AAAFx Review 2025

|

|

AAAFx is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to AAAFx |

| AAAFx Facts & Figures |

|---|

AAAFx is a forex and CFD broker, established in 2007 and headquartered in Greece. The company is regulated by the HCMC and FSCA and supports a selection of ECN accounts with low spreads, fast order executions and convenient deposits. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Cryptos |

| Bonus | 100% Deposit bonus available for Global clients |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS & Android |

| Trading App |

AAAFx does not offer its own app, but you can trade forex, stocks, indices, commodities and crypto on the MT4 and MT5 platforms. The apps offer a reliable environment for experienced mobile traders with robust charting tools. However, clients of AAAFx can’t manage their accounts, so you still have to log into the client area online to make deposits and withdrawals, making for a less complete mobile trading experience. |

| iOS App Rating | |

| Android App Rating | |

| Payments | Bank wire - FNB (First National Bank, KoraPay through Praxis, Help2Pay, PayRetailers. Bank cards - debit/credit cards. E-Wallets- FairPay, VirtualPay, Skrill, Neteller. Cryptocurrency - match2pay (ETH, BTC and USDT), Capital Wallet |

| Min. Trade | 0.01 Lots |

| Regulated By | HCMC, FSCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | AAAFx provides CFDs on forex, stocks, indices and cryptocurrencies through the MT4 and MT5 desktop, web and mobile platforms. Leverage up to 1:30 is available in the EU and up to 1:500 for global clients. |

| Leverage | 1:30 (EU), 1:500 (Global) |

| FTSE Spread | 1.0 |

| GBPUSD Spread | 0.1 |

| Oil Spread | 3.5 |

| Stocks Spread | Variable |

| Forex | AAAFx shines for its forex offering with over 70 currency pairs and spreads from 0.1 pips and low commissions from $0.99. Forex traders also get access to MetaTrader 4, alongside impressive execution speeds, a free VPS and zero restrictions on trading strategies. |

| GBPUSD Spread | 0.1 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.1 |

| Assets | 70+ |

| Stocks | AAAFx offers an average selection of around 185 stock CFDs, providing long and short opportunities on large companies like Apple and Amazon. However, there are no stock screeners or insights into company financials, which could help traders discover opportunities. |

| Cryptocurrency | AAAFx provides just 6 crypto CFDs, covering BTC and other major digital currencies paired with USD. Yet despite competitive and transparent spreads, there are no opportunities on up-and-coming digital currencies. |

| Coins |

|

| Spreads | 0.1 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

AAAFx is an award-winning forex and CFD broker offering a wide range of assets to an international client base. This 2025 broker review will cover crucial details such as minimum deposit requirements, maximum leverage, withdrawal times and any bonus programs available to new users. Discover whether AAAFx is suitable for your needs.

This material is not intended for UK residents. AAAFx is running off its UK business and does not provide its services to UK residents.

About AAAFx

Founded in 2007, AAAFx boasts clients from over 170 global jurisdictions and more than 500 total trading instruments. The broker is run from a head office location in Greece and has regulation from the local financial licensing authority, the Hellenic Capital Market Commission (HCMC).

The broker is also regulated by the Financial Sector Conduct Authority (FSCA) in South Africa.

Part of the Finvasia Group Alliance, the company offers institutional grade spreads and liquidity to all clients regardless of account type through its deep liquidity ECN system. Four trading platforms are supported, including the ZuluTrade copy trading service (more on these later).

AAAFx won several awards worth mentioning, such as the Most Transparent Broker award at the Ultimate Fintech Awards 2022, Best FX Service Provider at the Forex Expo Dubai 2023, and The Best CFD Broker – MEA at the Ultimate Fintech Awards 2023.

Markets

AAAFx offers over 500 CFD trading products across markets, such as forex, indices, commodities and cryptocurrencies like Bitcoin.

Forex

An impressive 70 currency pairs make up the AAAFx forex offering, spanning major, minor and exotic instruments. Spreads start from 0.0 pips on EUR/USD and are tight across the entire range of major pairs.

Indices

AAAFx supports eleven spot indices instruments, including prominent products from Europe, the US and the UK like the F40EUR, U30USD and E50EUR. In addition, users can trade the Euro-Bund Futures Index as the broker’s only futures index offering.

Commodities

The broker offers eight metals and fuels products with this broker. These are gold, silver, WTI Crude oil, Brent Crude oil and Natural Gas. Clients can trade gold in USD, EUR and AUD currency pairs, while silver is available as a USD or EUR cross.

Stocks

With more than 400 global stocks to speculate on, AAAFx has a solid equities offering. While most products are from US exchanges, 20 stocks from Europe are also provided, though UK-listed equities are not supported.

Cryptocurrencies

Six of the major cryptocurrency instruments are available through AAAFx, such as Bitcoin, Ethereum, Ripple and others.

Leverage

Traders can get access to maximum leverage based on the trading instruments and jurisdiction:

- Forex pairs – 1:30 (EU), 1:500 (Global)

- Indices – 1:20 (EU), 1:200 (Global)

- Commodities – 1:20 (EU), 1:100 (Global)

- Cryptocurrencies – 1:2 (EU), 1:5 (Global)

- Stocks – 1:5 (EU and Global)

AAAFx enforces a margin call at the 100% level before imposing a stop-out at 70%.

Account Types

There are four account types available to AAAFx clients: the standard ECN account, the ECN Plus account, the ECN Zero account, and an Islamic account for global clients of the Islamic faith.

These accounts all utilise a non-dealing desk (NDD) model to pass trades straight through to liquidity providers. UK traders will be pleased to know that all accounts also support GBP as a base account currency.

ECN Account

With an AAAFx ECN account, clients have a minimum deposit as low as $100 and can take advantage of spreads as tight as 0 pips.

A minimum trade size of 0.01 lots means traders are provided for regardless of their capital. At the same time, leverage of up to 1:30 for the EU and 1:500 for Global clients allows investors to multiply their positions.

The commission charged by AAAFx depends on the account type. For the ECN account, the commission is $2.50 per $100k.

ECN Plus Account

AAAFx offers its ECN Plus account for clients with higher trading capital, which reduces commissions in exchange for a higher minimum deposit amount.

The trading conditions mirror those of the Standard ECN account, with spreads from 0.0 pips, 1:30 maximum leverage for EU traders and 1:500 leverage for Global clients, and a 0.01 lot minimum trade value.

The commission charged by AAAFx for the ECN Plus account is $1.50 per $100k. The minimum deposit stands at $1,000. Fees on indices and commodities are reduced to around £6 per round traded lot. Stocks are charged at 0.075% per lot and crypto commissions are reduced slightly to 0.08%.

ECN Zero Account

EN Zero Account differs from the previously mentioned accounts because clients can enjoy trading with zero commission using this account type. The minimum deposit required for opening an ECN Zero Account is $50.000, with a commission of $0 per $100k.

Islamic Account

This account type is available for global clients only. AAAFx offers swap-free trading for traders of the Islamic faith, with a minimum deposit of $100 and a commission of $2.50 per $100k.

Demo Accounts

When signing up for a new broker, testing its trading conditions and supported platforms can give invaluable insight into the service.

AAAFx provides a risk-free demo account compatible with the MT4 and MT5 trading platforms. Unfortunately, ZuluTrade and ActTrader demo accounts are not supported.

Clients can continue to use the demo account to refine their strategy and experiment with new markets after creating a live account login.

Trading Platforms

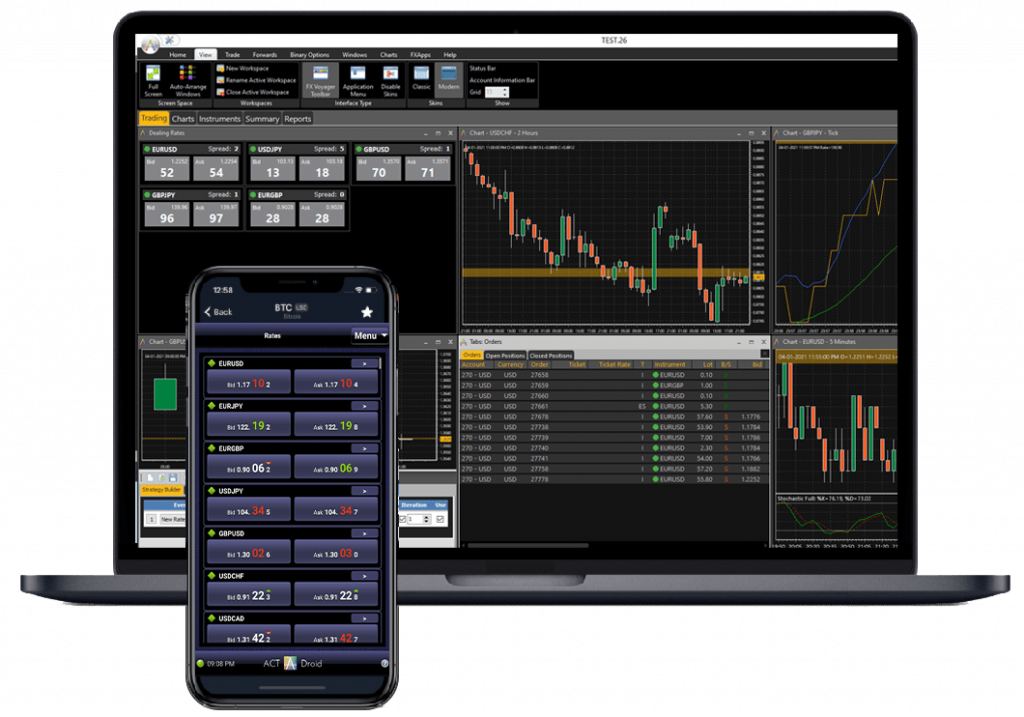

There are three trading platforms supported by AAAFx: MetaTrader 4 and MetaTrader 5 from MetaQuotes, plus ActTrader. For social trading, AAAFx clients can use the ZuluTrade platform.

MetaTrader 4

Perhaps the most well-known forex and CFD trading platform, MetaTrader 4 is supported by hundreds of brokers and used by millions of global investors. Created in 2005, the MT4 platform is available as a free download for Windows, Mac and Linux, a browser-based WebTrader and a mobile app for iOS and Android devices.

Thirty standard indicators and 31 graphical objects can be supplemented by custom indicators from the well-populated MQL4 marketplace. Nine time frames provide overviews of an asset’s price activity. In addition, easy expert advisor (EA) integration makes automated trading a breeze on MT4 and nine order types facilitate intricate trading strategies.

MetaTrader 5

Launched in 2010, MetaTrader 5 supports a greater range of markets and asset types than its predecessor and has made some significant upgrades over MT4.

An updated MQL5 coding language enables the use of more complex expert advisors and custom indicators, while the integrated depth of market data and a built-in economic calendar enhances the trading experience of users.

38 standard indicators, 44 graphical objects and 21 timeframes allow for comprehensive technical analysis. The addition of two more pending order types helps clients execute complex strategies.

MetaTrader 5 is available to download for Windows, Mac and Linux, as a mobile app for Android and iOS or via the MetaQuotes WebTrader platform.

ActTrader

Boasting over 1.8 million retail users, ActTrader is a growing trading platform designed for retail and institutional clients alike.

Advanced risk management tools supplement dozens of integrated technical analysis tools and indicators to create a solid system. In addition, one-click trading support and customisable alerts mean that investors will never miss an opportunity.

ActTrader

ActTrader is available as a free download on Windows, Android, iOS or via the WebTrader platform.

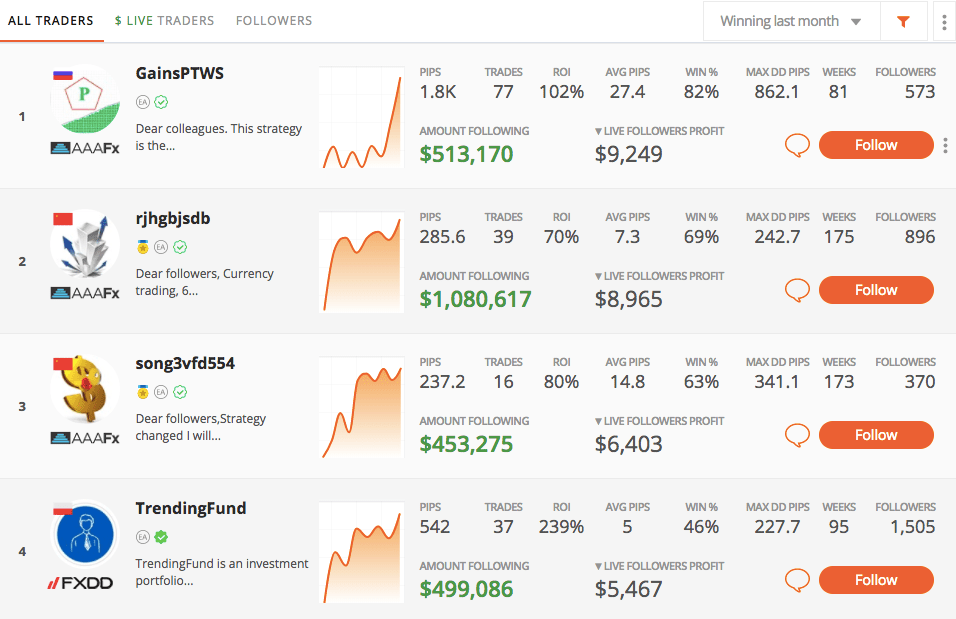

ZuluTrade

Copy trading is more popular than ever, with many investors trusting their capital to experienced traders.

ZuluTrade provides a user-friendly and safe platform for clients to learn more about the markets and emulate the positions of proven traders. Users can rank top traders through ZuluRank. This feature helps investors to choose traders by ranking them based on several factors, such as high profits, low drawdowns, frequency of trader’s login, length of time trades stay open and more.

ZuluTrade

Payment Methods

AAAFx supports a variety of deposit and withdrawal options for its customers. EU clients can make a deposit via bank wire (EuroBank, Swissquote), bank cards (debit/credit cards), e-Wallets (GiroPay, EPS, Skrill, Neteller, Sofort, iDEAL, Przelewy24, Qiwi) and cryptocurrency (Match2Pay – BTC, ETH and USDT).

Global clients can make a deposit via bank wire (FNB – First National Bank), KoraPay through Praxis, Help2Pay and PayRetailers), bank cards (debit/credit cards), e-Wallets (FairPay, VirtualPay, Skrill, Neteller) and cryptocurrencies (Match2Pay – ETH, BTC and USDT, and Capital Wallet).

There is only a $100 minimum deposit amount when adding funds to an existing account. Likewise, withdrawals must exceed $100.

Deposits process in 2-3 business days for Skrill and bank wire transfers, 30 minutes for Bitcoin and instantly for card and Neteller. Once approved by the broker, withdrawals from AAAFx take between 2 and 3 business days or can clear immediately using some methods.

Deposit & Withdrawal Fees

This review is pleased to report that AAAFx levies no deposit or withdrawal fees. The broker goes one step further and reimburses clients for transaction costs of up to 5% for e-wallets and up to £20 for bank wire transfers. However, gas fees on crypto transactions are borne by the client.

Trading Fees

Trading fees are crucial for prospective clients looking for a new trading broker.

A competitive commission structure, which sees forex fees reach as low as £0, on top of tight spreads makes AAAFx an easy recommendation in this respect. In addition, the broker does not charge an inactivity fee on dormant accounts.

Swap rates, often referred to as rollover rates, vary from asset to asset and can be found via each supported trading platform.

Security & Regulation

Safety is critical when operating in the forex and CFD markets. Selecting a broker licensed by a reputable regulator helps give investors greater peace of mind and access to enhanced protection measures.

To this end, AAAFx earned its licence to operate in the EU from the Hellenic Capital Market Commission of Greece. AAAFx is also regulated by the FSCA in South Africa. The organisation enforces protective measures such as negative balance protection and the Greek Guarantee fund which can compensate EU investors up to EUR 30,000 in case an investment firm goes bankrupt or is not able to fulfil its obligations to clients.

However, the broker does not offer two-factor authentication (2FA) on its client portal for maximum login security, though MetaTrader 4 and 5 can be set up with one-time passcodes.

Customer Support

For AAAFx customers that encounter any issues or have any questions, there are several options available to contact the brokers’ friendly support team. These include two dedicated email addresses, a range of social media accounts, 24/5 live chat and a UK contact number.

- Global Phone Number: +30 213 0117 498 (Global)

- Support Email Address: support@aaafx.com (EU), contactus@aaafx.com (Global)

The broker’s website also features a well-stocked FAQ section with answers to common questions about deposits and withdrawals, forex trading and the MT4 platform.

Educational Content

While many firms offer their clients educational content in the form of articles, videos and webinars, AAAFx does not provide any such materials.

For beginner traders looking to learn the ropes, plenty of paid and free educational content can be found across the web, including through AAAFx’s partner ZuluTrade.

Advantages Of AAAFx

- Award-winning broker

- Free demo accounts available

- Low spreads starting from 0.0 pips on Forex

- Free VPS for eligible clients

- Zero commission fees (with ECN Zero Account)

Disadvantages Of AAAFx

- No 2FA support

- No educational content

Promotions

Many trading services offer promotions to tempt new clients and encourage high-volume trading. These often include deposit bonuses, demo account trading competitions and commission rebate schemes.

While non-EU AAAFx investors can take advantage of a deposit bonus of up to 100%, domestic traders cannot access this promotion due to ESMA regulations.

Additional Features

Additional features such as VPS access or trading calculators can give traders the highest chance of profitable speculation.

To this end, AAAFx provides high-volume clients with access to free VPS hosting after depositing a minimum of $5,000. A swap calculator, margin calculator and pip calculator are also included for all users, while an economic calendar helps investors keep on top of upcoming market events.

Trading Hours

AAAFx follows the 24/5 trading hours of the forex market. Its platforms open from 21:00 on Sunday to 21:00 on Friday for the GMT time zone, subject to daylight saving differences. However, trading hours for individual stocks and indices will follow the market times of their local exchanges.

Clients can access their accounts via the AAAFx website at any time to monitor trading stats or make deposits and withdrawals.

AAAFx Verdict

AAAFx receives a highly positive rating from this broker review due to its low minimum deposit and withdrawal requirements, strong regulation and a solid range of trading instruments and tools. Clients can also choose from several account types and trading platforms to suit their preferences. However, high-margin traders may be put off by the 1:30 maximum leverage restrictions for EU clients. In addition, the lack of bonus schemes for the UK and Europe is slightly disappointing.

FAQ

Is AAAFx Safe & Trusted?

AAAFx is regulated by the Hellenic Capital Market Commission of Greece, a respected regulatory body. It offers negative balance protection and a fund protection scheme to all of its clients. AAAFx is also regulated by the Financial Sector Conduct Authority in South Africa.

What Is The AAAFx Minimum Deposit?

AAAFx requires an initial minimum deposit of $100 to open the ECN account, $50,000 for an ECN Zero account, $1,000 for an ECN Plus account, and $100 for an Islamic account (for global clients).

How Can I Contact AAAFx?

AAAFx has multiple contact methods, including a website live chat feature, a dedicated support email address and a phone line, provided above.

Does AAAFx Offer A Deposit Bonus?

Unfortunately, the AAAFx 100% deposit bonus is unavailable to clients from Europe or the UK.

Can I Open An AAAFx Demo Account?

Prospective clients are encouraged to register for a demo account before committing to a live account.

Top 3 AAAFx Alternatives

These brokers are the most similar to AAAFx:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

AAAFx Feature Comparison

| AAAFx | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.9 | 4.8 | 4.8 | 4.7 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $10 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | HCMC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | 100% Deposit bonus available for Global clients | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:30 (EU), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | AAAFx Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| AAAFx | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

AAAFx vs Other Brokers

Compare AAAFx with any other broker by selecting the other broker below.

Popular AAAFx comparisons: