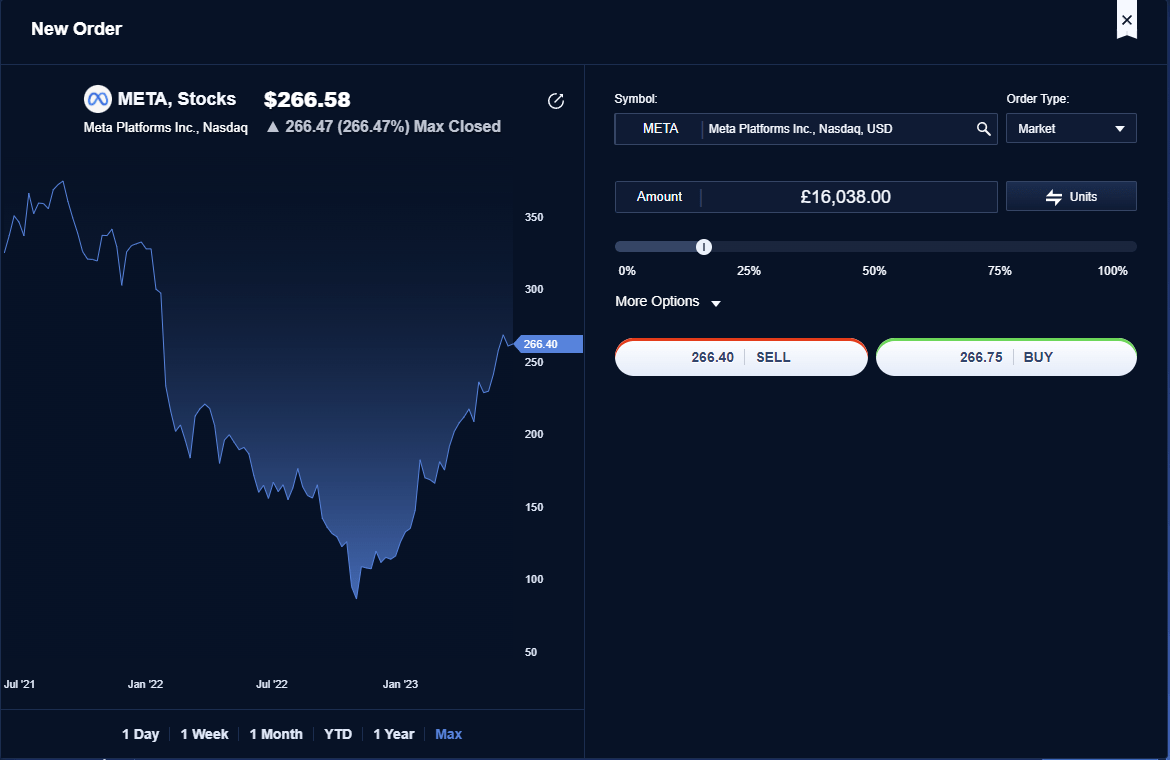

How To Place An Order With AAATrade

- Log into your chosen trading platform

- Choose the asset you would like to trade

- Perform your analysis

- When you are ready to place a trade, click the Trade or New Order button at the top of the screen

- The order window will open

- Fill in the details of your order, including the volume, stop loss and take profit

- When you are ready to make your trade, click the Buy or Sell button to place your order

AAATrader Order Window

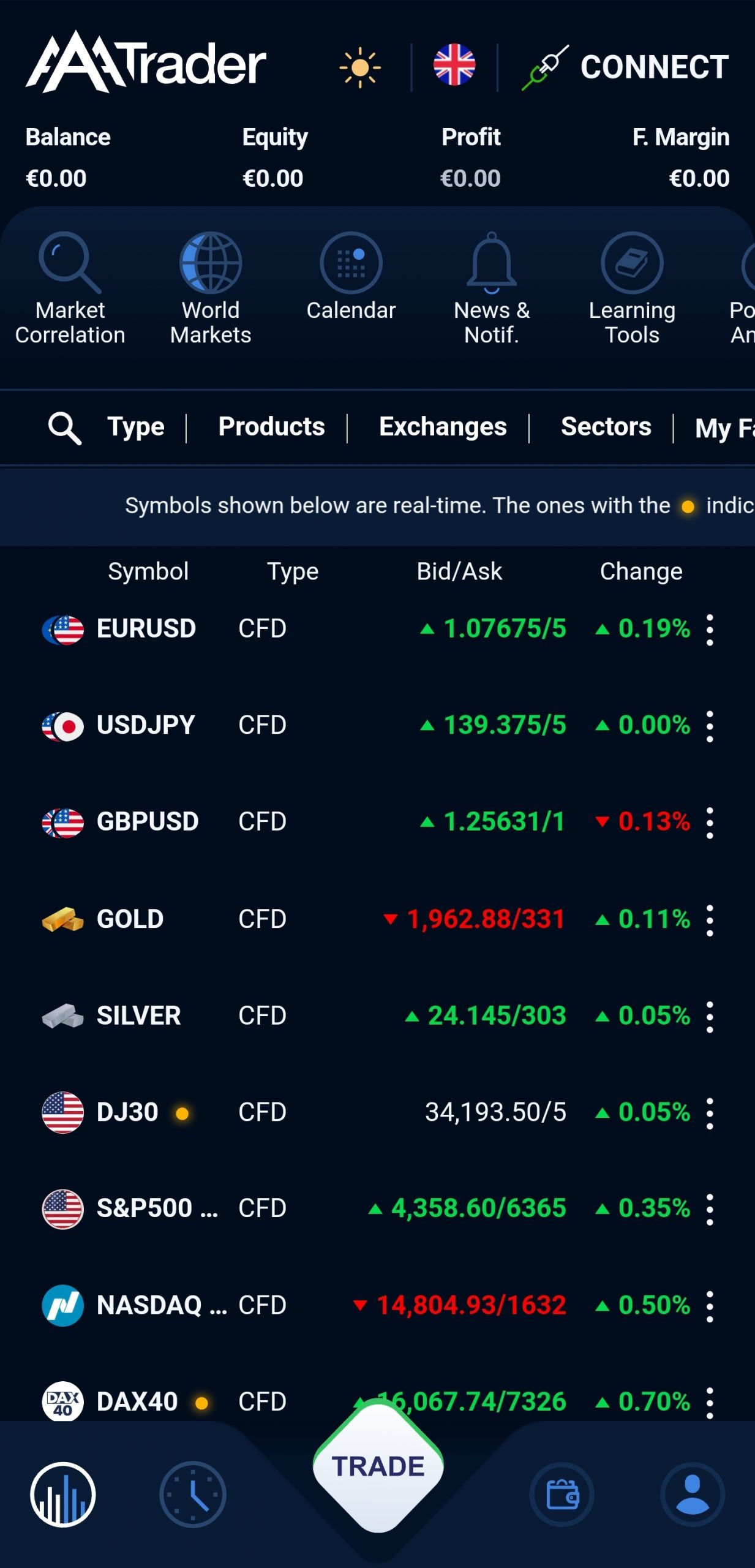

Mobile App

Both the AAATrader and MT5 trading platforms offer mobile apps. These applications are available on both the Android Google Play Store and Apple iOS App Store for free.

Each app provides a mobile experience of its desktop counterparts. Many of the desktop features are carried over to the mobile apps, with AAATrader’s integration with the client portal and its sleek design, and MT5’s powerful technical tools and charting capabilities. Both apps allow traders to place orders on the go.

AAATrader Mobile

Leverage

Leveraged trading is offered by AAATrade with maximum rates varying amongst assets and account types. Professional traders can reach leverage rates up to 1:200, while most retail traders can only access up to 1:30 due to European Securities and Markets Authority (ESMA) restrictions.

Maximum limits for each asset type are given below:

- Energy Futures (Major & Minor) – 1:10

- Energy Futures (Exotic) – 1:5

- Bonds & Interest Rates – 1:5

- Agriculture Futures – 1:10

- Cryptocurrencies – 1:2

- Indices Exotic – 1:2.5

- Indices Major – 1:20

- Indices Minor – 1:10

- Metal Futures – 1:10

- Forex Minors – 1:20

- Forex Majors – 1:30

- Commodities – 1:10

- Forex Exotics – 1:5

- Silver – 1:10

- Stocks – 1:5

- Gold – 1:20

- ETFs – 1:5

Margin rates also vary for each asset type. The margin call level is 70% and stop outs are at 50%.

Demo Account

AAATrade allows up to three free demo accounts to be open at once. The broker lets you open these accounts on either trading platform, with either account type and in any of the three base currencies.

Our experts often recommend that traders practise investing on a demo account before committing funds to a live account. Not only will you get accustomed to the trading platform and fee structure but you can also test new trading strategies and explore new markets.

AAATrade Bonus Deals

The broker offers two promotional loyalty programmes to clients with accounts that hold over £25,000, a positive interest rate programme and the commission rebate programme.

The positive interest rate programme offers the client 0.25% yearly interest on free margin. The commission rebate deal offers 5% or 10% commission rebates depending on their account size (£25,000 and £100,000 respectively).

However, this rebate structure matches the additional services the broker boasts for users that achieve the Advanced Services account tier, so this is not really an additional deal. Our experts would expect a greater deal of clarity and honesty from a brokerage before recommending its services.

Extra Tools & Features

When we used AAATrade, our team found that the firm offers a small range of additional tools for clients. These include live market event articles, an economic calendar, AAATrade market and technical analysis posts, trading calculators and an academy.

The academy is an online educational resource that is chock full of webinars, e-books, video tutorials, articles, demonstrations and sessions to help enhance their trading skills. All additional tools are available to all clients, even those on the Basic Service.

These services are good to see and definitely do not sit at the lower end of online brokerages. However, alternatives like City Index and RoboForex offer much more at lower cost.

Customer Service

AAATrade offers multiple contact avenues, including an online live chat window, online contact form, telephone number and customer support email address. The team were fast to respond and useful upon testing.

- Live Chat – Contact Us webpage

- Email Address – cs@aaatrade.com

- Contact Number – +357 250 300 60

- Contact Form – Contact Us webpage

Company History & Overview

AAATrade was established in 2013 with a head office in Limassol, Cyprus. The firm aims to provide accessible investment products to traders of all levels, with an extensive range of assets and services to suit all investors. The firm is registered with and regulated by the CySEC, with additional registrations with other European bodies.

The brand provides access to over 60 different exchanges, thousands of assets, educational resources, free analysis and strong portfolio management. However, the company’s fees are confusing and excessive, to the point that many beginners will be confused.

Trading Hours

Each asset has different opening hours that depend on the product’s base market or exchange. For example, the UK Gilt can only be traded between 08:00 to 18:00, Monday to Friday (GMT), while cryptocurrencies are open 24/7.

Details for each asset’s trading hours are given on the AAATrade website.

Security

We were pleased to see that, being regulated by the CySEC, AAATrade has many security features in place to protect traders.

These include segregation of clients’ funds, fiat being held in segregated banks across the EU and Switzerland, working with a reputable exchange secured by Qualys, using cross-border servers, strong encryption to protect personal information and the use of reputable banks and payment systems.

Should You Invest With AAATrade?

We feel that AAATrade offers an impressive range of tradable assets and markets to investors, at the same time providing a variety of educational resources and powerful trading platforms. The firm also supports GBP transactions via a decent range of payment methods and is transparent about its leverage capabilities and trading hours.

However, our team has reservations about the company’s fee and account structure. The inclusion of high deposit and withdrawal fees, coupled with charging users throughout any investigations, suggests the company is happy to push the limits of how much it can eat into its clients’ profits.

FAQ

Is AAATrade Good For UK Investors?

We think that AAATrade offers a wide range of instruments with GBP as a base currency, providing decent accessibility to its services for UK clients. However, the firm’s fee structure is very complicated and the company is regulated by the CySEC, which is less secure and stringent than the UK’s own FCA.

What Trading Platforms Does AAATrade Offer?

AAATrade offers two trading platforms, MetaTrader 5 and AAATrader. The bespoke AAATrader is built into the client portal with a sleek, modern design and intuitive UI. The platform is perfectly integrated with the additional features offered by the firm, including its news articles, analysis reports and economic calendar.

Alternatively, MetaTrader 5 is one of the most popular online trading platforms, offering a wide range of technical analysis tools and customisation, making it a great platform for both new and experienced traders.

How Many Assets Does AAATrade Offer?

Our team found that AAATrade offers over 16,000 assets, ranging from forex CFDs to stock securities and metal futures. This makes it a strong broker for a variety of investing styles and diversification goals.

Is AAATrade Safe?

AAATrade is regulated by the CySEC and registered at BaFin, suggesting that the broker is a safe and legitimate firm. The broker employs lots of safety features to ensure traders are protected, including KYC, AML, strong encryption, segregated funds and Qualys security.

How Can You Contact AAATrade?

AAATrade offers several contact avenues for customer support, including online live chat and contact forms, as well as a +357 phone number and an email address.

Article Sources

AAATrade Website

CySEC Regulation

BaFin Registration

Top 3 AAATrade Alternatives

These brokers are the most similar to AAATrade:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

AAATrade Feature Comparison

| AAATrade | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 3.5 | 4 | 4 | 4.8 |

| Markets | CFDs, Forex, Stocks, Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $0 | $1,000 | $40 | $0 |

| Minimum Trade | $0 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:200 | 1:30 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | AAATrade Review |

Swissquote Review |

FP Markets Review |

Pepperstone Review |

Trading Instruments Comparison

| AAATrade | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

AAATrade vs Other Brokers

Compare AAATrade with any other broker by selecting the other broker below.

Popular AAATrade comparisons: